State of Market Intelligence

Read the report

Now that Congress has passed the $1 trillion infrastructure bill, the U.S. is ready with picks and shovels to break ground. And that’s excellent news for infrastructure stocks.

The infrastructure bill allocates $550 billion in new federal investments in American infrastructure over the next five years, including $110 billion for roads, highways, and other related projects.

The original $2.25 trillion infrastructure proposal would have been the most extensive public works program in decades. Unfortunately, large portions of the proposed bill initially faced significant challenges in Congress, particularly the sections related to improvements to the home healthcare system and creating jobs at prevailing wages in safe and healthy workspaces. Despite the challenges it initially faced, infrastructure spending is typically popular with voters. Republicans and Democrats tend to find common ground in their hatred of potholes and gridlock.

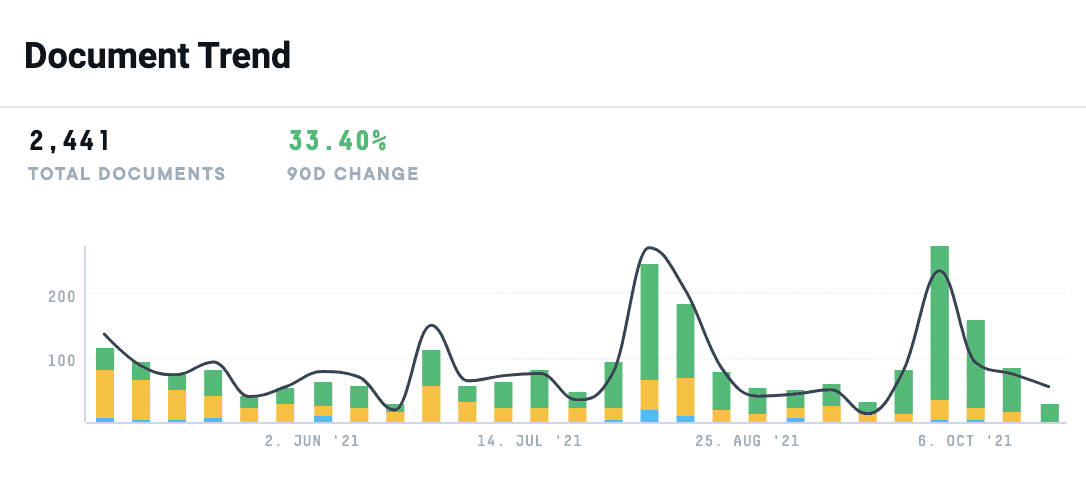

In the last six months alone, there have been over 2,000 documents uploaded around “Biden” and “Infrastructure Bill,” spanning over 30 key infrastructure-related industries, including automobiles, metals & mining, and machinery.

“Maintaining America’s place as the world’s premier economy isn’t something that just happens,” says Chase Robertson of Houston-based RIA Robertson Wealth Management. “It requires investment. Most of that investment comes from the private sector, but certain things – particularly roads, bridges, and shared infrastructure – tend to be funded by the government. And the new administration has made it very clear that this is a major priority.“

And while many initiatives in this bill won’t kick in for a few years, the boost from this round of stimulus could come at just the right time as the recovery wears off. No market segment comes with a guarantee of an upside, especially amidst the current waves of wild speculation. Infrastructure tends to be a bit different, as no matter what happens politically, it often maintains a level of pertinence.

Here are 20 infrastructure stocks that could likely see a boost from Build Back Better.

Related Reading: 10 Best Stock and Investment Research Tools

1. Nucor (NUE)

Nucor is the largest domestic steelmaker in North America. They have a proven track record in providing products for several of America’s prominent structures, including airports, bridges, dams, and waterways. Nucor is a safer bet amongst their competitors, such as ArcelorMittal or Nippon Steel, because they are an American-based company, fitting the Biden Administration’s desire to build American. Nucor has already seen a massive boost in demand from the pandemic due to pent-up demand from automakers and other industrial buyers.

