Cannabis—it’s an industry that generated $43.72 billion globally in 2022 and will grow cashflow to $55 billion by 2027 according to BDSA. But, the haphazard state-level legalization of cannabis in the US, more specifically the conflicting regulations across states, has muddied waters for aspiring national growers, retailers, and investors. This has left many wondering: what law-abiding opportunities exist?

In our latest episode of Signals, AlphaSense’s Director of Research, Nick Mazing, sat down with Aaron Edelheit, an investor in both public and private cannabis companies. In the episode, Edelheit provides context to the apprehension of legalizing “weed” at the federal level, including classifying it as a Schedule I drug, and how states have embraced medical and recreational use since its legalization.

Further, Edelheit discusses the challenges of cultivating consistent products at scale and how this obstacle could set the stage for what competition looks like within the industry. Find the answers to some of the most pressing questions (i.e. will cannabis be a brand-dominated industry or a commodity) below.

Understanding the Industry

Cannabis’s Medicinal Value: Is the federal government’s Schedule I controlled substance classification for cannabis accurate? Drugs under this category are “not currently accepted for medical use as they have a high potential for abuse” according to the DEA. But Edelheit questions this line of thinking.

“How many people have overdosed from cannabis this year? Zero,” Edelheit says. “So the medicinal value is we know that it helps cancer patients tolerate their drugs. It is clear pain relief, it helps people with anxiety and post-traumatic stress disorder.”

“There is an approved FDA drug that is a synthetic form of cannabis that treats kids with epilepsy,” he continues. “So there are just so many [medical uses], and now we’re finding that it could possibly work against COVID. We’re just starting to explore really how cannabis works and how it can work.”

Federal and State Legislative Conflict:

