Digital transformation, long-emerging, has officially arrived in investment banking. Driving this transformation is the power of data analytics, giving institutions more information and insight (and doing it more quickly and intelligently) than ever before.

JP Morgan recently announced that they are hiring 4,000 new employees specializing in digital skills like cloud technologies, big data, and cybersecurity. Financial institutions are expanding their executive leadership teams to include more technical experience and expertise.

After more than a year of accelerated digitalization, clear data analytics trends are emerging for investment banks.

Here are five data analytics trends we have our eyes on.

1. Automation Enhances Employee Roles

Across industries and around the globe, automation technology tools continue to emerge with new capabilities for streamlining processes, eliminating potential human error, and increasing overall efficiency for organizations. Still, many companies don’t fully embrace it, investment banks included.

Why? Well, it’s no secret that automation is seen as a risk to the current role analysts play in investment banks, where many positions are highly functional. The assumption is often that any process performed by a machine is viewed as one being taken away from a human who once did it manually.

In reality, investment banks have an opportunity to shift this perspective by looking for ways to create collective intelligence and increase their strategic responsibility as previously time-consuming processes become automated, allowing for a focus on more high-value work.

Investment banks assist large, corporate clients across the globe on a myriad of complex financial transactions, meaning they need to possess analytics capabilities in order to stay ahead of more quickly-evolving client expectations and behavior.

A recent study by McKinsey reinforces this notion that workforce demand won’t diminish, but rather the skills required will evolve to include less basic cognitive skills and allow for analysts to make more social, emotional, and technological decisions.

Here’s how McKinsey predicts time spent on skill areas will shift through 2030:

About the banking and financial services industry specifically, the study notes:

“The need for a workforce that uses only basic cognitive skills, such as data input and processing, basic literacy, and basic numeracy, will likely decline, while the number of technology experts and other professionals will grow, as will the number of occupations that require customer interaction and management. This increase will drive strong growth in the demand for social and emotional skills.”

Bankers often grapple with low confidence in the completeness of data. Finding that esoteric company information is just as important as knowing when it cannot be found. Hours are often wasted looking through sources and resource platforms to ensure they’ve covered all their bases. Investment banks with their finger on the pulse of this trend, then, will amplify their analysts to glean real-time insights, create higher quality work, and strengthen their client relationships.

2. Governance and Accountability Increase

With digital transformation in banking has come an increase in regulations and governance, creating increased accountability for investment banks in the ways they collect, analyze, share, and report their data.

This has been no easy accomplishment — and it’s one still in progress — for federal regulators and other governing bodies aiming to keep up with the rapid pace of digital transformation.

Investment banks and other industry institutions have taken notice of the emerging trend and are proactively taking steps to increase data security and govern their data. In 2020 USAA expanded its leadership team to include an SVP-level Chief Technology and Data Officer with a primary focus on data governance and analytics. Fifth Third Bank has adopted a solution to tokenize cloud data for added security.

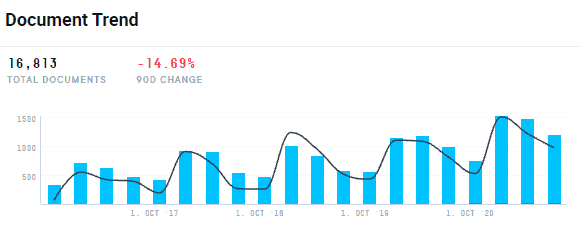

Industry chatter in general reflects a growing focus on data governance and its larger implications. In the AlphaSense platform, the company document trend over the past 5 years shows a steady incremental climb.

Action throughout the industry shows a prioritization not only of internal data governance and security but also the standardization of data best practices.

This is an important step given the increasingly complex set of players within the industry, such as fintech and the big tech who often don’t fall under the same regulatory requirements, but have access to much of the same data that investment banks do.

Big techs, in particular, are taking a significant role in payment services (read: Apple and Google pay, among others) and have even begun offering insurance and wealth management services to small businesses.

This trend is predicted to force a culture shift in which central banks, the SEC, and other industry regulators will be required to expand their policy scope to include data or collaborate with data governance regulators to do it.

3. The Client Experience Evolves

Client expectations have evolved alongside digital transformation. While financial services industries have been somewhat notoriously known for digital resistance (especially in a pre-COVID era), clients have long been demanding experiences that align with those offered by the consumer brands they interact with.

The pandemic eliminated any resistance banks may have wanted to maintain to offer a fully digital experience. In 2020, banks were forced to move operations and core client communications fully online, things previously deemed impossible not to do without at least some true face-to-face interaction.

