In a world where change is the only constant, staying on top of emerging trends isn’t merely an option; it’s a strategic imperative.

Ongoing economic uncertainty has created dynamic shifts in the consumer market. In order to grow and even sustain business, companies must stay ahead of consumer trends to beat the competition and become the brand of choice.

In today’s dynamic market, it’s no longer enough to simply track consumer preferences and behaviors—you must also understand how these impact market outlook, company strategy, and product innovation. This allows you to adapt your offerings to shifting consumer demands and make informed decisions that enable you to thrive in the ever-evolving consumer landscape.

Here are four questions you need to answer to stay ahead of the constant market shifts and develop a successful growth strategy:

Question 1: What are the most impactful consumer preferences shaping today’s market?

To stay ahead of this curve, you need to receive insightful and relevant information to act upon before anyone else. Utilizing AlphaSense’s real-time alerts and dashboards is a great way to monitor macro and industry trends proactively. These tools allow you to never miss out on new information—such as a broker report titled, “Gen Z and Millenial Consumers are Changing the Game”.

In this report, you can get a high-level market overview of various macroeconomic and industry-specific trends fueling innovation and disruption for B2C companies. One is an increase in vegan/vegetarian diets, which has catalyzed the rise in plant-based foods.

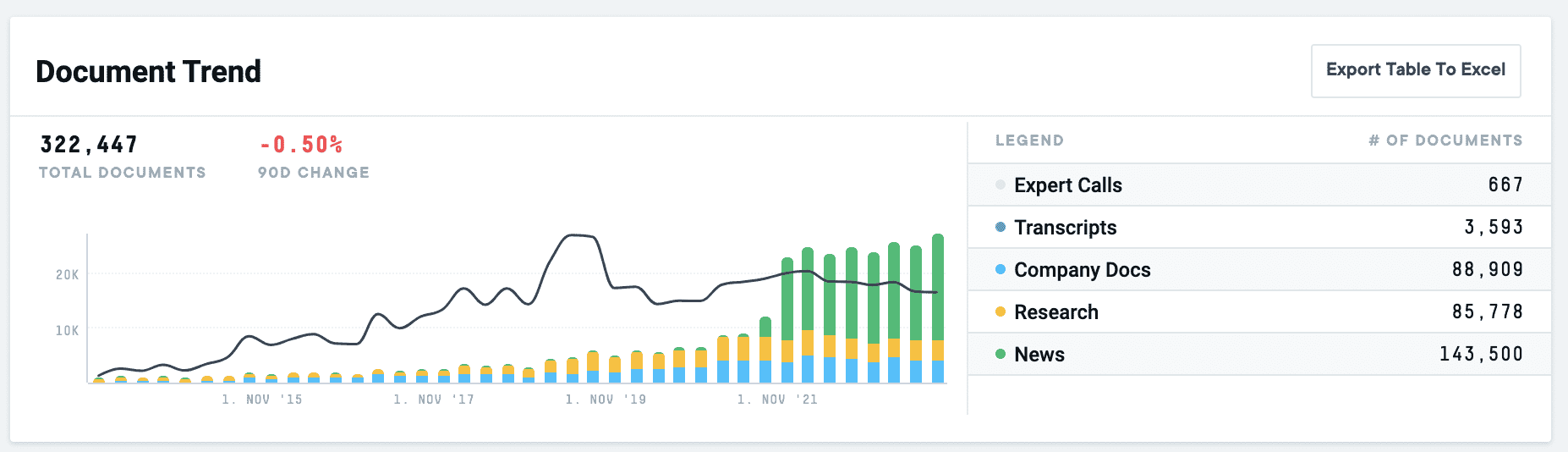

With AlphaSense, you can quantify qualitative mentions for trends, helping to understand better trend lifecycles and if a topic is truly the center of conversation in the market. Looking at mentions of plant-based trends, you can see a clear spike around the end of 2021. The trend has remained consistent since then but hasn’t seen further growth.

Having access to historical document trends allows you to easily vet out the market to understand the difference between short-lived fads or lasting changes to an industry.

Question 2: What is the market opportunity for this emerging space?

