In our volatile market, public companies are testing new approaches that engage their shareholders and simultaneously meet expectations from various stakeholder groups. But on top of this mounting pressure of demand, regulatory oversight has increased, accompanied by heightened shareholder activity—making it that much more difficult to appease everyone.

As Investor Relations (IR) departments face the ongoing challenge of balancing the interests of their organizations and shareholders, what elements are essential for cultivating a genuinely proficient IR team? More so, how can IR deliver substantial value to CFOs, management, investors, and beyond?

Today, IR Officers (IROs) are responsible for effectively delivering high quality materials for quarterly earnings. As the days of merely elucidating corporate strategies and operations are quickly becoming a practice of the past, IROs are focused on crafting and sharing strategies optimally poised to unleash shareholder value. Ultimately, actions speak louder than words for long-term investors, as hard numbers (i.e., YoY and QoQs fiscal performance reports, etc.) outweigh empty sales pitches on strategy.

But, what does that entail exactly? What is the role of an IR office in today’s volatile market? How does an IR firm succeed in the midst of unpredictability, placate shareholder interest, and generate new investment interest? Below, we dive into these pressing questions and more.

Redefining the Role of Investor Relations

Equity markets have experienced significant transformations over the past decade (i.e., activist investing, ESG, the proliferation of index funds), which has led to changes in the function of IROs. Today, an effective IRO must embody a proactive, strategic, relationship-oriented persona, capable of not only supporting and communicating the company’s strategy but also bolstering the credibility of the company’s management team.

According to the Harvard Business Review, the evolution of an IRO can be characterized by four key responsibilities:

- Articulating Company Strategy: Traditional IRO functions have evolved beyond merely explaining corporate strategies and practices. IROs now focus on elucidating why a particular strategy is optimally positioned to unlock shareholder value, making it more attractive to long-term investors.

- Intelligence Gathering: The modern IRO transcends the role of a record-keeper and takes on the role of an intelligence agent. They proactively anticipate and identify issues that are of concern to investors, enabling the company to stay ahead of investor expectations.

- Identifying the Right Investors: In an environment where many companies are actively seeking investor capital, IROs must develop an in-depth understanding of their peer companies and keep abreast of trends among buy-side analysts. The best IROs possess the capability to identify the right investors for their company and ensure that these investors are aligned with the company’s strategic direction.

- Serving as the Early Warning System: Today, IROs are not merely financially astute but also possess a profound understanding of how investors function. They need to monitor capital allocation and talent management, discerning how these elements align with the company’s long-term strategy. In essence, the IRO’s role extends to functioning as an early warning system for potential challenges and opportunities.

Essentials Steps for an Effective IR Strategy

Finding the Right Partner

If your organization lacks the internal expertise to formulate a robust IR plan or require a fresh perspective, consider engaging an IR consulting firm. Professionals outside of your wheelhouse can provide invaluable insights, industry acumen, vital connections within the investment community, and expertise in capital markets to bolster your chances of success.

However, it’s important to note that IR consulting firms come in various shapes and sizes. Some may prioritize public relations, neglecting the essence of investor relations. Others may excel in tactical aspects like scheduling meetings and crafting press releases but may fall short in strategic planning. Therefore, thorough research is essential to ensure that the consulting firm you select possesses a proven understanding of your industry, its key investors, and a strong track record in the realm of Wall Street.

And remember, the relationships you establish with investors and on Wall Street are integral components of your business strategy. Consequently, the investments you make, whether in terms of time, strategic thinking, or resources, toward crafting a robust IR plan should yield substantial long-term returns.

Sharing the Good, Bad, and Ugly

In both times of success and turmoil, CEOs and CFOs must establish effective communication with investors when embracing a mindset of transparency and realism. This approach enables them to clearly and succinctly define the subject matter and ensure that every external stakeholder comprehends the proposed actions—whether it involves conveying good news or the worst-case scenario.

The key is maintaining a consistent and seamless message throughout the entire organization. It’s not solely about what the IR team, CEO, or CFO communicates to investors but also how your communications team conveys information to the media, how you share the news with your employees, and the messages delivered by the sales and business units to customers and vendors. Achieving this level of consistency demands significant coordination and strong partnerships across various functions within the company.

In those rare moments of turmoil, rather than avoiding or delaying a challenging message, it’s better to “run to the fire.” In other words, confront it directly by providing a candid assessment of the issue, its underlying causes, and the steps being taken to address it.

