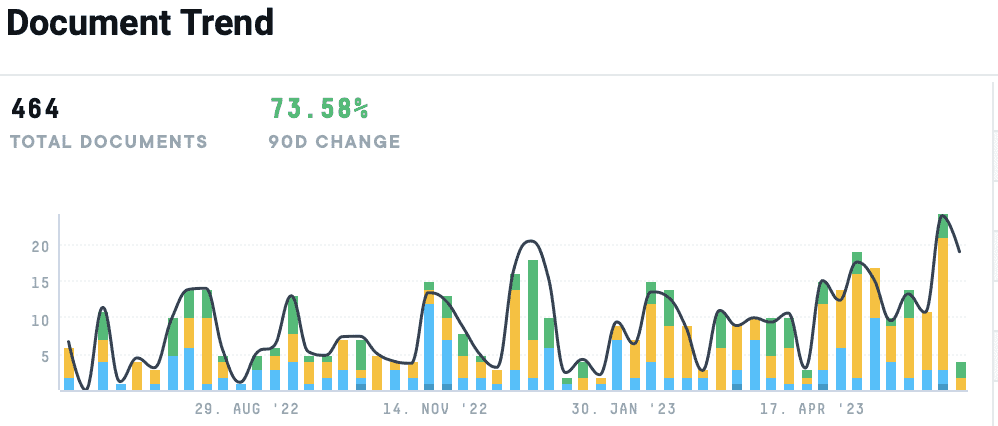

Within the past few YoYs, more industries and corporations have jumped on the bandwagon of strategizing how they can reduce their CO2 emissions, embrace a net-zero future, and authentically claim an ESG label. This is especially true of the freight railroad sector, where the number of conversations about implementing eco-conscious solutions has dramatically increased within the AlphaSense platform.

According to data from the Environmental Protection Agency, freight railroads account for a mere 0.5% of total U.S. greenhouse gas (GHG) emissions and only 1.7% of transportation-related GHG emissions. Further, freight by rail instead of truck would lower GHG emissions by up to 75%, on average. The Association of American Railroads’ analysis of federal data finds that if 25% of the truck traffic traveling at least 750 miles went by rail instead, annual GHG emissions would fall by approximately 13.6 million tons.

In short, there’s ample opportunity for rail companies to take advantage of their eco-potential in an increasingly green-focused economy. That’s why today, freight railroads are implementing green technologies, streamlining operational practices, and collaborating with their suppliers to reduce carbon emissions.

Below we dive into conversations North American railroad companies are having about how they plan to reduce their carbon footprint in the immediate and future quarters.

Norfolk Southern Company (NSC)

Metrics

“Fuel expense, which includes the cost of locomotive fuel as well as other fuel used in railway operations, increased in both periods. The change in both years was due to higher locomotive fuel prices (up 87% in 2022 and 43% in 2021) which increased expenses by $634 million in 2022 and $224 million in 2021. Locomotive fuel consumption decreased 2% in 2022, but increased 4% in 2021. We consumed 376 million gallons of diesel fuel in 2022, compared with 384 million gallons in 2021 and 368 million gallons in 2020.”

– Norfolk Southern Company | 10k Annual Report

Carbon Pricing

While Norfolk Southern Company’s operations or activities aren’t regulated by a carbon pricing system (i.e. ETS, Cap & Trade or Carbon Tax) they do anticipate being regulated in the next three years, according to their 2022 CDP Climate Change Survey. NSC’s strategy for complying with the regulatory systems includes emissions-reduction strategies, efficiency upgrades, and the generation of carbon credits.

Strategy to lower fuel consumption:

- Acquire and install technological improvements for NSC’s existing locomotives, including its DC to AC conversion program, aimed at improving their fuel consumption and GHG emission profile, as well as energy-efficient technological solutions for its road fleet

- Leveraging NSC’s Optimized Terminal Control System to automate and streamline operations at intermodal rail facilities, resulting in less fuel consumption and emissions.

