The healthcare and wellness sector has rapidly evolved over the past few years, with glucagon-like peptide-1 (GLP-1) drugs now at the forefront of industry trends influencing dietary habits.

These weight loss drugs have gained popularity due to their role in weight management: through oral or syringe administration, they simulate the effects of the GLP-1 gut hormone, which controls satiety post-eating and slows stomach emptying, ultimately leading to prolonged feelings of fullness and decreased calorie intake.

As GLP-1 drugs continue to gain traction, with roughly 9% of US adults currently using them, CPG leaders expect a corresponding shift in the food and beverages sector. GLP-1s cause patients to eat less, with some drugs like Ozempic leading Americans to consume 20% fewer calories, Axios reports. Fast forward to 2035, that would represent 1.3% of overall calories consumed. But while some might translate these statistics into a doomsday-like future for the food industry, it’s simply not the case.

So what can CPG leaders expect in the future with GLP-1s? If consumers’ consumption of foods and beverages doesn’t dramatically change due to curtailing appetites, what will? Is there new market opportunities, rather than simply profit loss, the food sector can take advantage of? Below, we answer these pressing questions and more.

Healthier Dietary Choices

While it’s clear that GLP-1s like Ozempic and Wegoovy promote rapid weight loss, they do so by significantly influencing dietary habits. Individuals prescribed these medications experience greater protein cravings and consumption—e.g. white meat, dairy, and to a lesser degree, plant-based protein consumption—over carbohydrates and fats. Contrarily, a notable decreased intake of sugary and salty snacks, along with greasy foods, is common among GLP-1 users primarily due to the medications’ ability to curb cravings and slow digestion.

How does this affect weight loss? A 2021 study revealed that individuals using a GLP-1 medication exhibited a reduction in fat-free mass when compared to those who were administered a placebo. Fat-free mass encompasses all tissues in the body that are not fat, including muscle, bone, and skin. This indicates that a portion of the weight loss associated with GLP-1s did not originate from excess body fat but rather from these lean tissues.

In fact, existing research suggests that adhering to a high-protein diet while undergoing weight loss can help mitigate the loss of lean body tissue. This effect may contribute to ensuring that a higher percentage of weight lost while using a GLP-1 medication comes from excess body fat rather than muscle mass.

But protein isn’t the only quintessential building block in successful GLP-1 efficacy. Other food options have proven helpful in keeping patients on track: fruit (due to its capacity to healthily satiate sweet cravings), protein shakes, and homemade soups have also seen an uptick in popularity, given their balanced nutritional content and convenience for those with reduced appetites.

GLP-1 drugs don’t just affect food consumption; they also influence beverage intake. While some individuals have reported a decrease in coffee consumption, others have transitioned from calorie-rich alcoholic beverages like beer to lower-calorie spirits. This trend towards healthier, lower-calorie food and drink choices underscores the transformative effect of GLP-1 drugs on dietary habits.

The bottom line: dietary consumption isn’t reduced but adjusted on GLP-1s to accommodate healthier foods.

Patient Experience of GLP-1s

Although GLP-1 drugs have proven to produce significant weight loss results, they come at the expense of unpleasant side effects. According to broker research from Bernstein, respondents who were taking GLP-1s for an average of almost 8 months lost an average of 1.49 pounds a week—meaning their target weight would be achieved, on average, after 14 months of treatment if weight loss were linear.

However, GLP-1 patient responses as to how long they intend to be on these drugs appear fairly vague. A study in the Journal of Pharmacology and Therapeutics found that one year after withdrawal of once-weekly subcutaneous semaglutide 2.4 mg and lifestyle intervention, participants regained two-thirds of their prior weight loss, with similar changes in cardiometabolic variables. It becomes the case that, for most patients, ongoing treatment is required to maintain their weight loss results.

So why are patients discontinuing their GLP-1 prescriptions? There’s a slew of side effects that come with taking GLP-1s. From “Ozempic face” to gastrointestinal symptoms (e.g., nausea, vomiting, diarrhea, and constipation) to more severe, less common side effects including jaundice, gallstone attacks, bile duct blockage, etc.—GLP-1 usage should not be taken lightly.

According to Bernstein, “the most common ongoing side effects were nausea, constipation and energy loss (all with 28% of patients reporting experiencing these side effects on an ongoing basis) as well as mood swings (27%), sagging loose skin (25%) and headaches (24%). The least common ongoing side effects were suicidal thoughts (8%), allergies (12%) and vomiting (14%). Many individuals noted that the side effects wore off as their body adjusted to the drug, but initially they experienced nausea (24%), abdominal pain and headaches (both 23%) as well as diarrhea (20%).

Are GLP-1s for weight management a long term solution or a passing trend?

A study examined the use of GLP-1 receptor agonists (GLP-1 RAs) in the UK from 2009 to 2017, finding that 45% of the 589 patients initiating GLP-1 RA therapy discontinued within 12 months, with 65% discontinuing within 24 months. A similar investigation was conducted in the US over a comparable timeframe, encompassing a larger cohort of diabetic patients. Results indicated a comparable discontinuation rate to the UK findings, with 47% discontinuing within 12 months and 70% within 24 months. On average, participants in this study remained on the drug for approximately 13 months before discontinuation.