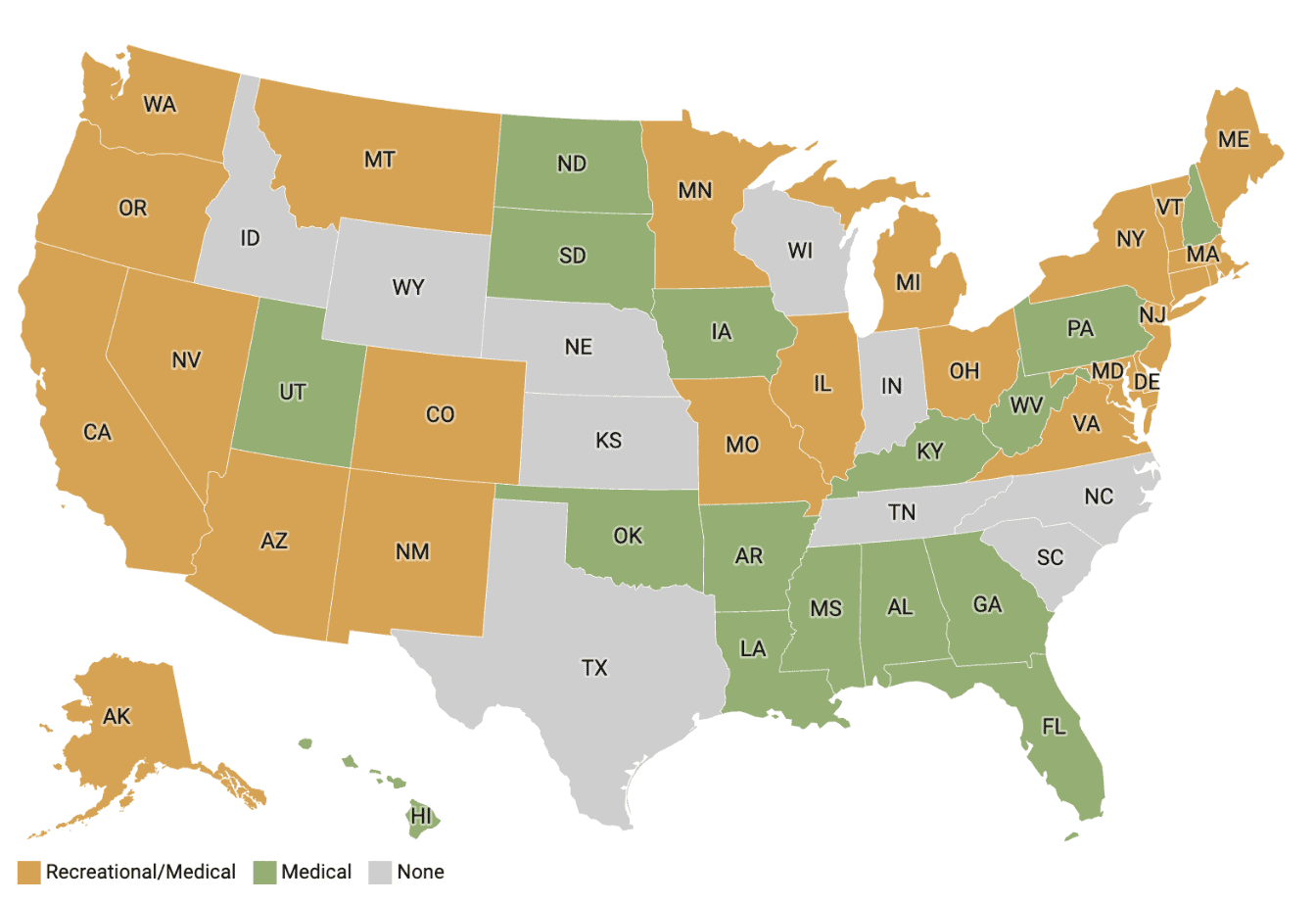

Even though states have moved towards embracing the sale and use of recreational and medicinal cannabis, the government has not budged on its Schedule I substance classification—causing tension and ambiguity for those involved within the space.

“You have like 38 or 39 states that have [said] we’re just going to ignore the federal government, and we’re going to legalize it in our state for medical [use]. And then you have a number of states who are like, we’re just going to make [available for recreational use]. And what happened? The reason why more and more states are legalizing it is [because when they do] everything gets a little bit better.”

