Over the last decade, the investment banking sector has been completely transformed by a myriad of factors—the mounting prevalence of digital transformation, shifting economic paradigms, and opportunities in trending areas such as sustainable finance, blockchain, RegTech, etc. This rapid change of pace has left even the most seasoned professionals wondering how they can not only stay ahead of trends, but ahead of their competitors.

To navigate it all successfully, it’s imperative to have the tools and resources to facilitate confident decisions in today’s market. But what do these “tools and resources” look like for the industry? How can they help streamline day-to-day workloads and ultimately secure deals?

Artificial intelligence (AI) and smart market intelligence solutions are the key to keeping banks competitive in unpredictable markets. They allow analysts to maintain a birds-eye view of their market landscape while drilling down into the sectors, companies, industries, and trends that matter most to them. By quickly gleaning industry activity, you’ll gain valuable insights in real-time that empower you to capitalize on fleeting opportunities.

AlphaSense is a trusted solution for most of the world’s leading institutions, including 80% of the world’s top investment banks. Below, we share our platform’s extensive capabilities: simplifying coverage research, establishing a single source of truth, benchmarking, access to exclusive expert insights, and so much more.

Industry Primers & Initiation of Coverage Reports

For investment banks, there’s nothing more important than an initiation report, which is a comprehensive assessment of a company’s function and performance. However, initiation reports can be tens to hundreds of pages long, depending on the complexity of a company—leading analysts to spend hours, if not days, reviewing them. Ultimately, countless time and money is wasted reviewing and extracting insights from these reports.

With AlphaSense, you can identify any instance where new coverage has been initiated for companies of interest in a matter of seconds, by filtering content to Research > Initiation Reports:

- [“New Coverage Initiations” search] > Replace companies/tickers with those of interest to you:

Quickly Glean Industry Activity and Competitive Landscapes

When it comes to industry intelligence, you could manually search and hope for the best. But with an ever-growing deluge of information published daily, it becomes nearly impossible to keep tabs on everything—market intel on dozens of companies you monitor, the most promising deals in the market, the macro trends and impacts your clients face, and so much more.

Ultimately, you must keep tabs on every and any discussion that could lead to new, lucrative opportunities. AlphaSense boasts an extensive universe of content—spanning over 10,000 private, public, premium, and proprietary sources—which our clients use to monitor any trends across sectors.

