Pharma leaders are in a frenzy after the Senate Commerce Committee passed a bipartisan bill aimed at eliminating the practice of “spread pricing” last month. Spread pricing refers to when a Pharmacy Benefits Manager (PBM) charges a payer (i.e., commercial health insurance plans, third-party health insurance plan administrators, and government programs such as Medicare and Medicaid) more for prescription drugs than they pay the pharmacy and then keep the difference.

The House also introduced a similar bipartisan bill, leading the House Oversight Committee Chairman James Comer and bipartisan leaders of the Senate Finance Committee to release a legislative framework of a reform bill that focused on “transparency” and “making sure PBMs pass on meaningful savings to consumers.”

In the spirit of the Inflation Reduction Act reigning in drug manufacturers, lawmakers are putting PBMs under a microscope for reform. But even with bipartisan support, it’s unclear how much progress there will be with the U.S.’s divided Congress. This potential legislative standstill has given pause for pharma C-Suite leaders to consider how future QoQ and YoY fiscal performances may look if the bill does pass.

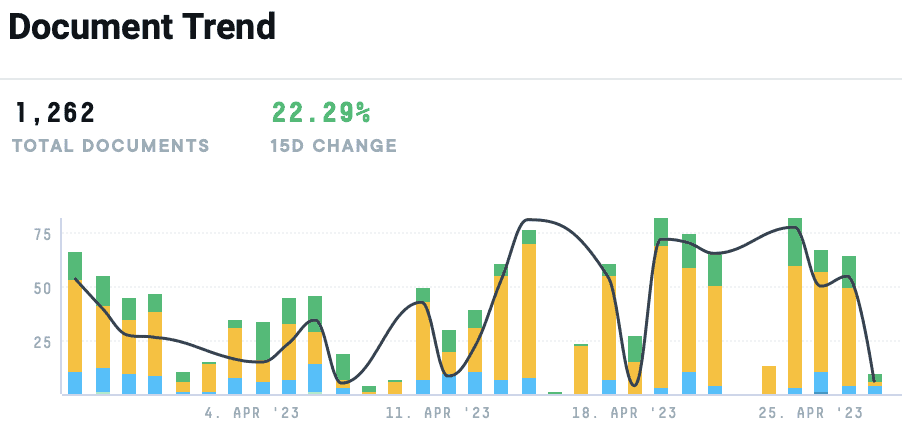

In the AlphaSense platform, we saw an over 22% increase in documents mentioning “pharmacy benefits manager” over the last month. Below, we dive into the role PBMs are playing in this congressional discussion, what pharma executives are saying about the matter, and dig into the frame of the proposed bill.

The Role of PBMs in Drug Prices

Fifty years ago, PMBs had limited capabilities within the industry, serving as mere fiscal intermediaries adjudicating prescription drug claims. Today, PBMs not only settle claims but also develop and manage pharmacy networks, determine drug formularies, set co-pays and criteria for prior authorizations, as well as the patient’s choice of pharmacy. As PBMs also negotiate with drug manufacturers and pharmacies to control drug spending, they’re now facing growing scrutiny about their role in rising prescription drug costs and spending.

But while drug manufacturers blame PBMs for the high prescription drug costs, industry leaders say that the role of a PBM is misunderstood, with executives pointing fingers at manufacturers. From the C-Suite perspective, PBMs are negotiating with insurers and manufacturers for lower drug costs and larger discounts for medications. PBMs collect rebates from drug manufacturers in exchange for coverage by a health plan, passing these savings on to insurance plans, resulting in lower premiums for consumers.

According to a report conducted by the RAND Corporation, prescription drug prices in the United States are significantly higher than in other nations, averaging 2.56 times higher than those seen in 32 other nations. Brand-name drugs have an even heftier price tag, as the gap between prices in the U.S. is averaging 3.44 times higher than those of other nations. Prices for unbranded generic drugs—which account for 84% of drugs sold in the United States by volume but only 12% of U.S. spending—are slightly lower in the United States than in most other nations.

