The company

Headquartered in California, this leader in materials manufacturing solutions is the world’s preeminent semiconductor and display equipment company. Over the last 50 years, their innovations have fundamentally changed how the world works and the way people interact with each other through technology. Their solutions are used to produce virtually every new chip and advanced display in the world, helping make products such as computers, mobile devices and flat panel displays affordable for millions of people globally.

Their Manager and Information Specialist manages the information center (e-Library) and supports the company’s 22,000 employees with their information needs. In addition to supporting the entire company’s data and information requests, she works alongside the corporate venture capital team to help them understand emerging innovations and assess new investment opportunities in smartphones, AR and VR, AI, driverless cars, big data, life sciences, 3D printing, robotics, cleantech, and advanced materials.

The challenge

This company lives by the mantra, “Think big, test small, fail fast, and learn quick” and is constantly facing the question of how to solve the business’ biggest challenges in a more efficient way. To stay ahead of the competition and mitigate the risk of poor investments that could cost the company millions, the firm relies on the e-Library team to both monitor the market for competitive movements and assess new business and investment opportunities that fuel the company’s strategy forward. The pain points of this manager’s process were:

Data. Was. Everywhere

“We were using different systems and leveraging different teams who had certain privileges and access to different data sets,” she says. These disparate sources also led to a fear of missing information, with the team not confident that they were capturing the full picture for their internal stakeholders, who rely on the team’s insights to make “very expensive” decisions.

Bottlenecks in research process

Historically, the team lacked access to broker research reports, an information source that the company heavily relies upon for expert opinions and analyses on industries, companies, disruptors, and overall market trends. “We were spending more time asking for data access than we were actually analyzing the data” the manager mentioned, describing the various bottlenecks in their process.

Time wasted manually reviewing documents

The information team often needs to find and synthesize granular pieces of information like market size, emerging players, competitive outlook and Wall Street sentiment. As she describes it, “I read, and read all day long” trying to pinpoint that ‘needle in a haystack’ piece of relevant information.

“I can spend more time researching efficiently, less time chasing internal teams, and more confidently advising our teams”

Manager and Information Specialist

Results

Deeper support of valuable partners & customers

The e-Library team uses AlphaSense to gain instant insights on their most valuable partners and customers that company leaders then uses to provide above and beyond support. With entity recognition, “we can hone in on the exact sentence or paragraph that mentions my customer by name” and share that information with her team to quickly react, says the manager. Teams across the company – from Business Development and Competitive Intelligence to Corporate Venture – now leverage the e-Library team’s research to bolster their strategies or bring new ideas to the table for their partners, customers and stakeholders. “We’re seen as research experts. The Information Center has been completely amplified within the business over the past couple of years, in part, due to the efficiencies gained in using AlphaSense’s AI tools”, shared the manager.

Frictionless process saves money

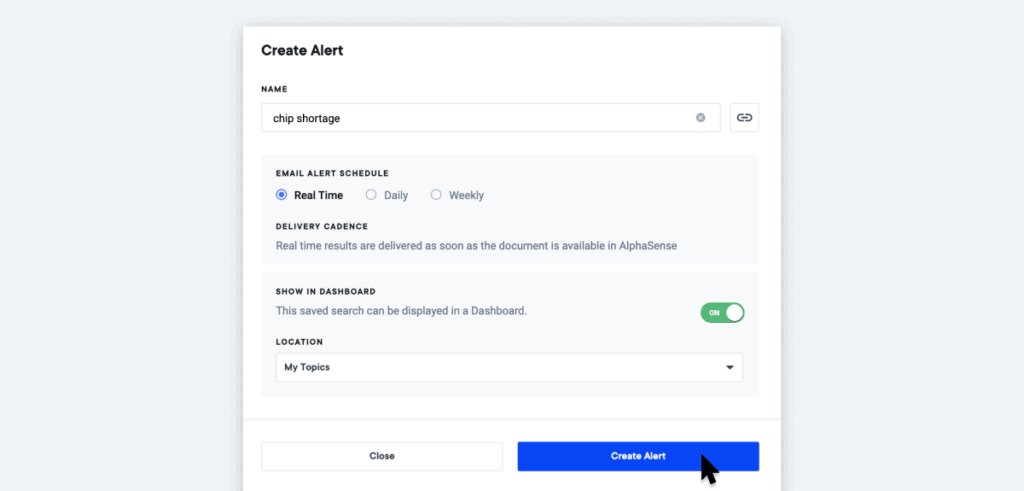

The platform allows the e-Library team to efficiently pull information on the themes impacting their industry, partners, customers, and competitors. In particular, they find the advanced filtering and Alert capabilities to be helpful to pinpoint the right information and automate portions of her research workflow. “AlphaSense has really enabled us to dig below the surface-level data and work quickly,” shares the manager, “The minute one of our competitors goes to market with a new product, we have automatic notifications set so we’re the first to know about these competitor movements.” The time saved in automating the research process also translates to “[saving] the company money” as they make “very expensive” decisions.

Confidence in decisions

The company not only gains speed, they have also increased confidence in their research by using AlphaSense to synthesize important information found across internal documents, SEC filings, trade journals, and more into one platform. As an added bonus, the e-Library team has now secured access to the broker research reports that the firm “heavily relies upon” in their analyses. “I can spend more time researching efficiently, less time chasing internal teams, and more confidently advising our teams”, says the manager. In unifying all of their content into one platform and gaining access to research that her team previously did not have privileges to, the manager shares, “we can make better decisions on new product developments or investments in a particular startup.”

This leader believes that AI is a newfound advantage for this semiconductor leader, allowing the organization to remain agile, automate critical insights and deepen their most valuable relationships with high-value information. AlphaSense has empowered the team to live by their mantra to “Think big, test small, fail fast, and learn quick.”

“We’re seen as research experts. The Information Center has been completely amplified within the business over the past couple of years, in part, due to the efficiencies gained in using AlphaSense’s AI tools”

Manager and Information Specialist

Get started today

The world’s leading corporations and financial institutions—including a majority of the S&P 500, over 85% of the S&P 100, and 75% of the top asset management firms—trust AlphaSense for smarter, faster decisions.

Start my free trial