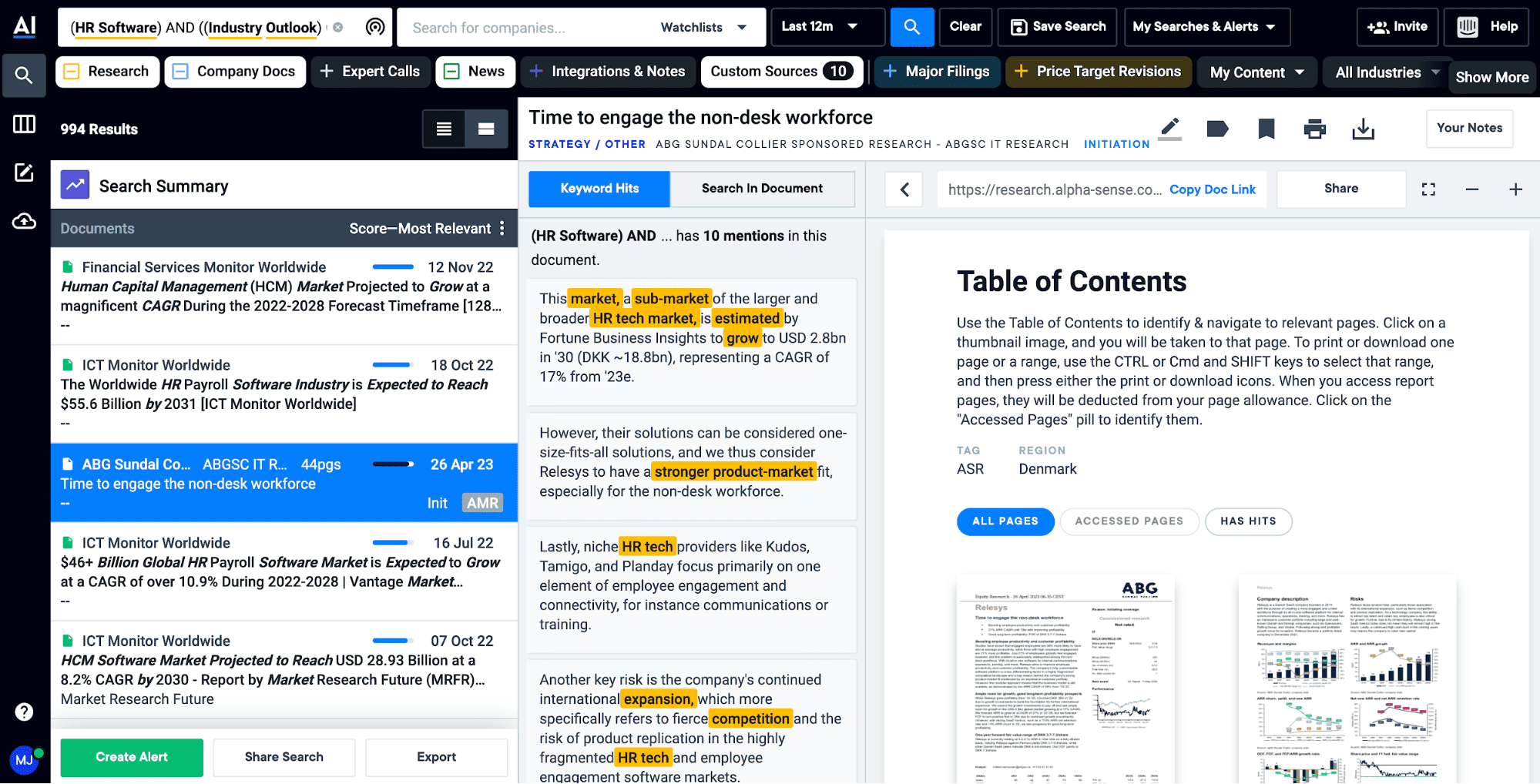

To get a comprehensive industry outlook in AlphaSense:

- [“Industry Outlook” search] > Replace “HR Software” with the industry of your choice:

A Single Source of Truth

The rapid introduction of new data makes it increasingly difficult to weed out the noise from critical insights. Nothing typifies this more than the first step in any market and competitive landscape analysis or due diligence effort—mapping the landscape.

