GLG

The Gerson Lehrman Group (GLG) is a professional insight company, also known as an expert network company, that connects business professionals to experts from a variety of industries for insights, advice, and mentorship.

On the GLG platform, users can access a network of more than 900,000 subject-matter experts on demand, empowering them to make better-informed business decisions.

The key product, GLG Direct, focuses on offering expert consultations. These are typically one-on-one sessions between clients and subject-matter experts, where clients ask questions and receive direct answers and advice on topics of interest, businesses, or industries. These consultations occur via phone and video calls, private meetings, placements, and in some cases, expert witness services.

GLG also offers qualitative and quantitative research insights gathered through surveys, focus group discussions, workshops, and discussion panels. Users can also access the GLG Library, which contains thousands of teleconference transcripts, on-demand webcasts, and other resources.

GLG Strengths:

- Access to over 900,000 experts

- Serves multiple types of clients, including law firms and a diverse range of businesses

- Offers both qualitative and quantitative insights

- Provides a massive library of expert calls and transcripts

GLG Weaknesses:

- No broker research available

- GLG does not use advanced AI search or Sentiment Analysis in their platform

- No real-time monitoring of markets to keep users updated

- Content is restricted to expert calls and conventional qualitative and quantitative research findings

GLG operates primarily as an expert network. So if expert insights are all you are looking for, you may find it valuable to combine several expert networks in your workflow. That way, you have access to even more unique and insightful insights, enabling you to stay on top of the market and maintain an edge over your competition. And if you are looking for a platform that encompasses more than just expert insights and offers a more holistic approach to market research, read on for some alternative solutions.

Related Reading:

PitchBook Alternatives & Competitors

Whether you are looking for a complement to GLG to help you unlock even more expert insights, or looking to replace GLG with a more full-scale research solution, here are some of the best options to consider:

AlphaSense and Tegus

As of July 2024, AlphaSense and Tegus have joined forces, bringing unparalleled access to even more insights, and covering more industries and companies than ever before.

Both platforms come with extensive libraries of high-quality research, as well as data and AI tools that allow users to extract the most value from the insights they find.

Tegus has an extensive and fast-growing library of high-quality expert research, which includes coverage of 35,000+ public and private companies across TMT, consumer goods, energy, and life sciences sectors. Additionally, Tegus’ financial data offering, which includes financials, KPIs, and fully drivable models on more than 4,000 public companies, as well as its BamSEC self-serve solution to search and access securities filings, adds new and unique offerings to AlphaSense’s extensive product suite and datasets.

Meanwhile, AlphaSense has an extensive universe of content, spanning the four key perspectives of research, as well as industry-leading automation and AI search capabilities. These features will help Tegus customers gain a deeper understanding of market sentiments, investment strategies, and financial forecasts, complementing the expert perspectives they already rely on.

Here’s what each platform brings to the equation to empower clients to make more informed decisions with confidence:

AlphaSense

AlphaSense is a leading all-in-one market intelligence platform and smart search engine. It’s the ideal tool for research and business professionals—from analysts and financial researchers to corporate professionals—looking to implement a qualitative research strategy powered by proprietary AI technology and automation.

Financial professionals use AlphaSense to access 10,000+ premium sources of information, including trade journals, SEC filings, and company filings.

Moreover, AlphaSense provides access to broker research and an expert call library that facilitates deeper insight into companies and markets. These extra resources are accessible through two AlphaSense content sets:

- Expert Insights – 45,000+ transcripts of one-on-one calls with industry experts, customers, professionals, competitors, and former and current executives, available as an add-on to the AlphaSense package.

- Wall Street Insights® – A collection of broker research from Wall Street’s leading firms, covering global sector themes, industries, and companies from 1,000+ sell-side and independent firms, available within the AlphaSense platform. The best part? Research professionals can preview the contents of a broker report, saving them wasted time and money on potentially fruitless research.

