Environmental, Social, and Governance (ESG) investing is on the rise in every industry and is expected to continue on its upward trajectory in the coming years. With 1 in 4 dollars (or $20 trillion) of global AUM currently managed under ESG strategies, investors and firms align accordingly, expecting increased adherence to ESG standards (sometimes entirely requiring them). At the same time, market-wide standardization of reporting continues to evolve and improve.

The energy industry has a complex relationship with ESG investing in that ESG, on the surface, can be (and mostly is) perceived as a threat to the oil and gas companies whose impact on the environment is continually scrutinized and viewed as unfavorable.

At the same time, the intense focus on ESG gives significant players in the oil and gas industry a platform to change the unfavorable public perception of their environmental impact.

The onset of the COVID-19 pandemic and the months that followed hit the oil and gas industry hard as travel diminished worldwide and demand for fuel essentially disappeared. Now the industry appears to be recovering, but not without hiccups.

Is it possible that ESG could lend momentum to struggling oil and gas stocks? Evidence points to yes. Here’s how.

Quick takeaways

- The hyperfocus on ESG issues in public and the investment industry has created a platform for oil and gas companies to highlight their ESG efforts and impact.

- Available capital is increasingly tied to ESG expectations and requirements; by incorporating a solid ESG strategy, companies can widen their access to investment capital.

- ESG initiatives, when implemented effectively, create a win-win scenario where companies are making a positive impact on the world while also increasing efficiency, profitability, and attractiveness to potential investors.

Shifting the narrative

Over the past few years, ESG has transformed from a nice-to-have differentiator for companies looking to attract environmentally-focused investors to a must-have across basically all markets and industries.

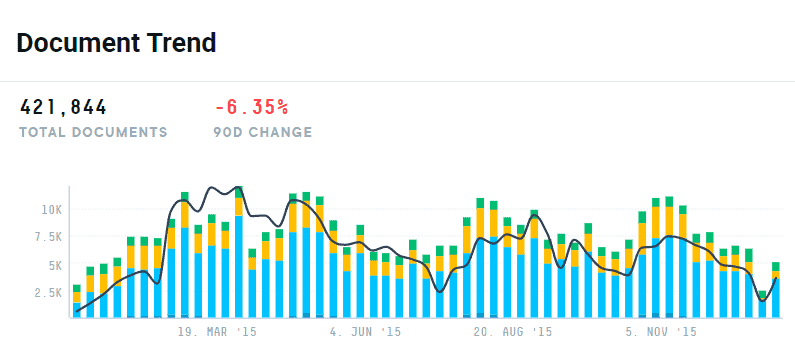

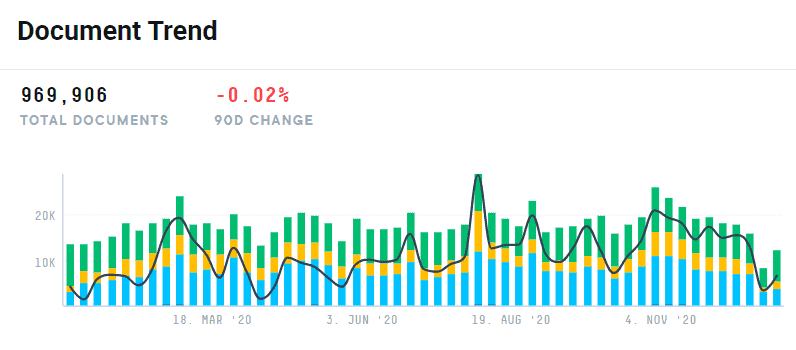

The increase in ESG importance is apparent in AlphaSense search comparisons for mentions of ESG in company documents over time. Results showed 421,844 words in 2015 compared to 969,906 in 2020 — a 130% increase in just five years.

AlphaSense search results for document mentions of “ESG” during the 2015 calendar year.