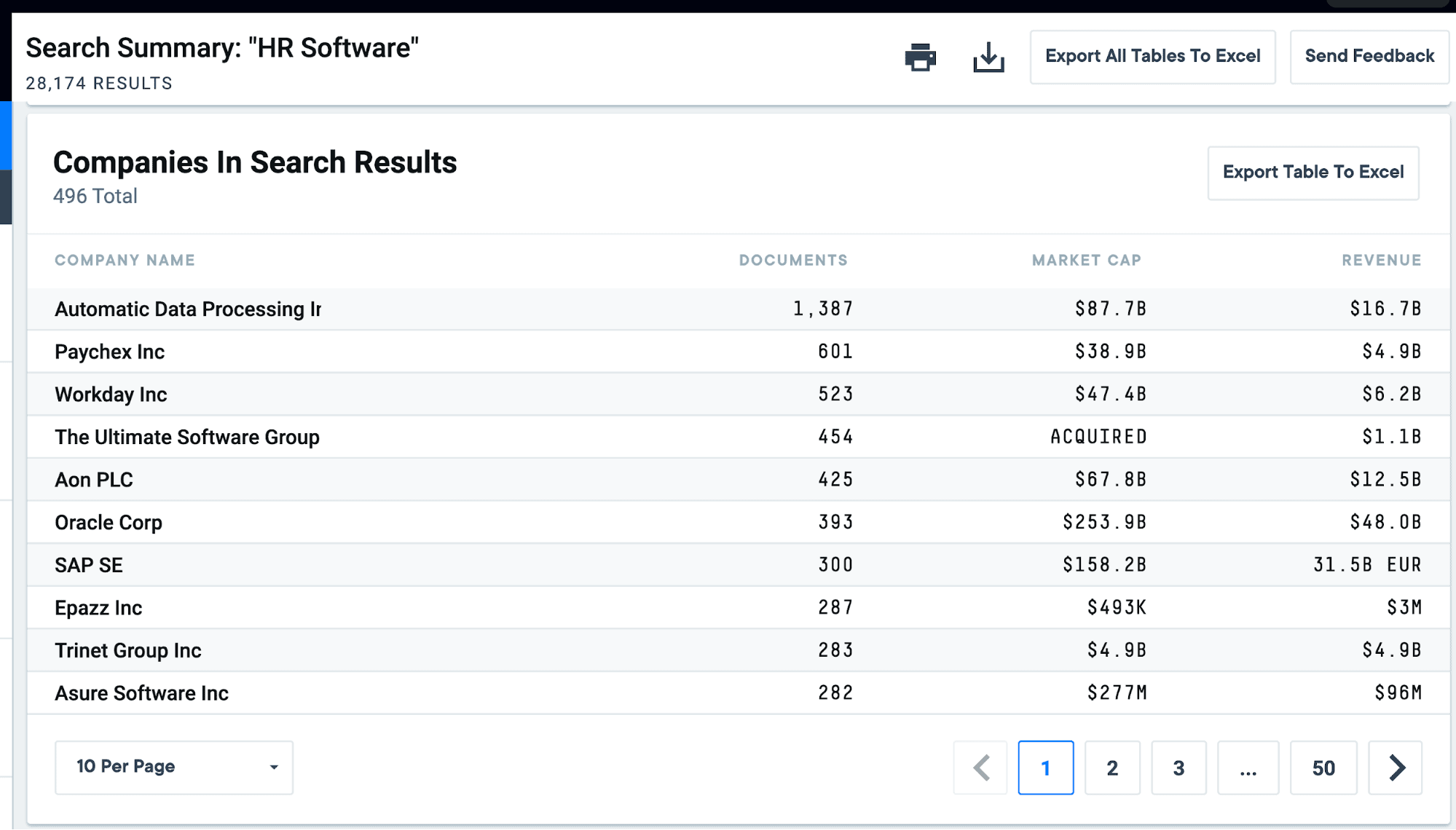

Typically, building out a landscape involves gaining an understanding of the key organizations operating in a given sector and identifying their revenue streams and product offerings. With AlphaSense, users can rapidly generate an exportable list of the companies most involved in a space by viewing the “Companies in Search Results” panel of their Search Summary.

To build a competitive landscape in AlphaSense:

- [“Competitive Landscape” search] > Replace “HR Software” with the industry of your choice:

Benchmarking Exercise

Some of the most valuable information buried within earnings documents is the data and financial information. This data can tell you a lot about a company, including overall performance and profitability, the success or failure behind new products or strategies, and even indications of where the company believes they will be successful—critical information for benchmarking in today’s market.

Our leading AI search platform allows you to find and compare core metrics and KPIs—all in one place. Dive deep into an earnings call and learn how a management team has self-reported over time to identify any changes in positioning.

To start benchmarking a company in AlphaSense:

Open a recent transcript on the left-hand side, select the “Insights” tab in the middle pane to see a graph of sentiment change as well as top topics and KPIs. Then, select “Show History” to open a historical view of mentions in transcripts across time.