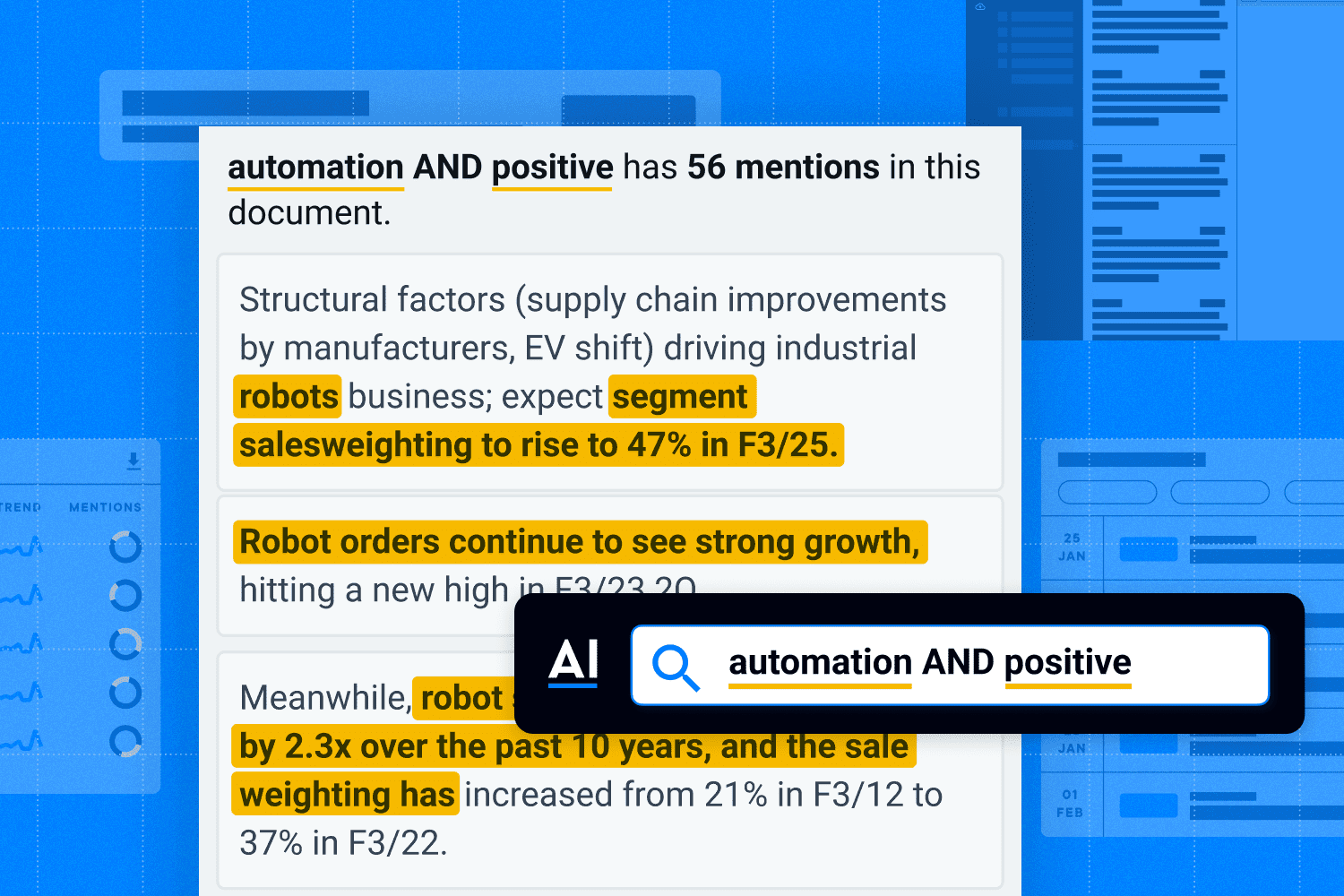

Unlike other research tools, AlphaSense incorporates smart search capabilities within its platform, empowering users to find everything needed for their research without manually toggling between multiple tabs. AlphaSense search also comes with added features like:

Smart Synonyms™

Smart Synonyms™ technology is an AI-supported feature that can recognize both the keywords and search intent behind a query.

AlphaSense uses advanced algorithms to eliminate noise from your search (i.e., content with matching keywords but ultimately irrelevant to your search objective) and leverages variations in language (for example, “impact investing” vs. “ESG investing”) to pinpoint the exact information you need.

