This week, BlackRock CEO and Founder Larry Fink released his 2021 Letter to CEOs, accompanied by BlackRock’s 2021 Client Letter. Echoing sentiments from 2020, this year’s letter is an urgent message to address climate change, social justice, and data disclosure.

Fink’s call for corporate executives to radically shift their thinking around ESG carries significant impact, as climate transition “presents a historic investment opportunity.” He warns that if companies do not begin taking deliberate steps to address climate change and social injustice, they will see their businesses and valuations suffer.

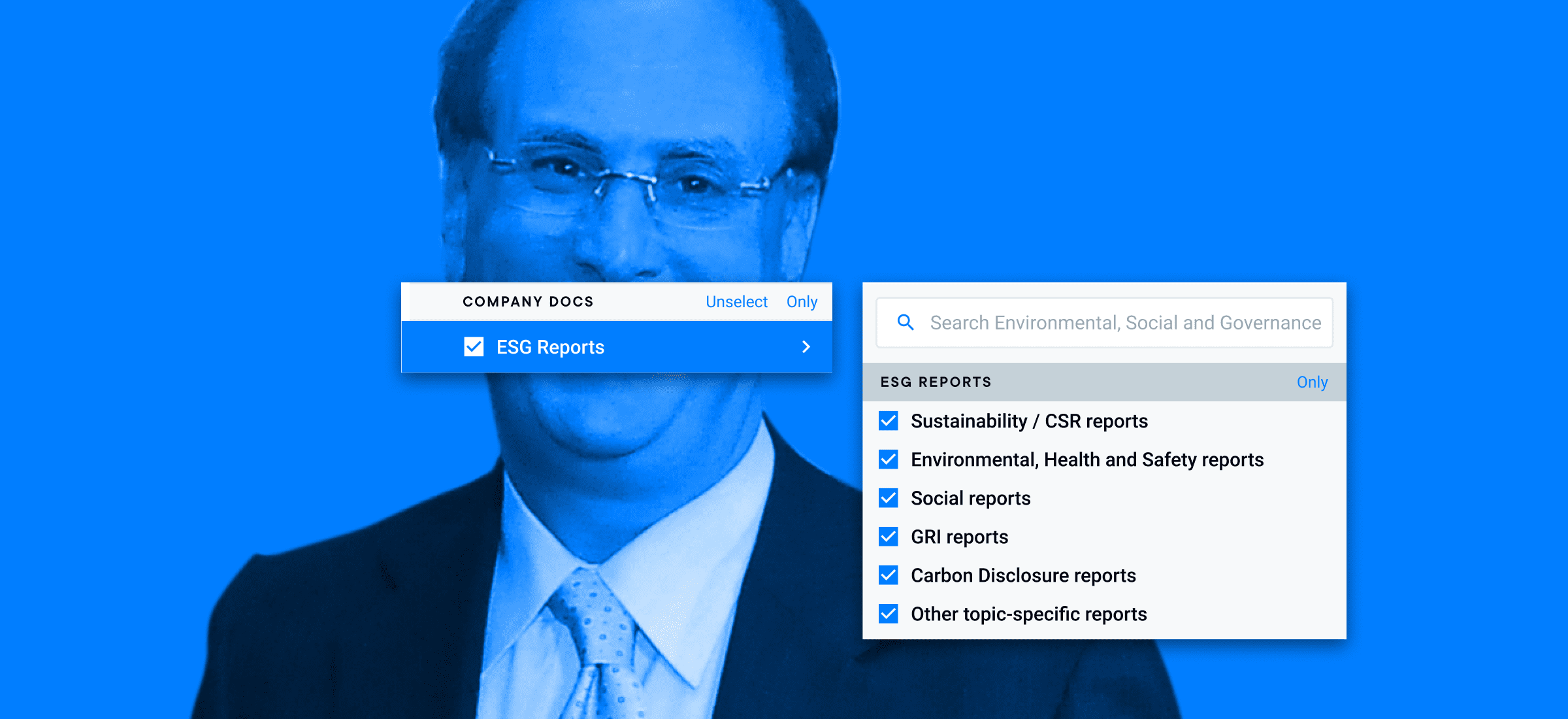

Below, we have compiled a list of pull quotes from the letter, accompanied by AlphaSense searches that can help track trends around ESG, climate commitments, carbon neutrality, and more.