- [“Companies’ Focus Over Time” search] > Replace companies/tickers with companies/watchlists you care about:

Precedent Transaction Analysis

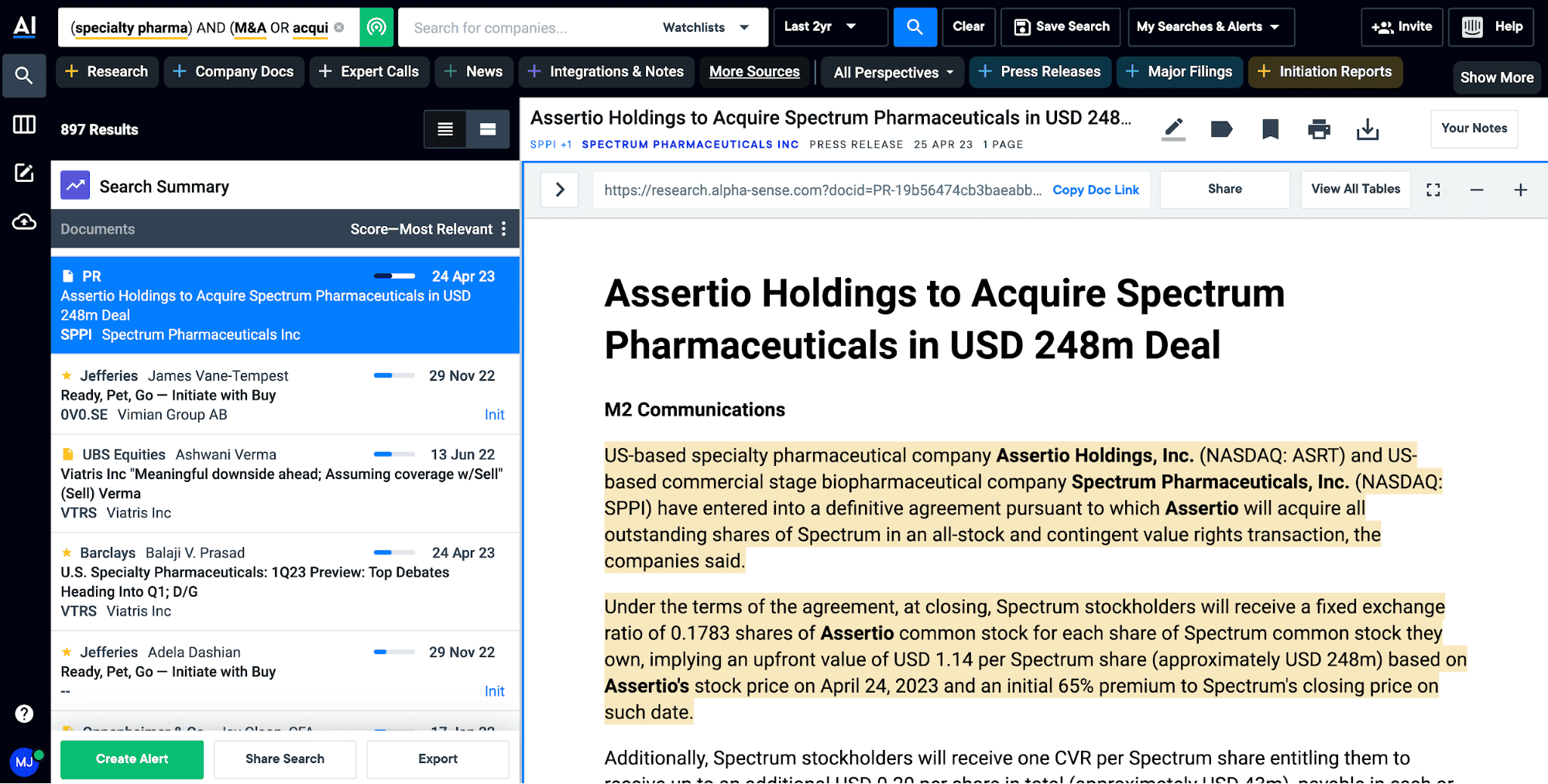

Conducting air-tight due diligence is more critical than ever in order to secure lucrative deals in today’s market environment. Having a trusted resource to surface the insights you need in a timely and relevant manner is key in navigating the complex M&A process and validating a potential deal.

The AlphaSense platform powers your due diligence with our Wall Street Insights®—a collection of equity research from 1,000+ providers, including reports from the world’s leading brokerage firms such as Goldman Sachs, JP Morgan, Morgan Stanley, and many more.

