Earnings season is a goldmine of information on the companies, peers, competitors, and even industry disruptors you want to keep an eye out for. For anyone who performs market landscape analysis (or any of the four main components: identifying the players, finding key data, understanding the trends, or monitoring the landscape), earnings season is a key time to update your landscape analysis.

From both company transcripts and Wall Street research, we break down the four major areas where earnings content can help you update and strengthen your analysis.

Related Reading: 8 Tools to Level Up Your Market Analysis in 2023

10 Market Research Tools to Trial in 2o23

Update Your Landscape of Players

One of the key pieces of a robust market landscape analysis is the identification of all the companies that operate in a specific area. Being able to quickly and accurately identify the main companies, the competitors, and the potential disruptors in a space is critical to understanding both the health and competition of a specific area of interest. Unsurprisingly, most market landscapes are not static. Instead, they are ever-evolving with M&A activity, new product launches, and emerging non-traditional competitors penetrating the scene.

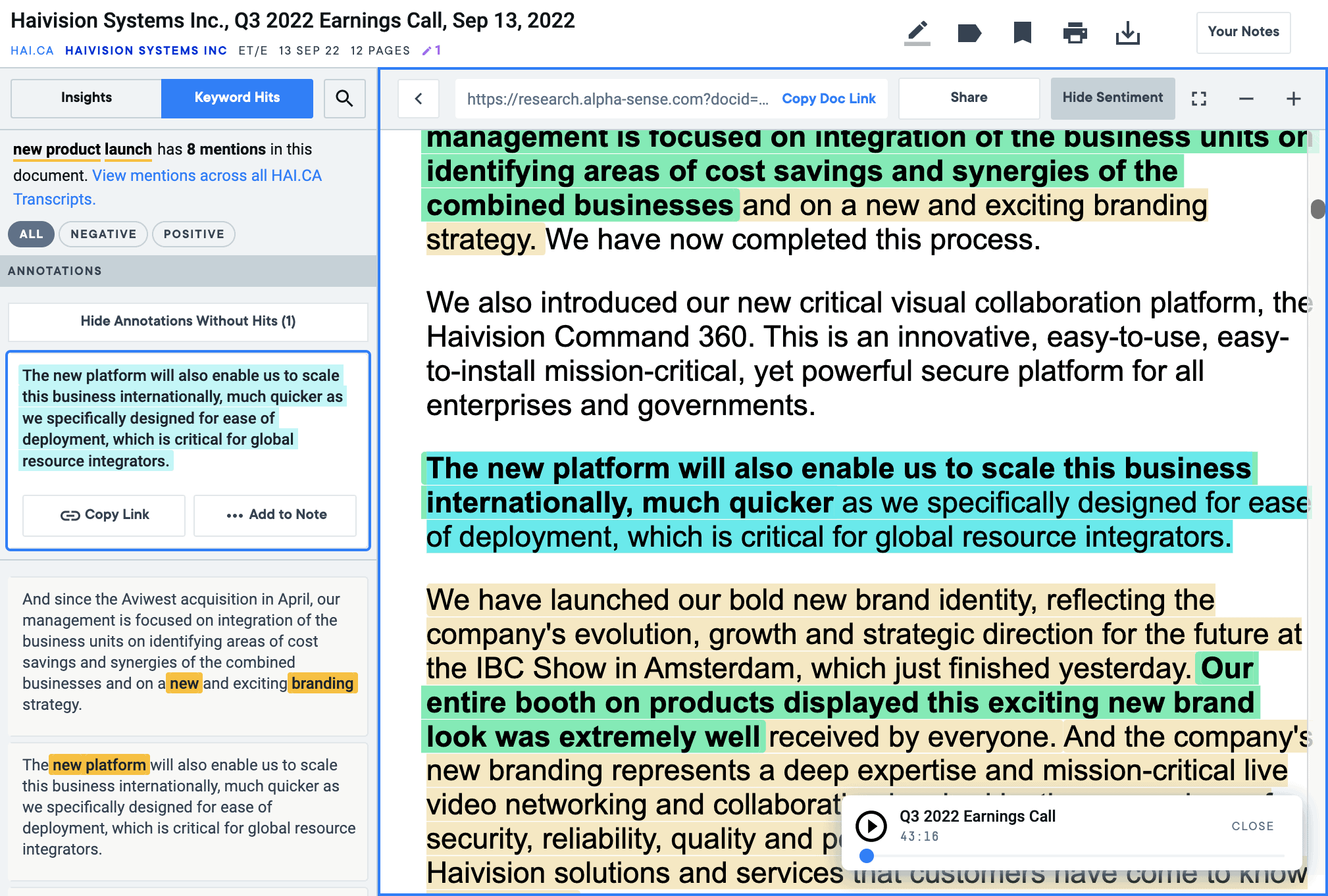

With AlphaSense, searching for updates is a sinch. Starting with a simple keyword search, I am quickly able to identify companies within a space that have launched new products (as in this case), started new strategic initiatives, and announced new partnerships. All of these activities could signal increased competition, or more interestingly, that a company within the space has an increased competitive risk or is a brand new competitor altogether.

In this scenario, I have easily identified that Haivision Systems Inc. has launched a new product, the Haivision Command 360, that will help them scale their international business. In seconds I have updated their competitive profile within my landscape analysis and alerted international teams to the emergence of this competitor.