AI search functionality allows you to easily find the exact documents and snippets that are most relevant to your search, giving you back time and energy to spend on more high-level tasks, like analysis.

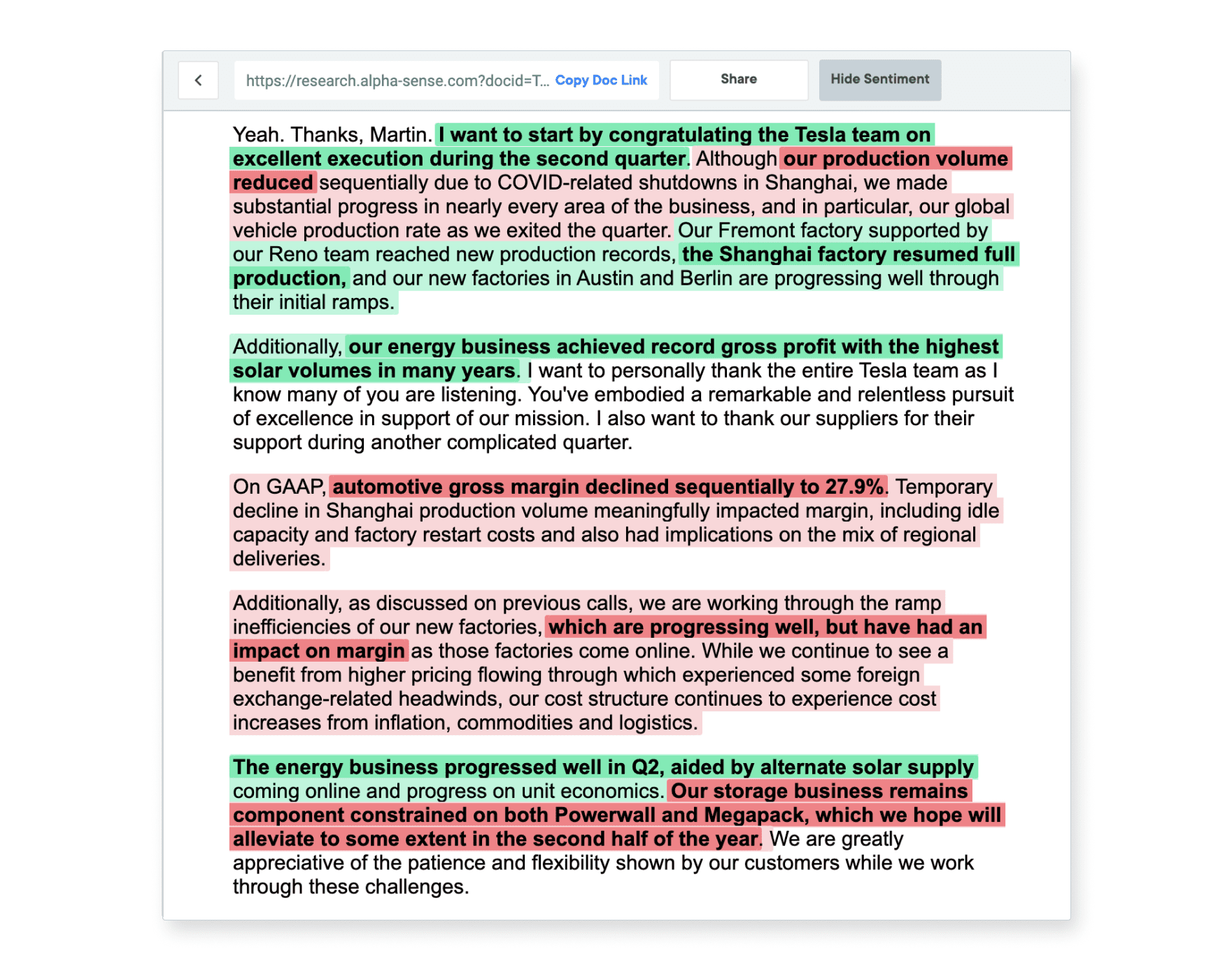

Sentiment Analysis

AlphaSense uses NLP in its sentiment analysis technology to identify differences in a text’s tone and subjective meaning. It then uses color coding to help readers identify the document’s positive, neutral, and negative sentiments.

