The evolution of digital currency has been an interesting journey for both enthusiasts and investors throughout the years. While it started as a seemingly niche and veiled asset class, cryptocurrency has since emerged as a dominant player, transforming traditional markets in its path.

Investors have not been shy about courting cryptocurrency and have been eager to deploy a functional investment model. Most recently, this came to fruition with the launch of eleven Bitcoin ETF products, which has taken the market by storm. In their first week of trading, the newly issued Bitcoin ETFs saw more than $4 billion in inflows.

After more than a decade in the making, cryptocurrency has established its presence in the institutional market, and momentum is expected to continue well into the next. As blockchain evolves and experiences mainstream adoption, digital assets continue to evolve just as rapidly.

Below, we’ll walk through the rise of the blockchain and decentralized currency, how institutional adoption came to be, how digital currency is expected to continue on a transformative path for years to come, and the potential impact on portfolios as investors seek opportunities in the space.

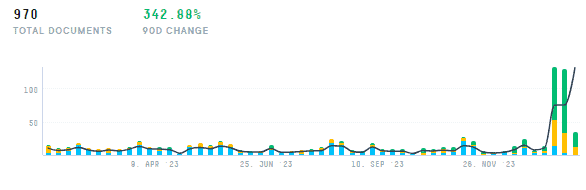

A search on the AlphaSense platform shows a steep increase in document activity over the past 90 days around the launch of the newly minted Bitcoin ETFs. With digital currency here to stay, it is more critical than ever to have the right insights and resources to stay ahead of the latest trends and navigate ongoing shifts with confidence.

The Origin and Rise of Bitcoin

Bitcoin started as a scarcely known, decentralized digital asset with the premise of transferring currency in a secure, anonymous, and instant way. In 2008, a whitepaper publication and website domain registration formally marked its introduction. In early 2009, the network launched, and the genesis block of bitcoin was mined, yielding a reward of 50 bitcoins.

The decade that followed chronicled the milestones and important events that would set the stage for the first bitcoin institutional product to debut:

- 2010: Bitcoin’s first retail transaction occurred with the sale of two pizzas in exchange for 10,000 mined bitcoin.

- 2011: Other cryptocurrencies began to emerge mirroring bitcoin’s open-source code. Bitpay was founded to provide mobile checkout services to companies wanting to accept bitcoins as a form of payment.

- 2012: Bitcoin Foundation was launched to “accelerate the global growth of bitcoin through standardization, protection, and promotion of the open source protocol.” BitPay records more than 1,000 merchants accepting bitcoin.

- 2013: Bitcoin gained increasing popularity in the retail and exchange world, was banned from trading in China, and was declared a ‘bubble’ by Alan Greenspan. Cameron and Tyler Winklevoss, founders of crypto exchange Gemini, filed an application with the SEC to create a spot bitcoin ETF. Around the same time, SolidX filed a proposal for a VanEck SolidX Bitcoin Trust.

- 2014: TeraExchange, LLC received approval from the US Commodity Futures Trading Commission to list an over-the-counter swap product based on the price of a bitcoin. It marked the first time a US regulatory agency approved a bitcoin financial product.

- 2015: More than 100,000 merchants globally accept bitcoin as a form of payment.

- 2017: The SEC rejects the Winklevoss Gemini application. Grayscale files an application to launch the Grayscale Bitcoin Trust, subsequently withdrawing the paperwork three months later and opting to list it on the OTC market instead. Bitcoin hits a high of $20,000.

- 2018: Online payment firm Stripe discontinues accepting Bitcoin as a form of payment. The US Department of Justice investigates possible price manipulation, and bitcoin drops to below $5,000.

- 2020: Grayscale converts its Bitcoin Trust into an SEC-reporting entity, making it the first publicly traded bitcoin fund in the US. The Indian company 69 Shares lists a set of bitcoin exchange-traded products (ETP) on the Deutsche Boerse.

- 2021: The Purpose Bitcoin ETF launched in Canada as the first spot bitcoin ETF. In the US, Proshares Bitcoin Trust listed the first futures-based bitcoin ETF.

