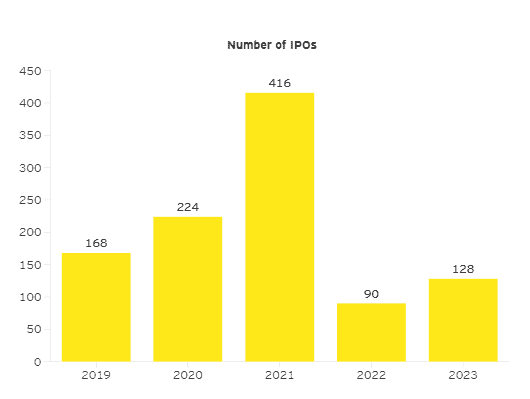

It is no secret that firms looking to go public have faced considerable headwinds the last couple of years. In fact, initial public offering (IPO) activity is at its lowest level since 2016. Swelling interest rates, tightened borrowing, and ongoing market volatility have all deterred IPO activity to record lows.

While IPO activity is expected to regain some momentum in 2024, the residual effects of a difficult IPO environment and the macroeconomic factors driving its instability are starting to show for some firms that braved the ‘IPO winter’ and consequently struggled to meet shareholder expectations.

There is a growing trend among private equity firms buying back and re-privatizing companies that experienced unsuccessful IPOs and delivered lackluster performance since going public.

Below, we’ll take a look at market factors contributing to diminishing IPO activity, a case study on recent private equity re-acquisitions, and a glimpse into IPO failures within the last six months, examining the common trends and themes that are emblematic of the current IPO environment.

Factors Shaping the IPO Landscape

Coming off historically low IPO activity in 2022, 2023 continued to see a flatline trend as a result of ongoing economic headwinds including high interest rates, tight lending conditions, recessionary fears, and weak equity markets.

Market volatility has undoubtedly created an unfriendly IPO environment in recent years, and its reach spans into other transaction activity as well. M&A activity fell to its lowest level in ten years globally in 2023, as high interest rates and an economic slowdown weighed on companies’ deal-making confidence.

IPO activity in 2024 will likely continue to experience residual effects of macroeconomic conditions, and be shaped by peripheral factors such as the US presidential election and geopolitical conflicts across the world.

From their recent 2024 IPO outlook, EY offers a consultant perspective on IPO success in the current environment: “It is crucial for IPO aspirants to build trust and confidence among key stakeholders: have the right management team in place, demonstrate a track record of performance and show a predictable path for growth and profitability.”

A Flurry of Private Equity Bailouts

Endeavor Holdings (NYSE: EDR)

Endeavor Holding’s debut on the NYSE in 2021 was the first of its kind for an entertainment and talent company, however it was not the first time the conglomerate attempted to go public. In 2019, Endeavor Holdings experienced two failed IPO attempts, amid exaggerated valuations and significant debt levels.

According to an expert interview with a former Head of Client Strategy at a creative sports agency sourced from the AlphaSense platform, the talent management industry faces several risks. These include competition and the movement toward monetizing one’s own talent:

“The biggest disruptor for the industry, in my opinion, is the creator economy and the new platforms that are coming out to help monetize creators directly without the need of having a third party. Their ability to do direct deals with themselves, negotiate their own endorsement deals or sponsored content deals, the creators are getting a lot smarter.

Technology is making the world smaller, so the relationships that these agencies used to tout aren’t really hard for top creators to get those relationships themselves. You can reach anybody with a couple clicks of a button. I think that’s going to be tough for the agencies to compete with.”

– Former Head of Client Strategy at a creative sports agency | Expert Interview

In October 2023, Silver Lake announced plans to re-privatize Endeavor, just two years after helping to take the company public. Silver Lake currently owns a 71% voting majority in Endeavor and is formalizing its re-acquisition plans for the talent giant.

SUSE (SUSE: Frankfurt Stock Exchange)

SUSE, a global open-source software company, joined the IPO boom in 2021 with its listing on the Frankfurt Stock Exchange and backing by Swedish private equity firm EQT. In August 2023, an agreement was reached for EQT, a 79% equity owner, to take SUSE private again.

Analyst research sourced from the AlphaSense platform offers key insights into detractors of SUSE’s performance, including slower Linux customer adoption, competitors expected to gain market share, data security and infrastructure issues, and leadership turnover.

According to an expert interview with a former SUSE salesperson sourced from the AlphaSense platform, SUSE’s product offerings struggle to remain competitive and ultimately hinder growth and retention:

“On the Rancher front, there is potentially a lot of competition from start-ups as well as some established players like OpenShift and those types of folks. In terms of stickiness, the Rancher product is definitely not as sticky as their Linux portfolio just because of the nature, that it’s a management product. It sits on top of and manages other infrastructure products that you’re using. Its core proposition is about centralizing management control for users and being able to audit environments and all those. It’s a great solid proposition, but they’re not the only game in town. There’s healthy competition for products like Rancher.”

– Former SUSE Salesperson | Expert Interview

In both situations, there are consistent themes and learnings for firms targeting an IPO. High on the checklist are sound fundamentals and a clear and well-articulated vision for the future. This is particularly critical in a less than optimal market environment that stress-tests operational viability and easily exacerbates weaknesses.

A Look at Recent IPO Failures

For firms that braved the ‘IPO winter’ of 2023, some experienced disappointing debuts to the market and bear similar characteristics to the instances we just discussed.

Instacart/Maplebear Inc (NASDAQ: CART)

Instacart (CART) listed on Nasdaq in September 2023 and within two days plunged 11%, losing nearly all its IPO gains.

An expert perspective sourced from the AlphaSense platform finds that Instacart’s operating model presents a challenging scenario particularly post-Covid for sound growth:

“E-commerce is 20% online penetration. One out of five purchases that were previously retail are now made online. Grocery’s been stuck at 10% post-COVID. One explanation for that, rather than cost, is that people actually legitimately just like going to their grocery store. They like the experience of going in, looking around, seeing what’s going on, seeing what’s new, touching their produce, all that stuff. At Instacart, any project we took, assume that that number would hit 20%, 25% by 2025. It follows a similar curve as e-commerce, and that actually just hasn’t happened. It’s stayed flat, which is the number of people who purchased groceries online in general. That’s, I think, been a big surprise to Instacart and actually very bearish for growth.”

– Former Instacart Strategist | Expert Interview

Birkenstock (NYSE: BIRK)

Birkenstock made its long-awaited debut on the NYSE in October 2023. The stock tumbled more than 20% in its opening week, making it the worst debut by a company worth over $1 billion in nearly two years. Analysts point to exaggerated valuations that set Birkenstock’s IPO price at an artificially high level.

Despite its shaky debut, analyst research sourced from the AlphaSense platform praises Birkenstock’s differentiated operating model. Their prioritization on distribution quality and supply chain control with manufacturing centralized in Germany by and large outperforms competitors in Asia. Citing the retail stronghold in the US and Europe, analysts also believe the firm can successfully penetrate other geographies over time.

Related Reading: Retail Market Research

Stay Ahead of the Curve with AlphaSense

AlphaSense’s leading AI-search driven platform equips you with the insights, market intelligence, trends, and expert opinions to remove the complexity and guesswork of conducting your research.

In a fast-changing and unpredictable IPO environment, AlphaSense helps you cut through the noise and surface the information you need to make confident, data-driven decisions. Streamline your research workflow, gain the competitive edge, and uncover new opportunities with AlphaSense.

Start your free trial today and navigate the IPO landscape with confidence and ease.