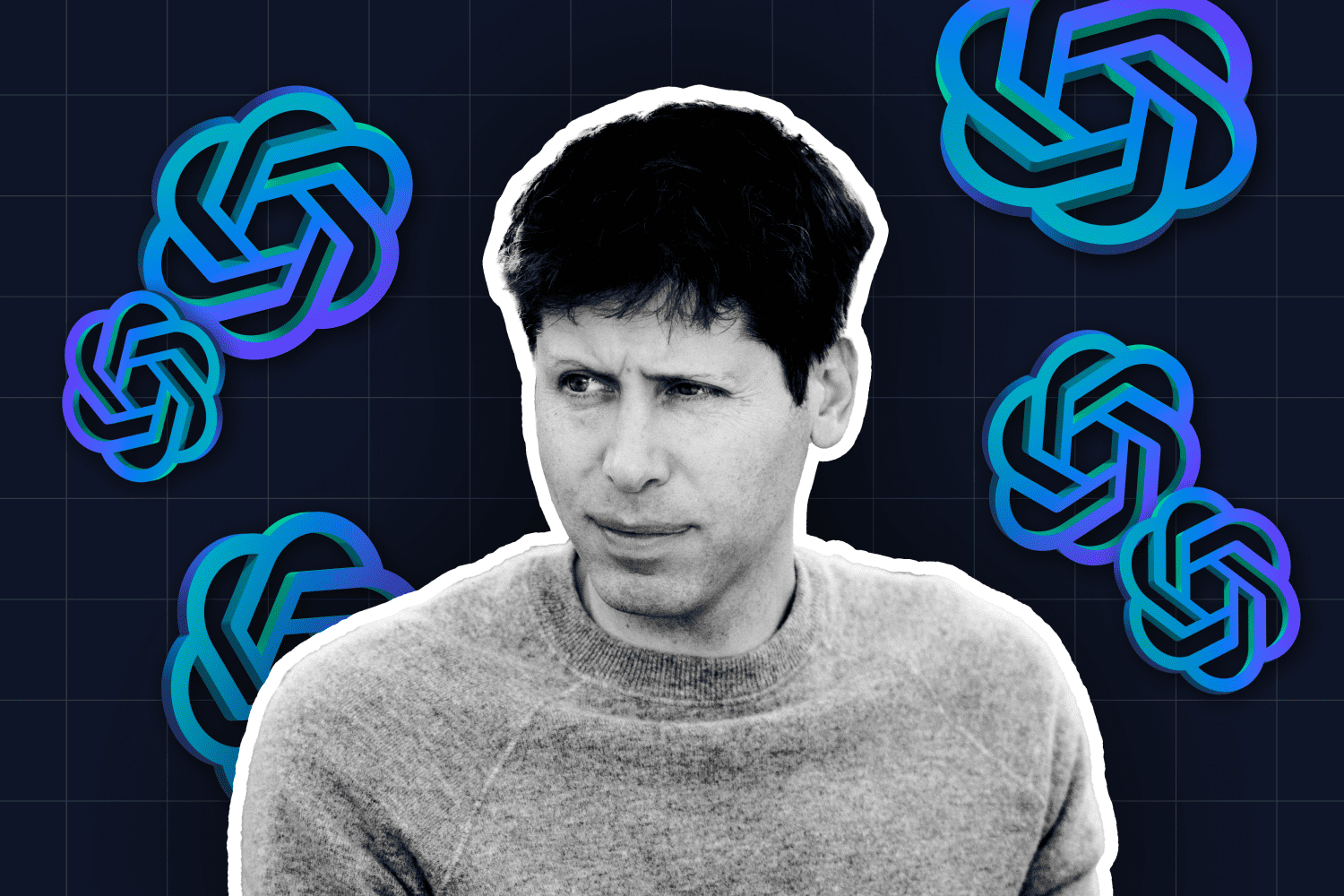

OpenAI, the company behind large language model-based chatbot ChatGPT, is making headlines yet again—and for concerning reasons. Last week, Sam Altman was fired as CEO of the AI startup by the company’s board of directors, which led longtime president and co-founder, Greg Brockman, and three senior OpenAI researchers, to resign.

The news rippled across the tech industry, rapidly diminishing trust in the fate of OpenAI and leaving many questioning leadership within the AI startup.