Expert Insights also allows you to quickly pick up on sentiment shifts in the expert interviews that go beyond surface-level commentary.

This award-winning technology assigns each search term a numerical sentiment change score to help users track any slight change in market sentiments across time. Users can take advantage of it to make better-informed investment decisions and improve their risk management strategies.

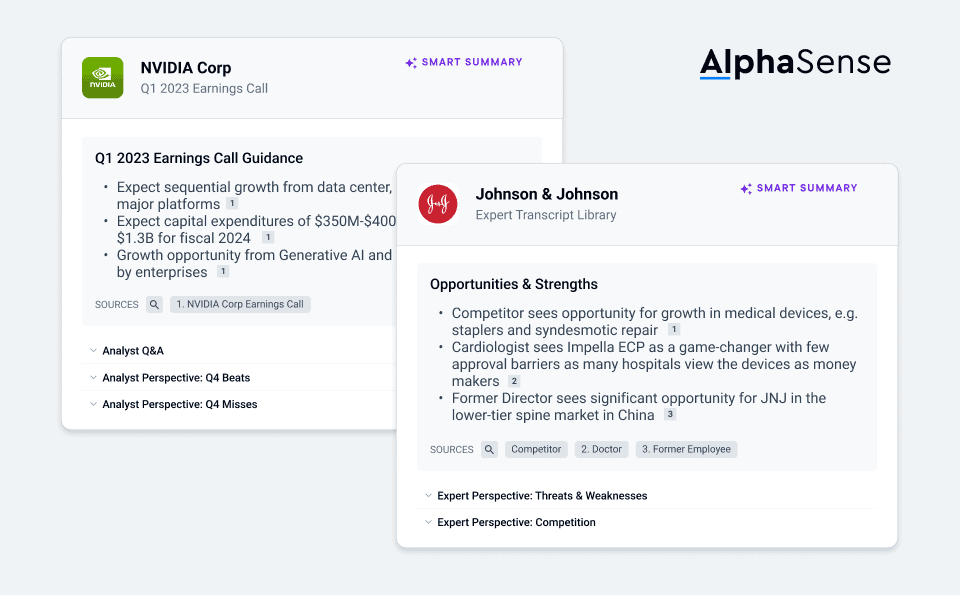

Smart Summaries

Unlike other generative AI (genAI) tools that are focused on consumer users and trained on publicly available content across the web, AlphaSense takes an entirely different approach. As a platform purpose-built to drive the world’s biggest business and financial decisions, our newest Smart Summaries™ feature leverages our 10+ years of AI tech development and draws from a curated collection of high-quality business content.

With Smart Summaries™, you can glean instant earnings insights—reducing time spent on research during earnings season, quickly capture company outlook, and generate an expert-approved SWOT analysis straight from former competitors, partners, and employees.

Integrations and APIs

It’s now becoming the industry standard for many market intelligence platforms to offer integration of internal content containing both structured and unstructured data, but it’s key that this content is indexed and immediately available. A market intelligence platform should also offer the ability to upload new external content sources (such as RSS or web content), so that you can leverage the platform’s analysis tools to pull relevant insights.

AlphaSense provides integration with commonly used programs like OneNote, Sharepoint, and Evernote, enabling streamlined collaboration with members across your organization and improving team productivity. It also allows you to search across all internal and external company content to find key insights, and the proprietary AI technology catches what other platforms miss in a secure and automated way.

Automated Monitoring

Instead of wasting hours manually monitoring, AlphaSense offers real-time alerts to keep users updated with trending topics, companies, and industries of interest. Users can also take snapshots of multiple companies frequently within the AlphaSense platform, staying in touch with the most critical insights, news, and market changes they need to know.

Exceptional User Experience

AlphaSense is built to fit into a user’s processes and workflow seamlessly. In addition to an intuitive user-friendly interface to display data and information, it allows professionals to export crucial data to their mobile devices or PCs. AlphaSense also boasts exceptional customer service—product specialists are readily available 24/7 to assist with putting together searches—which users find massively helpful in streamlining workflows.