2. United Rentals (URI)

Construction investment is a given against the backdrop of infrastructure spending in the years ahead. An increase in construction naturally yields an increase in demand for equipment. United has a network of over 1,000 rental locations, most of which are in the U.S., spread out between General Rentals and Trench, Power, and Fluid Solutions. General Rentals focuses on standard construction equipment, whereas Trench, Power, and Fluid Solutions rent out specialty equipment for underground and fluid work.

3. Vulcan Materials (VMC)

Vulcan Materials is one of the more apparent picks for the Bipartisan Infrastructure Investment and Jobs Act. Vulcan Materials is America’s largest producer of construction aggregates, which includes crushed stone, sand, and gravel. Aggregates alone make up for 76% of its revenues and 91% of its gross profits. It’s also a producer of asphalt and cement. Vulcan is about as American as it comes to a company. They boast more than 360 aggregate facilities scattered throughout the country. The company has been doing business for 64 years and is known as a leader in its industry. The Biden Administration has shown a preference for buying American, and Vulcan fits perfectly.

4. Martin Marietta Materials (MLM)

Similar to Vulcan, Martin Marietta Materials could be among the best infrastructure stocks over the coming months and years. They are a building materials company specializing in large construction and infrastructure projects. They make crushed sand and gravel products, ready-mixed concrete and asphalt, and paving products. They also make magnesia-based chemical products and produce dolomite lime. In addition, their chemical products are used in flame retardants, wastewater treatment, and other environmental applications.

5. Caterpillar (CAT)

Caterpillar primarily designs, manufactures, and markets construction machinery and related equipment. They have an extensive dealer network across the globe, making them the largest construction equipment manufacturer in the world today. In March of last year, the shares found a bottom and have shot up nearly 130% since then, signaling that investors consider infrastructure spending as a major component of any economic recovery plan.

6. American Tower (AMT)

The infrastructure bill doesn’t focus solely on roads and bridges. It also includes $65 billion to improve Americans’ access to the internet and bolster the availability of 5G wireless internet. American Tower is a global provider of wireless communications infrastructure and next-generation wireless technologies. This stock has been a top performer so far in 2021, up 29% on the year, and further gains can be seen to power America’s information superhighway.

7. Deere & Co (D.E.)

Deere is famously known for its tractors and other heavy-duty farming equipment. The company is also a major producer of construction and forestry equipment, used explicitly in moving earth and roadbuilding. Stimulus aid from the Federal Government and other central banks are helping to fuel surges in commodity prices, particularly with soft agricultural commodities.

8. Brookfield Infrastructure Partners L.P. (BIP)

Brookfield Infrastructure Partners L.P. and their sister company, Brookfield Infrastructure Partners (BIP), make up BIP, one of the largest diversified infrastructure companies in the world. Their operations span utilities, transportation, energy, and data infrastructure. They strive to be shareholder-friendly, with a long-term return on equity of 12-15% and annual dividend growth of 5-9%.

9. ChargePoint Holdings (CHPT)

Biden is serious about electric vehicles. He has made it very clear that he intends to command that space on a national level. One of the green initiatives that Biden pledged is to build hundreds of electric vehicle charging stations across the country by 2030. That pledge directly benefits companies like ChargePoint Holdings. They have been in business since 2007, long before E.V.s was on the radar of investors.

10. Oshkosh (OSK)

Another green initiative that Biden is going after is the electrification of the federal vehicle fleet, including trucks used by the United States Postal Service. Oshkosh recently won the contract to produce over 160,000 new mail trucks, with a significant percentage of them being E.V.s. This is a good sign for future projects to come. Oshkosh also has several vehicles used in construction projects, including cement mixers and hydraulic lifters.