- 2022: Marking a tumultuous year for crypto, the SEC rejected several spot bitcoin ETF applications, crypto prices plummeted, and a handful of crypto companies went out of business, including FTX and the infamous Sam Bankman-Fried fraud scandal.

- 2023: Another round of institutional spot bitcoin ETF applications submitted to the SEC from issuers include BlackRock, VanEck, Ark, Bitwise, Fidelity, Valkyrie, Grayscale, Wisdomtree, Global X, Franklin, Hashdex, and Invesco.

- 2024: The SEC approves the listing of eleven spot-bitcoin ETFs.

A Growing Institutional Appetite

The SEC’s approval of nearly a dozen bitcoin exchange-traded funds (ETFs) on January 10 was a landmark decision, paving the way for institutional adoption after nearly a decade of failed attempts. BlackRock’s iShares Bitcoin Trust (IBIT) ETF led the pack with over $1 billion in inflows the first week of trading alone.

With $4.6 billion inflows the first day of trading, digital assets are undoubtedly taking their place in the institutional space. Analyst research sourced from the platform finds that over the next five years, it is expected that digital product assets under management will grow more than ten-fold.

Over the next decade, analysts also expect blockchain transactions to increase dramatically and mirror the speed of major card payment networks such as Visa and Mastercard, and exchange transactions such as Nasdaq.

Analyst research sourced from AlphaSense also indicates that as institutions expand their product footprint through public blockchains, digital assets adapted to these blockchains will see strong institutional investment flows and adoption. Driving this momentum is the belief that the blockchain can enhance bottom-line impact and create a more efficient digital market structure.

Regulatory Finessing and Risk Management Architecture

With a track record of inconsistent approvals and long-delayed launches, digital currency will likely continue to face an uphill battle with regulators. This will be especially relevant as various digital assets enter the marketplace and continue to expand their institutional profile.

In addition to cryptocurrencies such as bitcoin, digital assets span central bank digital currencies (CBDCs), non-fungible tokens (NFTs), stable coins, and real-world assets (RWA), among others.

Risk mitigation and the development of standardized regulation will continue to foster confident investing among investors and a continued appetite for the digital asset class. It will also be integral in bringing centralized and decentralized financial models together, and may change operational architecture as a result.

One such operational facet may be asset custody. According to an expert interview with a Former Managing Director of a Custodian Bank sourced from the AlphaSense platform, there is a high likelihood of US institutions custodizing digital assets within the next five years:

“If you’re investing in [the digital space], you’re going through an ETF vehicle and then it’s up to the asset manager to manage the crypto exposure beneath that. They would need a good strong custody solution for the crypto that is behind funds and ETFs servicing that goes with it, [including] ETF servicing and then, obviously, crypto asset servicing as well. That’s the key thing, I think, over the next 12 months, if those crypto ETFs do get the approval to launch, then that’s very much a gateway into the space opening up.”

– Former Managing Director of a Custodian Bank | Expert Call 2023

While it is expected that crypto regulation will make progress into 2024, a formal regulatory framework still remains to be seen. In fact, this year, the SEC will mark the seventh year of its campaign to regulate cryptocurrencies, with cases pending against Coinbase, Binance, and Kraken.

As a result, crypto products entering the mainstream institutional market continue to experience pushback, such as the SEC delaying a decision on the Fidelity Ethereum ETF in early January. This is indicative of the evolving and cautious regulatory landscape around digital assets, and the finessing that will likely continue for the foreseeable future.

Navigate Evolving Digital Currency Shifts and Trends with AlphaSense

Staying ahead of the ever-shifting digital currency landscape is of the essence for investors. AlphaSense’s powerful platform removes the complexity and guesswork of conducting your research and surfacing the best opportunities.

Our market intelligence platform is an unparalleled resource layered with AI search technology. Access thousands of premium, public, private, and proprietary content sources—including broker research, financial documents, expert calls, earnings call briefings, and more—in seconds, for the most comprehensive trends to drive informed decision-making.

Start your free trial today and navigate the digital currency space with confidence and ease.