The consumer and retail industry may be the most affected by economic hardships, and therefore, conditional purchasing behavior. Even the most essential consumer & retail subsectors (food, household products, beverages, etc.) are subject to fiscal performance affected by the trade down effect—–the phenomena of consumers buying cheaper brand goods as a way to save money.

“Market volatility,” “economic downturn,” and “macroeconomic hardships,” are often cited as the forces driving consumers to reconsider what they put into their shopping carts. But what exactly do these terms mean in today’s landscape?

Using the AlphaSense platform, we dive into the themes shaping how, where, and when consumers buy products. From rising interest rates to a 3.5% unemployment rate—a rate so low that economists argue the U.S. economy is becoming inefficient—there’s a lot the American consumer is conscious of.

Prices and Interest Rates

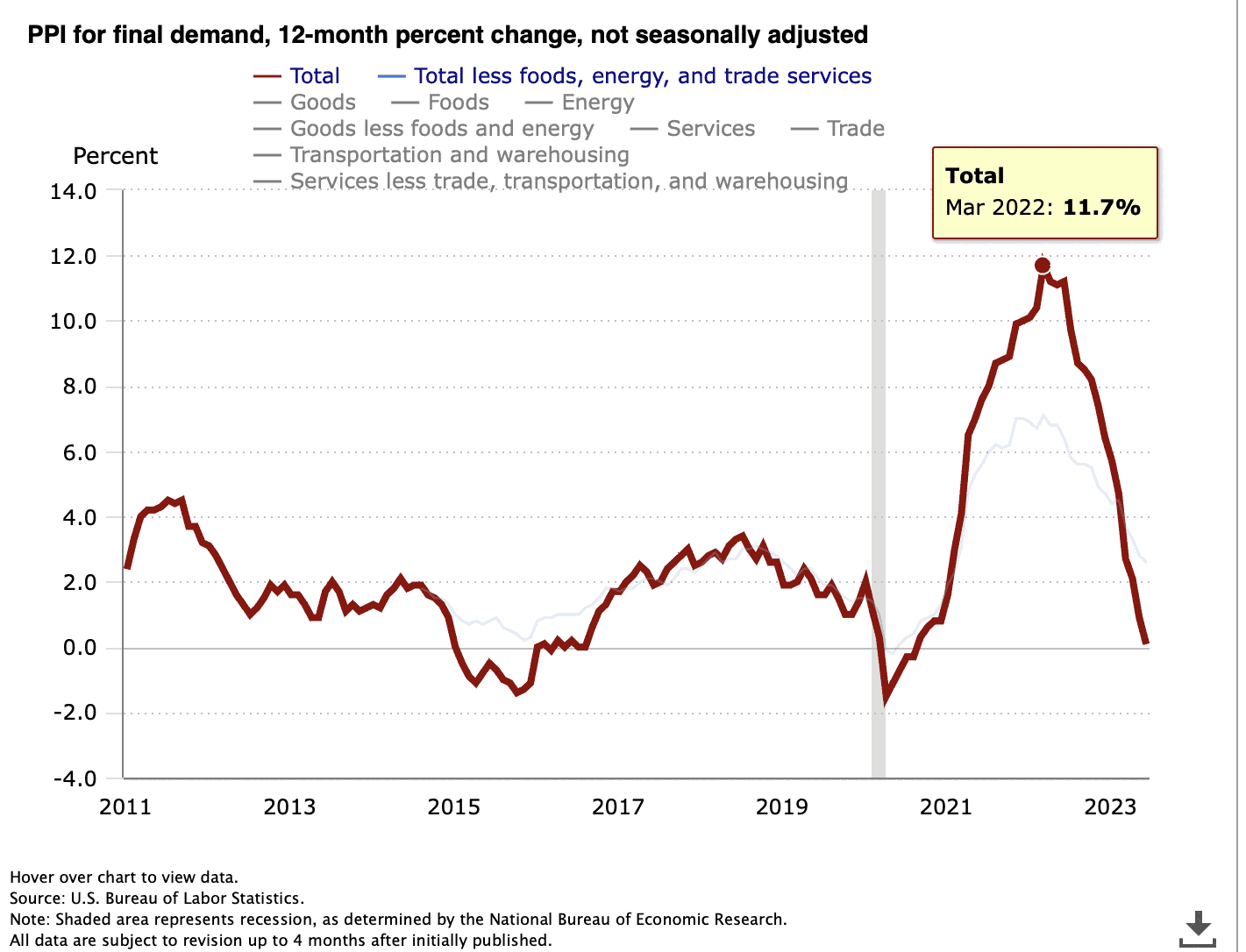

There’s no denying that prices for the consumer & retail industry have skyrocketed due to inflation, which has impacted consumer spending and, consequently, fiscal performance. This is evident in the producer price index (PPI) and the consumer price index (CPI). The PPI program measures the average change over time in the selling prices received by domestic producers for their output, while the CPI relays the prices paid by urban consumers for a market basket of consumer goods and services.

According to the U.S. Bureau of Labor Statistics, PPI final demand increased by 0.1% this past June—an insignificant number. However, data from the past two years reveals a dramatic history of the increased prices producers had to pay, hitting a peak of 11.7% in March of 2022.

For the CPI, it rose 0.2 percent in June on a seasonally adjusted basis, after increasing 0.1 percent in May, the U.S. Bureau of Labor Statistics reported. Over the last 12 months, the index increased 3% before seasonal adjustment.

Ultimately, higher inflation rates deteriorate purchasing power that stems from consumers having excess income to spend after covering basic expenses such as food and housing. The bottom line: higher price tags on consumer goods deters spending.

But that does not underplay the role of interest rates and how they impact the level of spending on consumer goods. Many higher-end consumer goods (ie., automobiles, technology, etc.) are purchased with credit. Higher interest rates make these purchases more expensive and tighten credit as well, which hinders access to necessary financing, and therefore, deters these expenditures.

Inflation and high interest rates leave any sector within the consumer & retail industry, from low- to high-end, susceptible to unfavorable consumer behavior and poor fiscal performance.

Consumer Confidence

Consumer confidence is a crucial factor for forecasting demand for consumer goods. Regardless of a consumer’s financial stability, they’re more likely to purchase a greater volume of goods when they feel confident about the economy’s health and their personal financial future. High levels of consumer confidence can especially affect consumers’ inclination to make major purchases and to use credit to make purchases.