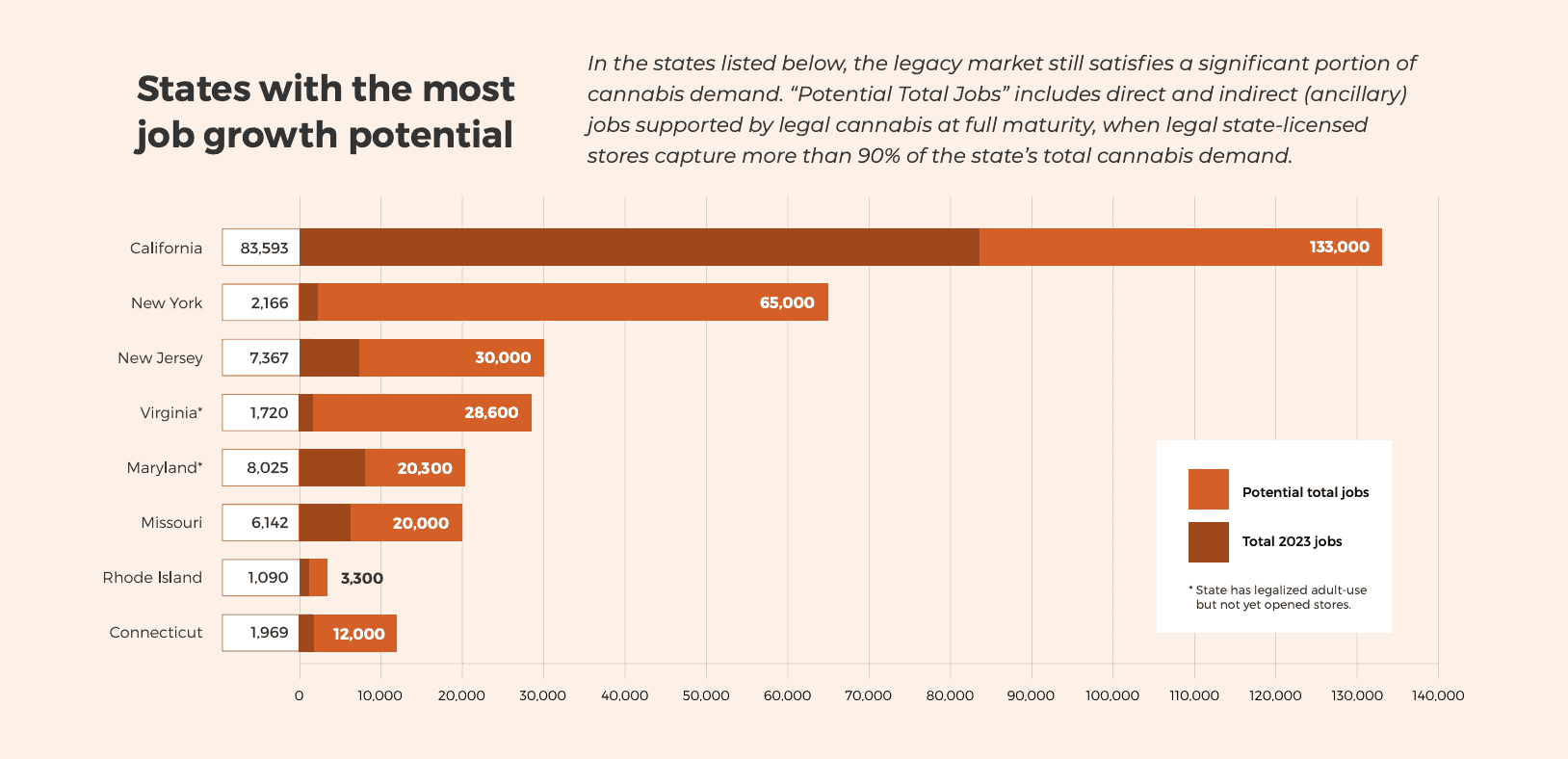

According to the 2023 Vangst Jobs Report, states like California, New York, New Jersey, Virginia, and more have yet to embrace the full potential of their respective cannabis industries—and the plushy employment opportunities that come with it. For example, California has only reached around 83,000 cannabis jobs of a potential 133,000.

Vangst explains that “if state policymakers work together to move legacy market consumers into legal, licensed, tax-paying stores, we should see the return of double-digit job growth.” The number of full-time equivalent jobs supported by legal cannabis (417,493 jobs) dropped 2% from one year earlier due to economic headwinds, but is expected to get back on track in terms of revenue and job growth.

A Huge Investment Opportunity:

While the discourse between state and federal legislation is slowing this industry from reaching its full potential, there’s still an opportunity to see promising returns from cannabis. As more states adopt lax stances on weed, money will follow.

“This is just a small taste of how totally absurd what’s going on in cannabis is and I love it,” Edelheit says. “Basically, from an investor’s standpoint, there’s no competition. 99% of the smartest people in the world are involved and you have a $100 billion industry that exists right now. Albeit $70 billion is illicit, but it’s happening. You have 30 billion that’s state legal but federally illegal. And I think because of the medical applications, one day this is going to be 200 billion, but it’s almost all going to be legal.”

Cannabis Key Insights

Growing Consistently Good Cannabis Is Not Easy

Ultimately, growing cannabis is farming, and farming includes a lot of uncertainties ranging from incorrect nutrient planning to pests and diseases, an uncontrolled growing environment, and much more. The bottom line: planting a crop definitely does not guarantee a bountiful harvest, as many things can go wrong along the way.

“One of the things that has been so fascinating is that when you talk to the people trying to do this, you realize how hard it is, and you see the companies that stumble; companies that have spent hundreds of millions of dollars and still cannot grow cannabis — where consumers are like, I’m not going to use that stuff,” Edelheit says. It’s just very inconsistent, or you’ll have it’s just not good, or that you’ll have it’s really good, but it costs a fortune.”

Supply Chain Inconsistency

The US cannabis market demands a constant, mammoth supply for retail sales, edible and concentrate production. And the demand for massive amounts of flower is likely to increase as more states allow medical patients and recreational consumers to legally purchase the plant.

By 2027, BDSA predicts the legal US cannabis market will reach $55 billion in annual sales. But with growing inconsistencies affecting quality and supply, the issue of a stable supply chain comes into question.

“When I think about as an investor, supply chain becomes really important because when this becomes legal, and you have Diageo, or you have British tobacco want to come in, they’re going to want a consistent supply chain, and they’re going to want the companies that can enable them to have consistent products and brands,” Edelheit says.

The Importance of Branding

Reaching a target audience for a particular cannabis brand can be challenging without creating a sense of identity. In order to reach new and established consumer bases, fostering product recognition and loyalty will be crucial to beating out the competition in the long run.

“I think eventually you’re going to have brands. You don’t walk into a bar and say, ‘I want grain alcohol.’ You just don’t do that. Maybe if you just turn 21 or you’re getting your first drink, you’ll be like, ‘I’d like a beer,’” Edelheit says.

“But people don’t do that. If they want just kind of an inexpensive but good quality beer, they’ll get a Budweiser; they want something more, they’re going to order more. It’s the same thing with wine. It’s the same thing with tobacco. Normally people don’t say, ‘I just want a cigarette.’ They might, but normally people have preferences, and eventually, this is going to be branded.” he continues.

The Future is Green

It seems that marijuana is no longer a topic of debate amongst most Americans and legislators, as support for legalizing cannabis is at a record 70%. According to a recent Gallup poll, seven in 10 Americans think cannabis should be legal, the highest level ever recorded. Since recreational marijuana first became legal back in 2012 within the states of Colorado and

Washington, following the passage of Amendment 64 and Initiative 502, 24 states have followed suit as of January 2024. Medical marijuana is also now legal in 40 states.

