As generative artificial intelligence (genAI) gains momentum among institutional investors, investment teams are actively adapting to embrace this trending technology. They are most interested in understanding how genAI can transform their unique workflows and day-to-day functions that are traditionally plagued with complexity and inefficiencies.

With capabilities that are uniquely powerful and vast, understanding how to successfully harness genAI’s many use cases can be half the challenge with its implementation.

Furthermore, as resourcing and budgeting considerations remain top of mind for firms, it is more critical than ever to accelerate and centralize information sharing, prevent duplication of work, and avoid making poorly informed investments that can be costly in the long run.

Below, we explore five use cases for genAI that are revolutionizing workflows and ultimately optimizing analyst productivity. From surfacing insights faster with summarization, to unlocking the value of proprietary research, genAI is proving itself an invaluable tool to make informed, data-driven decisions with confidence.

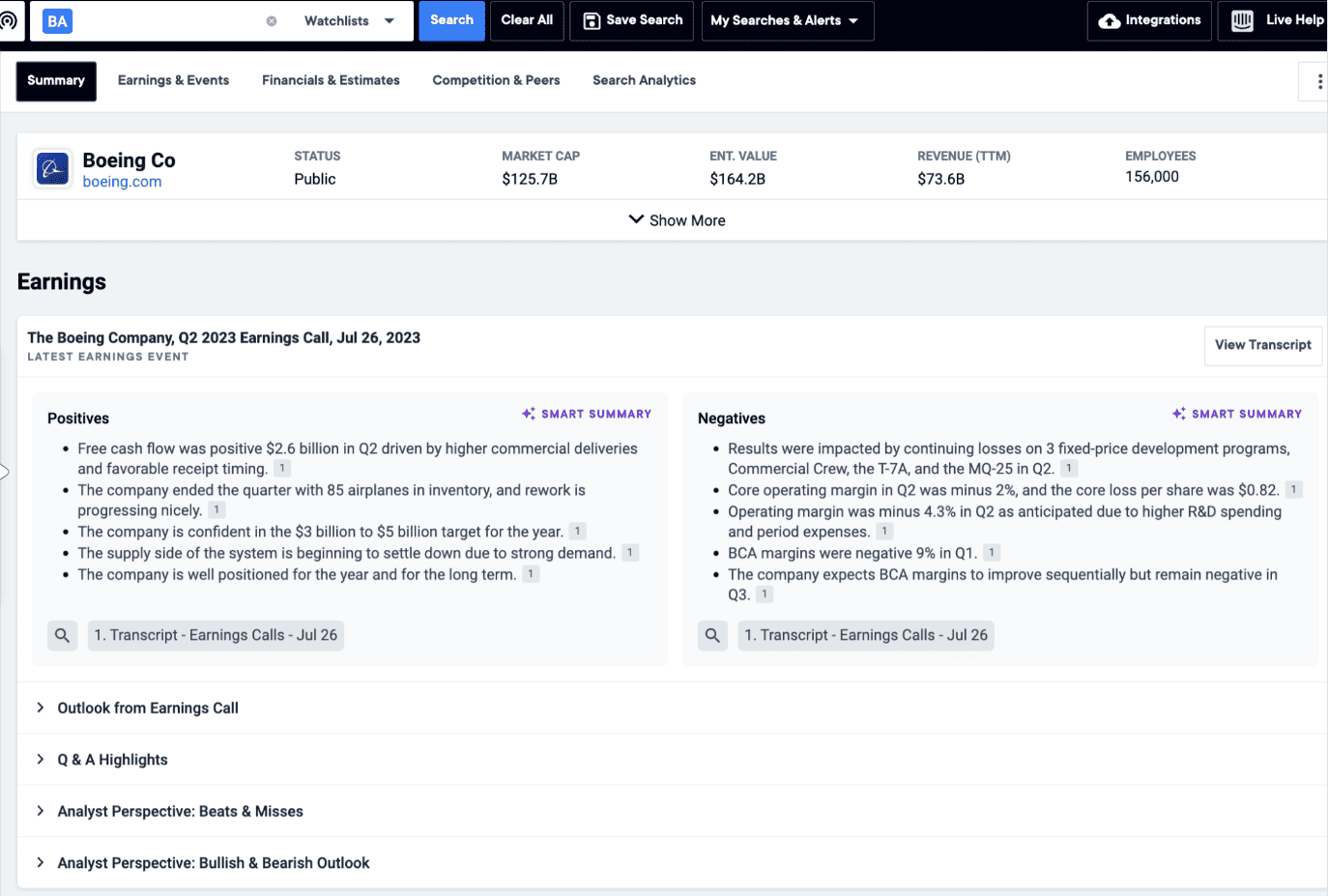

Instant Insights with Summarization

As part of the fundamental research process, a big genAI win for analysts is the ability to surface insights instantly. Prior to its arrival, it would take considerable amounts of time to review lengthy documents such as earning reports, broker research, and expert perspectives and extract valuable information.

With genAI’s purpose-built summarization functionality, time wasted on redundant activities is non-existent. Analysts can simply search for a particular company or industry and surface tidbits of information most relevant to their research.

AlphaSense’s Smart Summaries is a generative AI tool that draws from our premium content universe and is built on a foundation of over 10 years of investment in AI technology and large language models developed to answer critical market intelligence questions. It provides an analysis of the positives, negatives, outlook, and Q&A from earnings transcripts—all verifiable within a single click.

With this invaluable resource, analysts can not only capture a company’s self-reported results and outlook—but also summaries of analyst reactions post-earnings call. This enables you to capture the full picture of bullish or bearish reactions, and make recommendations to position your portfolio accordingly.