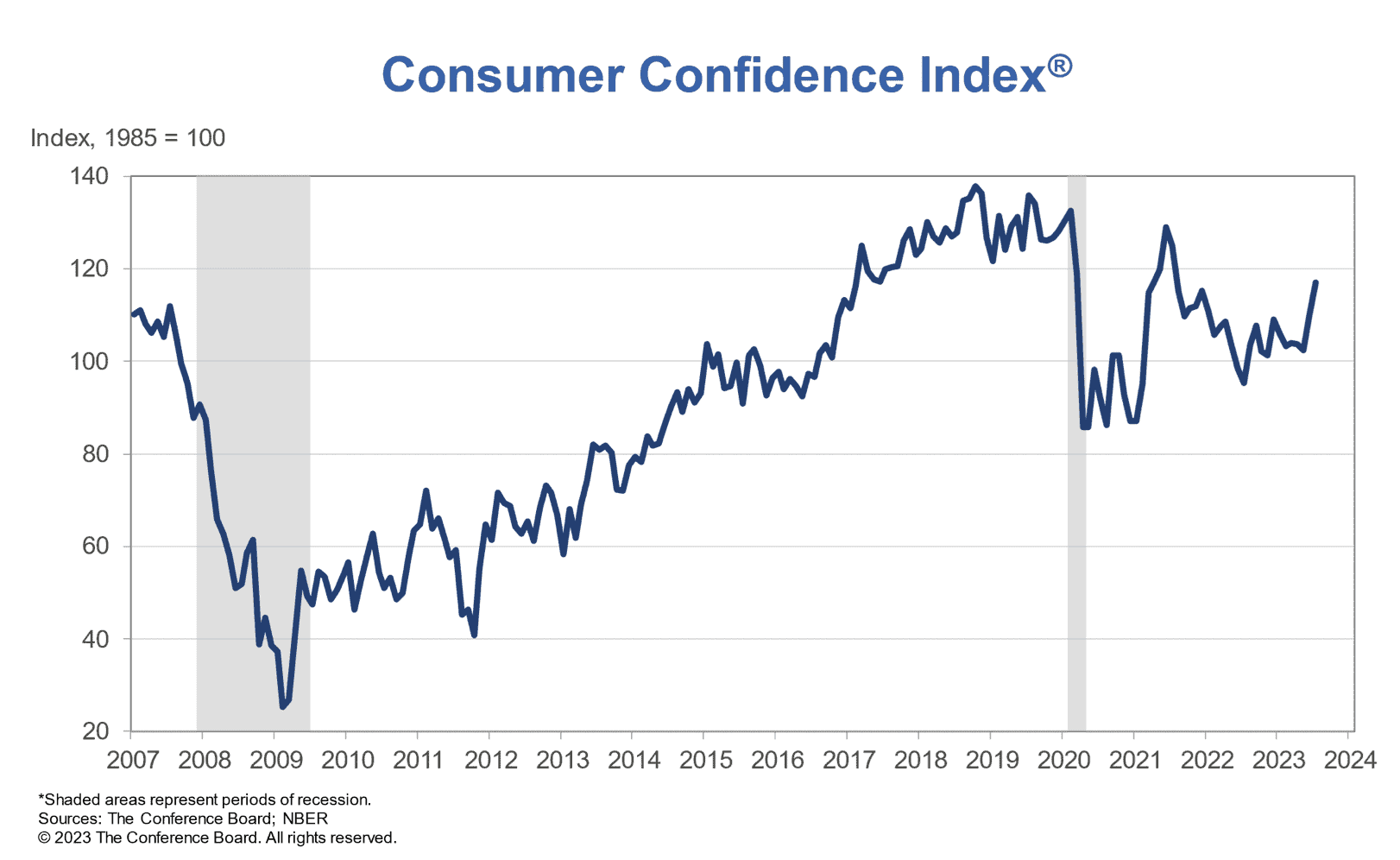

This inclination is represented by the Consumer Confidence Index. The Conference Board’s Consumer Confidence Survey for the past July reveals an optimistic outlook for consumers, who see prevailing business conditions and likely developments for the months ahead.

The index rose again in July to 117.0 (1985=100), up from 110.1 in June. The Present Situation Index—based on consumers’ assessment of current business and labor market conditions—improved to 160.0 (1985=100) from 155.3 last month. The Expectations Index—based on consumers’ short-term outlook for income, business, and labor market conditions—improved to 88.3 (1985=100) from 80.0 in June.

“Importantly, Expectations climbed well above 80—the level that historically signals a recession within the next year,” reads the Conference Board’s survey. “Despite rising interest rates, consumers are more upbeat, likely reflecting lower inflation and a tight labor market. Although consumers are less convinced of a recession ahead, we still anticipate one likely before year end.”

“Consumer confidence rose in July 2023 to its highest level since July 2021, reflecting pops in both current conditions and expectations,” added Dana Peterson, Chief Economist at The Conference Board.

Overall, demand for consumer goods is directly correlated to the economy’s growth. An economy showing consistent overall growth, with opportunity for new growth prospects (i.e., tax cuts, tax rebates, etc.) is accompanied by a corresponding growth in the demand for goods and services.

Employment and Wages

Consumer spending is entirely dependent on surplus income—the more people receive a steady income (and continue to receive one), the more consumers are willing to make discretionary purchases.

Likewise, wages play a part in consumer spending. If wages are steadily rising, consumers generally have more discretionary income to spend, but if they are stagnant or falling, demand for optional consumer goods is likely to fall. Median income is one of the best indicators of the condition of wages for American workers.