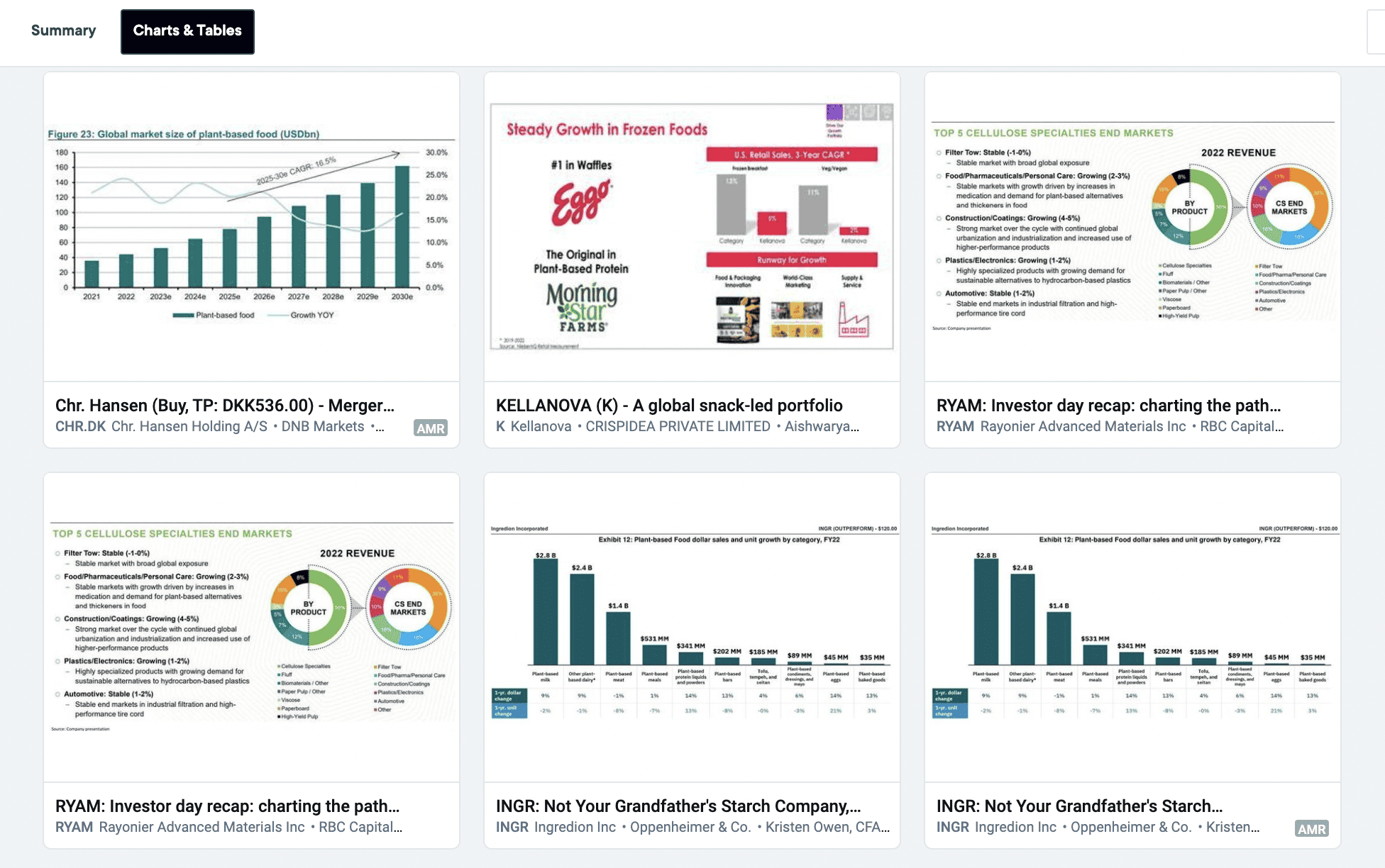

Broker research is a premium source that helps you track market forecasts and outlooks with greater confidence. Diving into the platform, you can immediately search the keyword “plant-based food and growth” and filter it to broker research content exclusively. Our Smart Synonyms™ technology recognizes variations in language, so there is no need to list other related words, like “vegan” or “vegetarian”. Our platform surfaces all documents that are relevant to the keyword and its synonyms, ensuring you don’t miss any critical information and mitigate research blind spots.

When looking for more qualitative data in qualitative content, a fast way to get to the numbers is to use our image search feature, which extracts all charts and tables from relevant documents. With a simple scroll, you can quickly find the images that most align with what you’re looking for, ensuring you have complex and complete data to back your position.

The top right graph gives a holistic view of the plant-based space, illustrating a steady increase in market size into 2030. However, after 2026, the YOY growth is expected to taper off. This decline could indicate a matured or saturated market, transitioning from innovative to a more commoditized product. When considering this emerging market, the numbers from the report confirm the importance of early entry to capitalize on the growth before it neutralizes.

