Over the last 12-18 months, both venture capital investors and start-up firms have felt the aftershocks of ongoing economic volatility. Factors affecting funding activity include nearly a dozen interest rate hikes by the Federal Reserve Bank since early 2022, record inflation as the highest in four decades, fading valuations, and looming fears of a recession.

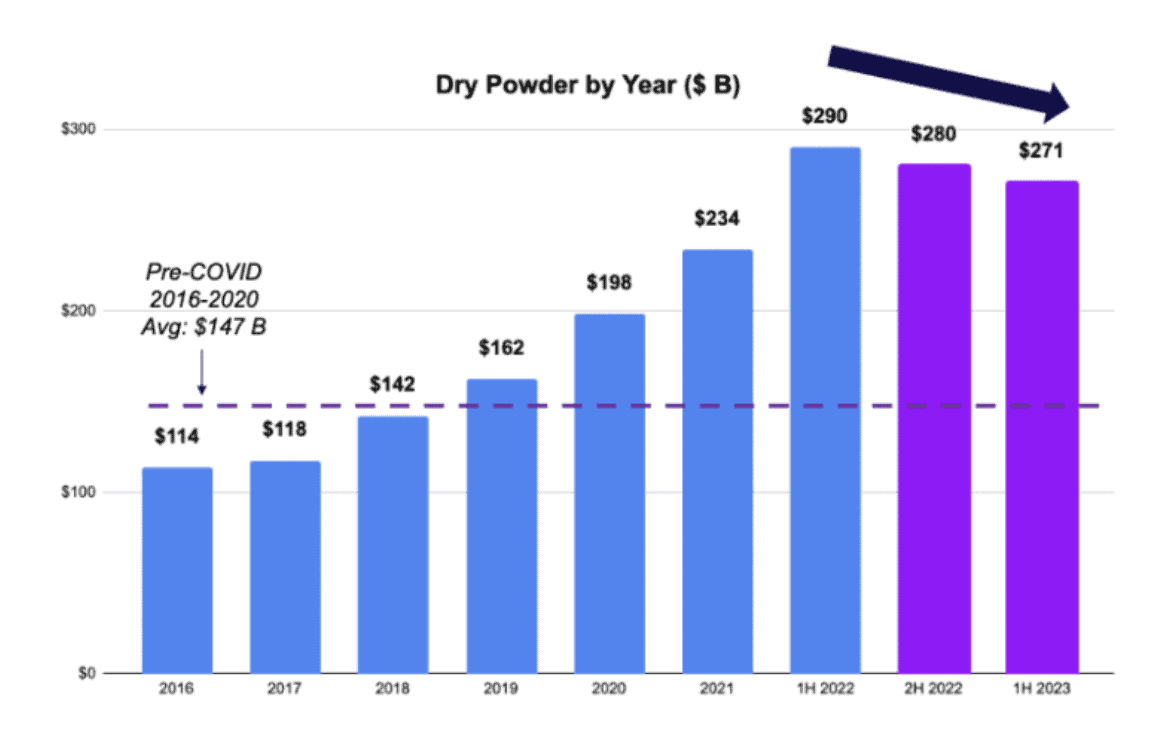

Following a ‘dry powder’ run in 2021, venture capital investment in the US nearly doubled from 2020. Investors began to fear the faltering economy and funding pulled back nearly 30% in 2022 and continued to slump at 40% into 2023.

With a stabilizing outlook on the horizon, venture capital investors are working with a sizable pool of uninvested capital. Whether we see an upward trend in funding activity or further plateauing, investors continue to be cautious about deploying capital.

In addition to caution, investors must be more diligent than ever in researching and qualifying prospective start-ups. On the AlphaSense platform, this reality rings true as we noticed an over 50% increase in documents mentioning “due diligence” over the past year.

Once an arduous and time-consuming task, the dawn of artificial intelligence (AI) and generative AI (genAI) has transformed the way venture capital investors conduct due diligence. The ability to generate valuable insights in a fraction of the time equates to more informed decision-making and ultimately leads to better investment outcomes.

