When considering the most integral points of view of market intelligence, expert perspectives undoubtedly make the top of the list. Expert call transcripts provide a window into unique insights from thought leaders, former company executives, customers, partners, and competitors—from a specific industry or company.

These firsthand perspectives are a critical addition to secondary research. They transform your research process from reactive to proactive and ensure you outpace your peers by giving you the competitive edge.

The expert network industry is constantly evolving—it has grown to $1.5 billion in the last few years and is set to continue expanding. Among the expert network companies, there are some that serve specific industry needs, some that are better-suited for large corporations, and others that work best for small businesses or individuals. Some are equipped with artificial intelligence (AI) capabilities that enable you to maximize and streamline your research, while others are more conservative in their approach.

In this guide, we compare two popular expert transcript companies—Tegus and GLG—analyzing their use cases, strengths, and weaknesses. Since Tegus and AlphaSense have joined forces, we will also discuss how our AI-based market intelligence research solution strengthens Tegus’ platform and how their combined value compares with GLG.

Here is an overview of each platform:

GLG

The Gerson Lehrman Group (GLG) is an expert network company that offers intelligence on corporations and connects professional users to experts from multiple industries for advice, insights, and mentorship.

GLG has access to a network of 900,000+ subject-matter experts on demand, who empower users with advice, research, and insights for better-informed business decisions.

GLG’s essential product, GLG Direct, focuses on expert consultations, which are one-on-one sessions between clients and subject-matter experts. Clients with relevant questions and issues receive direct answers and insights on business topics, regulations, legal advice, and intelligence on industries and businesses.

Consultations are often private meetings, placements, and phone or video calls. Many GLG consultants also work as expert witnesses in legal proceedings.

GLG also gathers qualitative and quantitative research insights. To that end, it uses primary research methods like focus group discussions, surveys, discussion panels, and workshops. The GLG Library is another rich user resource, with thousands of on-demand webcasts, teleconference transcripts, and other documents.

Ease of Use

The GLG platform is accessible and user-friendly, making it easy for new users to onboard and use. The expansive network of users worldwide makes GLG a resourceful platform for a global overview of topics of interest.

Support

First, GLG identifies a topic based around your business need and then builds a plan with you and your team. Their team of professionals work with you to create the approach that best identifies, assesses, and answers your questions on your timeline. Then, based on your needs and the identified approach, they work with you to design a detailed plan, choosing from their distinct research offerings.

GLG boasts exceptional customer support. Users can contact the support team directly from the platform, or they can reach out by call or email. GLG also sends frequent follow-up emails to experts regarding projects they have been invited to in order to ensure faster response time for clients.

AlphaSense and Tegus: Better Together

As of July 2024, AlphaSense and Tegus have joined forces, bringing unparalleled access to even more insights, and covering more industries and companies than ever before.

Both platforms come with extensive libraries of high-quality research, as well as data and AI tools that allow users to extract the most value from the insights they find.

Tegus has an extensive and fast-growing library of high-quality expert research, which includes coverage of 35,000+ public and private companies across TMT, consumer goods, energy, and life sciences sectors. Additionally, Tegus’ financial data offering, which includes financials, KPIs, and fully drivable models on more than 4,000 public companies, as well as its BamSEC self-serve solution to search and access securities filings, adds new and unique offerings to AlphaSense’s extensive product suite and datasets.

Meanwhile, AlphaSense has an extensive universe of content, spanning the four key perspectives of research, as well as industry-leading automation and AI search capabilities. These features will help Tegus customers gain a deeper understanding of market sentiments, investment strategies, and financial forecasts, complementing the expert perspectives they already rely on.

Here’s what each platform brings to the equation to empower clients to make more informed decisions with confidence:

AlphaSense

AlphaSense is a leading all-in-one market intelligence platform and smart search engine. It’s the ideal tool for research and business professionals—from analysts and financial researchers to corporate professionals—looking to implement a qualitative research strategy powered by proprietary AI technology and automation.

Financial professionals use AlphaSense to access 10,000+ premium sources of information, including trade journals, SEC filings, and company filings.

Moreover, AlphaSense provides access to broker research and an expert call library that facilitates deeper insight into companies and markets. These extra resources are accessible through two AlphaSense content sets:

- Expert Insights – 45,000+ transcripts of one-on-one calls with industry experts, customers, professionals, competitors, and former and current executives, available as an add-on to the AlphaSense package.