Congressional Intervention

At the beginning of April, Senate Finance Committee Ranking Member Mike Crapo and Chair Ron Wyden unveiled the framework of their bipartisan bill aimed at pharmacy benefit managers (PBMs) practices and reducing drug costs. The Committee oversees coverage for more than half of all Americans—roughly 180 million people–through Medicare, Medicaid, the Children’s Health Insurance Program (CHIP), and the individual marketplace.

Under these programs, “prescription drug spending accounts for a significant portion of national pharmaceutical spending, which totaled $577 billion in 2021, and supply-chain complexity has complicated efforts to track the flow of these dollars.”

According to the bill, the Committee has a critical responsibility to examine supply chain practices to make prescription drug spending under these programs more efficient for patients and taxpayers. To ensure these benefits, legislators have identified four key challenges that call for policy solutions:

- Misaligned Incentives that Drive Up Prices and Costs

Ideally, all stakeholders participating in the supply chain, including pharmacy benefit managers (PBMs), should have an incentive to prefer medications that deliver the best results at the lowest cost. Unfortunately, under the current system, higher drug list prices often translate into higher compensation for intermediaries. By tying administrative fees, rebate-based compensation, and other payments to a percentage of list price, current arrangements incentivize increases in sticker prices. These dynamics can result in higher out-of-pocket costs for consumers, particularly in Medicare, where a list-price benchmark can determine cost-sharing amounts.

- Insufficient Transparency that Distorts the Market

The complexity and opacity of the supply chain have hindered efforts by patients, plans, and policymakers to make informed choices at virtually every level. Incomplete disclosure requirements have constrained accountability, eroding Medicare’s ability to select the services that best serve seniors. Policymakers and researchers lack adequate line of sight into the financial flows and incentives that inform pricing. Perhaps most importantly, beneficiaries need better tools to make decisions with major implications for their health care quality, access, and affordability. The current system must do more to address information asymmetries and gaps.

- Hurdles to Pharmacy Access

Pharmacies have long played a pivotal role in providing vital services to Americans from all walks of life, and are often one of the primary points of care in rural and underserved communities. As the market has evolved through ramped-up vertical integration with national PBMs and major changes in contracting practices, however, many independent and regional pharmacies have struggled, and some have been forced to shut their doors altogether, leading to access gaps for patients and consumers. While a range of factors have triggered these trends, ambiguities in Medicare’s “Any Willing Pharmacy” rules, significant growth in pharmacy fees, and unpredictable performance-based quality measures appear to have contributed, limiting the freedom of choice at the core of the Medicare program.

- Behind-the-Scenes Practices that Impede Competition and Increase Costs

In recent years, reports have pointed to a range of practices that appear to drive up out-of-pocket costs for seniors, in addition to increasing taxpayer spending. Studies suggest, for instance, that seniors and the Medicare program overpay for certain generic prescriptions that should lend themselves to a competitive, low-cost market. Medicaid audits have also found that intermediaries sometimes drive up costs by charging health plans more for pharmacy reimbursement than what they ultimately pay pharmacies, and pocketing the difference. The rising success of a number of disruptors also indicates that beneficiaries could sometimes achieve a better deal for certain prescriptions outside of conventional channels and drug benefits, raising questions around the dynamics underlying the large and concentrated firms at the center of our current programs.

C-Level Responses

“Regarding the level of interest in the PBM business model, as you know, we’ve been around for over 20 years in the PBM space. And we have a legacy of business where the majority of that business is pass-through, but we also have a significant part of our business that operates on a traditional spread model.

“And regarding what’s happening in Washington and in different debates around the state, we do think it’s extremely important to be able to preserve the choice of which model to operate under for clients. There are benefits to both of those structures. We offer both of those structures, and we think it’s very important that clients continue to have the ability to queue it whether they want to operate on a pass-through or on a spread model.”