Tegus

For investors who spend too much time manually searching, parsing, and aggregating data from disparate sources, the Tegus platform reinvents the investment research process so you can compete on your unique ability to analyze data correctly and make great investment decisions. The Tegus platform gives investors the fastest way to learn about public and private companies, and delivers the most critical content and data on a unified platform experience, all for a single software license.

Unlike legacy research methods, the Tegus platform gives investors:

The fastest way to learn about public and private companies – Whether getting up to speed or performing deeper diligence, investors need to quickly understand a company’s business model, drivers,and so much more. Tegus helps this process get done in minutes instead of days.

The most critical content and data on a single platform – The only solution with expert research, robust qualitative content sets, and key financial data in one place. Don’t settle for siloed systems and fractured data sets that slow you down.

A single software license to drive value and consolidate research costs – Tegus provides simple platform pricing so you don’t get nickeled and dimed for those high-value datasets or powerful workflows. It’s all included.

Here are some of the main features Tegus offers, now as part of AlphaSense:

Tegus Expert Transcripts

Tap into a unique, powerful set of expert perspectives through 1:1 expert calls, panel calls, management checks, and the deepest and fastest-growing library of expert call transcripts on the market. With over 100,000 expert transcripts and growing, you can discover your unique perspective faster. The Tegus platform offers the largest curation of public and private company transcripts built on top of leading AI-powered functionality to easily find, sort, and surface powerful insights.

Tegus Expert Call Services

Connect live to the most relevant experts to fit your unique research needs. Unlike other expert networks, our call services deliver curated quality experts—fast, without the markup.

Company Perspectives (BamSEC)

Make quantitative investment research easier by transforming how you work with public company data. By streamlining access to SEC filings, earnings and events transcripts, financial documents, and more, BamSEC enables analysts to focus on what matters, save time, and do better work.

BamSEC enables users to search across multiple companies and SEC filings. Customers can use these documents to perform due diligence on companies and explore performance metrics efficiently.

Using the tables on BamSEC, users can explore past filings, create models, and benchmark company performance, all in one place, without needing to pull up individual filings to manually track a company’s metrics.

Financials and Metrics (Canalyst)

Gain instant access to over 4,000 global fundamental models and over 60 industry dashboards, all hand-built and sourced by sector-focused analysts in Vancouver. Unlike building your own models and comp sheets, using Tegus’s off-the-shelf models, dashboards, and data reduces your time spent on undifferentiated work, allowing you to compete on your ability to analyze the data, not aggregate it.

AskTegus

Tegus’ most recent AI innovation, AskTegus, is an AI-powered chat experience that allows investors to quickly cut through the noise and get the insights they need. AskTegus creates a super-charged analyst, giving users the ability to sift through Tegus’ extensive database—comprised of the largest investor-led transcript library —uncovering insights within seconds, empowering investors to drive to a high-conviction decision supported by proprietary and trusted data.

Compliance

Tegus’ leading compliance framework helps ensure your research is SEC-compliant and implements transparent checks and guardrails so you can make better investment decisions. Our powerful platform and team of experienced compliance professionals use the latest technology and rigorous policies to prevent and detect potential risks or violations. Every expert call transcript is pushed through a multi-layered compliance review process that deploys proprietary AI and a team of highly trained specialists to identify and remove potential confidential information or MNPI.

Tegus allows customers to search, explore, and detect potential compliance risks or violations. The platform uses over 40 compliance experts to ensure all calls meet SEC, FINRA, and EU regulations without creating conflicts of interest or other potential violations.

Using its internal compliance tools, users can manage company-specific protocols and their team’s Tegus activity in expert calls and resulting transcripts.

AlphaSense and Tegus Pros:

- Extensive content universe with 10,000+ premium sources of information

- Access to SEC and company filings

- Large library of experts and expert call transcripts

- Ability to set up monitoring tools and alerts

- Ability to annotate and comments to call transcripts

- All-in-one access to the four key perspectives of market research

- Smart AI-powered functionality that helps streamline the research process and ensures you never miss a critical insight

- Powered by generative AI features that accelerate and enhance research

- Integration with commonly-used programs like OneNote, Sharepoint, and Evernote that enable better team collaboration and productivity

- User-friendly interface and exceptional customer service

AlphaSense and Tegus Cons:

- Visualization tools are limited at this time

- Collaboration tools are limited to users with AlphaSense licenses

Third Bridge

Another GLG alternative is Third Bridge, a private research firm that offers unique insights and analysis to asset managers, corporations, and consultants, enabling them to make smarter decisions faster.