- Wall Street Insights® – A collection of broker research from Wall Street’s leading firms, covering global sector themes, industries, and companies from 1,000+ sell-side and independent firms, available within the AlphaSense platform. The best part? Research professionals can preview the contents of a broker report, saving them wasted time and money on potentially fruitless research.

Unlike other research tools, AlphaSense incorporates smart search capabilities within its platform, empowering users to find everything needed for their research without manually toggling between multiple tabs. AlphaSense search also comes with added features like:

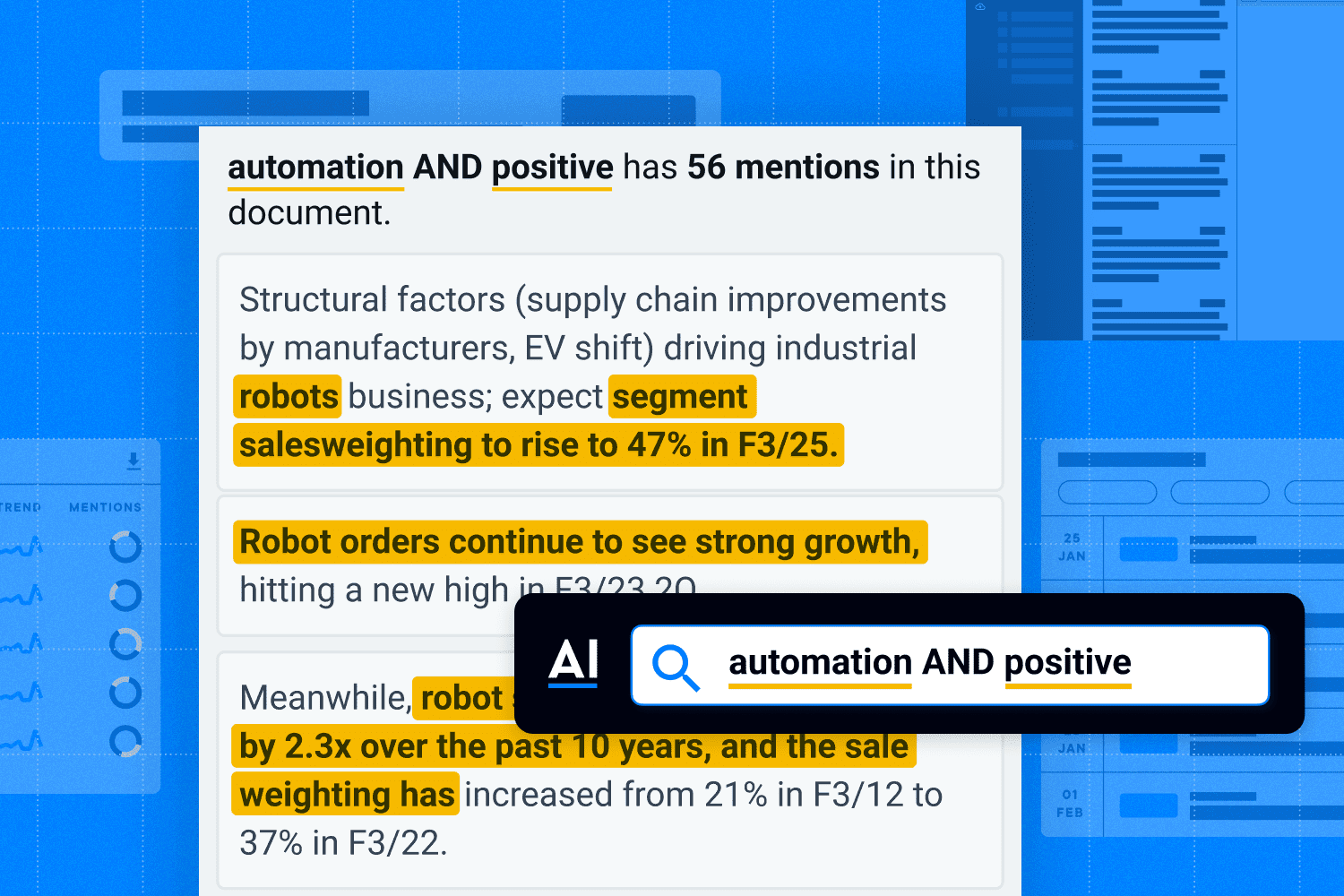

Smart Synonyms™

Smart Synonyms™ technology is an AI-supported feature that can recognize both the keywords and search intent behind a query.

AlphaSense uses advanced algorithms to eliminate noise from your search (i.e., content with matching keywords but ultimately irrelevant to your search objective) and leverages variations in language (for example, “impact investing” vs. “ESG investing”) to pinpoint the exact information you need.