One way to conduct due diligence is to search for precedent transactions specific to any industry in AlphaSense:

- [“M&A Activity/Precedent Transactions” search] > replace “speciality pharma” with the industry you’re interested in

Private Company Alerts

In today’s competitive landscape, investors must stay ahead of developments on the companies and industries they follow to eliminate any uncertainty around an investment thesis and surface lucrative opportunities. To address this challenge, our platform allows for users to save their keyword searches and set up email or mobile push alerts on any companies, products, industries, or investment themes they care about. These automated alerts include text snippets with keywords in context, and users can be notified at a frequency of their choosing.

To turn on private company alerts in AlphaSense:

Search private companies you monitor in the Keyword Search and create alerts to capture any mentions of them across the market:

- [“Private Company” search] > replace “velocity clinical research” with the full name of the private company

Expert Calls to Get the Inside Scoop

In today’s globalized and ever-evolving economy, more and more companies are recognizing and leveraging the power of expert insights. The expert network industry has grown dramatically in value over the last few years, and it is expected to expand at a CAGR of 18+%. Expert calls are one-on-one interviews with seasoned subject matter experts (i.e., former executives, customers, partners, and competitors) from a specific industry or company. These experts provide unique perspectives that otherwise would be inaccessible to investment analysts and other professionals.

AlphaSense’s on-demand library is equipped with 39,000+ expert call transcripts paired with powerful intelligence search tools that help you make faster, more confident decisions. Leverage expert calls to understand industry expert perspectives on any topic or theme.