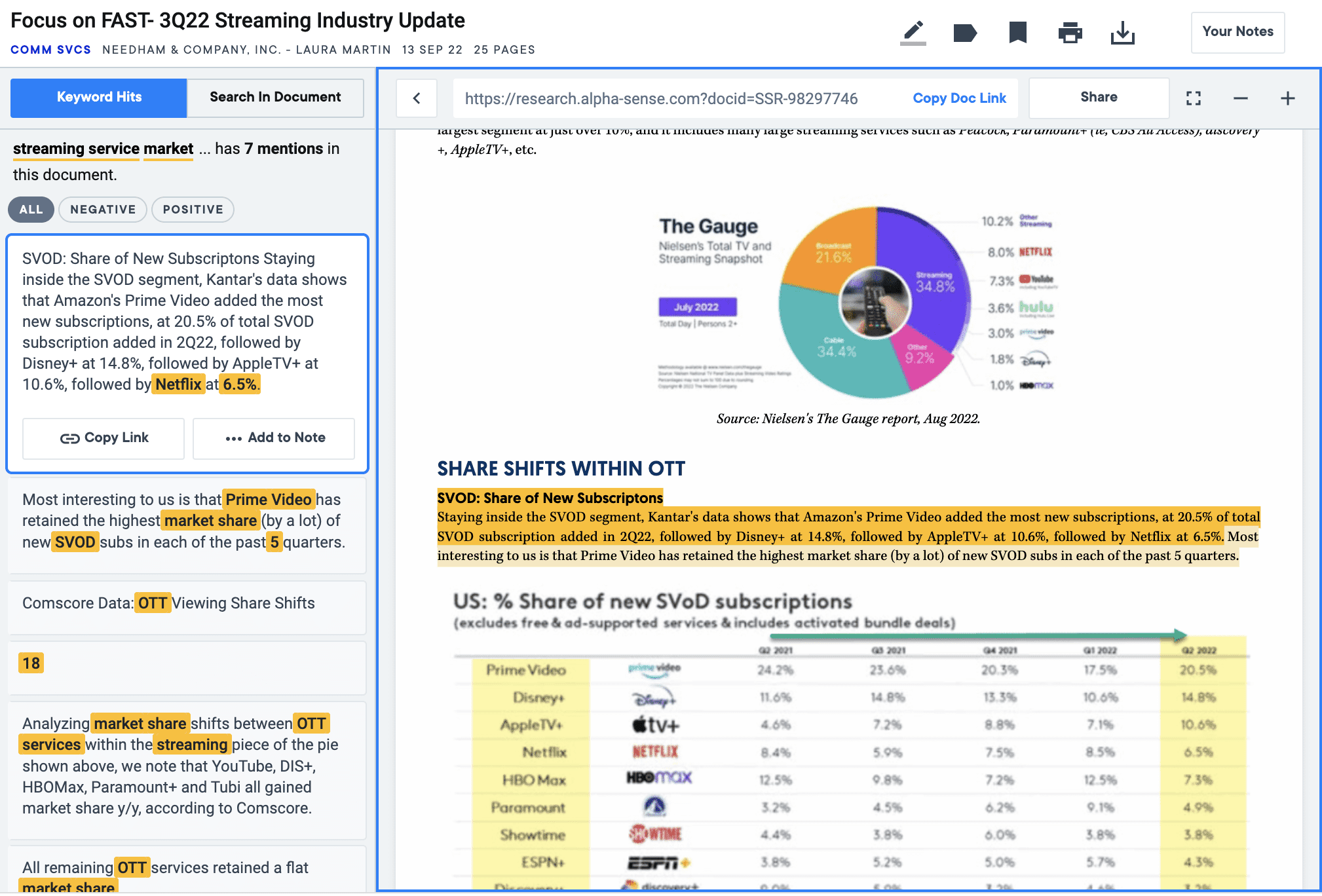

Another important area of focus during earnings is the recalibration of any market data you previously collected. Earnings documents are rich in company data, providing ample opportunities to update how the landscape looks, and where each of the players sits in terms of market share and growth potential.

With access to Wall Street InsightsⓇ in AlphaSense, I can leverage broker research, as well as the company earnings documents themselves. By focusing my search to pull back market share data and filtering to broker research, I now have a clear picture of the market share of new subscriptions in the streaming services world.

Not only is AlphaSense’s search technology able to find text hits across all relevant synonyms by leveraging Smart Synonym technology, it can pull back and isolate data in both structured (i.e. tables and charts) and unstructured (i.e. text) formats. This speeds up the process of finding and updating my landscape market data.

Refresh the Key Trends

Earnings is a crucial time to make sure you understand the key trends. Within AlphaSense, there are two topic modules available that instantly synthesize all the available earnings content and provide a summary of the key trends for the company, watchlist, or industry you care about.

