The emergence of COVID-19 early last year brought about a transformation of the financial services industry unprecedented in speed and scope. In response to the crisis, institutions made sweeping organizational changes that typically would have taken years or more in the span of just a few weeks. At the center of these changes were tech solutions that supported remote operations and a fully digitized customer experience.

The result? Companies that are more digitally capable than ever before, and a new normal where tech trends that were once cutting edge are now required for survival. Will Financial Institutions (FIs) continue to keep up? Which fast-tracked solutions will be permanent? Here we’ll explore key technology transformations that have changed the industry and what they’ll look like post-pandemic.

Related Reading: 3 Ways Emerging Technology Is Disrupting Private Investments

Quick takeaways

- Adoption of the cloud and AI technology made it possible for institutions to operate during the pandemic. Both will continue to increase in strategic importance and implementation in the future.

- The use of contactless digital payment methods increased significantly during the pandemic and will have long-term implications for the future of cash and physical currency.

- The pandemic accelerated the shift from a competitive to a collaborative relationship between traditional FIs and fintech. As a result, industry leaders from both groups are working toward innovative tech solutions that will continue to transform the industry post-pandemic.

Living in the cloud

At the top of the pandemic, cloud-based solutions had to be implemented at warp speed as institutions across the financial services industry transitioned employees to a home model and adjusted to serve clients digitally in the absence of in-person operations. Even the most hesitant cloud adopters had to make the jump.

Last summer, Morgan Stanley put cloud adoption at the top of their list of trends that would accelerate during and post-pandemic. Today, major players in the industry are working to make it possible for financial institutions to more easily adopt cloud solutions while maintaining regulatory compliance and reliable data security.

- IBM has partnered with Bank of America to develop IBM Cloud for Financial Services, explicitly designed to reduce risk and help institutions implement compliant cloud solutions

- Deutsche Bank and Google Cloud agreed to create “next-generation” tech-based solutions for financial services industry clients.

- Luminor, a banking leader in the Baltic region, also adopted IBM Cloud for Financial Services to migrate its entire IT infrastructure to the cloud.

- Santander International will use Tenemos SaaS to “strategically position the bank…in a post-COVID-19 era.”

- The EY Cloud Enablement Center will support cloud-based innovation in the financial services industry.

The cloud is here to stay and is becoming a ubiquitous part of financial services. Institutions must now think beyond the quick implementation required by the onset of COVID-19 and consider how cloud strategy will be integrated into their core business models.

AI becomes essential

The idea of increased artificial intelligence is often met with reservation in a world where pandemic-induced unemployment and the possibility of human-machine redundancy is a top concern for employees across the industry. Still, AI is an undeniable necessity as consumers now seek constant and instant access to their finances.

AI not only supplements employee capabilities to keep the proverbial doors open for business 24/7, but it also decreases the potential for human error, streamlines workflow, and saves a lot of money. Business Insider estimates that by 2023, AI will save banks $447B (while also reporting that 80% of banks are aware of the importance of AI capabilities). With that kind of cost savings at stake, financial institutions have no choice but to adopt AI.

Here are the key areas where AI is playing a role in finance:

- Customer service

- Underwriting

- Risk assessment

- Security / cyber-attack protection

- Workflow automation

- Predictive analytics

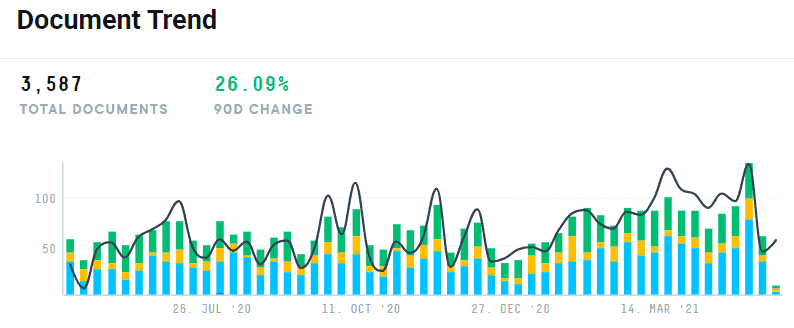

A quick AlphaSense search for “AI” and “finance” shows more than 3500 documents and a consistent upward trend over the past 12 months, with banks and capital markets ranking in the top five industries represented.

Document trend results from a search for “AI” and “finance” in AlphaSense (search link.

Cash is no longer king

We recently covered how blockchain, cryptocurrency, and NFTs are impacting the finance industry. Still, traditional payment methods are also undergoing a fundamental shift toward contactless and digital that could have implications for the future of physical currency.

While e-commerce has been thriving for over a decade, contactless payment options were not widely adopted before the pandemic. Card payments were as quick and convenient as tap-and-pay methods like Apple Pay or Google Pay, and consumers had no real need to change their behavior.

