On August 16, 2022, President Biden signed into law the Inflation Reduction Act (IRA)—a landmark legislative move by Congress addressing clean energy and climate change. Focusing on the urgent challenges posed by the climate crisis, the act intended to usher in an era of heightened American commitment to innovation and creativity, aimed at reducing consumer expenses and propelling the global clean energy economy to new heights.

This would be accomplished by spurring investments in domestic manufacturing capabilities, promoting supply sourcing from domestic companies or free-trade partners, and kickstarting development and commercialization of cutting-edge technologies like carbon capture and storage and clean hydrogen. According to the Congressional Budget Office (CBO), the act is projected to reduce budget deficits by $237 billion over the next decade.

However, the IRA is not the first legislation of its kind aimed at fostering domestic competition with the caveat of promoting eco-friendliness. In fact, the act marks the third legislative initiative passed since late 2021, all geared towards enhancing US business innovation and industrial productivity.

So, a year after its signing into law, is the Inflation Reduction Act keeping its promise of improving the country’s economic and environmental health? If so, what’s developed from these business incentives offered by the IRA? Below, we dive into everything that has unfolded since the act was signed into law in 2022.

Promises of the IRA

Diverging from previous major U.S. environmental legislation, the IRA leverages ‘carrots’—financial incentives (i.e., tax breaks) designed to stimulate investments in clean energy technologies—over employing ‘sticks’ in the form of mandates or fees.

This becomes important when hundreds of billions of dollars earmarked for incentives aimed at curbing emissions and promoting domestic manufacturing are involved. After all, the law is poised to exert significant influence on various crucial developments in clean energy, energy efficiency, electric vehicles, and more—making these ambitious investments capable of lowering US emissions to a range of 43 to 48 percent below 2005 levels by the year 2035

While many speculate that the IRA will likely fall short of achieving the national objective of a 50% emissions reduction by 2030, it has played a pivotal role in fundamentally redirecting the U.S. economy towards the target of achieving net-zero emissions while simultaneously addressing other crucial economic and equity considerations.

Ultimately, the pace of the transition to clean energy will be influenced by the decisions made by federal agencies in implementing specific IRA provisions, as evidenced by the impact already observed in areas such as energy communities, tax credits for electric vehicles, and the 45V tax credit for clean hydrogen production.

