The Organization of the Petroleum Exporting Countries Plus’s (OPEC+) recent decision to cut oil production by two million barrels per day starting this November has stirred up international crude negotiations.

OPEC’s influence on global economic markets is immeasurable, as the group consists of the 23 largest oil-exporting countries and produces around 30% of the world’s crude.

In 2016, when energy prices were particularly low, OPEC joined forces with ten other oil producers to create OPEC+. These additional countries include the United Arab Emirates–the biggest single oil producer within OPEC+, producing more than 10 million barrels a day–and Russia, also yielding 10 million barrels daily.

Together, these nations produce about 40% of the world’s crude oil.

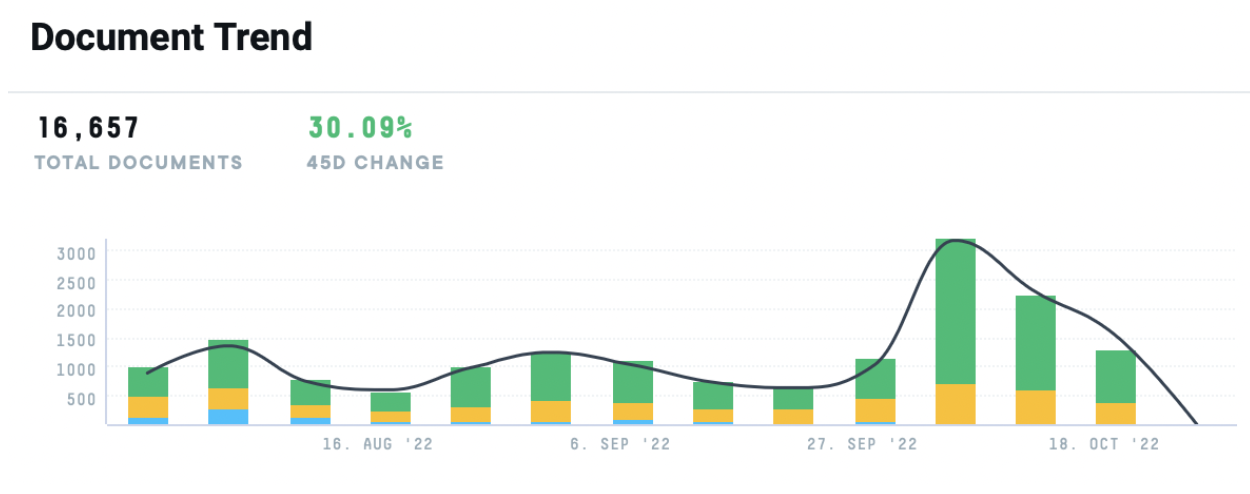

Accordingly, we’ve seen a 30% increase in documents across the AlphaSense platform mentioning OPEC+. And based on our findings, countries around the world are already discussing how they’ll compensate for this drastic cutback, as it will affect nearly every industry and sector.

Below, we pulled key insights from the nations leading these conversations to see how they are reacting to this economic-disrupting information.

Biden Administration’s Response to Oil Cutbacks

While OPEC+’s announcement has sent shockwaves around the world, diplomatic frustration is potentially most apparent in Washington and, more specifically, with President Biden. Some Congress members see OPEC+’s decision as a means to funnel financial support for Russia in the Russia-Ukraine War, as they are reportedly spending $900 million a day to invade Ukraine and heavily depend on revenues from its gas and oil exportations.

However, Saudi Arabia claims their cutbacks are precautionary economic measures for the recession experts are predicting will unfold in the next half year. During the 2008 Financial Crisis, OPEC+ oil prices fell from $100 to eventually $32 per barrel in a matter of months. Significant price shifts not only damage the economies of oil-producing countries but also affect oil fields due to abrupt halts in production.

Regardless of the United Arab Emirates’s justification, Biden is facing an ensuing oil crisis at home as barrel prices have already jumped $10 since OPEC+’s announcement. To tame tensions over escalating gas prices, the President met with Saudi officials this past October to negotiate a delay in OPEC+’s decision, pushing the cutback to take effect in December, more notably, after the US midterm elections. Unable to sway Saudi Arabia, congress is considering taking drastic measures, including freezing all cooperation, halting arms sales for a year, and removing American troops and missile systems from the Kingdom.

In an effort to lower gas prices and compensate for a lack of imported oil, Biden began releasing millions of crude barrels from the nation’s Strategic Petroleum Reserve (SPR) and onto the market this past October–consequently depleting the Reserve’s levels to its lowest since 1984. Historically, Biden’s administration had reservations on authorizing releases from the SPR until this past June, when the President tapped into the reserve and lowered US gasoline prices.

Fifteen million of the 180 million barrels the administration is purchasing from the SPR will also be available to the market in December to continue curbing gas prices, with more to come depending on Russian or other actions disrupting global markets. The Strategic Petroleum Reserve houses roughly 400 million barrels of crude oil in underground facilities within Texas and the Louisiana Gulf Coast.