That all changed with the arrival of COVID-19 and the need for contactless payment methods to help slow the spread of the virus. Around the world, consumer habits are changing.

-

- In a 2021 Oracle survey conducted of more than 2000 US consumers, 46% indicated they began using digital payments during the pandemic period.

- European consumers report similar results; consumer respondents to a 2020 survey by the European Central Bank reported a 40% increase in digital payment usage.

In India, where cash is still overwhelmingly the primary method consumers use, 75% have reported higher digital payment options during the pandemic, and 80% of those respondents indicate that they’ll continue to use them post-pandemic.

- ACI Worldwide found that in 2020, global real-time (digital) payments increased 41% from 2019

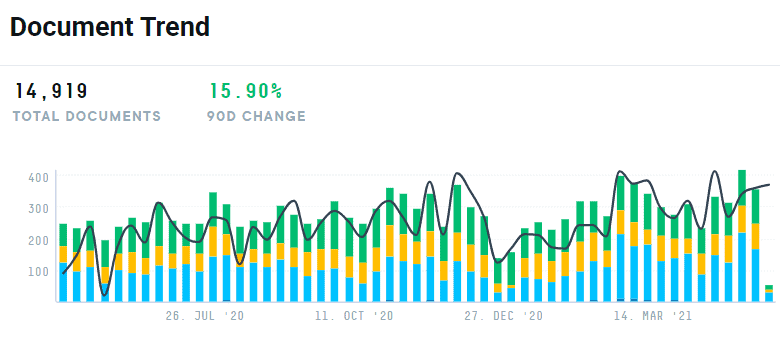

Financial institutions have taken note, and banks are adjusting and increasing customer adoption of digital payments and banking>. An AlphaSense search for “digital payment” and “banks” yields more than 14,000 documents, and the documented trend shows a steady increase over the past 12 months.

Document trend results from a search for “digital payment” and “banks” in AlphaSense (search link).

Fintech is a friend (not foe)

Agility is essential as technology advances more quickly, and traditional FIs can’t do it alone. Post-pandemic, we can expect to see the interaction between incumbent financial institutions and fintech shift from competitive to collaborative. This is a shift that began before the pandemic hit but has accelerated over the past year.

Beroe reports that 80% of banking executives anticipate increasing their fintech partnerships in the next 3-4 years. In addition, researchers at The Chinese University of Hong Kong (CUHK) Business School found that while fintech can sometimes make the market more vulnerable and unpredictable, they are also making traditional FIs more innovative, efficient, profitable, and accessible.

“Fintech is disruptive, but it is also a force for emancipation,” says Professor Jason Yeh, Associate Professor in the Department of Finance at CUHK. “Not only has it democratized the access to financial services for the masses in emerging markets, but it also plays a pivotal role on the road to greater financial inclusion.” (source)

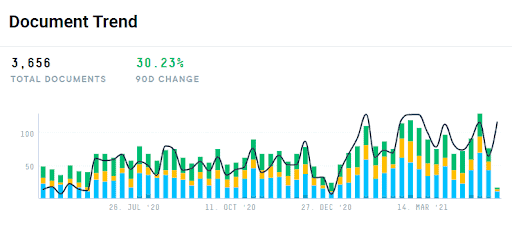

An AlphaSense search for “fintech” and “partnership” shows a clear and steady document trend increase, with the number of documents in April 2021 showing double the amount as the same time last year and industry giants Mastercard and Visa sitting atop the list of companies mentioned.

Document trend results from a search for “fintech” and “partnership” in AlphaSense (search link)

This seems to be just the beginning of the fintech impact, and it will be interesting to see how the ecosystem and the relationships between its players continue to evolve. UConn is even offering a master’s degree in fintech for professionals aspiring to become experts in the space. It will be a missed opportunity for any FI not to consider how they can benefit from the extraordinary innovation fintech brings to the industry.

Conclusion

Tech transformation has been at the center of the financial services industry over the past year as institutions have navigated unprecedented change and market uncertainty. Key enablers like the cloud, AI, and contactless payment options have been essential to survival for FIs during the pandemic and will likely increase strategic importance moving forward.

During this time, better collaboration between FIs and fintech has fueled innovation, scaled up tech solutions that work, and will continue to be essential to the industry’s ability to adapt to a post-pandemic world.

In the future, technology will only continue to evolve more widely and rapidly. The most innovative institutions will focus not only on adopting new technologies as they arrive but also on creating more agile, forward-thinking organizational practices that keep them one step ahead. But, as we’ve seen quite often in the past year, this is likely just the tip of the tech transformation iceberg.

To learn more about innovative technology disrupting the traditional finance industry, check out our CBDC and Digital Currency webcast here.