Further, it’s essential to have a well-thought-out plan and carefully consider the implications of the message you are conveying, ensuring that it remains consistent across all the different audiences you are addressing. You should be mindful of the company’s previous public statements to bridge any gaps between past communications and the current message.

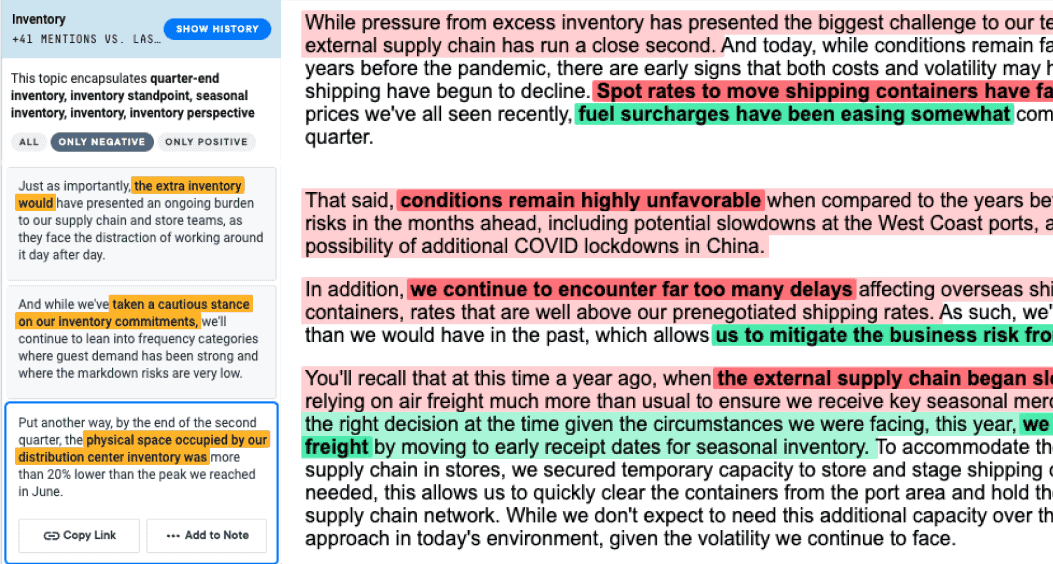

IR professionals can benefit from using sentiment analysis to understand how their own messaging or that of their peers was perceived in past quarters. AI picks up on nuances in language and understands the context behind the phrase, enabling IR professionals to highlight specific topics and shift their language around more negatively perceived themes.

Ultimately, it’s best to review how you handled previous challenges. Ask yourself: what has been your most successful approach to overcoming obstacles? Rather than simply acknowledging the problem, communicate openly with investors regarding the nature of the issue, the reasons behind it, and the actions the company is taking to rectify the situation. Go the extra mile of providing comprehensive explanations to ensure that investors fully understand the situation and have confidence in your management team’s ability to implement a plan to get things back on track.

Refine Your Messaging

To effectively convey your company’s strengths, it’s imperative to begin with a comprehensive understanding of the broader industry landscape and its existing markets. With this foundation in place, you can then zero in on the unique qualities that set your company apart from competitors.

When crafting your messaging, resist the urge to delve into every detail of your business. Instead, create a concise and compelling investment summary that distills your message into a manageable set of bullet points, something that could comfortably fit on a single page in a PowerPoint presentation.

Here are some key questions to consider:

- What makes your primary market enticing?

- How does your company innovate to address this market differently?

- What’s your strategy for growth?

Offer investors a clear grasp of your company’s business model by succinctly outlining your objectives and the strategies you’re employing to achieve them. While investors seek data, exercise caution in selecting which metrics to emphasize. Particularly in fields like healthcare and life sciences, statistics and data can significantly influence a stock’s value. Concentrate on a few key metrics that serve as reliable benchmarks for gauging your company’s progress, and consistently report these metrics on a predictable schedule, such as quarterly updates.

Maintaining consistency in your messaging is paramount. Ensure that all your representatives convey the same narrative by developing a set of core points within your IR presentation and reiterate these points across all communication channels, including press releases, investor presentations, your website, and during Q&A sessions with investors.