CSX Corp (CSX)

Metrics

“CSX’s success in moving more freight with less asset intensity and reducing fuel consumption has enhanced its reputation for reliable service that allows customers to move freight from the highway to rail and reduce their overall carbon footprint.”

“In 2019, CSX improved its 2018 record fuel efficiency, becoming the 1st and only U.S. Class I railroad to operate below 1 gallon of fuel per 1,000 gross ton-miles. In 2021, this still holds true, and CSX is operating at 0.963 gallons per 1,000 gross ton-miles, while the U.S. industry average for 2021 was 1.063 gallons per 1,000 gross ton-miles.”

– CSX | 2022 CDP Climate Change Survey

Carbon Pricing

For CSX, its operations are not regulated by a carbon pricing system (i.e. ETS, Cap & Trade or Carbon Tax) and are not anticipated to be regulated in the next three years, according to its 2022 CDP Climate Change Survey.

Strategy to lower fuel consumption:

- Reducing fuel consumption and Scope 1 emissions during idling (note: CSX has invested more than $50 million since 2000 in idle-reducing technologies including Automated Engine Start Stop (AESS)

- Operational changes such as trailing engine shutdown and distributed power—both reduce fuel consumption and therefore emissions

- Network operational changes to a “Scheduled Railroading” business model results in improved freight haul efficiencies and less fuel consumption (with a corresponding reduction in emissions).

Canadian National Railway Co (CNI)

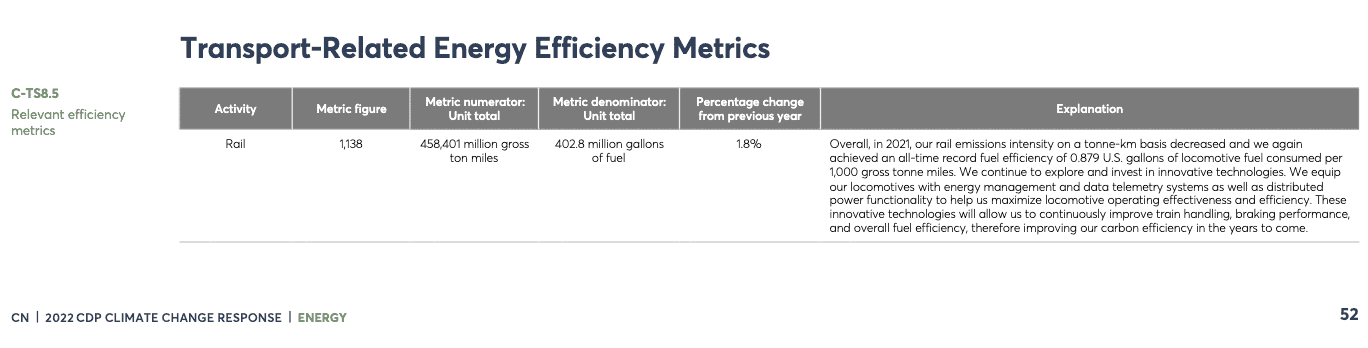

Metrics

“Overall, in 2021, our rail emissions intensity on a tonne-km basis decreased and we again achieved an all-time record fuel efficiency of 0.879 U.S. gallons of locomotive fuel consumed per 1,000 gross tonne miles. We continue to explore and invest in innovative technologies. We equip our locomotives with energy management and data telemetry systems as well as distributed power functionality to help us maximize locomotive operating effectiveness and efficiency.”

– CNI | 2022 CDP Response

Carbon Pricing

CNI was exposed to the Canadian Government’s Federal Fuel Charge increasing by $15 per tonne yearly from 2023 to 2030, which aligns with the British Columbia, New Brunswick, and Northwest Territories carbon tax requirements. These carbon pricing mechanisms have a direct impact on CNI’s operational costs, as well as the flow-through costs to their customers.

The financial impact of our exposure to carbon price mechanisms is estimated to be within the range of approximately $200 million to $450 million, according to CNI’s 2022 CPD Climate Change Response.

