The Inflation Reduction Act (IRA) of 2022 has clear objectives: to channel fresh federal investments towards a net-zero future, bolster funding for the Internal Revenue Service, enhance taxpayer compliance, and—potentially, most important—reduce healthcare expenses.

Through the IRA, Congress aims to enhance the affordability of prescription drugs by instituting reforms designed to curtail drug prices and alleviate out-of-pocket expenses for a substantial portion of Medicare beneficiaries. In the current healthcare landscape, prescription drugs account for 20% of the out-of-pocket expenditures for Medicare recipients, even as other healthcare costs have diminished.

But as Congress works to lower the prices consumers are paying for their prescriptions, C-Suite leaders remain concerned as to how the IRA could impact more than just QoQs earnings. Executives are asking: what does the Inflation Reduction Act mean for my company? What drugs are next on the price-cutting chopping block? Where should I look to stay updated on these matters?

Below, we dive into the conversations executives are holding about the IRA, how it could affect their product and assets, and strategies to overcome unintentional backlash from the regulation.

Understanding the IRA

The U.S. Centers for Medicare & Medicaid Services (CMS) spent an astounding $50.5 billion between June 1, 2022 and May 31, 2023 (the time period used to determine which drugs were eligible for negotiation) on the 10 drugs selected for price negotiations. This accounts for about 20% of the total cost of drugs in the Medicare prescription drug program known as Part D.

Until this past year, US laws had prohibited Medicare from negotiating pharmaceutical prices as part of its prescription drug program that began about 20 years ago. The 10 initial drugs were chosen based on certain criteria set out by Medicare: they must be sold in pharmacies, not have substantial generic competition, and need to have been on the market for at least nine to 13 years for more complex biotech drugs.

So, how could this become a problem for pharma companies in future QoQs? For starters, this is not the only time Medicare will be negotiating drug prices. CMS will choose 15 more drugs covered under Part D for 2027 for price negotiations, another 15 the following year (including drugs covered under Part B and Part D), and up to 20 more drugs for each year after that, as outlined in the Inflation Reduction Act.

Legal Action Taken by Pharma Leaders

As IRA negotiations take place, the pharma industry is responding by launching a series of new lawsuits that invoke the First and Fifth Amendments. Merck & Co. and Bristol Myers Squibb, for instance, are challenging the IRA’s constitutionality. Meanwhile, lobbyists and their co-litigants are incorporating the Eighth Amendment into their lawsuit.

According to a Pharma Voice article, William Soliman, CEO and founder of the Accreditation Council for Medical Affairs, views this approach of litigation as strategic. “They are using a multi-pronged approach in tandem,” he says. “The purpose (is) to hit the government on all ends and to ultimately force them to overturn or seriously limit the impact the IRA can have.”

Merck contends that the Negotiation Program, which relies on financial penalties to coerce manufacturers into accepting the government’s predetermined price, constitutes an infringement on the Fifth Amendment, as it is not a genuine negotiation process.

In Merck’s statement, leadership wrote that the “Fifth Amendment requires the Government to pay ‘just compensation’ if it takes ‘property’ for public use. Yet the singular purpose of this scheme is for Medicare to obtain prescription drugs without paying fair market value.”

Shortly after Merck filed its lawsuit, Bristol Myers Squibb filed one of its own, making the same First and Fifth Amendment arguments regarding the Negotiation Program. Similarly to Merck, Bristol Myers Squibb also pointed out that it continues to support certain IRA provisions, such as capping out-of-pocket costs for Medicare patients and allowing them to pay those costs over the course of a year.

Conversations with Pharma Execs

“I think that collaboration is going to be increasingly important in a post IRA world because making sure that we get those insights into very early decisions about investments that we make is going to be critically important…We’ve anticipated the IRA coming, so we have built very strong capabilities in the company to understand the implications of IRA for our existing assets…We are looking at the implications of IRA for investment decisions, not even at an asset level, but it’s really at a program level within an asset.”

– Bristol-Myers Squibb Company | M&A Special Call

“There are 3 Medicare Part D drugs in our portfolio, which we expect to be subject to IRA price concessions over the 2026 to 2027 period, namely Xtandi, Imbruvica and Trelegy. However, based on the specific dynamics of each of these 3 Part D medicines, we calculate the impact from the IRA to adjusted cash receipts to be in the low single-digit percentage range for 2026 with an even lower portfolio NPV impact…Moreover, given our flexibility, we are already reflecting the potential impact of IRA in the valuation and investment structure of new royalties we may acquire.”

– Royalty Pharma | Earnings Call Q2 2023

“We are carefully looking at assets in terms of potential IRA impact and ensuring that we think we have opportunities to either manage the IRA impact or avoid the IRA impact, certainly with conditions like Charcot-Marie-Tooth, cystinosis. These are areas where you wouldn’t be impacted by IRA as best as we currently see those patient populations.”

“But I think the biggest thing for us is we want assets that are in our core therapeutic areas or in our core platform technologies that have adequate risk reward, where they’re derisked from the basic science, but still there’s an upside that we believe we can deliver based on our capabilities. And we don’t want to overpay for very large deals where assets are fully valued and it’s difficult for us to find upside Novartis is contributing, and therefore, difficult to create value for our shareholders.”