Stats from the White House

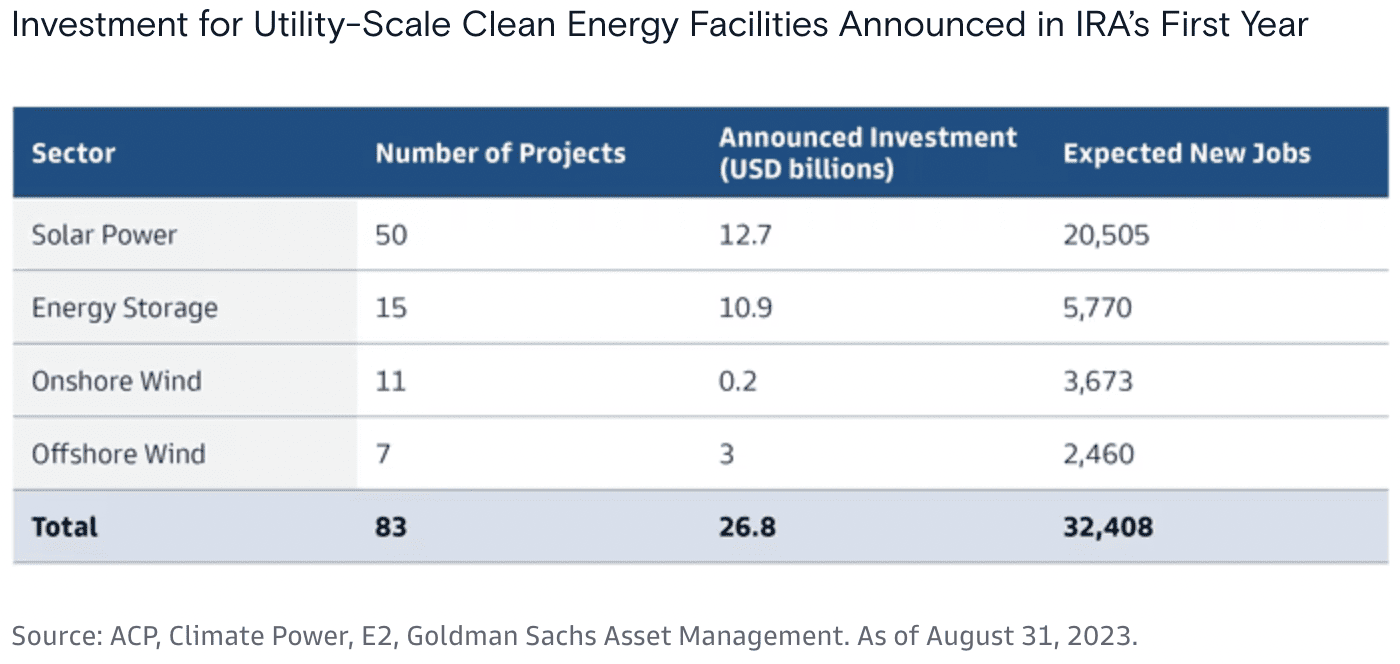

This past August, Biden’s administration shared the impact of how the Inflation Reduction Act has already made substantial impact in the past twelve months:

- The private sector has declared commitments exceeding $110 billion in new investments for clean energy manufacturing, with over $70 billion dedicated to the electric vehicle (EV) supply chain and more than $10 billion allocated for solar manufacturing. Since the President’s election, the private sector has unveiled approximately $240 billion in fresh investments for clean energy manufacturing.

- The collective investments in clean energy and climate initiatives since the enactment of the Inflation Reduction Act have generated over 170,000 jobs, and external estimates suggest that the law is poised to create an additional 1.5 million jobs over the next decade.

- The Administration has already disbursed over a billion dollars to enhance community resilience and shield them from the adverse impacts of climate change, including drought, heat, and extreme weather.

- Newly released data from the Department of Energy predicts that American families are expected to save between $27-38 billion on their electricity bills from 2022 to 2030 compared to a scenario without the Inflation Reduction Act.

- Furthermore, nearly 15 million individuals are experiencing average savings of $800 per year on their health insurance premiums. The nation’s uninsured rate has hit a historic low, and millions of seniors on Medicare are witnessing reduced out-of-pocket costs for prescription drugs, including a capped insulin cost of $35 per month.

- In a move to enhance tax enforcement, the Internal Revenue Service (IRS) is intensifying efforts against wealthy tax evaders and increasing recoveries from delinquent millionaires. Simultaneously, customer service for law-abiding taxpayers has been improved, cutting phone wait times from 28 minutes last tax season to just 3 minutes this year.

Promoting Low-Carbon Hydrogen Fuel

The Inflation Reduction Act (IRA) introduced a tax credit known as “45V” specifically for hydrogen production, which consists of four tiers of value, determined by the total amount of carbon dioxide emitted during the production process. The most generous tier of this tax credit applies to “green” hydrogen, produced through methods like electrolysis or equivalent technologies powered by zero- or low-carbon electricity.

Additionally, the law substantially increases the value of another tax credit, “45Q,” designed for carbon capture, utilization, and storage. This technology plays a crucial role in reducing carbon dioxide emissions from the power, energy, and industrial sectors and can be utilized in the production of “blue” hydrogen. Blue hydrogen is generated from natural gas, with producers storing the resulting carbon dioxide emissions.

This storage process allows blue hydrogen to exhibit significantly lower carbon dioxide emissions compared to the prevalent method of hydrogen production known as “grey hydrogen,” which involves the same production process but lacks the capture and storage of carbon emissions.

However, clarifications of how 45V and 45Q will be imposed are still unknown amongst most C-Suite executives—as specifically displayed in earnings calls found within the AlphaSense platform:

“The industry also waits for the IRS to finalize its guidance on the tax credits available on the Inflation Reduction Act, including the 45V production tax credit. We believe these rules will provide the industry with the clarity needed to get projects past the final investment decision stage and into construction.”

– Ballard Power Systems Inc. | Q3 2023 Earnings Call

“And we continue to have discussions with potential off-takers for green ammonia supply, but we need clarity and finalization of the 45V Tax Credits before we can make a decision to move forward.”

– LSB Industries, Inc. | Q3 2023 Earnings Call

“The 45V is still not much information out there. I mean as we know, the requirements in order to qualify for those projects [have not been established]. So we’re still waiting to determine how much—how much effort we’ll need to put in, in order to say, hey, I qualified for the full $3 a kilogram of hydrogen.”