11. United States Steel Corporation (X)

United States Steel Corporation is an integrated steel producer and one of the largest in the U.S. The company prides itself on innovation across the automotive, construction, appliance, and container industries. One of their biggest innovations as of late is their investment in a state-of-the-art non-grain-oriented electrical steel line.

12. Crown Castle International (CCI)

As mentioned earlier, Biden is committed to reaching 5G and expanding internet access. Crown Castle International is one of America’s leading wireless tower real estate investment trusts. As mobile data usage continues to snowball, Crown Castle has a solid play in capitalizing on that trend. While it is not a traditional infrastructure stack, it does have an attractive long-term play concerning mobile data usage.

13. Eaton (ETN)

Eaton is a major supplier of electrical components and systems, particularly in the green energy space. Eaton has a lot of opportunity within the green-focused spending, as wind and solar farms become integrated into the national grid. They have been a power management company for over a century and could become crucial with the shift towards longer-term infrastructure plans.

14. Freeport-McMoRan (FCX)

Copper is a critical component of building and construction. It has been the preferred metal in electrical wiring and plumbing. Roughly 63% of all mined copper is used in building construction and transportation equipment. That means a spending boom in infrastructure could lead to a boom in demand for copper. Freeport-McMoRan is one of the world’s largest copper miners. Beyond the traditional uses of copper, it has also proven to be a considerable part of the green energy push. E.V.s use more copper than conventional internal combustion vehicles. Solar and wind energy use more copper than oil and gas.

15. Cemex (CX)

Cement producer, Cemex, has seen surges in their stock on the heels of the housing boom. It is safe to assume that the Biden infrastructure bill will further accelerate that demand. They are a reliable maker of cement, asphalt, ready-mix concrete, and aggregates essential for construction, roads, and highways. The company recently acquired Texas-based company Beck Readymix, showing they are committed to cement-volume growth, their largest market.

16. NextEra Energy (NEE)

While Nucor could benefit from virtually every single aspect of an increase in infrastructure spending, NextEra Energy is in a great position to capitalize on two specific areas related to the energy sector. First, NextEra is the largest electric utility company in the U.S. and owns NextEra Energy Resources, a clean energy business generating renewable energy from wind and solar. They have already proven themselves to be committed to ESG, making them a successful and profitable company for investors even without new infrastructure bill spending.

17. Autodesk (ADSK)

Tech has some skin in the game when it comes to increased infrastructure spending. Autodesk sells software to businesses that make things. For example, they recently acquired Innovyze, which helps utility companies manage assets and optimize their operations. With the infrastructure bill proposing over $200 billion in spending for piping, water systems, and the electrical grid, it is likely money will flow through to software like Innovyze. Autodesk also recently acquired Spacemaker, a tool powered by A.I. that helps architects and real estate planners build more efficiently. Biden’s bill has already committed over $300 billion to home and school construction, a clear area of opportunity for Spacemaker and green building in general.

18. Parsons Corp. (PSN)

Parsons, a digitally enabled solutions provider and a global leader in many diversified markets focusing on security, defense, and infrastructure, is looking well-positioned to reap the benefits of an increase in federal spending. 75% of Parsons’ infrastructure work is based on transportation operations, like road and bridge construction. They also do environmental remediation, toxic site cleanup, and wastewater treatment operations.

19. Atlas Technical Consultants (ATCX)

Atlas Technical Consultants provides engineering and design services, inspection and certification of buildings and public works, and other construction-related services. Though they are small and a relatively young public company that tends to get minimal Wall Street coverage, there is a unique play here for Atlas. They are well-positioned to benefit from an increase in construction and building.

20. Tetra Tech (TTEK)

An increase in spending on what’s traditionally defined as infrastructure means an area of promise for an engineering consultancy. Tetra Tech, an engineering consulting firm that works in water infrastructure, environmental management, sustainable infrastructure, and renewable energy, is in a great position to benefit from Biden’s commitment to green initiatives. Right now, Tetra generates 30% of its revenue from federal spending.