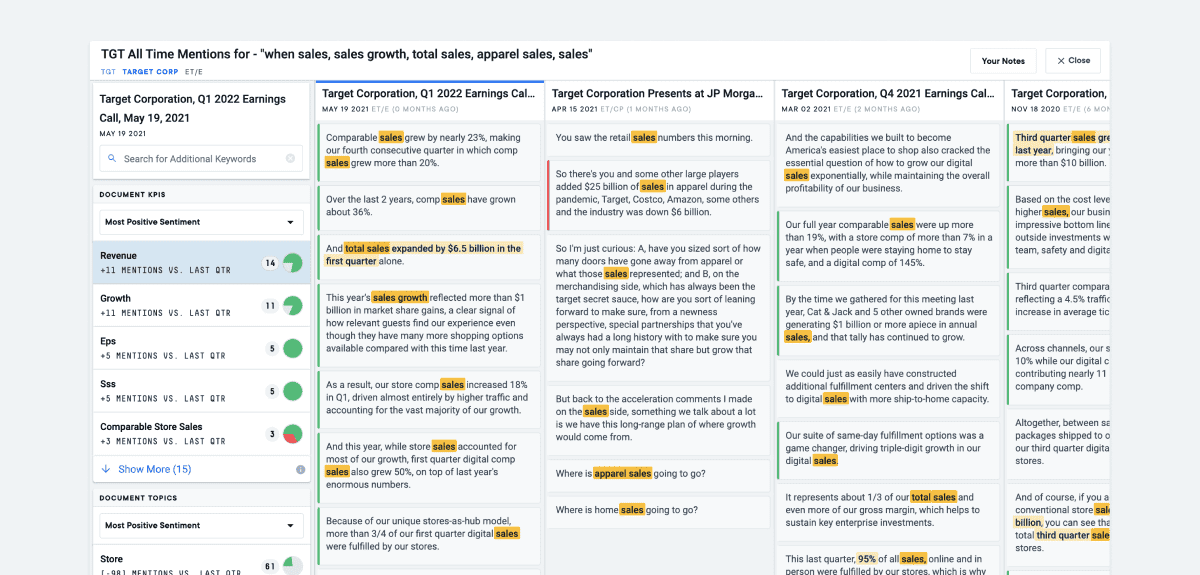

AI tools can help you quickly do a historical analysis of how you’ve covered a topic quarter-by-quarter. When armed with smart search technology that finds synonyms beyond what a Ctrl+F search would surface, IR teams can mitigate the risk of missing key phrases or mentions.

Establishing Trust with the Financial Community

In any successful IR strategy, building credibility with both the buy and sell-side of the financial community is paramount. Start by ensuring that your narrative is straightforward and maintain a consistent message. Always keep in mind that you are “narrating” a story rather than aggressively “selling” it.

While it’s essential to share your story with passion and enthusiasm, investors will quickly disengage if they sense over-promotion. Avoid excessive promotional tactics, and when planning your annual conference schedule, be discerning about the frequency of shareholder meetings. Quality trumps quantity in this context.

Credibility hinges on transparency. Establish a robust disclosure policy and a clear approach to providing comprehensive and timely information. Define the company representatives responsible for making such disclosures and specify how this information will be disseminated.

Maintaining transparency and responsiveness is particularly crucial when facing challenges. Though the instinct may be to shield bad news, this approach is counterproductive. It’s imperative to stay visible even during challenging times. Instead of shifting blame to external factors, take ownership if the issue is internally driven, and articulate a clear plan for rectifying the situation.

Earning credibility during periods of prosperity ensures that your team will receive the benefit of the doubt from investors when circumstances deviate from the expected course.

Engage the Shareholders Fit for your Company

Understanding your shareholder base is a critical step. Without a comprehensive grasp of their decision-making process, it becomes challenging to determine their expectations. Conducting a perception audit is an effective approach to gather this information. This audit serves as a valuable tool for evaluating how your target audience perceives your company, your current product lineup, and your position within the market. Perception audits can be executed through in-person or phone interviews. Analyzing the outcomes will provide you with a clearer insight into investor expectations, enabling you to refine your messaging and potentially even your product offerings.

Once you have established a robust shareholder base, it’s vital not to take them for granted. Develop a strategy to nurture these relationships through a thoughtfully planned series of activities, including conferences, non-deal roadshows, fireside chats, and one-on-one meetings. These events present an opportunity to communicate significant milestones, generate excitement, gather feedback, and also introduce you to potential new clients, thus diversifying your shareholder base.