“The AI community is reeling,” Ryan Jannsen, CEO of Zenlytic, told CNBC, adding that technologists are confused about the circumstances related to Altman’s firing.

“I imagine Microsoft might ask for a board seat next time they decide to plow $15 billion into a startup,” said Zachary Lipton, a Carnegie Mellon University professor of machine learning and operations research.

While Altman has been reinstated as CEO of OpenAI with the condition for OpenAI to reconfigure its board of directors, many are seeing this display of boardroom drama at one of the most promising VCs as a harbinger for how business will be done in the future.

This narrative of an innovative founder being ousted by a board that lacks a basic understanding and empathy for the “soul of the company,” is not a new one, but rather a recurring one. In fact, it’s one that’s been played out by Steve Jobs, Travis Kalanick, and Adam Neumann.

So why are business leaders forecasting the OpenAI debacle to change boardroom dynamics around the world? We unfold the events that have taken place at OpenAI these past few weeks and share how they could shape the future of AI business.

What Happened At OpenAI

Below, we break down the chain of events that led to Altman’s firing and reinstatement as CEO of OpenAI.

Tuesday, November 17

- OpenAI board terminates CEO and co-founder Sam Altman, while President Greg Brockman resigns after being ousted from the board. The company appoints Mira Murati as the interim CEO.

Wednesday, November 18

- According to an internal memo from COO Brad Lightcap, Sam Altman’s dismissal was a result of a “breakdown in communication between Sam and the board,” and not due to any “malfeasance.”

- Khosla Ventures, an early investor, expresses the desire to have Altman return to OpenAI, emphasizing their support for him in whatever endeavors he pursues next.

- Rumors emerged of certain employees considering resigning if Altman was not reinstated as CEO by the weekend’s conclusion, while others indicated their backing for joining his prospective new venture, as per sources familiar with the situation.

Friday, November 19

- Altman explores the prospect of rejoining the company while contemplating the launch of a new AI startup, as informed by a source to Reuters.

Saturday, November 20

- Microsoft CEO Satya Nadella announces the recruitment of Altman, Brockman, and their team to spearhead a new advanced AI research division at the Windows company.

- OpenAI names former Twitch chief Emmett Shear as interim CEO, with Shear pledging an investigation into Altman’s departure. Simultaneously, the OpenAI board engages in discussions with Anthropic’s CEO about a potential merger, entertaining the prospect of assuming the top leadership role in the deal.

- Simultaneously, nearly all OpenAI staff plan to resign and join Altman at Microsoft if the board does not step down. Some investors of OpenAI are even exploring legal options against the company’s board.

Sunday, November 21

- OpenAI announces that Altman will resume his role as CEO, accompanied by a revamped initial board consisting of Bret Taylor, Larry Summers, and Adam D’Angelo. Additionally, Brockman will be making a return to the startup.

- News emerges that Altman was fundraising in the Middle East for a new venture rival AI chip maker Nvidia, which controls about 80% of the global AI chip market. Altmans’s goal was to provide lower-cost competition to Nvidia and reduce the costs for OpenAI running services like ChatGPT.

Sunday, December 3

- Reporting from Wired reveals that OpenAI had signed a letter of intent to spend $51 million on AI chips from a startup called Rain AI, a company in which he has also invested personally. Rain AI is developing a chip it calls a neuromorphic processing unit, or NPU, designed to replicate features of the human brain. OpenAI in 2019 signed a nonbinding agreement to spend $51 million on the chips.

- Many speculate that Altman’s firing was due to his “web of personal investments” being “entangled with his duties as OpenAI CEO,” Wired reports.

Investments Outside of the Office

Contrary to common knowledge, Altman’s rise didn’t start at OpenAI.

Before he co founded the artificial intelligence firm with Elon Musk in 2015, Altman was president of Y Combinator, one of the world’s most renowned startup incubators, from 2014 to 2019. During that time, he led dozens of Y Combinator’s investments in early-stage companies and continued to invest in startups after leaving the firm.

Throughout the years, Altman has provided funding for close to 100 companies, according to Crunchbase. The majority of Altman’s portfolio consists of private companies, posing a challenge in determining his exact net worth, but some estimates suggest that the entrepreneur and investor’s wealth surpasses $500 million—a value primarily attributed to equity ownership in the companies he supports. Interestingly, Altman clarified during a congressional hearing on May 16 that he holds no equity in OpenAI, despite its recent valuation at $29 billion.