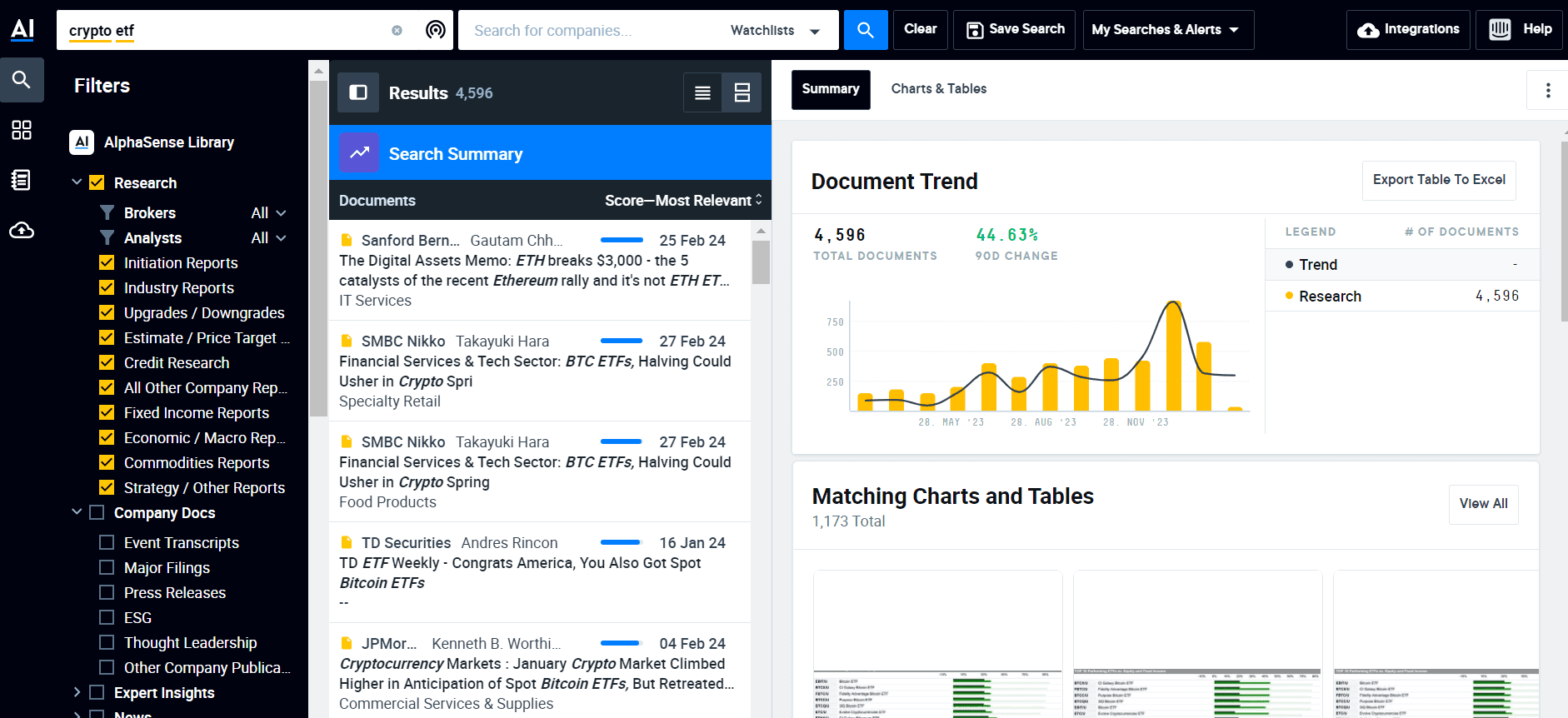

Curate Timely and Relevant Market Intelligence

GenAI is also transforming the way investment teams conduct their market intelligence and identify emerging trends and disruptors. In addition to structured data, genAI is streamlining how teams can consume and leverage unstructured data. This includes news articles, company documents, presentations, and other qualitative sources that are ordinarily time-consuming to scour and pinpoint valuable insights from. Additionally, image searches have the ability to extract data from charts, tables, and images that would be missed by a regular search.

To assess and stay informed on trends actively shaping the industry, analysts have traditionally aggregated intelligence from multiple sources and have run the risk of missing critical insights elsewhere—until now.

The AlphaSense platform uses genAI to centralize the information you need in order to execute top-down and bottom-up searches with ease. Our simple thematic searches enable you to map the market, identify segment-specific drivers, and discover new companies not on your radar.

For example, a search on the AlphaSense platform for recent trends in cryptocurrency shows a heightened increase in document activity over the last 90 days, accompanied by industry and news coverage, as well as expert opinions. With genAI, you can gain the full picture with any thematic search and generate innovative investment ideas by staying informed on emerging markets and new industries.

Unlock the Value of Proprietary Research

Perhaps the most prized use case of genAI is the ability to pair in-house research with the power of AI-layered technology to unlock insights and intelligence in real time and capitalize on proprietary knowledge.

Often, investment teams are plagued with inefficiencies created by internal research and external content spread across disparate systems and teams working in silos. Critical components of your firm’s market intelligence—internal research, investment memos, client deliverables, strategy presentations, and meeting notes—are often fragmented and inaccessible, resulting in lost opportunities and doubled work. As a result, firms lose the ability to swiftly pivot in response to market conditions and struggle to maintain a competitive edge.

AlphaSense’s Enterprise Intelligence solution does just this, and unlocks the value of your firm’s prized internal knowledge using generative AI.

Our purpose-built AI searches, summarizes, and interrogates your proprietary internal data alongside a vast repository of 300M+ premium external documents to surface the most valuable insights. It allows you to automatically integrate and tag your PDFs, SharePoint documents, CIMs, Excel sheets, and more. You can also interrogate long documents with natural-language chat that go straight to the source to surface the most relevant insights.

With our Enterprise Intelligence solution, analysts can instantly discover and verify insights while removing any unknowns, potential blind spots, and reputational risk.