Third Bridge uses primary research techniques in its business model, including interviews with industry experts and professionals, to gather information on various companies, industries, and topics. These insights help investors make better decisions, assess market opportunities, and develop business strategies.

Product Features

Forum

This archive contains analyst-led investigative interviews to give global industry knowledge and full sector insights. Its library has over 30,000 transcripts and conducts over 10,000 interviews annually.

Maps

Third Bridge keeps track of public and private company value chains to help users speed up their early research. It uses a proprietary market research model to rank, filter and prioritize companies to enable investors to make decisions fast.

Connections

Investors can gain direct access to prequalified industry experts in one-on-one consultations for better insights into the market.

Community

Their Community feature gives clients access to anonymized interviews through their Forum. From the Third Bridge website, “Community connects our clients to the highest quality, relevant experts by leveraging our extensive global expert network, thorough pre-qualification processes and a robust compliance framework.”

Third Bridge Pros:

- Over 30,000 call transcripts in the Third Bridge Forum library

- One-on-one interviews with pre-qualified experts

- Uses a proprietary company ranking model

Third Bridge Cons:

- Cannot upload internal content

- No broker research insights

- No advanced AI-powered smart search or Sentiment Analysis

McKinsey & Company

McKinsey and Company offers consulting and strategic business advice to businesses and institutions worldwide. It provides professional services like strategy, operations, and organizational design consultations. McKinsey also helps organizations in digital transformation using advanced technology, proprietary information, and expert advice to help their clients grow and expand.

Product Features

Market Intelligence

McKinsey & Company uses various research methods to gain insight into supply and demand trends worldwide and to take advantage of multiple profit pools.

Diagnostics

Using this feature, McKinsey helps you benchmark your Company or business against your peers and best practice to improve your performance and operations.

Analytics

Using proprietary models and technology like Big Data, McKinsey helps you make better decisions and improve your outcomes.

McKinsey Pros:

- Use proprietary technology and models

- Serve multiple industries and business functions

- Offer numerous solutions, including expert calls

McKinsey Cons:

- Services are expensive and beyond the reach of small businesses.

AlphaSights

AlphaSights provides its clients with information services that help them make better business decisions and deliver outstanding results. It uses a combination of industry experts, technology, and compliance to provide business intelligence and analysis to investors, corporations, and consultants.

Product Features

With AlphaSights, you can gain access to the following:

Experts

You can consult multiple experts on AlphaSights and get access to intelligence from industries across 120+ countries. It facilitates over 350,000 unique expert client interactions annually and vets each expert for every project.

Services

Besides one-on-one phone calls with experts, you can access other AlphaSight services, including interviews, surveys, and meetings.

AlphaSights Pros:

- Serve multiple industries and business functions

- Offer multiple solutions, including expert calls

AlphaSights Cons:

- No advanced AI-powered smart search or Sentiment Analysis

- No broker research insights

- Cannot upload internal content

- No support for integrations

How to Choose an Alternative to GLG

Beyond the above companies, there are plenty of additional alternatives to GLG, including Coleman Research Group, Capvision, and Guidepoint. In order to decide which platform is right for your business and research needs, consider the following questions:

- What is your budget? Quickly eliminate any options outside of your price range.

- How do you work? Do you work solo, or do you collaborate with other teams or team members? Do you need a tool that integrates with other programs and allows you to search across internal and external company content? Make sure the tool you choose matches your research workflow.

- What are your goals? For some, getting access to proprietary expert insights from a few different sources is enough. For others, a more full-scale and robust research solution that provides access to a variety of voices, from journalists and companies to analysts and industry experts is instrumental in gaining a full picture of the market landscape. Choose a platform that is aligned with your unique business needs and goals.