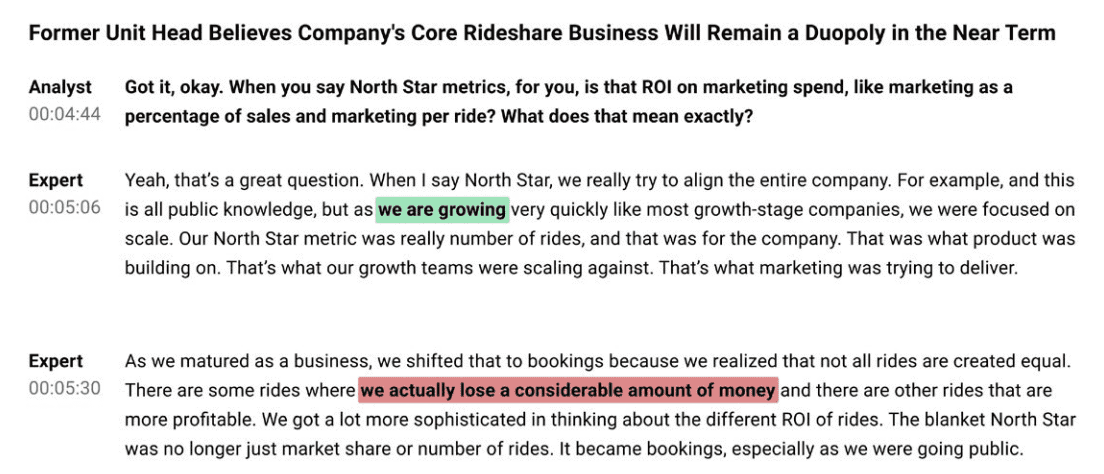

Today, IR professionals are leveraging the power of expert transcripts in AlphaSense to stay prepared for the unexpected. Expert call transcripts are a highly valued source to inform investor communications, as they allow IR leaders to monitor questions buy-side analysts are asking competitors. Knowing what these analysts are asking your industry peers will help you create relevant investor presentations, guide conversations, and prepare your C-suite for earnings Q&A.

Read our case study to learn how a leading cloud software company relies on Expert Insights to anticipate any potential question an investor might raise in an earnings call.

Fundamentally, IR is about cultivating relationships. While most companies recognize the importance of fostering and maintaining relationships with both sell-side and buy-side research analysts, few realize the significance of establishing connections with key sales professionals at prominent investment banking firms. Institutional sales people frequently possess two to three decades of experience and have strong relationships with buy-side investors, making them influential advocates for your cause.

Indicators of an Effective Investor Relations Strategy

- Notable recognition within the investment community signifies that your company is on the radar of potential investors and financial analysts. This recognition can lead to increased visibility, better relationships with stakeholders, and a heightened ability to attract long-term, committed investors. Furthermore, a strong presence within the investment community can enhance the company’s credibility, making it more likely to be considered for favorable investment opportunities.

- Understanding your competition and position within the industry helps IROs provide context and perspective to investors. By monitoring the competitive landscape, IROs can offer valuable insights into how the company differentiates itself and the unique opportunities it presents. This understanding enables IROs to effectively communicate the company’s strengths and growth potential to investors, enhancing their confidence in the company’s long-term prospects and supporting strategic investor relations efforts.

- Effective showcasing of the company’s management strengths instills confidence and trust in potential investors. When IROs highlight the competence, experience, and vision of their leadership, it not only demonstrates the company’s ability to navigate challenges but also fosters a positive perception in the eyes of the investment community. This, in turn, contributes to stronger investor relationships and increased investment interest, benefiting the company’s overall performance and stability.

- Establishment of comprehensive sell-side analyst coverage helps broaden the reach of the company’s financial information and analysis. This coverage ensures that the company’s story is effectively disseminated and understood by a wide audience of investors, ultimately attracting more attention from the investment community. Furthermore, it enhances transparency, credibility, and can lead to more accurate valuations, all of which are pivotal in building and maintaining trust among stakeholders and potential investors.

- Broadening the base of shareholders diversifies the investor pool and reduces the company’s reliance on a small group of investors, enhancing stability. A more diverse shareholder base can contribute to better liquidity, reduced volatility, and a more robust capital structure, which can be particularly important during challenging economic conditions. Additionally, it reflects the company’s ability to attract and retain a broad range of investors, strengthening its market position and attractiveness to potential shareholders.

- Maintaining steady and equitable valuations safeguards the company’s reputation and attractiveness to investors. Consistency in valuations signals stability and reliability, which are highly valued by investors. Moreover, stable valuations can support the company’s ability to raise capital, execute strategic initiatives, and foster investor confidence, contributing to long-term success and growth.