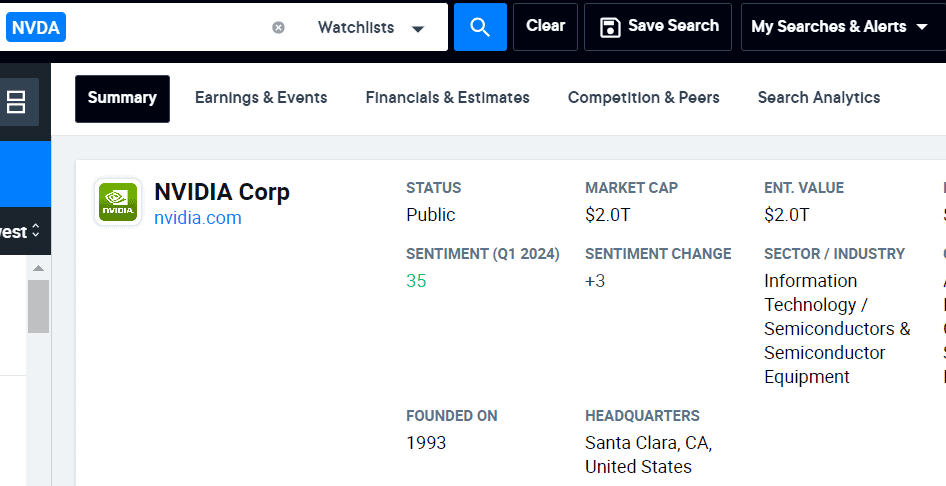

Sentiment Analysis to Drive Informed Decision-Making

An often overlooked use case—and likely undervalued—is the inherent value of sentiment analysis. With generative AI, sentiment analysis can be scaled in real-time to deliver instant insights and greater efficiencies.

Sentiment refers to the tone and nuance beyond the semantic meaning of what an executive leader, news source, or client is saying. This is particularly important when analyzing earnings transcripts, as inflection points in tone often serve as a proxy signal anticipating stock movement and shifting corporate strategy.

Sentiment analysis plays a critical role in structuring the investment recommendations that are passed on to portfolio managers as part of the research process. Analysts rely on a plethora of buy-side and sell-side research, company documents, expert perspectives, regulatory filings, and more to craft their findings and share vetted reports with the broader investment team.

As a machine learning and natural language processing (NLP)-based feature, sentiment analysis sifts through many of the documents analysts rely on, extrapolating tone and language nuance to provide the subtext within seconds. This feature is built into the AlphaSense platform, enabling you to quickly recognize the positive, negative, or neutral sentiment in the source you are analyzing.

Sentiment scoring on the AlphaSense platform can potentially spot stock movement before it happens, and also gain a deeper understanding of a pivotal market event or trend. Overall, it is a catalyst for driving better, more informed investment decisions.

Risk Mitigation

An all-encompassing feature of genAI is the ability for investment teams to holistically mitigate reputational and operational risk.

By empowering analysts with cutting-edge tools and functionality, genAI has revamped traditional workflows once mired by tedious, time-consuming tasks that may have yielded insights with limited or inaccurate visibility. The potential result? Inferior investment guidance, or worse—reputational risk.

Having the ability to proactively monitor macroeconomic conditions, provide end-to-end research coverage, expert perspectives, and track early signals to surface market-moving trends is a hallmark of generative AI’s vast capabilities, and one that ultimately fosters alpha generation.

Competitively Position your Team with AlphaSense

AlphaSense’s leading AI-search driven market intelligence platform equips you with the insights, market intelligence, trends, and expert opinions to remove the complexity and guesswork of conducting your research. Paired with our Enterprise Intelligence solution, unlock and integrate your firm’s valuable internal knowledge seamlessly and with ease, for the most comprehensive internal and external knowledge set.

Learn how our industry-leading genAI platform can help you sift through the noise, accelerate your research, and bring efficiencies to your workflow.

Harness the power of genAI and competitively position your team—start your free trial of AlphaSense today.

Checklist: 4 Best Practices to Unlock Value from your Firm’s Internal Knowledge