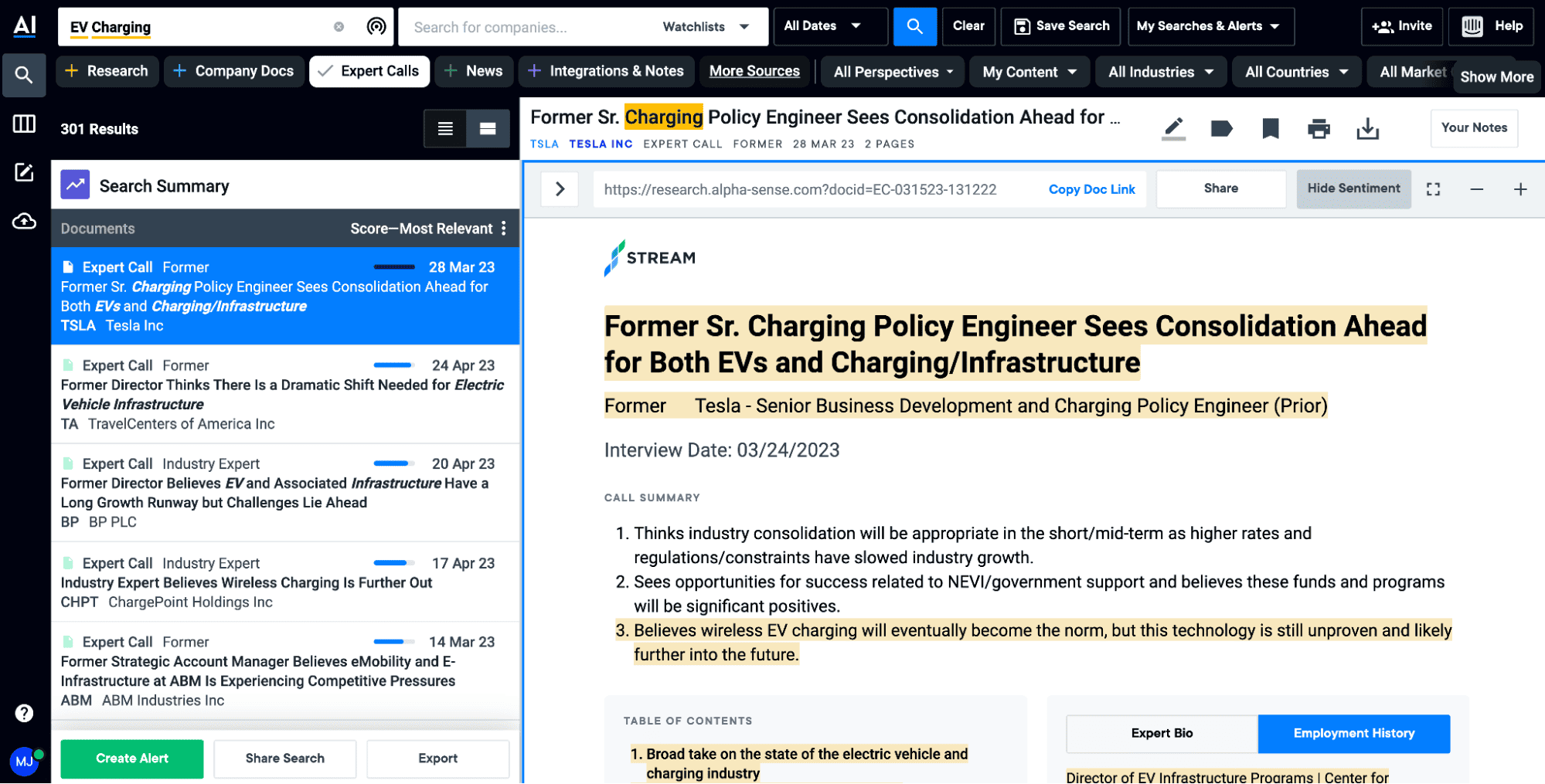

To search through AlphaSense’s expert transcript library:

- [“Expert Calls – Topic” search] > replace “EV charging” with your topic of interest:

Note: If you do not have access to Expert Calls but are interested in learning more, please reach out to your Account Manager or “Live Help” and we’d be happy to assist.

Deep Dive into a Company, Public or Private

Curious to learn what these experts have to say about a specific competitor or company, public or private? An expert can provide valuable intel on a company’s operations, history, internal teams, competitors, and other relevant strategies. Knowing these details about one’s peers or competitors can empower more proactive strategy and help uncover specific competitive advantages and gaps of competitive interest.