AI search functionality allows you to easily find the exact documents and snippets that are most relevant to your search, giving you back time and energy to spend on more high-level tasks, like analysis.

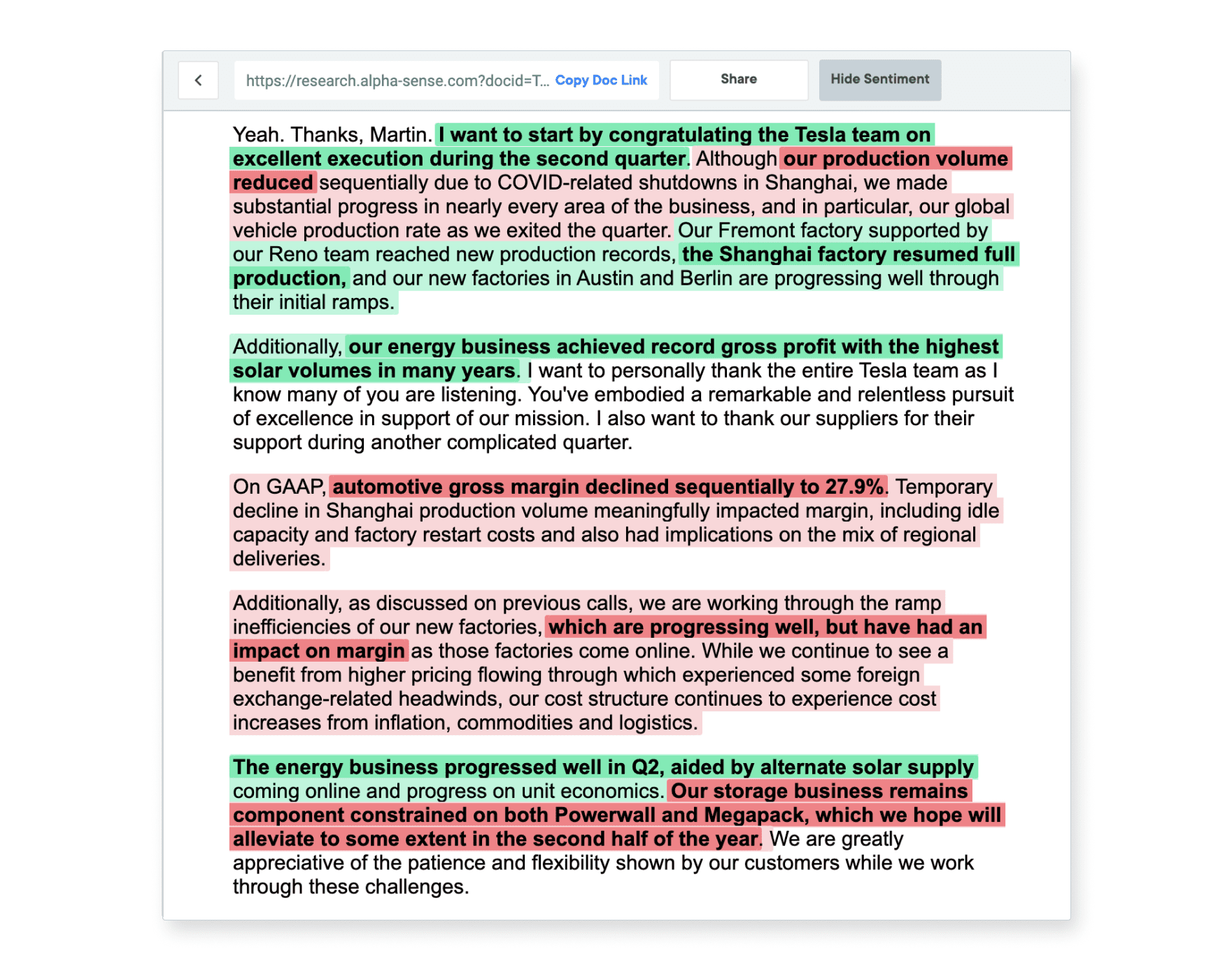

Sentiment Analysis

AlphaSense uses NLP in its sentiment analysis technology to identify differences in a text’s tone and subjective meaning. It then uses color coding to help readers identify the document’s positive, neutral, and negative sentiments.

Expert Insights also allows you to quickly pick up on sentiment shifts in the expert interviews that go beyond surface-level commentary.