How We Got Here: Hinging on Macroeconomic Sentiment

A perfect storm of factors—declining equity markets, rising interest rates, soaring inflation, and recessionary fears—have undeniably slowed venture capital funding in its tracks. Similar to other asset classes, venture capital deal patterns mirror macroeconomic sentiment.

According to WilmerHale’s 2023 market report, “The stunning March 2023 collapse of Silicon Valley Bank—the dominant banking player in the venture capital ecosystem—and the fallout among other financial institutions is likely to have a significant effect on VC-backed companies and venture capital financing and liquidity activity.”

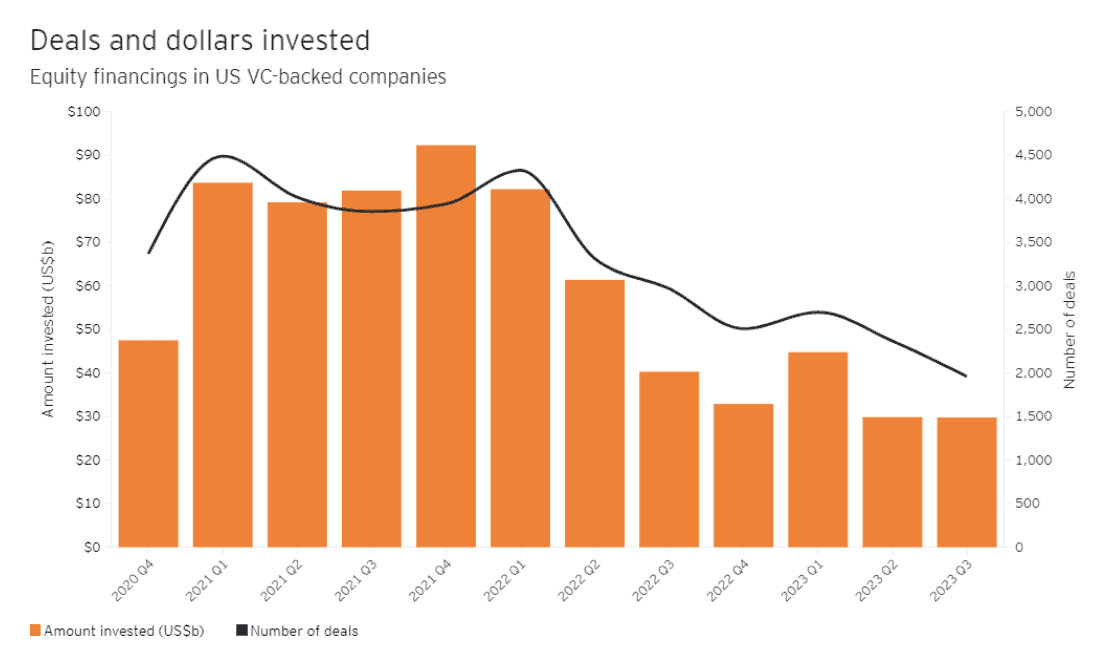

Source: EY

The decline in funding trajectory following the Q1 2023 Silicon Valley Bank collapse and the larger downward trend since 2021 are notably captured in the above image.

Dry powder capital is now estimated to be near $300 billion heading into the end of 2023. As markets continue to stabilize, this may indicate a resurgence in deal activity. The case for robust due diligence plays a vital role in either fight-or-flight market scenario.

Source: LinkedIn

The Inefficiencies of Traditional Due Diligence

Traditional due diligence for start-up investors has historically been riddled with inefficiencies—tying up resources to sort through countless documents and copious amounts of data, and manually crafting market comparisons and performance. It is truly a ‘needle in a haystack’ exercise that is not only time-consuming but also offers limited visibility and lacks the complete picture.