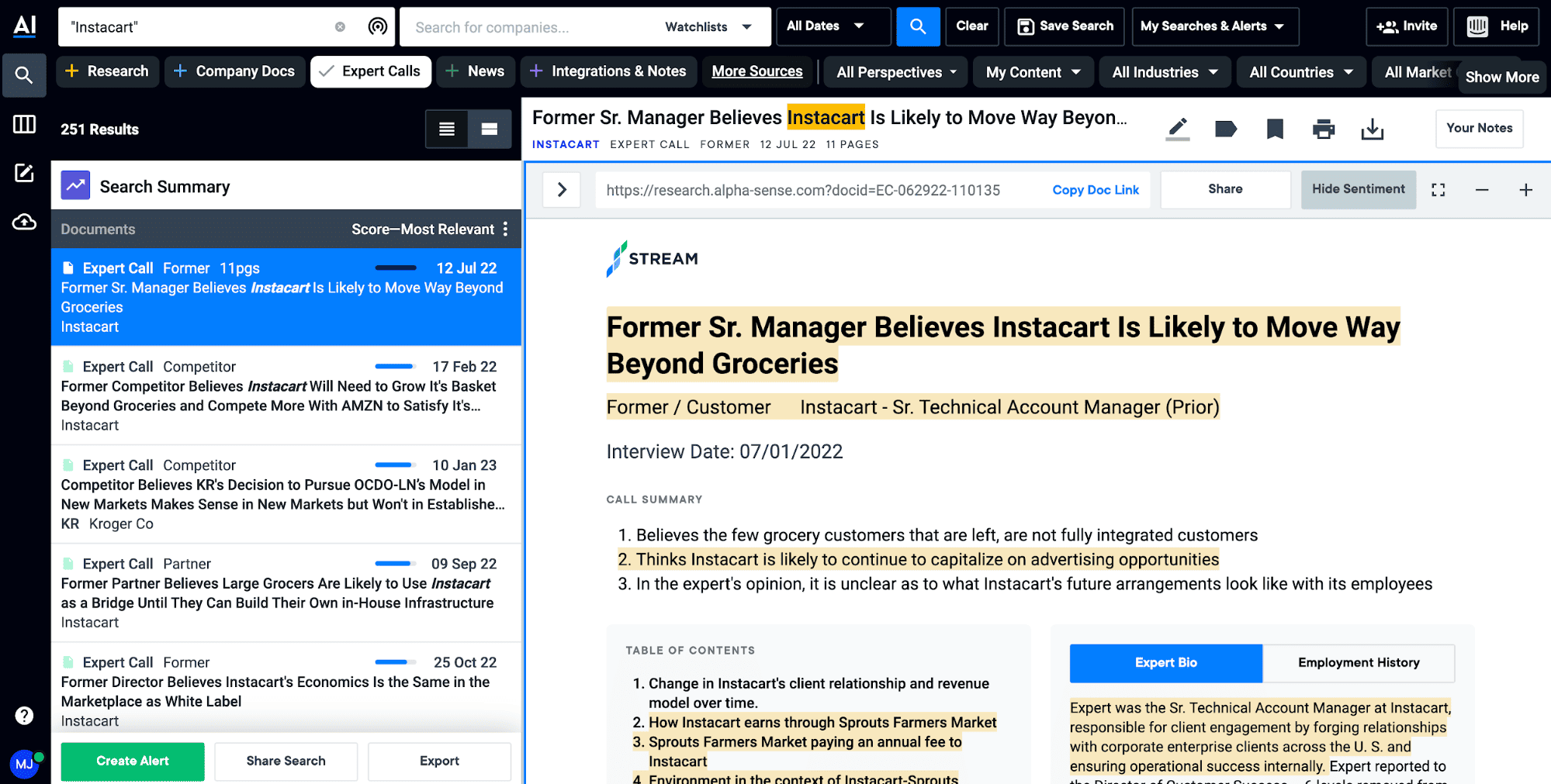

To learn more about a specific company in AlphaSense’s Expert Transcript Library, customize expert calls to understand industry expert perspectives around any company:

- [“Expert Calls – Company” search] > replace “Instacart” with your company of interest

Staying Ahead in the Race for Information

There’s no denying that surfacing the right information in today’s market can result in lucrative deals. That’s why time to insight has become a priority with everyone from analysts to managing directors—the quicker you arrive at a business decision, the more likely you are to strike big.

AlphaSense’s powerful AI eliminates the guesswork of locating crucial insights by quickly parsing through an extensive content universe of expert transcripts, broker research, financial documents, and more to pinpoint quality insights and metrics in seconds.

Enhance and accelerate the depth and efficiency of your research with our innovative features:

- Fast Navigation – Utilize AI-driven features like Smart Synonyms™ and sentiment analysis in the platform to quickly surface nuanced due diligence insights. These tools allow you to quickly find relevant documents based on positive or negative sentiment, making it easy to navigate across the four perspectives found in our vast content library.

- Instant Insights – Leverage our generative AI to glean instant insights from any expert or earnings transcript with Smart Summaries. Smart Summaries is the only generative AI (genAI) tool that draws from a premium content universe specifically curated for investment professionals.

- User-Friendly Interface – Stay informed in real-time with automated alerts and use custom search filters to surface documents relevant to your research. For expert transcripts, AlphaSense’s user-friendly platform offers timestamped audio, making your research process even more efficient.

- Smart Search – Browse by expert title, company name, industry, topic and other smart search features, like our AI assistant, to discover nuanced insights that will fill in research gaps in your M&A strategy for a comprehensive understanding of your target company.

- Generative AI – Use AlphaSense Enterprise Intelligence which enables secure searches, summaries, and follow-up questions across your proprietary internal data and a vast repository of 300M+ premium external documents—all powered by our industry-leading AI for market intelligence.

- Sentiment Analysis – Identify and quantify language nuance and tone around specific research topics. Using a boolean operator, you can search for mentions of a specific topic in a positive, negative, or neutral light (for example, “acquisition” AND “positive”) and filter by relevant keyword.

Start your free trial of AlphaSense to accelerate your deal success and discover the power of our Enterprise Intelligence.