Another graph that popped up to the bottom right-hand side, breaks down the market into specific food groups, giving you the insight into prioritization. While the graph shows that milk and other dairy products had the largest sales volume, it is essential to consider volume growth that is likely tied to demand. With that in mind, protein powders and eggs show substantial volume growth, giving you two other areas of opportunity to consider in your strategy-building.

For further insights and context on graphs, you can click on them and instantly go to their exact location within a given document. Searching around the image, you are able to find additional metrics to back your decision, such as dollar growth, unit growth, unit share, household penetration, repeat rate, and more.

Question 3: What competitors are already in the space, and what is their strategy?

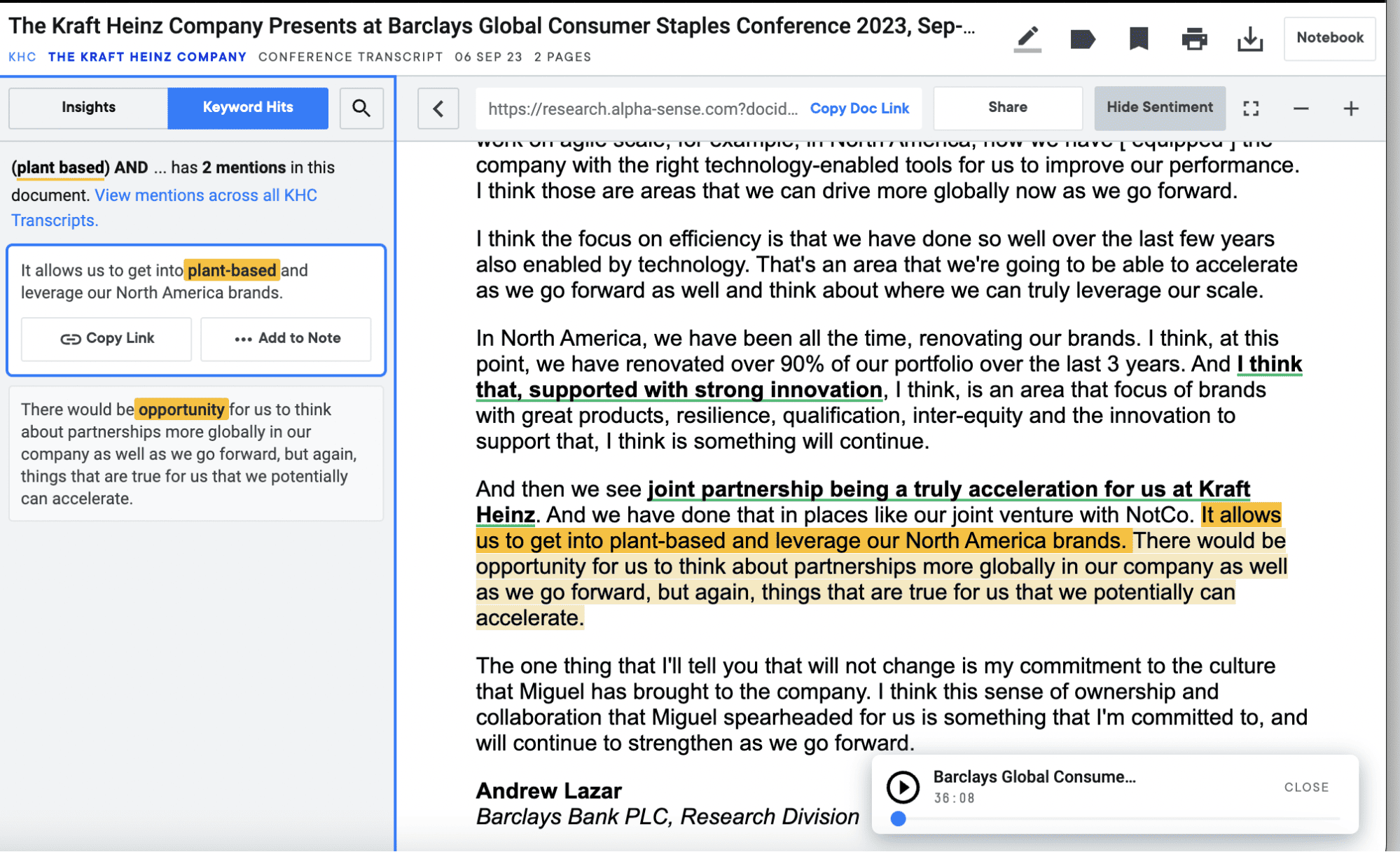

Looking at competitors is easy with AlphaSense’s company search. By simply typing in the company ticker and filtering for company documents, we can eliminate the noise and look at content straight from the source. For example, if Kraft is one of your key competitors, you likely want to assess and benchmark their strategies in this domain. By combining AlphaSense’s keyword and company search functionalities, you gain instant insights into Kraft’s plant-based business plans.