- Facilitating simpler and more cost-effective access to capital directly impacts the company’s financial flexibility and growth prospects. By ensuring efficient access to capital markets, IROs help the company raise funds when needed, whether for expansion, innovation, or addressing unforeseen challenges, without incurring unnecessary costs or complexities. This ability to secure capital efficiently enhances the company’s strategic agility and competitiveness, positioning it favorably in the eyes of investors and supporting its long-term financial health.

- Maintaining high-quality and consistent Investor Relations materials serves as the primary means of communication between the company and its stakeholders. These materials, which include financial reports, presentations, and investor communications, must be accurate, transparent, and reliable to build trust and credibility among the investment community. Consistency in the quality and message of these materials ensures that investors receive a clear and accurate picture of the company’s performance, strategy, and prospects, which is fundamental to fostering long-term investor relationships and supporting the company’s financial health.

- Levering an AI-based market intelligence tool can add substantial value to one’s quality of work—offering tools that streamline tedious processes and unearth information buried in traditional databases. AlphaSense offers a vast content universe and advanced search technology that makes market intelligence research and earnings prep a cinch. With our generative AI feature, Smart Summaries, you can conduct earnings analysis in record-breaking time. Unlike other consumer-grade genAI tools trained on publicly available data, AlphaSense takes an entirely different approach. Smart Summaries is purpose-built to deliver business-grade insights and leans on 10+ years of AI tech development.

Avoiding the Most Common IR Pitfalls

Whether your company is currently pursuing IPO status or is already a publicly traded entity, establishing and sustaining a robust rapport with Wall Street necessitates meticulous strategy and skillful execution. Interacting with both the buy and sell sides is a multifaceted endeavor. Too often, companies make missteps in their IR programs, which can undermine the credibility of management within the financial community. These are the most common mistakes IROs make:

- Evasion of Unpleasant News: CEOs and CFOs are inherently inclined to deliver positive updates to their investors but often hesitate to communicate emerging issues for various reasons. Sometimes, they convince themselves that they can miraculously resolve the problem, which is seldom the case.

The best approach is to address any issue as soon as it becomes evident. Investors understand that plans may need adjustments due to unforeseen circumstances, so it’s best to do so communicate promptly and transparently. Ultimately, attempting to conceal or deny a problem is counterproductive. - Neglecting Guidance Implications After Exceeding Quarterly Projections: While surpassing quarterly estimates is good news, companies must provide sufficient detail on what drove the positive results to prevent analysts from excessively elevating their annual estimates. Management teams must be cautious when stating it’s too early to adjust annual estimates, as this can lead to confusion among analysts and affect future quarterly results.

- Excessive Focus on Stock Price Fluctuations: Premium valuations are built on consistent, transparent, and successful results over time. Overemphasizing short-term stock price fluctuations is usually futile. Instead, concentrate on executing your strategy, set realistic and achievable guidance, and maintain consistency in the metrics you report.

- Overloading Investor Deck Slides: Some management teams inundate their presentation slides with excessive information, assuming that more content is better. In reality, simplicity is more effective. Each slide should convey a clear and specific point, contributing to a coherent narrative that resonates with the target audience.

- Inadequate Access to Research Analysts and Their Clients: Pursuing a broad analyst coverage at the expense of neglecting existing relationships can be counterproductive. Being inaccessible to analysts, especially those who cover your company, is a common mistake. Analysts rely on interactions with management to provide value to their clients.

- Failure to Tailor the Message to the Audience: Tailoring your communication to the specific needs of your audience is vital. Identify the nature of your audience, whether they are pre-IPO bankers, sell-side analysts, or buy-side investors, and adjust your presentation accordingly to meet their expectations and needs.

Building an Effective IR Strategy

In the midst of market volatility, staying up to date on market developments requires a tool that separates the noise from the insights you need. Consequently, by streamlining the process required to be up-to-date on Wall Street chatter and industry dynamics, you waste less time and money on appeasing stakeholders and gaining investor interest.

With AlphaSense’s vast content universe and advanced search technology, you can conduct deep, comprehensive, and accurate research to make earnings prep fast and easy—all while saving time and resources for higher-value tasks.

Today, AlphaSense powers deep market analysis capabilities for leading organizations around the world, including 85% of the S&P 500, 75% of the world’s leading asset management firms, and 80% of the top consultancies.

Start your free 2-week trial today to explore the AlphaSense platform firsthand and see how it can help your organization transform.