– SB Industries, Inc. | Special Call

“And while there’s, I’d say, a variety of views on the 45V, it’s certainly further along than many other countries, and so it gives a framework to at least have private companies that want to spend money with a company that’s doing a project and has some of those credits and some of that stimulus is starting to push that along.So we’ve seen an uptick in terms of the commercial pipeline itself but we’ve yet to see those types of projects actually coming into backlog.”

– Chart Industries, Inc. | Conference Transcript

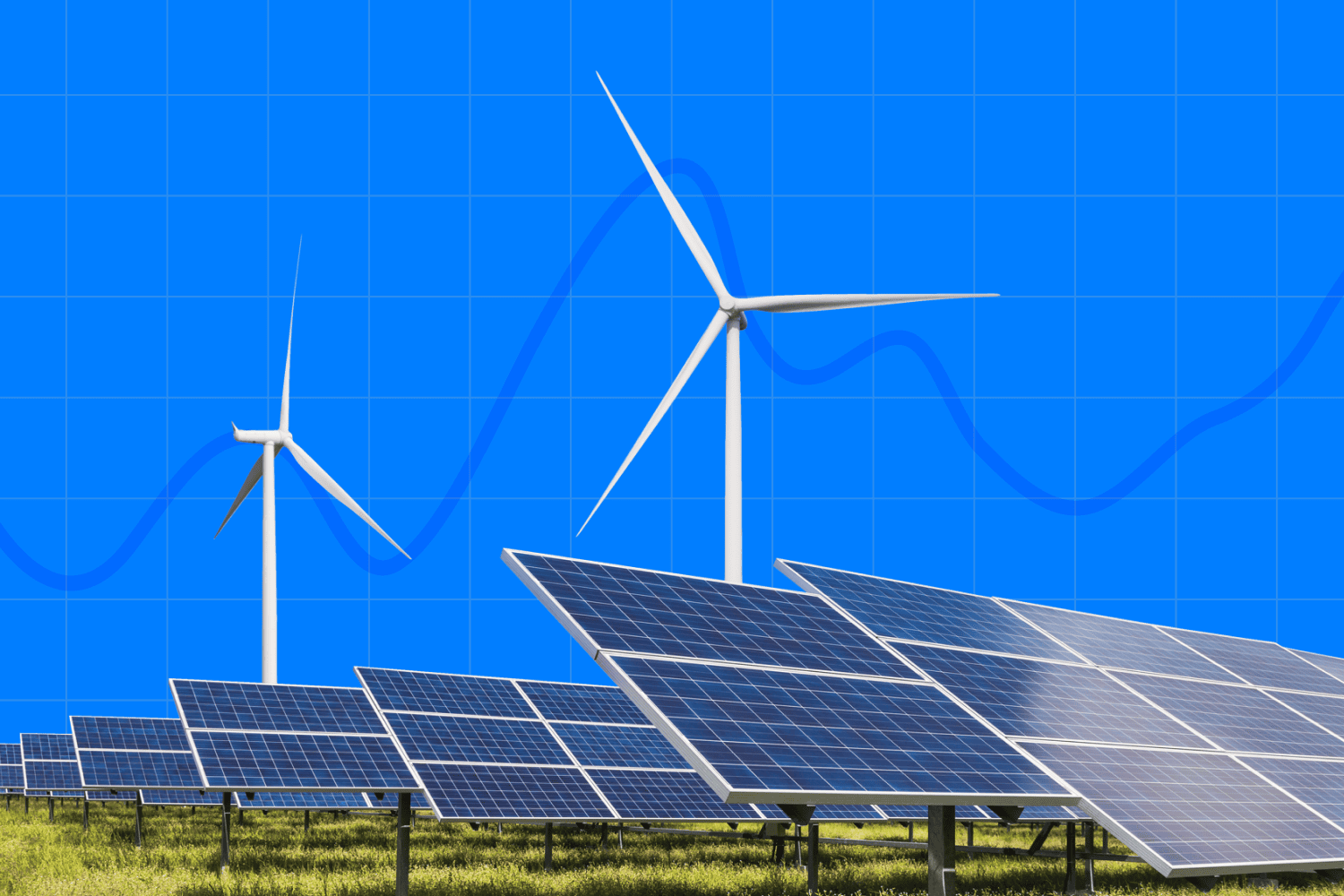

Clean Energy for the Power Sector

The electricity sector contributes to 25% of the US’s greenhouse gas emissions, so one of the IRA’s objectives is to promote the transition to cleaner energy in this sector by offering tax credits for initiatives such as clean electricity generation, energy storage, and the upkeep of nuclear facilities.