However, the juggling of his diverse endeavors and the resulting distraction seemed to contribute, to some extent, to his recent termination by OpenAI’s board. Individuals familiar with the situation, although not authorized to discuss it, highlighted the role of uncandid communications in the decision—more specifically, OpenAI’s $51 million contract with Rain.

While leadership may see the Rain deal as a conflict of interest for Altman, it does also highlight OpenAI’s readiness to invest significant amounts of capital into securing chip supplies essential to advancing groundbreaking AI projects.

In fact, Altman has openly expressed concerns about a “brutal crunch” in AI chips and the significant costs associated with them. While OpenAI utilizes Microsoft’s robust cloud infrastructure, OpenAI’s primary investor, access to certain ChatGPT features has been intermittently restricted because of hardware limitations. This is due to the pace of OpenAI’s AI progress, which Altman suggested, may hinge on innovations in chip designs and supply chains.

Rain, in its efforts to attract investors earlier this year, anticipated reaching a crucial milestone by “taping out” a test chip, indicating a design ready for fabrication as early as this month.

However, recent leadership changes and investor reshuffling occurred after reports that a US government body overseeing national security risks mandated Prosperity7 Ventures, a Saudi Arabia-affiliated fund, to divest its stake in Rain. This fund had previously led a $25 million fundraising round for Rain in early 2022.

Corporate Governance Unfolding in AI

What this whole OpenAI debacle has made clear is that AI—a technology expected to be the most significant innovation in our lifetime—is being developed by private companies, led by executives, overseen by boards of directors, and funded by investors. And how these various stakeholders of authority act is based on corporate governance—a framework that often regulates power distribution and handles conflicts within corporations like OpenAI.

In contrast to a traditional corporation, investors lack the authority to appoint or dismiss board members, and both the investors and the CEO do not hold sway over the board. The company’s charter explicitly cautions investors that OpenAI’s objective is “to ensure that artificial general intelligence (AGI) benefits all of humanity,” and the company’s foremost fiduciary responsibility is to humanity. Essentially, this duty supersedes any obligation to generate profits.

It’s a highly unusual structure for a cutting edge company like OpenAI. Their intent is to shield corporate governance from the imperative of profit maximization and to limit the authority of the CEO. Should the company prioritize safety over financial gains, investors and executives may express dissent, but they lack the authority to enforce a different decision by the board.

These cases of corporate governance share a crucial lesson for everyone involved: If a company is earnest about embracing social purpose and prioritizing stakeholder welfare, it cannot depend on conventional corporate governance. Instead, it must curtail the influence of both investors and executives.

In other words, Microsoft, OpenAI’s primary investor, lacked the authority to dismiss the board and reinstate Altman as CEO. However, it retained the ability to hire Altman and numerous other staff members, effectively acquiring OpenAI without incurring any cost to the company’s shareholders. While the governance structure limited the actions of the legal entity OpenAI, the knowledge generated by the company, its primary asset, could be obtained and utilized without being bound by these constraints.

After a massive management and board shake up, will OpenAI go back to business as usual? Will new innovation be slowed or sped up? What are governance considerations? Dig deep into AlphaSense’s expert insights about the matter in our report, Generative AI: The Road To Revolution.

Keeping Tabs on the TMT Space

In the midst of market volatility, staying up to date on market developments requires a tool that separates the noise from the insights you need. Consequently, by streamlining the process required to be up-to-date on industry chatter and industry dynamics, you waste less time and money on appeasing stakeholders and gaining investor interest.

With AlphaSense’s vast content universe and advanced search technology, you can conduct deep, comprehensive, and accurate research to track companies, both private and public—all while saving time and resources for higher-value tasks.

Today, AlphaSense powers deep market analysis capabilities for leading organizations around the world, including 85% of the S&P 500, 75% of the world’s leading asset management firms, and 80% of the top consultancies.

Looking to learn more about the future of AI? Watch our webinar with Eric Schmidt, Co-Founder of Schmidt Futures and Former CEO & Chairman of Google, and David Solomon, Chairman and CEO of Goldman Sachs, as they discuss the biggest questions in AI today—from the economic potential of generative AI to how AI will reshape the mega-cap tech world, society, work, and geopolitics.

Start your free 2-week trial today to explore the AlphaSense platform firsthand and see how it can help your organization transform.