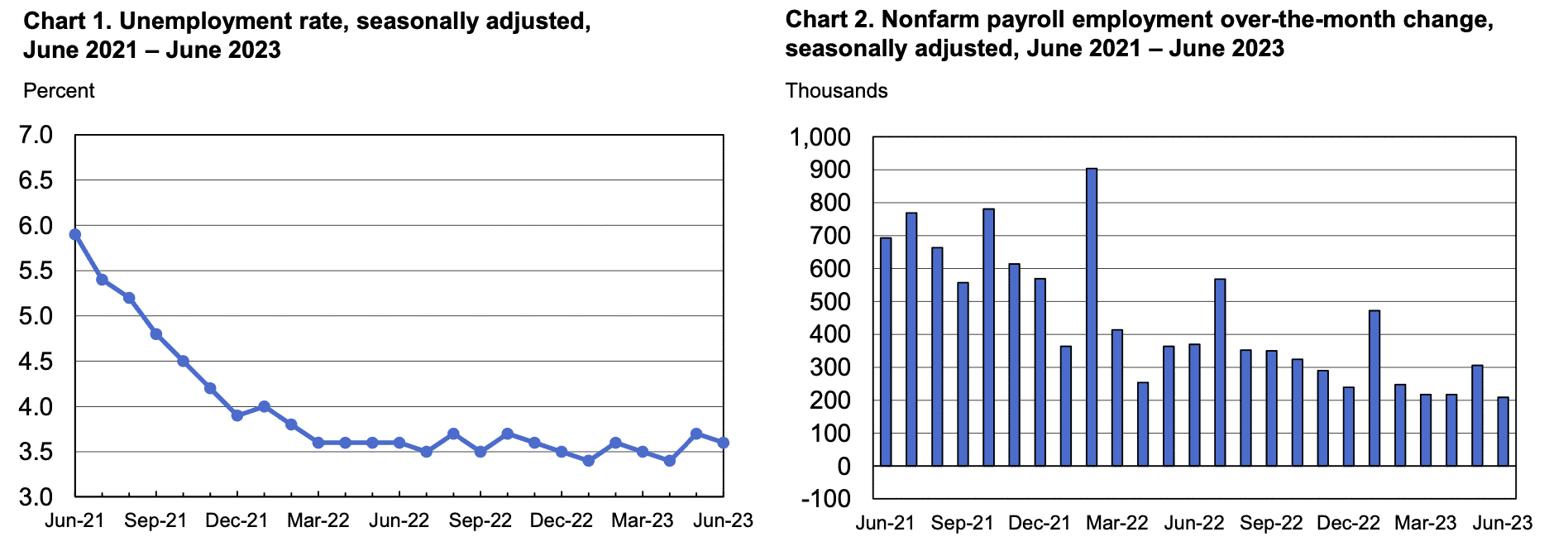

As of June 2023, the Bureau of Labor Statistics reported that total nonfarm payroll employment increased by 209,000, and the unemployment rate changed little at 3.6%. Employment continued to trend up in government, health care, social assistance, and construction.

Many would see low unemployment usually regarded as a positive sign for the economy. A very low rate of unemployment, however, can have negative consequences, such as inflation and reduced productivity. When the labor market reaches a point where each additional job added does not create enough productivity to cover its cost, then an output gap, or slack, happens.

The level at which unemployment equals positive output is up for debate, however, economists suggest that as the U.S. unemployment rate gets below 5%, the economy is very close to or at full capacity. So at 3.6%, one could argue the level of unemployment is too low, and the U.S. economy is becoming inefficient.

Wage inflation comes about by increasing demand for labor as the unemployment rate is falling. With a smaller work population, employers are forced to increase wages to attract and hold onto talent. A knock-on effect of rising wages is that some small firms have to dip into the less talented work pool, reducing productivity.

Forecasting the Future of Consumer & Retail

In a volatile market, having access to timely, accurate research is only part of the equation. You need AI search technology to help you speed up your ability to uncover patterns and key trends so you can better inform your decision-making.

AlphaSense offers an extensive universe of company filings, earnings transcripts, expert interview transcripts, news, trade journals, and equity research—paired with proprietary AI-based search technology—to pinpoint valuable insights in seconds.

Start your free trial with AlphaSense today.