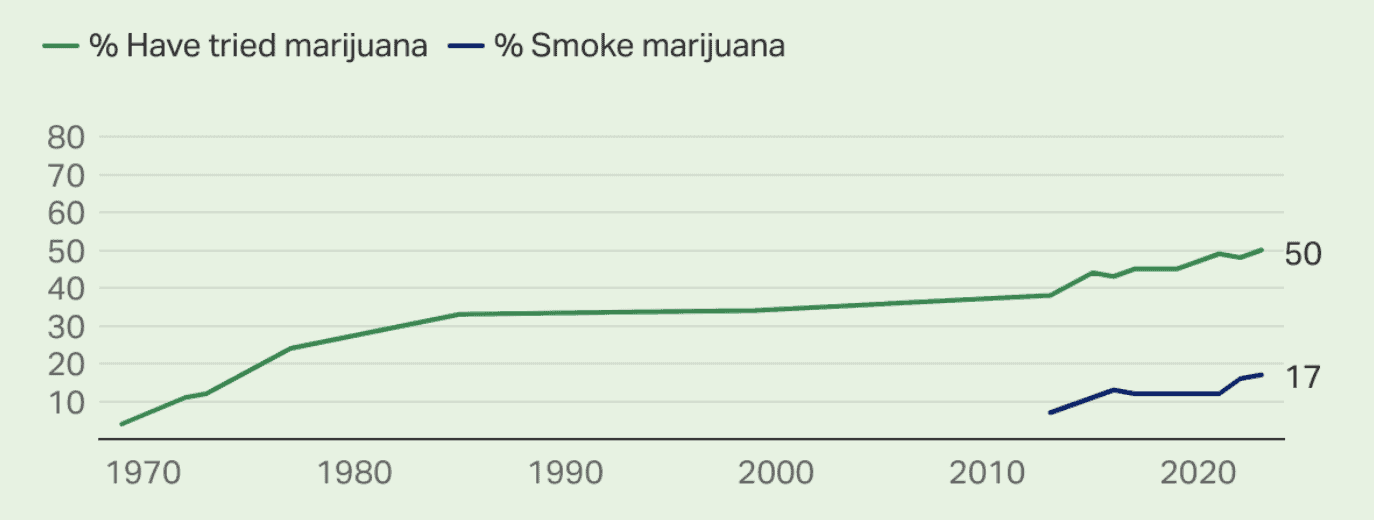

The number of Americans who have experimented with weed has skyrocketed between 1969 and 2023, reaching a new high point (50% of Americans) according to Gallup. So what does this mean for the cannabis market? The US cannabis industry is expected to reach almost $40 billion in 2024 according to projections from Statista, reaching a total revenue of $39.85 billion. And for every $10 consumers and patients spend at dispensaries, an additional $18 will be injected into the economy—amounting to roughly $115.2 billion, MJBizFactbook reports.

One major force driving cannabis’s exponential market growth: Dry January. In a report from CivicScience, researchers found that 21% of Dry January participants are replacing alcohol with cannabis and CBD. The largest demographic of those replacing alcohol with cannabis are aged 21-24 (34%), followed by those aged 25-34 (24%)—Gen Z and Millenials. This trend, while bad for the alcohol industry, is benefiting states when it comes to tax revenue.

“The largest and longest-established markets generated the most [cannabis tax] revenue in California, Washington, and Colorado. In the first quarter of 2023, 10 states—Arizona, Colorado, Maine, Massachusetts, Michigan, Montana, Nevada, New Mexico, Oregon, and Washington—generated more revenue from cannabis than from either alcohol (9 states) or tobacco (Washington),” the Tax Foundation reported.

Spotting Opportunities with AlphaSense

Interested in learning more about the emerging cannabis market? Subscribe to our Signals podcast and listen to the entire episode on the cannabis investing landscape. Signals by AlphaSense features conversations with executives, experts, journalists, and analysts. These deep but quick insights from the world of finance, business, and research will help you make better decisions every day.

With new regulations and consumer markets forming, staying on top of every new development is imperative to getting your foot into the cannabis business. To do so, you need a tool that aggregates leading industry information, all while helping you cut through irrelevant noise. AlphaSense is that and more. Read how Verano, a vertically-integrated operator of licensed cannabis cultivation, uses our platform to scan through an influx of information and find the insight they need in seconds.

Using our innovative market intelligence platform, our clients can access broker research, company documents, and more from over 10,000 plus content sources—ensuring that our users have all the information they need.