AlphaSense search results for document mentions of “ESG” during the 2020 calendar year

This means that oil and gas companies are under the microscope to increase transparency and reporting around their current ESG impact, which can be daunting for companies who have traditionally fought against a reputation for being detrimental to the environment by nature. However, the rise of ESG also presents the energy industry with an opportunity to shift the narrative.

Amy Stutzman, Managing Director of energy consulting firm Opportune, summed it up nicely.

“…contrary to what it seems like we read in the news where you see the industry majors making investments in renewables and green energy initiatives, I don’t think sustainability excludes the continued development of fossil fuels,” Stutzman shared in a recent interview on the Opportune website.

She continues: “So, I think ESG is an opportunity for our industry to tell their story. It’s important to tell that story because there’s been a shift in the investment community, and ESG impacts access to capital more than it ever has before.”

It’s a shift in perspective that could be the difference between who emerges in a post-pandemic era alongside the ESG trend successfully vs. those who fall behind.

And while it’s not an easy task, allocating more time and resources to ESG initiatives, transparency, and reporting can start with small steps. For example, in the same interview, Stutzman suggests that oil and gas companies, especially smaller ones with thinner budget margins, begin by assessing what they’re already doing related to ESG, highlighting it effectively, and then scaling up over time.

“There’s not an expectation of perfection in year one,” Stutzman notes, “but rather the expectation is that companies are engaging in the issues and showing progress over time.”

In other words, making a concerted effort better to understand ESG issues and your company’s impact is an excellent first step for companies overwhelmed about where to start.

Increasing Access to Capital

According to Ernst & Young, 88% of investors ask managers how ESG plays a role in their decision-making. In addition, the number of investors required to invest in ESG products has almost doubled in the past year, with 26% needed for the U.S. and 42% needed in Europe. This number is expected to continue growing.

What this means is that incorporating ESG into your business strategy isn’t just a matter of PR. It’s essentially a prerequisite for having access to much of the capital available in the market.

The way oil and gas companies view the situation again comes down to a matter of perspective, but it can be an opportunity for growth with the right approach.

While some funds take an exclusionary approach to oil and gas, many ESG-conscious investors use a more inclusionary, best-in-class strategy that assumes there are ESG “leaders and laggards” in every industry. These investors seek not to eliminate sectors that struggle with ESG issues but rather invest in those who do it best, thus encouraging ESG in every industry. BlackRock, for example, manages $133B in ESG broad strategies by taking this best-in-class approach.

It doesn’t hurt that oil and gas serve as a reliable ESG portfolio stabilizer by diversifying your portfolio and hedging against inflation. As a result, the demand for oil and gas investment opportunities that align with ESG awareness is high; it’s up to individual companies to step up and meet the criteria.

Making an Impact

Last but certainly not least on the momentum-building list ESG impacts oil and gas stocks is the actual impact.

Energy industry leaders (even the likes of BP, who have had environmental crises and tons of bad press as a result) are positively impacting the environment in many different ways. From investing in biofuel to developing more sustainable oil extraction technologies to adding entire divisions to the organization (like Shell’s New Energies division, founded in 2016) — it is not all doom and gloom for oil and gas and the environment.

At the same time, incorporating ESG efforts into a business model can save costs, improve public perception, increase employee satisfaction, and make for an overall more efficient and profitable business that is more attractive to investors. It’s a win-win.

Conclusion

ESG presents new and complex challenges for oil and gas companies, some industry-specific and others common across industries and markets. But with all signs pointing toward ESG’s continual rise, companies who don’t embrace it and strategize accordingly are sure to be left behind and lose investors.

The good news is that evidence shows that ESG expectations and requirements can benefit oil and gas companies (even those underperforming) with the right approach.

An effective ESG strategy can create internal and external advantages that make a company more profitable and improve its investment prospects, lending momentum to its potential growth.

Search comparisons for mentions of ESG in company documents over time and start improving your investment prospects with a more focused strategy today. Request a free trial to AlphaSense and access data from over 10,000 content sources. Sign up here.