International Perceptions on the Cutback

While the US has been potentially the most vocal in taking action against Saudi Arabia, nations around the world are discussing the impacts of the OPEC+ cutback.

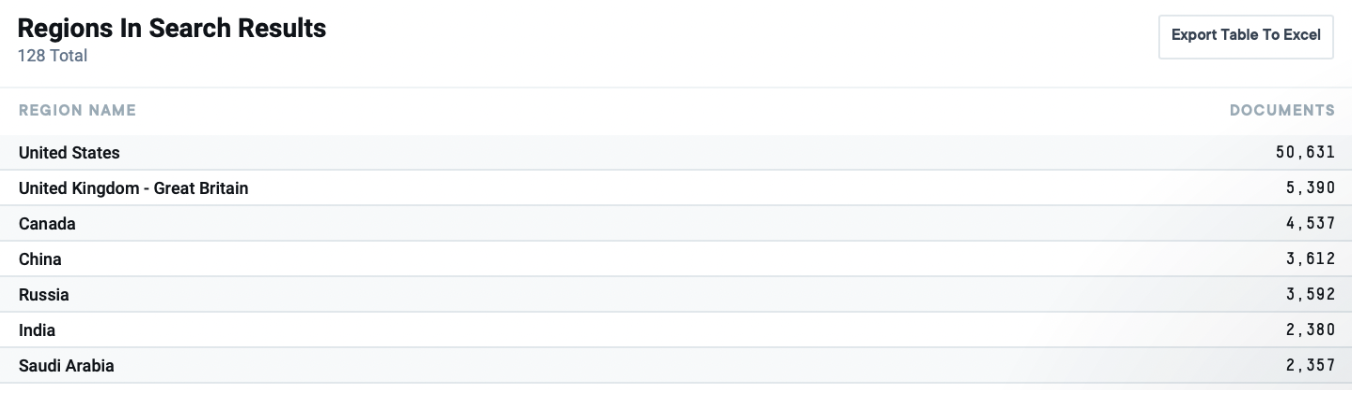

Within the AlphaSense platform, we’re seeing non-OPEC+ countries (US, Canada, China, UK) and OPEC+ countries (Russia, Saudi Arabia, India) dominate the conversation throughout press releases and company documents.

After scanning thousands of documents, we pulled key insights that give an indication as to how these countries are approaching the matter–whether the cutback is a geopolitical move in support of Russia, a lucrative opportunity to export energy supplies, or ensuing crisis for heavy energy-consuming 4nations.

Canada

Canada, a major oil producer and non-OPEC+ country, views OPEC+’s decision to cut back oil as both lucrative and problematic. With less oil and gas supply emanating from countries top-producing oil countries, like Russia and the United Arab Emirates, higher demand for these supplies will be placed on Canada and other non-OPEC+ countries.

Continuous demands for gas and oil that emerged during the COVID-19 pandemic have positioned Canada for a dependable revenue stream. Even the recent news of OPEC+’s decision has resulted in a lift to QoQ performance for Canadian energy companies. Though, interest rates and global inflation certainly will affect pricing and, therefore, financial gains.

“We expect strong crude oil and natural gas demand to continue, and tight supply in a robust commodity price environment may further drive oilfield services industry activity and rate improvements during the remainder of 2022. While we expect oil and natural gas producers to remain committed to prioritizing shareholder returns, higher oilfield service industry utilization is expected to drive day-rate pricing improvements year-over-year.”

– Ensign Energy Services Inc. | Q2 2022 Report

India

As one of the major countries to consume oil, India has valid concerns about the cutback OPEC+ announced. To date, India consumes roughly 4.92 million barrels per day, accounting for 5% of the world’s total share, according to the US Energy Information Administration. And this need for oil is growing, with the country’s demands outpacing any other in the world. Producing nearly 1,016,371 barrels a day and ranking as 20th largest producer in the world, India certainly will not be able to satisfy its own oil needs–last year alone, the country imported 85% of its crude oil.

“India’s demand for petroleum products like petrol and diesel will grow by 7.73 per cent in 2022, the fastest pace in the world, an OPEC report said. India’s demand for oil products is projected to rise from 4.77 million barrels per day (bpd) in 2021 to 5.14 million bpd in 2022, OPEC said in its monthly oil report. The growth in demand is the fastest in the world ahead of 1.23 percent of China, 3.39 percent of the US and 4.62 percent of Europe. For 2023, the Organisation of Petroleum Exporting Countries (OPEC) projected a growth of 4.67 per cent in India’s demand to 5.38 per cent.”

– CNN-News18 | News Article

“In the past two decades, India encountered a disproportionate increase in oil consumption. The country’s crude import bill increased from USD 48.1 billion in FY07 to USD 119 billion in FY 2021-22.OPEC indicates India could report the fastest average annual oil demand growth of 3.7% per annum through to CY40. This oil intensity is the principal reason behind India accounting for 70% of the world’s 20 most polluted cities in 2021.”