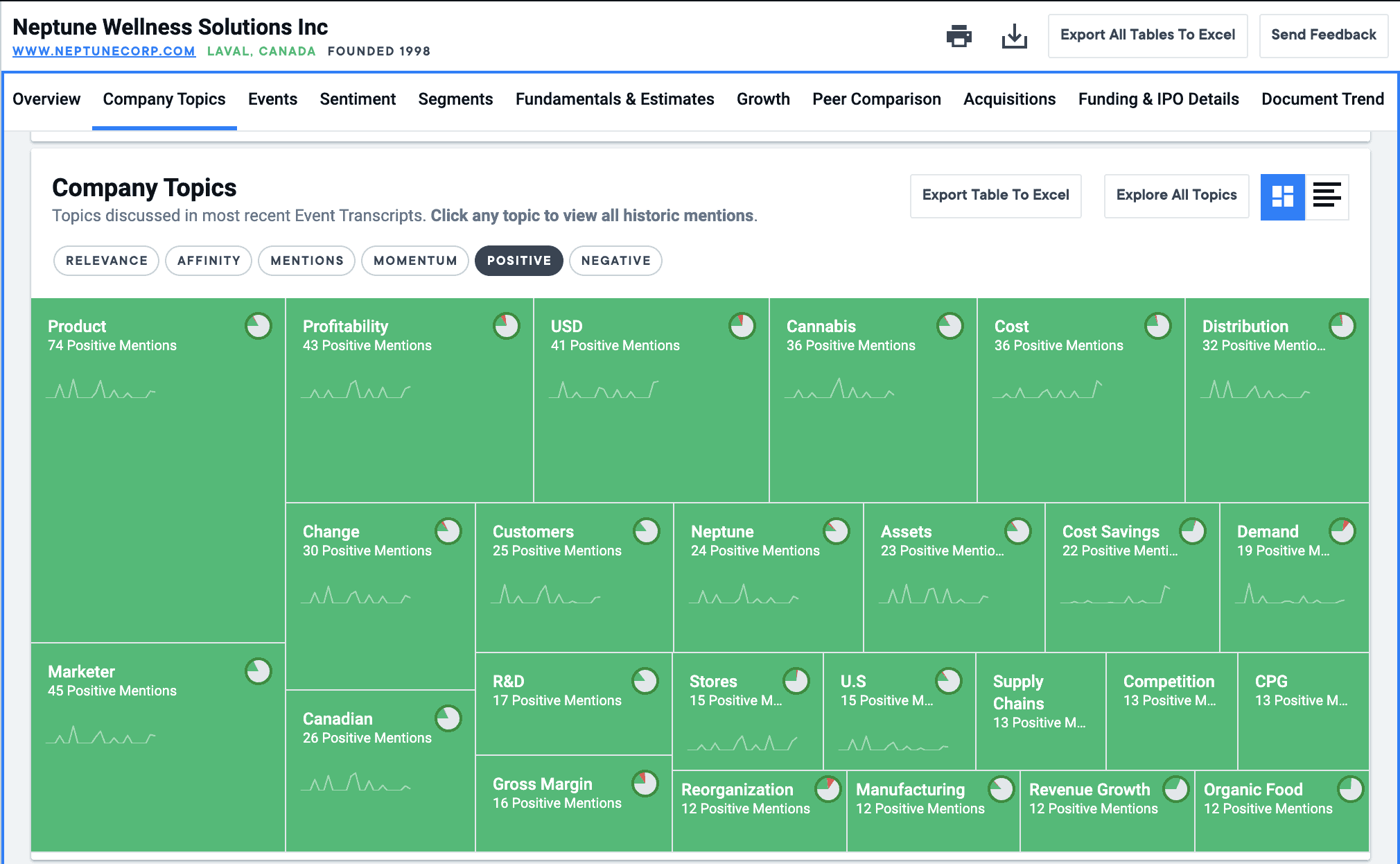

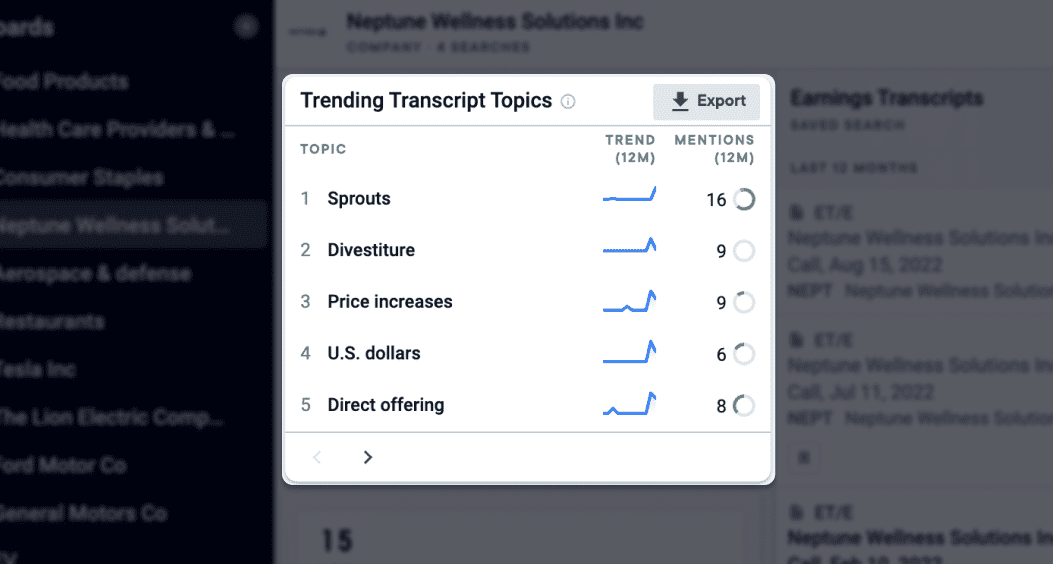

From a company perspective, I can use the Company Topics module to determine what key topics are driving a company’s performance. Within my dashboard view of a company I have access to top topics trending across the companies I care about. In other words, these are the topics that have the top momentum for the companies I want to keep an eye on. For access to the full Company Topics module, I can head to the company profile page and see a range of topic filters, like positive or negative sentiment and affinity (to see the topics that are unique to the company).

From the dashboard view, I get access to the topics which are trending for a specific company. Even better, from both views I can export the data for further analysis or inclusion in any models I have.

