Sentiment analysis can play a vital role in understanding company outlook and nuances in language on earnings calls. Having a firm grasp on the implications behind earnings messaging can help determine the best course of action to take when investing — or not investing — in a company.

Company sentiment that’s conveyed on earnings calls often translates to shifts in the market. With AlphaSense, analysts can apply a deep learning sentiment lens to transcripts within moments of them appearing in the platform, elevating their ability to spot potential stock movement before it happens.

We built the best sentiment product in the market for analyzing financial language in earnings transcripts. Read on for recent examples when our sentiment model captured shifts in sentiment that were then correlated with stock price movement.

Using sentiment trends to identify inflection points

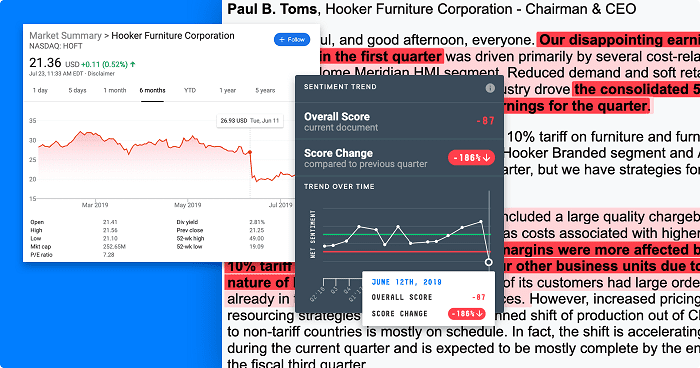

In Q1 2019, Hooker Furniture Corp.’s (HOFT) stock plunged following a particularly rough earnings season:

Even before diving into the transcript, AlphaSense Sentiment trends signals a 186 percent drop in Sentiment score within the latest earnings report when compared to the quarter prior, and an overall document score of -87 (measured on a scale of +100 to -100). It’s a significant change, and a potential red flag that warrants closer analysis. With highlighting of phrase-level sentiment (shown above right), you can hone in on the most powerful statements to get the context you need. (AlphaSense users can log in for full transcript here).

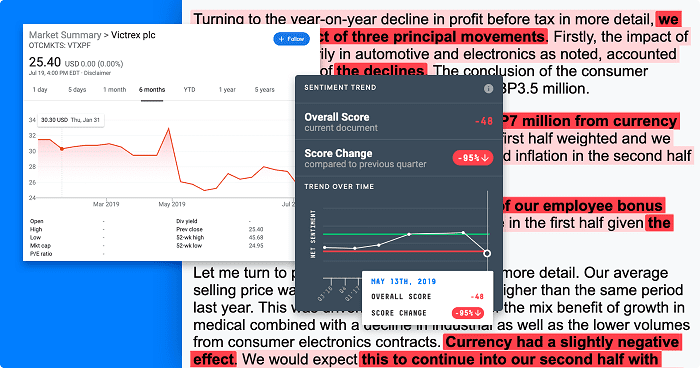

Tracking impact of global economic trends

In this example from Victrex, you can clearly see that shift in score deviates from positive sentiment trends noted in the prior two earnings reports (located in the left-pane view) — something that’s directly reflected in stock movement following the announcement.

Diving further into the transcript reveals negative mentions of sluggish sales in the automotive and electronics industry, and inflation concerns – both indicators of larger global economic trends that could continue to impact business over time. (AlphaSense users can log in for full transcript here).

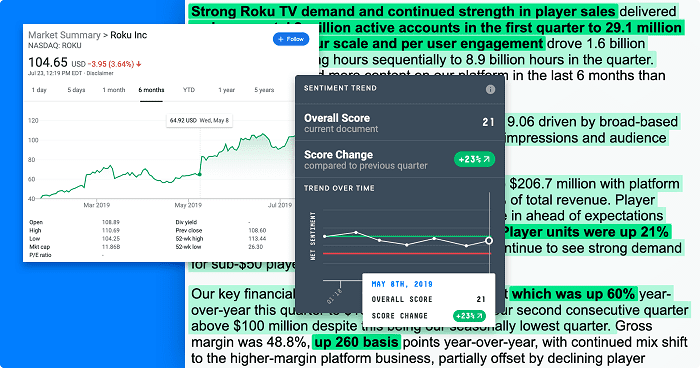

In another example, streaming television provider Roku saw a bump after announcing they were raising their outlook in Q1 2019, citing strong demand.

Roku’s stock has continued to rise through Q2, as streaming services continue to grow as a popular consumer trend. (AlphaSense users can log in for full transcript here).

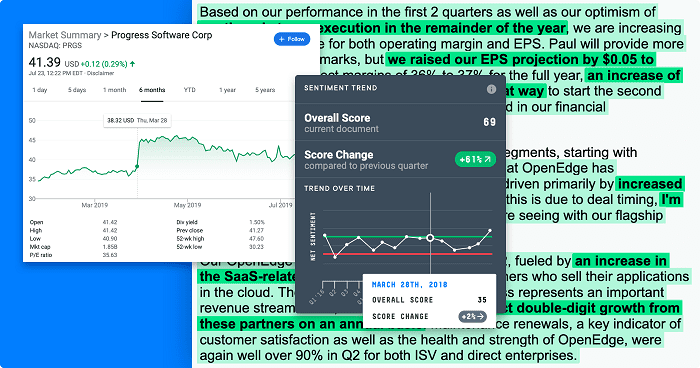

Analyzing Impact of new business and acquisitions

Q2 2019 was a big quarter for Progress Software Corp. (PRGS) which secured its acquisition of IT management firm Ipswitch in May.

AlphaSense Sentiment clearly notes details of the acquisition, along with other areas of growth opportunity for the company. (AlphaSense users can log in for full transcript here).

Detecting potential stock movement with AlphaSense Sentiment

Trained to understand the nuances of financial language, AlphaSense Sentiment is the smartest sentiment analysis capability for financial language on the market. Want to see more? Get in touch for a personalized demo now.