If you are an AlphaSense user, you can easily save these searches, set up alerts to track each topic, and access thousands of ESG reports from the world’s leading companies.

Not an AlphaSense user? Sign up for a free two-week trial.

ESG remains essential for corporate teams

One of the key takeaways from Fink’s letter was the importance of ESG. As AlphaSense noted in its 2020 Year in Review, ESG stocks outperformed the market in the first half of last year.

2020 also highlighted important social justice issues–the need for racial and gender equality was a key conversation throughout the year, as protests exploded during the summer and the CDP revealed that women accounted for 100% of the labor market’s job losses in December.

| Pull Quotes: ESG | Track the Trend (Related Search) |

| “From January through November 2020, investors in mutual funds and ETFs invested $288 billion globally in sustainable assets, a 96% increase over the whole of 2019.1 I believe that this is the beginning of a long but rapidly accelerating transition – one that will unfold over many years and reshape asset prices of every type.” | Mutual funds and ETFs: sustainable assets |

| “As you issue sustainability reports, we ask that your disclosures on talent strategy fully reflect your long-term plans to improve diversity, equity, and inclusion, as appropriate by region. We hold ourselves to this same standard.” | Sustainability reports: Large-Cap companies

Corporate Responsibility Reports: Large-Cap companies |

| “It’s not just that broad-market ESG indexes are outperforming counterparts. It’s that within industries – from automobiles to banks to oil and gas companies – we are seeing another divergence: companies with better ESG profiles are performing better than their peers, enjoying a “sustainability premium.”” | Automotive Industry ESG Reports |

Net zero carbon emissions should be the ultimate goal

The pandemic highlighted how quickly a company’s success can be impacted by external events. Fink points to climate change as the external event that will impact all companies and calls on them to incorporate it into their ESG strategies—both to minimize the risk, but also to generate new business.

| Pull Quotes: Net Zero | Track the Trend (Related Searches) |

| “There is no company whose business model won’t be profoundly affected by the transition to a net zero economy – one that emits no more carbon dioxide than it removes from the atmosphere by 2050, the scientifically-established threshold necessary to keep global warming well below 2ºC.” | Net Zero Economy |

| “ In 2020, the EU, China, Japan, and South Korea all made historic commitments to achieve net zero emissions. With the U.S. commitment last week to rejoin the Paris Agreement, 127 governments – responsible for more than 60% of global emissions – are considering or already implementing commitments to net zero.” | Paris Climate Agreement |

| “Companies with a well-articulated long-term strategy, and a clear plan to address the transition to net zero, will distinguish themselves with their stakeholders – with customers, policymakers, employees and shareholders – by inspiring confidence that they can navigate this global transformation.” | Net-Zero Strategies |

Companies must track and disclose ESG data/strategies

| Pull Quotes: Data and Disclosure | Track the Trend (Related Searches) |

| “Assessing sustainability risks requires that investors have access to consistent, high-quality, and material public information. This is why last year, we asked all companies to report in alignment with the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD) and the Sustainability Accounting Standards Board (SASB), which covers a broader set of material sustainability factors. We are greatly encouraged by the progress we have seen over the past year – a 363% increase in SASB disclosures and more than 1,700 organizations expressing support for the TCFD. (BlackRock issued our own inaugural TCFD and SASB reports last year.)” | Task Force on Climate-Related Financial Disclosures Tracker (TCFD) |

Moving Forward: Optimism and Aladdin Climate

Fink maintains a positive outlook moving forward, noting that “many companies are taking these challenges seriously–they are embracing the demands of greater transparency, greater accountability to stakeholders, and better preparation for climate change.”

To better understand climate risks, BlackRock announced that it is developing Aladdin Enterprise. The new organization aims to help investors manage and meet their climate objectives by measuring the portfolio impacts of physical risks like extreme weather and transition risks like the impact of policy changes, technology, and energy supply.

Gain access to thousands of ESG reports from leading companies and set up alerts around themes like climate change, racial & gender equality, net-zero strategies with AlphaSense.

Not an AlphaSense user? Sign up for a free two-week trial.