– Rite Aid Corporation | Q4 2023 Earnings Call

“We’ll continue to evolve our business models to our clients’ needs while we continue to engage policymakers and others to make sure that everybody understands the essential value of that PBM service, the distinctive capabilities and transparent business model of OptumRx and in addition, make sure that we ensure client choice and we preserve that function.”

– UnitedHealth Group Incorporated | Q1 2023 Earnings Call

“There’s certainly a bit of additional scrutiny recently that’s come up from those different areas. But if you go back in the 25 years I’ve been in the health care world, there have been many instances like this where it spikes and then we prove the value that we create for our clients and customers and then it moves on, right? And so we’re confident that with the inquiries that are underway now, we’re going to be able to tell our story, show the value creation from the standpoint of the data and the analytics that surround that and come out stronger on the other side.”

“That said, clearly there are some opportunities that led to these inquiries. One is we’re seeing more and more independent pharmacies, put their hand up and saying, I’m struggling to survive. So maybe the PBMs are to blame. Two, we have, in some instances, some of our patients who have high cost sharing, right, they might be in a high deductible plan. They might have a specialty pharmaceutical it needs to get filled, and that creates noise in the system, particularly early in the year. And it’s important for the industry to get after that as an opportunity.”

“And then finally, part of our role in terms of controlling costs is at times, we have to say no where we have to gain access to certain drugs and that creates noise at times. We’re confident that through the ability to create value for our clients and customers and participate in some of that value that we create, we’re striving for the lowest net cost outcome for the finance year and ultimately creating value for clients and driving cost out of the system compared to if PBMs did not exist.”

– The Cigna Group | Cowen 43rd Annual Healthcare Conference

“How the industry is evolving and budget dynamics—I think I would speak generally that the industry is always changing. We believe our network, our relationships with retail, with PBM, with pharma manufacturers is the strongest it’s been in our history. When we look at various entities in those channels, you mentioned spending budget for awareness, and one entity that would do that, for example, would be the pharma manufacturers. We believe that there are—on a long-term basis, the environment there is very good. We think that we will see strong growth this year in manufacturer solutions and glad to discuss some of this more.”

– GoodRx Holdings, Inc. | Q4 2022 Earnings Call

“Then we expect approximately 20 basis points of benefit from a new PBM contract and other initiatives to yield an estimated 2024 Medicaid HBR of approximately 90.1%.In Medicare and Marketplace, we are still refining our bids that are due this summer. So we’re going to be a little guarded with getting too granular with bid assumptions for each of those lines of business. In the Marketplace, our first quarter results were on track. And while one quarter doesn’t make the year, we are so far pleased with the marketplace positioning not just for 2023 but also the longer-term benefit from strengthening our #1 market position.”

– Centene Corporation | Q1 2023 Earnings Call

“But I’d say, broadly speaking, I think we as a sector need to do a better job clarifying the policymakers that in order to invest in innovation in Europe, we need a pricing environment that rewards innovation, particularly when it improves the outcomes for patients. And this can be seen as a place to constantly cut costs, especially relative to the rest of the world. So that’s going to be our focus to try to educate. But for us, I think Germany remains the most attractive market. And therefore, I think from a financial outlook standpoint, we feel comfortable with the guidance that we’ve given.”

– Novartis AG | Q4 2022 Earnings Call

Tracking Shifts in the Pharma Industry in Real Time

Monitoring every and any major activity within the pharma industry can be a tedious, full-time job without a market intelligence platform. But intel on legislation and aspects beyond that are crucial to strategy crafting and decision making. That’s why more and more life science professionals are turning to AI search technology to power their research efforts.

Staying in the know is streamlined with AlphaSense’s powerful proprietary AI and vast content universe so you can find the insights you need in seconds.

Sign up for your free trial of AlphaSense today.