This award-winning technology assigns each search term a numerical sentiment change score to help users track any slight change in market sentiments across time. Users can take advantage of it to make better-informed investment decisions and improve their risk management strategies.

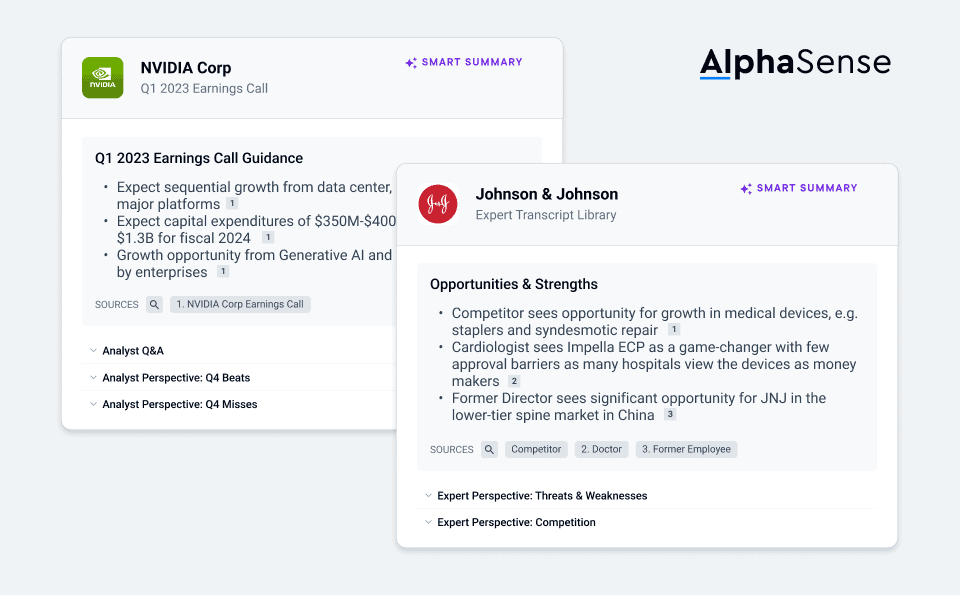

Smart Summaries

Unlike other generative AI (genAI) tools that are focused on consumer users and trained on publicly available content across the web, AlphaSense takes an entirely different approach. As a platform purpose-built to drive the world’s biggest business and financial decisions, our newest Smart Summaries™ feature leverages our 10+ years of AI tech development and draws from a curated collection of high-quality business content.

With Smart Summaries™, you can glean instant earnings insights—reducing time spent on research during earnings season, quickly capture company outlook, and generate an expert-approved SWOT analysis straight from former competitors, partners, and employees.

Integrations and APIs

It’s now becoming the industry standard for many market intelligence platforms to offer integration of internal content containing both structured and unstructured data, but it’s key that this content is indexed and immediately available. A market intelligence platform should also offer the ability to upload new external content sources (such as RSS or web content), so that you can leverage the platform’s analysis tools to pull relevant insights.

AlphaSense provides integration with commonly used programs like OneNote, Sharepoint, and Evernote, enabling streamlined collaboration with members across your organization and improving team productivity. It also allows you to search across all internal and external company content to find key insights, and the proprietary AI technology catches what other platforms miss in a secure and automated way.

Automated Monitoring

Instead of wasting hours manually monitoring, AlphaSense offers real-time alerts to keep users updated with trending topics, companies, and industries of interest. Users can also take snapshots of multiple companies frequently within the AlphaSense platform, staying in touch with the most critical insights, news, and market changes they need to know.

Exceptional User Experience

AlphaSense is built to fit into a user’s processes and workflow seamlessly. In addition to an intuitive user-friendly interface to display data and information, it allows professionals to export crucial data to their mobile devices or PCs. AlphaSense also boasts exceptional customer service—product specialists are readily available 24/7 to assist with putting together searches—which users find massively helpful in streamlining workflows.

Tegus

For investors who spend too much time manually searching, parsing, and aggregating data from disparate sources, the Tegus platform reinvents the investment research process so you can compete on your unique ability to analyze data correctly and make great investment decisions. The Tegus platform gives investors the fastest way to learn about public and private companies, and delivers the most critical content and data on a unified platform experience, all for a single software license.

Unlike legacy research methods, the Tegus platform gives investors:

The fastest way to learn about public and private companies – Whether getting up to speed or performing deeper diligence, investors need to quickly understand a company’s business model, drivers,and so much more. Tegus helps this process get done in minutes instead of days.

The most critical content and data on a single platform – The only solution with expert research, robust qualitative content sets, and key financial data in one place. Don’t settle for siloed systems and fractured data sets that slow you down.