– Novartis AG | Earnings Call Q2 2023

“The IRA is obviously impacting all companies in how we’re looking at our resource allocation choices, our business development, evaluation and, of course, how we progress our pipeline. As we look at the coming years, we are confident in our company’s ability to grow given the volume growth we expect for our innovative portfolio, which more than offset the impact that IRA will have on the price points here in the United States.”

– Merck & Co. Inc. | Conference Transcript

“I think the implementation of the IRA in the U.S. has changed the pricing dynamics a bit in the U.S. I think if you look at the impact of IRA on Pfizer, it’s relatively modest, only because the likely products that are going to be impacted by the IRA in the near term are products that are losing patent protection in ’26 and ’27.”

– Pfizer Inc. | Conference Transcript

“I think where Teva is positioned the IRA is—has interesting ramifications for the business. But if you think about Teva, I sort of segment the business into generics biosimilars and innovative medicine. And when it comes to generating access to afford momentum, I think we’ve obviously got our generics pillar and our biosimilar pillar, which drive that and are innovative pillar, which maybe is something which is going to probably more be impacted by the IRA. So there are many things that I think need to be evolved in the pricing system in the United States to make the necessity for things like IRA less important. I think you’ve got to see how this plays out, particularly as we don’t really know how the IRA negotiations will go in the first place.

– Teva Industries Ltd. | Conference Transcript

“So the first thing when we look at internal programs and we look at external programs, when we do our NPV calculations, we include all aspects of IRA. So when we make decisions whether or not to invest in internal program or an external program, we take those things into consideration. Clearly, on external programs, as mentioned before, it has to make sense scientifically, but also financially. And so we’ll have a strong financial discipline from that side.”

“So there are opportunities to accelerate our product development also in other areas using artificial intelligence, but we do that also irrespective of the IRA because we always want to aim to be faster.”

– Roche Holding Ltd. | Earnings Call 2023

“There are some really good things about the IRA that we’re very supportive of the co-pays and [moving] in vaccines is important for our portfolio. There are some other things alongside others in the sector we’re concerned about in terms of unintended consequences. And two parts of our portfolio, HIV will be more like in ’25. And then in Gen Meds from next year there is some impact, four of which is explicitly absorbed in our guidance and in our outlooks.”

– GSK Plc. | Earnings Call Q2 2023

“So let me start with the IRA. Obviously, we remain very concerned about the government price-setting environment that the IRA creates, which we believe creates a significant disincentive to innovation without addressing the core problem, which is patient access. So it is a significant concern for us. And that’s one of the reasons, as Erik commented earlier, that we have filed a lawsuit versus the IRA. So that’s important for us.”

– Johnson & Johnson | Earnings Call Q2 2023

“If you’re thinking about an oncology product where patients get to the catastrophic phase very quickly, there is probably an additional cost associated with that for us moving from the previous 70% coverage gap to the 10% participation in the initial phase and then 20% in the catastrophic phase. For other indications, it might be the opposite. So there is a mix there. But then it’s important to think about the fact that given that patients are now going to have a limit of out-of-pocket when they get to the pharmacy counter, hopefully, that should improve adherence and compliance to medications, which should drive, obviously, better health outcomes for these patients, but also as we’re thinking about medication kind of adherence. So there’s going to be some pushes and pulls of that part of the IRA.”

– Eli & Lily Co. | Earnings Call Q2 2023

Keeping Tabs on the IRA

To be at the forefront of the pharma industry, it’s crucial to be on top of every new development. You need AI search technology to help you speed up your ability to track new regulations and key trends so you can better inform your decision-making and take the lead.

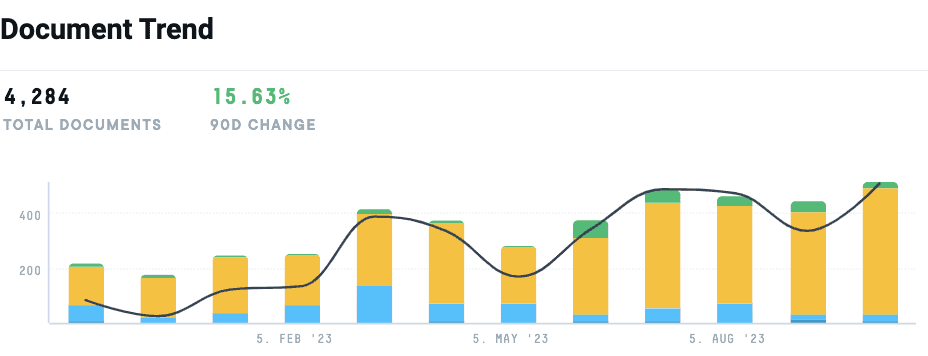

AlphaSense offers an extensive universe of company filings, earnings transcripts, expert interview transcripts, news, trade journals, and equity research—paired with proprietary AI-based search technology—to pinpoint valuable insights in seconds.

Start your free trial with AlphaSense today.