Strategy to lower fuel consumption:

- With approximately 87% of CNI’s direct GHG emissions generated from fuel consumption in its rail operations, there will be increased executive management oversight on the company’s fuel efficiency strategy to meet relevant targets and attention to CNI’s investments in innovative rail technologies.

- CNI also reached an agreement to purchase Wabtec’s FLXdrive battery‐electric freight locomotive, the first 100% battery heavy‐haul locomotive. When deployed as part of a locomotive consist, it is anticipated the technology will reduce the total fuel consumption and emissions by up to 30%.

Canadian Pacific Kansas City Limited (CP)

Metrics

“Supported by these investments, CP set a company record fuel efficiency in 2021, consuming 0.931 U.S. gallons of locomotive fuel per 1,000 gross ton-miles (GTMs), outperforming the Class I railroad sector average by 11.3 percent. CP continues to mitigate climate-related risks by reducing locomotive fuel consumption to improve operational efficiency.”

– CP | 2022 CDP Climate Change Questionnaire

Carbon Pricing

It was also conservatively assumed that both would be exposed to a $186 per metric ton carbon price by 2040. Therefore, CP’s costs from carbon pricing, both directly from fuel consumption and indirectly from purchased electricity, could total $378M, which would be $331M higher annually than under current prices (i.e., total 2019 baseline levels estimated at $47M, and $378M – $47M = $331M).

Strategy to lower fuel consumption:

- One of CP’s strategic approaches includes the implementation of its 8,500-foot high-efficiency product grain train (HEP train), which improves supply chain capacity, customer service, and fuel efficiency.

- Once implemented, the HEP train will allow CP to carry more than 40% additional grain per train, significantly reducing the total number of train starts, fuel consumption, and GHG emissions.

Union Pacific Corp (UNP)

Metrics

According to Union Pacific Reports First Quarter 2023 Results, it boasted a fuel consumption rate of 1.123, measured in gallons of fuel per thousand GTMs, which deteriorated by 1% from 2022. Fuel expenses grew 7% on a 9% increase in fuel prices as UNP moved less freight.

The company’s fuel consumption rate also deteriorated by 1% as the impact of its fuel conservation efforts was more than offset by reduced network fluidity, based on UNP’s Q1 2023 Earnings Call.

Carbon Pricing

Union Pacific may face substantially increased operational costs in the short- to mid-term due to increasing carbon prices, which can be mitigated by reducing company emissions. Carbon pricing may also represent an opportunity for UNP as potential customers seeking lower transportation costs shift transportation modes to rail.

Strategy to lower fuel consumption:

- UNP’s Energy Management System (EMS) on locomotives functions similarly to a cruise control system in a vehicle, automatically controlling a locomotive’s throttle and dynamic braking systems to optimize fuel usage and minimize GHG emissions.

- By the end of 2022, EMS will have been implemented in approximately three-quarters of UNP’s active road fleet, and it is still on track to fully implement EMS by 2025.

- In 2021, UNP’s full-year fuel consumption rate improved by 1%, a new record low. This represents the third consecutive year UNP improved its fuel consumption rate on a YoY basis and was a factor in helping its customers eliminate 229 million metric tons of GHG emissions by using rail versus truck during 2021, according to UNP’s 2022 Climate Action Plan.

- UNP also streamlined its operations, from right-sizing trains to applying new technologies designed to result in fuel-saving and improved tractive force for increased fuel efficiency. Its efforts resulted in reducing fuel consumption by more than 11 million gallons in 2021 compared to 2020.

Staying On Top of Freight Rail Industry Developments

As more freight rail companies continue to prioritize reducing their greenhouse gas emissions to rely less on toxic forms of energy, so begins the race to be the leaders of transportation using renewable energy. To get ahead, C-Suite executives are implementing market intelligence and search platforms into their operations to find the solutions they need and act swiftly.

AlphaSense’s AI search technology and extensive content library—which aggregates business documents from over 10,0000 content sources—allow our clients to remain at the forefront of their respective industries.

Start your free trial with AlphaSense today to see how our platform can keep you at the forefront of the railroad sector.