A single software license to drive value and consolidate research costs – Tegus provides simple platform pricing so you don’t get nickeled and dimed for those high-value datasets or powerful workflows. It’s all included.

Here are some of the main features Tegus offers, now as part of AlphaSense:

Tegus Expert Transcripts

Tap into a unique, powerful set of expert perspectives through 1:1 expert calls, panel calls, management checks, and the deepest and fastest-growing library of expert call transcripts on the market. With over 100,000 expert transcripts and growing, you can discover your unique perspective faster. The Tegus platform offers the largest curation of public and private company transcripts built on top of leading AI-powered functionality to easily find, sort, and surface powerful insights.

Tegus Expert Call Services

Connect live to the most relevant experts to fit your unique research needs. Unlike other expert networks, our call services deliver curated quality experts—fast, without the markup.

Company Perspectives (BamSEC)

Make quantitative investment research easier by transforming how you work with public company data. By streamlining access to SEC filings, earnings and events transcripts, financial documents, and more, BamSEC enables analysts to focus on what matters, save time, and do better work.

BamSEC enables users to search across multiple companies and SEC filings. Customers can use these documents to perform due diligence on companies and explore performance metrics efficiently.

Using the tables on BamSEC, users can explore past filings, create models, and benchmark company performance, all in one place, without needing to pull up individual filings to manually track a company’s metrics.

Financials and Metrics (Canalyst)

Gain instant access to over 4,000 global fundamental models and over 60 industry dashboards, all hand-built and sourced by sector-focused analysts in Vancouver. Unlike building your own models and comp sheets, using Tegus’s off-the-shelf models, dashboards, and data reduces your time spent on undifferentiated work, allowing you to compete on your ability to analyze the data, not aggregate it.

AskTegus

Tegus’ most recent AI innovation, AskTegus, is an AI-powered chat experience that allows investors to quickly cut through the noise and get the insights they need. AskTegus creates a super-charged analyst, giving users the ability to sift through Tegus’ extensive database—comprised of the largest investor-led transcript library —uncovering insights within seconds, empowering investors to drive to a high-conviction decision supported by proprietary and trusted data.

Compliance

Tegus’ leading compliance framework helps ensure your research is SEC-compliant and implements transparent checks and guardrails so you can make better investment decisions. Our powerful platform and team of experienced compliance professionals use the latest technology and rigorous policies to prevent and detect potential risks or violations. Every expert call transcript is pushed through a multi-layered compliance review process that deploys proprietary AI and a team of highly trained specialists to identify and remove potential confidential information or MNPI.

Tegus allows customers to search, explore, and detect potential compliance risks or violations. The platform uses over 40 compliance experts to ensure all calls meet SEC, FINRA, and EU regulations without creating conflicts of interest or other potential violations.

Using its internal compliance tools, users can manage company-specific protocols and their team’s Tegus activity in expert calls and resulting transcripts.

AlphaSense and Tegus Take Your Research to the Next Level

GLG is a great option if all you need are expert call transcripts or a consultation with an industry expert.

However, because of their content limitations, GLG cannot offer a holistic view of the market, and it may be necessary to invest in a secondary platform for additional insights. Further, it does not offer advanced AI search capabilities or sentiment analysis that eliminate research blind spots and improve the scope, accuracy, and speed of your market research.

If you are instead looking for a platform that will be your one-stop-shop for all your market intelligence needs, both from a content and an advanced search perspective, look no further than the combined power of AlphaSense and Tegus. Combined, these two platforms now offer customers the world’s most extensive and rapidly expanding expert transcript library.

Unlock proprietary insights, providing comprehensive coverage of both private and public companies across all industries. Connect to a unique, powerful set of credible expert perspectives through 1:1 expert calls, panel calls, management checks, and the deepest and fastest-growing library of expert call transcripts on the market. Gain unique perspectives from vetted experts, including former executives, customers, competitors, and channel partners.

AlphaSense and Tegus are the right choice for you if:

- You want a platform that fits your organization and can serve multiple strategic uses beyond expert consultations and advice.

- You need a platform that offers precise research tools and surfaces relevant data and real-time insights faster.

- You want access to a massive content universe of proprietary, premium, private, and public content inaccessible through consumer-grade search tools and many of your peers.

- You want to consolidate all your disparate research tools into an all-in-one solution.

- You want a platform that keeps you updated on every piece of critical information as the markets evolve, with customizable real-time alerts, watchlists, and dashboards.