A 2021 survey conducted by digital solutions provider Atos included 400 retail banking leaders across North America and Europe. Responses showed that 66% of banking leaders consider transforming the digital client experience a top priority for the next year.

“Digital disruption is not new to the banking industry,” said Adrian Gregory, Global Head of Financial Services & Insurance at Atos, “technologies advance and hungry market entrants are emerging all the time. What has changed, however, is the massively accelerated shift to digital channels as a result of Covid-19.”

For investment banks, this shift is heavily centered on mobile-app investing. New waves of individual investors are dipping their toes into the investment world through apps offered by fintech (think Robinhood, Acorn, and Reddit’s r/investing threads) but also from some of the industry’s more traditional players, like the JP Morgan Chase Wealth Management app and TD Ameritrade App. The latter has recently expanded its app experience to include live streaming content providing market analysis and investor education.

But for investment banks to reap the true value in embracing digital transformation as it relates to their client experiences, they must take it one step further to include sophisticated data analytics. While clients enjoy their enhanced digital experience, investment banks have access to larger and more informative datasets than ever before that give insight into nuanced financial metrics, consumer behavior trends, and more.

Investing not only in the ability to provide a digital client experience but to evaluate what the resulting data says about future trends is the key to staying a step ahead of industry competitors and ensuring analysts come to important conclusions faster.

4. Mass Migration to the Cloud

“Don’t try and do this softly,” says Yolande Piazza, former CEO of Citi Fintech and current Google VP of Financial Services. “Now is the time to rip the Band-Aid off.”

This is her advice to banks thinking about adopting cloud capabilities — and we agree.

For banks to take advantage of the many benefits digital transformation and big data have to offer, the migration of that data to a centralized location will be absolutely necessary.

From an internal perspective, the past 18 months have demonstrated how essential it is that analysts can access information to work from anywhere, as the workforce has shifted to fully remote (and taken many hybrid forms since then).

Offering analysts a centralized location to search for reputable data, helps them quickly source, aggregate, validate and share information with their clients, resulting in stronger relationships. Google Cloud and Salesforce have already recognized the opportunity and gotten in on the game, offering cloud solutions specifically tailored to the financial services industry for better cloud capabilities.

Beyond a centralized location, groundbreaking AI technology has been built to understand financial language and allow analysts to move faster, capturing all the relevant information around a topic that a simple CTRL+F can’t match.

For investment banks, these solutions and others like them, mean faster and more secure sharing of market data, smarter portfolio management, and better client services.

5. AI Creates New Insights and Capabilities

Last, but absolutely not least, is artificial intelligence and the transformative impact it is having in the financial services industry across a wide range of operational and strategic areas — mainly, data analytics, keyword extraction, and alerts to newly sourced information.

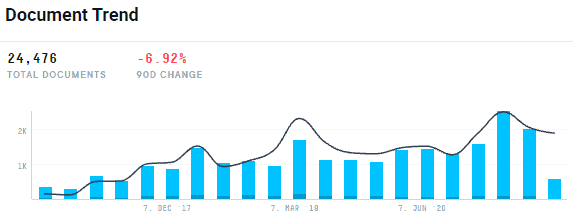

AlphaSense research shows a significant increase in financial services company documents mentioning “AI” over the past five years:

Within the financial services industry, most AI mentions (more than a third — 34%) live under banking, indicating that banking firms and professionals do indeed see the AI imperative that is emerging in their sector.

This is reinforced in the commentary:

HDFC Bank | Quarterly Earnings Call Transcript:

“[Our] immediate next best action is an artificial intelligence tool that studies the customer transaction patterns and digital behavior and can correctly pinpoint the financial need of the customer in the contextual relevance to suggest products and timing.”

Mitsubishi HSJ Financial Group | Annual Report:

“We mandate that all employees undergo e-learning focused on programming, AI, and other relevant topics to help raise their digital literacy.”

Howard Bancorp Inc (Maryland) | Quarterly Earnings Call:

“. . . we’re continuing to explore fintech relationships primarily to allow us to achieve certain processing improvements, including some modest early attempts in AI and RPA implementations.”

Real success in this space, then, will hinge not on a firm knowing that AI is a necessity but on the way they allocate strategic focus, resources, and manpower behind the meaningful implementation.

Putting Data Analytics and AI at the Center of Your Strategy

Investment banks have more information than ever before at their disposal.

Analysts and associates can eliminate redundant research and save their firms annually on wasted research-related costs. With the cost of research high and the underlying process slow, banks can increase their efficiency through an emphasis on data analytics, resulting in happier clients, stronger real-time decision-making, and more meaningful insight extraction.