New Market Opportunities for CPG

While the emergence of GLP-1 drugs poses perceived “challenges” to the food industry, it simultaneously brings forth a plethora of opportunities. Companies that proactively adapt their strategies and diversify their product offerings are poised to thrive in this evolving landscape. Ultimately, success hinges on vigilantly observing trends, fostering innovation, and adapting to the fluctuating consumer behaviors and preferences.

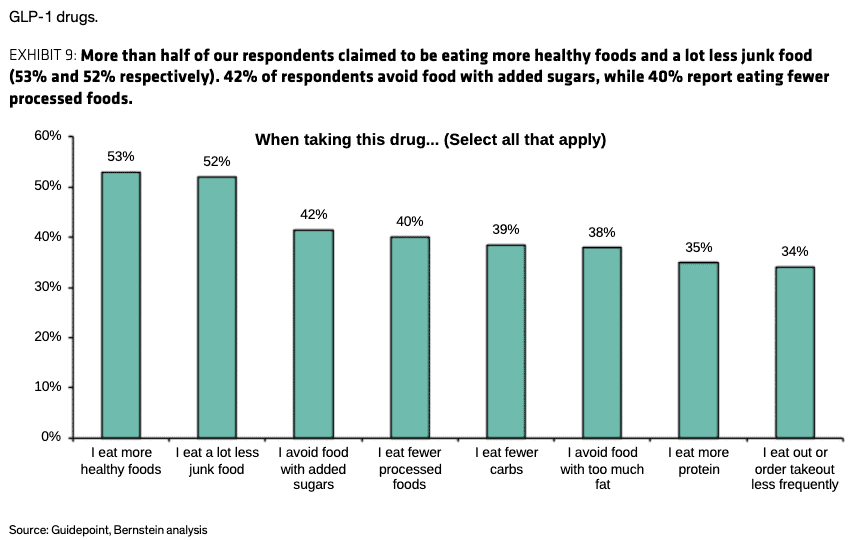

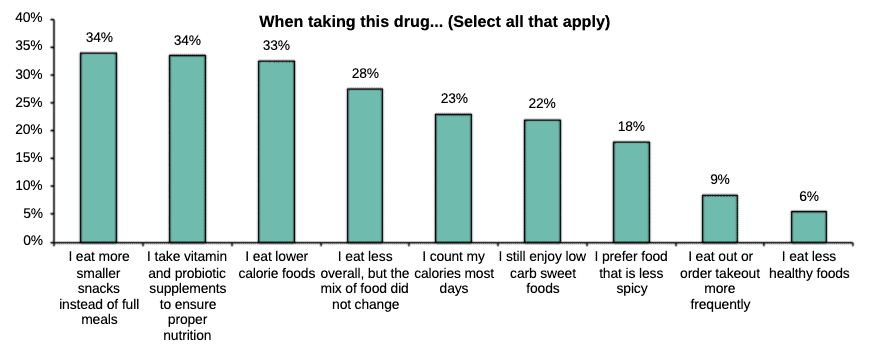

What does all this mean for CPG leaders? In terms of individual corporations, those with a protein focus such as Kraft Heinz may fare better than carbohydrate-focused companies like General Mills. According to a Bernstein survey, more than half of their respondents claimed to be eating more healthy foods and a lot less junk food (53% and 52% respectively) while 42% avoid food with added sugars and 40% report eating fewer processed foods. Additionally, 34% of respondents were also now eating smaller snacks instead of full meals as well as taking vitamin and probiotic supplements to ensure proper nutrition.

Overall, companies should be adjusting their strategies to accommodate the GLP-1 trend, potentially emphasizing portion control, premiumization, and considering the effects of GLP-1 drugs on potential mergers and acquisitions. With approximately a third of US adults classified as obese or overweight and 26% expressing a desire to lose weight, we could see a considerable decrease in calorie intake if 10% of US adults use these drugs within the next five years.

The emergence of GLP-1 drugs creates new opportunities for food and beverage businesses. GLP-1 drugs not only reduce cravings but also foster healthier dietary choices, significantly assisting individuals in accomplishing their weight loss objectives and enhancing their overall health.

Discover more insights on GLP-1s by saving your virtual seat for our webinar with Bernstein Analyst, Alexia Howard.

Getting Ahead of the Competition

Identifying and pursuing industry trends can be a full-time endeavor, as new weight loss drugs and approval processes are constantly being introduced to the market. It’s why more C-Suite executives are implementing market intelligence platforms that leverage AI into their operations and enable them to quickly find the answers they need to act confidently and swiftly. AlphaSense provides this and more.

Discover our extensive content library, aggregating business documents from over 10,000 content sources, as well as our powerful AI search technology, and be at the forefront of your industry.

Weight loss drugs are just one of the many market-moving trends projected to shape 2024. Curious to learn what else this year has in store? Be sure to download our report, 10 Market-Moving Trends for 2024, to get ahead of what’s unfolding in coming quarters.

Start your free trial with AlphaSense today to see how our platform can get you ahead of your competition.