In this example, let’s look at Neptune Wellness Solutions. Immediately, I can see that their chain of Sprouts stores is the top trending topic. By clicking on this topic, I am able to jump right into my research and start digging into all the relevant content and snippets that are behind this momentum to easily understand exactly why this topic is trending.

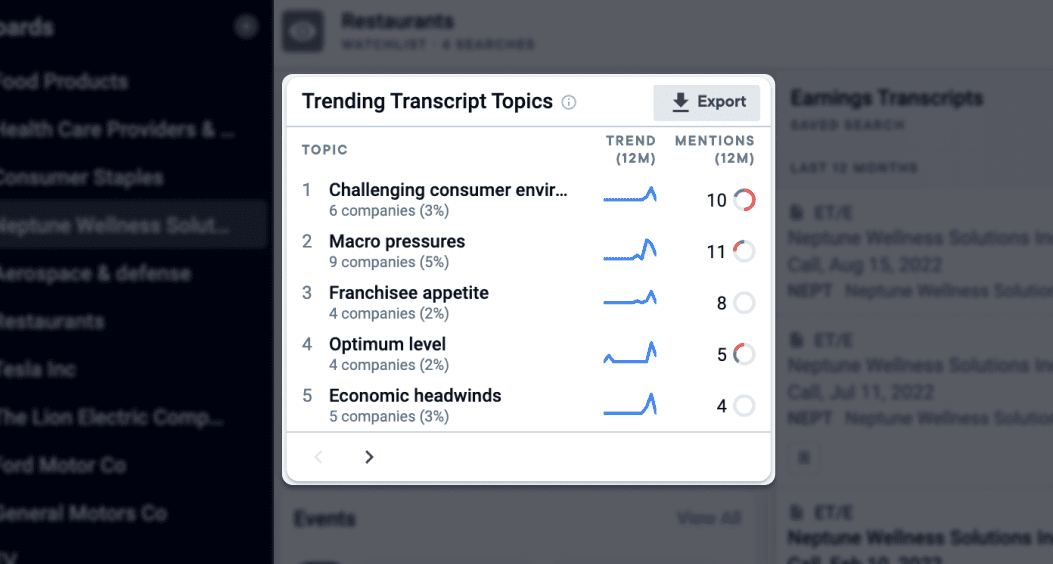

Similar to the above example, I can click the dashboard view to see the trending topics across a group of companies, watchlist, or industry. I now have instant access to the top 100 trends for that space and again, can easily export that data for further analysis.

It is now clear to me that across this group of restaurants, the trending topics include: a challenging consumer environment, franchise appetite, and macro/economic headwinds.

Stay on Top, Even After Earnings Season

Last but certainly not least is updating your monitoring tools. If you have created new searches that you want to monitor on an ongoing basis, you should add these to dashboards and alert schedules as needed. Performing this task will ensure that you are always in the know on any critical changes happening across the landscape.

In our whitepaper, The Competitive Intelligence Guide to Earnings Analysis, we dive into how AI-powered market intelligence platforms help you extract competitive insights 5-10x faster during earnings season.