The arrival of AI and gen-AI technology has entirely transformed this once laborious process. Teams can now leverage advanced algorithms and deep learning capabilities to analyze vast amounts of financial data, organize unstructured data, identify patterns, and generate valuable insights in a fraction of the time it would ordinarily take.

AI is proving itself to be an invaluable virtual partner in creating efficiencies, gleaning insights, and streamlining workflows that were once burdensome and time-consuming. Investors are now able to focus better on the task at hand—dedicating their time and energy on AI-generated outputs to assess, evaluate, and identify opportunities sooner and with greater confidence.

Leveraging AI to Surface Potential Opportunities

There is no doubt that generative AI has emerged as a powerful tool in the investment space. By leveraging natural language processing (NLP) algorithms, these machine learning models have numerous use cases— from providing instant insights to streamlining workflows, as well as saving valuable time.

Key generative AI use cases in venture capital include:

- Financial Analysis: GenAI can be used to automate the process of analyzing a start-up’s crucial financials. Algorithms can generate accurate and comprehensive financial reports, saving time and dramatically reducing the chance of human error.

- Market Analysis: GenAI is also a valuable tool for conducting market research, as it can analyze large volumes of market data, predict market trends, analyze customer preferences, and provide a snapshot of the competitive landscape.

- Forecasting Analysis: One of the most promising use cases for genAI is its ability to analyze financial data to generate potential forecasts. Using historical financial data and market trends to train on, these algorithms can provide insights into future financial scenarios.

- Competitive Analysis: GenAI can be employed to conduct a comparative analysis of start-ups in the same space by assessing firms within the same industry and offering side-by-side assessments of their strengths and weaknesses to quickly pivot in the decision-making process.

- Risk Assessment and Management: Unbeknownst to most professionals, genAI can play a crucial role in risk management. A model’s training data can teach algorithms to generate risk models and identify potential risks, helping to assess and mitigate risks, improve decision-making, and ensure the stability of operations.

- Market Intelligence at Scale: GenAI has the potential to securely pair a company’s internal content with leading premium market content sources using proprietary large language models (LLMs) and genAI trained on both business and financial content.

When used proactively, genAI can be implemented to do the heavy lifting associated with due diligence and to equip investors with the data, insights, and trends they need to make swift, smart decisions in the fast-moving world of venture capital.

How AI is Transforming Due Diligence for Venture Capital

By 2025, more than 75% of venture capital (VC) and early-stage investor executive reviews will be informed using artificial intelligence (AI) and data analytics, according to Gartner, Inc. This staggering statistic is representative of a more innovative and transformative shift in the asset management space away from archaic research methods.

AI-driven automation and algorithms accelerate the due diligence process and help venture capital investors:

- Harness better, more comprehensive insights and useful data to make sound decisions quicker

- Identify the most lucrative start-ups to invest in to foster their success and realize a return on investment more expeditiously

- Eliminate blind spots, enhance research workflow, and conserve valuable resources

- Consolidate internal and external deal intelligence and aggregate internal and external research

- Spend less time searching for key topics or deal terms

Read this blog, Generative AI in Financial Services, where we answer the questions every financial professional has about AI and genAI—including the pros, cons, and use cases.

How AlphaSense Helps Start-Up Investors Stay Ahead of the Curve

To successfully master due diligence, you need to leverage a market intelligence platform that allows you to swiftly pinpoint and analyze crucial business information. The best market intelligence tools leverage AI and automation technology to transform the due diligence process and widen the scope, scale, and level at which it is performed.

AlphaSense is a market intelligence platform that streamlines an extensive universe of content layered with AI search technology. Our platform offers an extensive universe of company filings, expert interview transcripts, news, trade journals, and innovative features to pinpoint valuable insights in seconds.

Beyond access to an extensive content universe in one platform, AlphaSense offers features that accelerate the due diligence process:

Want to read more about how AlphaSense equips venture capital investors with the insights and market intelligence they need to make confident decisions? Read our recent blog on ways to accelerate venture investment research.

Start your free trial today and accelerate your start-up research process.