Earlier this year, we explored oilfield water management as a key emerging risk to the sustainability of Permian Basin oil production. If not handled adequately, a tsunami of wastewater could drown out the U.S. oil boom.

The oilfield water business has since begun to transform, with transactions driving market structure change. Oilfield water deal news increased significantly in recent weeks as the industry transforms and starts rising to the occasion. For example:

- Multiple M&A deals have been executed – including one that our last post predicted by leveraging AlphaSense search tools.

- Rattler Midstream’s big IPO, with water implications, launched successfully.

- Oil executives gathered in Houston on June 21st at the first-ever conference entirely devoted to market structure, business model, and finance issues in oilfield water.

Oilfield water managers have toiled in relative obscurity for decades, watching activity like drilling and hydraulic fracturing take the spotlight. But now, their niche is fast becoming a high-profile sector within the U.S. oil industry.

Sentiment around oilfield water trends

In addition to using long-standing AlphaSense search tools to keep up with trends in water management, we’ve had a chance to leverage AlphaSense’s new Sentiment tool to enhance our exploration of oilfield water trends.

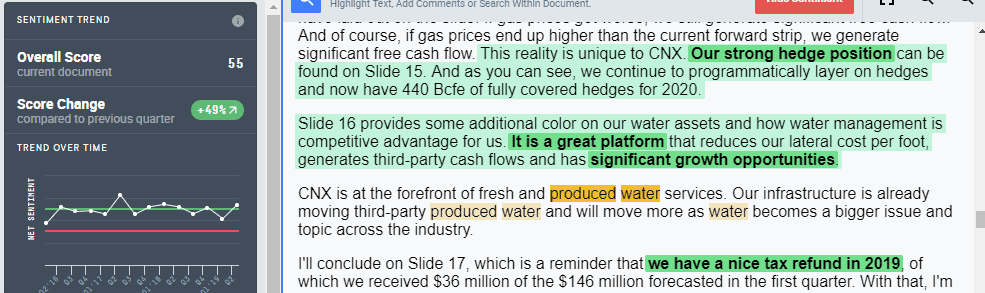

AlphaSense Sentiment leverages AI technology to identify positive or negative context within conference call transcripts, and quantify the level of sentiment relative to past discussions. Red or green highlights document positive or negative signals with varying degrees of intensity to provide visual cues on company sentiment on a sentence level.

While running the traps on our go-to list of oilfield water buzzwords, we couldn’t help but notice the positive sentiment with which the industry is discussing the water issue.

Oilfield water is an industry that tends to find opportunity in technical challenges. And that’s evident as oil producers are talking positively more often than not about water, their strategy for it, and cost control.

What’s driving the Sentiment trend?

In some cases, the positivity is related to recycling success. In other cases, it is related to the strength and benefits of the in-house water businesses these oil producers have built. That positivity could be either:

- Setting up potential divestitures of these water assets at accretive valuation multiples

- Setting up a rationale for keeping this critical path function in-house

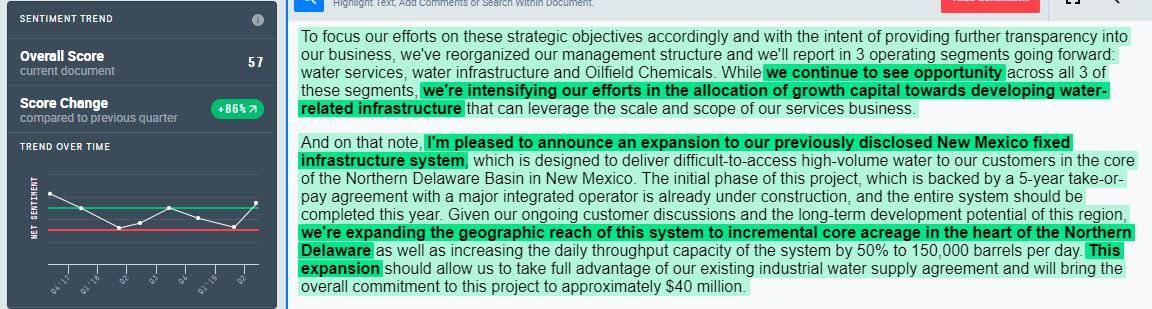

Suppliers and service companies are extremely positive about the opportunity. Select Energy Services, the only publicly traded oilfield water pure-play, showed an 86 percent improvement in their AlphaSense Sentiment score compared to last quarter. (Log in to view full transcript.)

Comparing Sentiment on a sector-wide scale

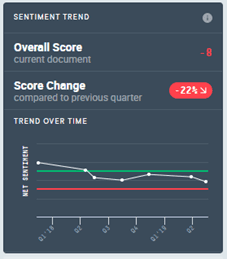

What’s interesting to us is that this excitement and positivity about oilfield water, even in the face of great challenge, runs counter to the general E&P sentiment trend revealed by AlphaSense’s Sentiment tool.

Looking at the 10 most recent U.S. independent oil producers to report Earnings, we see that the average AlphaSense Sentiment score was down 14 percent compared to the previous quarter and six of the 10 calls showed sentiment deterioration sequentially.

AlphaSense Sentiment shows U.S. oil producers are grappling with negative investor sentiment towards their sector, which is in turn bleeding through onto their conference calls. So, while not everything is rosy in the oil patch at the moment, it is a good time to be working in oilfield water relative to both history and other niches of the industry.

Joseph Triepke is the Founder of InfillThinking.com, an oilfield market information firm, and Co-Founder of OilfieldWater.com, an executive conference firm. Previously, he covered oilfield service as a publishing sell-side analyst and a buy-side analyst for leading financial institutions including Citadel, Guggenheim, and Jefferies. He majored in finance at the University of Texas at Austin.

Want to see how Sentiment can work for you? If you’re an AlphaSense client, log in now to get started with Sentiment, or Request a Demo.