Using a company presentation from September 2023, we can read about their market entry strategy and their partnership with NotCo.

Looking through additional company documents, we find the following snippets about Kraft’s plant-based food business plans:

“In the second quarter, we boosted our investments in R&D, 10% versus the previous year. We are continuing to build our innovation pipeline, enabled by our Agile Innovation Engine. In the U.S., after conducting regional tests, we launched NotCheese, NotMayo and plant-based Philly nationally. We are launching with robust media support and plan to reach full distribution by the fourth quarter.”

– Miguel Patricio Chair & CEO | Earnings Transcript

“Today, Philadelphia®, the leading cream cheese brand with 69% share of the category*, is bringing its signature multi-sensorial experience to the plant-based aisle. Philadelphia Plant-Based spread features a carefully crafted recipe with simple, high-quality ingredients, creamy spreadable texture and delicious taste…With this new offering, the brand hopes to delight the 52% of consumers who want to add more plant-based foods to their diets.*”

– The Kraft Heinz Company | Press Release

“Second, we intend to increase marketing spend double digits. Two brands where we are focusing investments to drive share are Philadelphia and Kraft Mac & Cheese. Our cream cheese, we are focusing on Philly’s one-of-a-kind point of difference as well as our recently launched plant-based Philadelphia. On Mac & Cheese, once again, we are focusing on our liquids portfolio and we’ll reinforce the brand values of comfort and indulgence. We expect this incremental investment in cream cheese and Mac & Cheese to stabilize share in both categories by the end of the second quarter.”

– Miguel Patricio Chair & CEO | Earnings Transcript

Combining insights from these snippets, you get information on market entry strategy, R&D and marketing spending, timelines, and product prioritization to benchmark and inform your strategy.

Question 4: What is the candid market commentary on the emerging space?

The last question to answer is on candid market commentary, which can be found in our expert transcript library. Expert Insights is a proprietary content set you can’t find in the public domain that provides first-hand, anecdotal commentary from those closest to the company or trends of interest. This content set gives instant access to 38,000+ high-quality, searchable, proprietary expert transcripts covering multiple perspectives, industries, and markets.

Fifty-six expert interviews have been conducted around the keyword search “plant-based food”. Clicking into the first document in the list (sorted by relevancy), we have a call from a former employee of Beyond Meat titled “Former Sr. Director Is Optimistic About BYND Long-Term but Sees Continued Near-Term Challenges From Inflation and Competition.”

Expert interviews are a great way to fill research gaps, gain candid insights, and get a more granular perspective on products and strategies. Using either the snippets pane or the table of contents, we can click on them to instantly go to the section within the document needed for further context.

Let’s look at the section around the competitive landscape in the screenshot below. This expert believes Beyond Meat is the leader, while larger corporate conglomerates may have a harder time in the space.

Using AlphaSense’s NLP-based sentiment analysis feature, you can quickly understand the underlying sentiment in the call transcript and use this information to inform your decisions and strategy. Our sentiment analysis feature identifies tonal nuance and subjective meaning and uses color coding to denote the document’s positive, negative, and neutral sentiments. This allows you to quickly scan the document and focus on highlighted areas that may be of greater importance, so you save valuable time that would otherwise be spent on manually reading the entire transcript.

Overall, it seems this expert believes that companies solely focused on this space, such as Beyond Meat, will outperform the giant conglomerates, such as Kellogg: “I think you already see Kellogg spinning off their plant-based organization into a smaller unit. I’m not entirely sure of what’s driving that, but I can’t imagine it’s the fact that they believe in the outsized growth of that opportunity that they’d spin it off.”

Expert Insights provide an additional layer to your decision-making process when deciding if this is an emerging market to focus on.

Start Vetting New Market Opportunities With AlphaSense Today

Understanding consumer trends and preferences alone is not enough to inform your strategy. Today, staying ahead of these constant shifts is challenging and nearly impossible to do without the help of a market intelligence platform.

AlphaSense enables teams to access crucial market insights they can’t find elsewhere and spend less time manually searching for information to back up decisions and strategies. With our AI search technology and extensive content universe, you can quickly vet new markets and product innovations to stay on the leading edge of your industry.

Start a free trial of AlphaSense today.