According to Nicholas Roy, Senior Research Analyst at RFF, the impact of the IRA on the power sector won’t be immediately apparent, as clean energy projects involve extensive long-term planning. Factors like permitting, siting, and material availability contribute to delays in implementation. Ultimately, the outcomes of the IRA incentives for the power sector will become clearer in a few years.

Nevertheless, there are encouraging early indicators that the IRA appears to have sent robust market signals to investors, companies, states, and grid operators. The incentives for various sectors like electric vehicles (EVs) and hydrogen are exerting pressure on the sector to enhance its generation capacity. Depending on the implementation of tax credits in these other sectors, the credits allocated to the power sector could result in an increase in affordable renewable energy, rather than a reliance on additional fossil fuel resources to meet growing demand. In essence, the IRA’s comprehensive, multisectoral approach promotes decarbonization beyond just the power sector.

Lowered Drug Prices on a State Level

The Inflation Reduction Act (IRA) of 2022 had clear objectives, one of which is to reduce healthcare expenses. Through the act, Congress aims to enhance the affordability of prescription drugs by instituting reforms designed to curtail drug prices and alleviate out-of-pocket expenses for a substantial portion of Medicare beneficiaries. In the current healthcare landscape, prescription drugs account for 20% of the out-of-pocket expenditures for Medicare recipients, even as other healthcare costs have diminished.

The issue of prescription drug affordability has long been a concern in the United States, with legislative solutions progressing slowly until the introduction of the 2022 Inflation Reduction Act (IRA). This act brings significant changes to how Medicare addresses the costs of prescription drugs, where Medicare has traditionally functioned as a price taker, paying for drugs at the list prices determined by manufacturers. Two key reforms under the IRA will directly influence these list prices:

- The “inflation rebate,” requiring manufacturers to reimburse Medicare for any list price increases exceeding inflation

- A provision granting Medicare the authority to negotiate payment terms with manufacturers for specific drugs

Since manufacturers establish list prices for the entire U.S. market, these policy shifts will extend beyond Medicare. The Congressional Budget Office (CBO) anticipates that manufacturers will curtail list price growth or potentially reduce prices for many drugs on the market, as they no longer stand to profit when Medicare spending surpasses inflation. The CBO also projects that the launch prices of new drugs may increase, as manufacturers incorporate inflation rebates and pricing negotiations into their future decisions. States with substantial financial responsibility for prescription drug spending are particularly attuned to manufacturer pricing choices.

After all, they oversee health plans for their employees, retirees, and marketplaces catering to individual and family plans. They also bear the costs of prescription drugs for incarcerated individuals and contribute to the drug spending of Medicaid beneficiaries, making lower list prices advantageous for state budgets. Reduced list prices have a positive impact on out-of-pocket costs for drugs, offering relief to state residents, including the uninsured.

Additionally, lower list prices contribute to decreased insurance premiums, benefiting the 35% of insured adults concerned about affording their monthly premiums. As premiums for employer-sponsored health plans are deducted from taxable income, the Congressional Budget Office (CBO) estimates that lower premiums will generate an additional $2 billion in federal tax revenue, with a likely increase in state tax revenues.

While consumers and patients benefit from lower list prices, the impact on state Medicaid programs and safety-net hospitals is more complex. Negotiations can save money for these entities as manufacturers are obligated to provide rebates to Medicaid. However, lower prices resulting from Medicare payment reforms are estimated by the CBO to reduce Medicaid rebates by nearly $16 billion over the next decade. Safety-net hospitals are similarly affected, facing less generous reimbursement from Medicare due to lower negotiated prices.

Keeping Tabs on the IRA

To be at the forefront of any industry, it’s crucial to be on top of every new development. On top of having access to content sets from the most reliable industry perspectives, you need AI search technology to help you speed up your ability to track new regulations and key trends so you can better inform your decision-making and take the lead.

AlphaSense offers an extensive universe of company filings, earnings transcripts, expert interview transcripts, news, trade journals, and equity research—and paired with our proprietary AI-based search technology, you can discover and extract the most valuable insights in seconds.

Start your free trial with AlphaSense today.