– Balrampur Chini Mills Ltd | Annual Report

China

Communist-led media in China views OPEC+’s cutback as a political move rather than an economic strategy, stating that it is a clear indication the organization is taking a stance against Western political and geopolitical intentions with the Russian-Ukraine war.

The Global Times– daily tabloid sister to the Chinese Communist Party’s flagship newspaper, the People’s Daily, which reports on issues from an ultra-nationalistic perspective–published a story that labeled Saudi Arabia’s intentions as self-serving.

Even with tensions high between China and the US due to the semiconductor crisis happening in Taiwan, China seems to be siding with Biden in the OPEC+ matter.

“The OPEC+ production cut, which came just days after the Group of Seven agreed to impose a price cap on Russian oil exports, is an unmistakable sign of the oil-producing countries’ opposition to the West’s geopolitical gambits at the expense of these countries as well as global markets.”

– Global Times | News Article

United Kingdom (Great Britain)

The UK believes that Biden’s inability to sway the United Arab Emirates to postpone their cutback this past October was an “embarrassment” on the White House’s part that exemplifies the US’s power, or lack thereof.

And with Biden and Congress’s threat to rollback diplomatic measures within Saudi Arabia, the UK press isn’t so sure they’ll follow through on them. In fact, some UK analysts see economic benefits from the OPEC+ cutback, believing that it has prevented the cost of oil per barrel from dipping below $75.

“We believe that the OPEC+ cuts have significantly reduced the likelihood of any immediate collapse below $75 per barrel, which would have been possible had the cuts been delayed.”

– Standard Chartered PLC | News Article

“The recent OPEC decision to cut oil production by 2 million barrels per day was a political embarrassment to President Joe Biden, proving the limits of White House influence even after Biden traveled to Jeddah in July and met with Saudi Crown Prince Mohammed bin Salman. The current and former officials said there is no real talk about changing the US troop presence in Saudi Arabia for now, but right after the OPEC announcement, the administration did begin talking about how many US troops are in Saudi, what they do, and how much it costs the US to have them there.”

– Pakistan Press International | News Article

Russia

The positive impacts of the OPEC+ cutback on Russia’s energy industry are certainly emphasized throughout company documents and news outlooks in the AlphaSense platform. In May 2021, OPEC+ gradually lifted the restrictions on crude oil production targets as the hardships of COVID-19 were less apparent.

Crude oil supply still lags behind global demand due to faster-than-expected economic recovery. However, OPEC+ was also not consistent with their proposed increased production plans due to accidents and repair works on oil facilities in a number of countries, which only grew the deficit in crude oil and increase in benchmark prices in the second half of 2021.

Consequently, during 2021, benchmark crude prices returned to the pre-pandemic levels of 2019 and continued further growth, which positively affected Russia’s sales prices.

“The production growth was attributable to the dynamics of the external limitations on oil production due to the OPEC+ agreement, as well as higher gas production volumes. Besides higher oil prices, EBITDA of the Exploration and production segment in Russia was positively affected by higher oil production volumes due to the changes in external limitations under the OPEC+ agreement, as well as higher positive time lag effect of export duty and MET.”

– GazProm PJSC | Industry Snapshots

Saudi Arabia

OPEC+, Saudi Arabia, and its press seem to be at odds with itself, based on the news information we sourced within the AlphaSense platform. Similar to China, publications are viewing the OPEC+ cutback as a clear stance of the organization supporting Russia in the ongoing war with Ukraine and view their “economic reasonings” as a farce.

However, OPEC+ has repeatedly confirmed that they continue to support UN resolutions regarding the war and that their decisions are purely based on economic considerations, such as limiting volatility that does not serve the interests of consumers and producers. However, there is also an emphasis on the importance of building upon the solid pillars with which the Saudi-US relationship has stood over the past eight decades–an indication of maintaining diplomatic relations.

“Some statements have described the OPEC+ decision as politically motivated and biased against the United States. The Kingdom expressed its total rejection of these ideas that are not based on facts but are meant to portray the OPEC+ decision out of its purely economic context. The Kingdom called for establishing a non-politicized constructive dialogue and to wisely and rationally consider what serves the interests of all countries in resolving economic challenges.”

– Arabian News | News Article

Key Takeaways from Research Documents

- While some countries see Saudi Arabia’s OPEC+ cutback as means to preserve its economic stability, most nations believe the Kingdom is supporting Russia in the Russia-Ukraine with this landmark decision

- The cutback has been beneficial for countries like Russia and Canada, where demand for oil has only increased and generated financial gain, whereas other countries like India are facing a potential crisis due to a growing need for more energy supplies and inflating prices

- As the deadline for the OPEC+ cutback approaches, nations will be observing if the US will carry out its threats against Saudi Arabia and how this will complicate international relations

Follow the latest developments of the OPEC+ oil production cuts with AlphaSense to access critical insights from top private equity firms, leading companies within the Energy and Industrial industry, and much more. Sign up for your free trial today.