The time is upon us: earnings season.

“Time is money” is never quite as true as during these first few weeks following the close of a quarter, when the world’s financial analysts, investors, IROs, and business leaders are tasked with analyzing the performance of their portfolios, peer sets, or clients.

Earnings calls offer unmatched insight into what company leadership is prioritizing, where certain business units are underperforming, and what analysts think are the most important topics to grill the C-suite about. But with most of the highest earning public companies posting financials and hosting earnings calls within days of each other, many analysts are tasked with listening to and doing write-ups for 2-3 earnings calls in a single day, for multiple weeks.

The deluge of earnings-related materials can easily overwhelm even the most seasoned of professionals, and presents a few obvious challenges:

- Working this quickly makes it nearly impossible to collect and understand all of the necessary contextual information to present a well thought-out analysis, and increases the likelihood of things getting lost in the shuffle.

- Some of us like to sleep. Further, some of us even enjoy regular interactions with our family.

The good news? With the explosion of Generative AI (genAI) offerings over the past year, there is unrivaled potential to dive deeper and create more well-rounded analyses with the limited time you have during earnings season.

Generative AI for Market Research

Artificial intelligence (AI) has been expediting research and analysis—during and outside of earnings season—for financial analysts and corporate strategists for over a decade. But it is the introduction of genAI—a branch of artificial intelligence that identifies patterns within datasets to generate new content—that has the potential to have an exponentially more significant impact on how we conduct earnings analysis.

While foundational AI has helped expedite the process of identifying and presenting relevant insights, generative AI can improve these workflows tenfold by not only collecting, but summarizing all relevant data into a format that is immediately digestible, verifiable, and shareable.

Since the release of consumer-grade generative AI tools to the market in late 2022, people have found ways to leverage these tools to expedite earnings analysis. The elephant in the room, of course, is ChatGPT—but with its knowledge cutoff of September 2021 and its propensity for both hallucinating facts and not citing sources, an open-ended question about earnings performance is certainly not the best use for a tool like this.

A number of other open-access platforms have popped up using OpenAI’s GPT language model that allow you to get closer to accuracy with business and financial questions by uploading or linking to specific documents (like an earnings call) and then asking questions about that specific data source. And while these platforms may be more accurate than ChatGPT, there’s still a major pain point that continues to arise: They aren’t using language models built to analyze financial data, which means that there’s a higher likelihood of misinterpretation, hallucination, and low quality analysis.

Our Solution: Smart Summaries

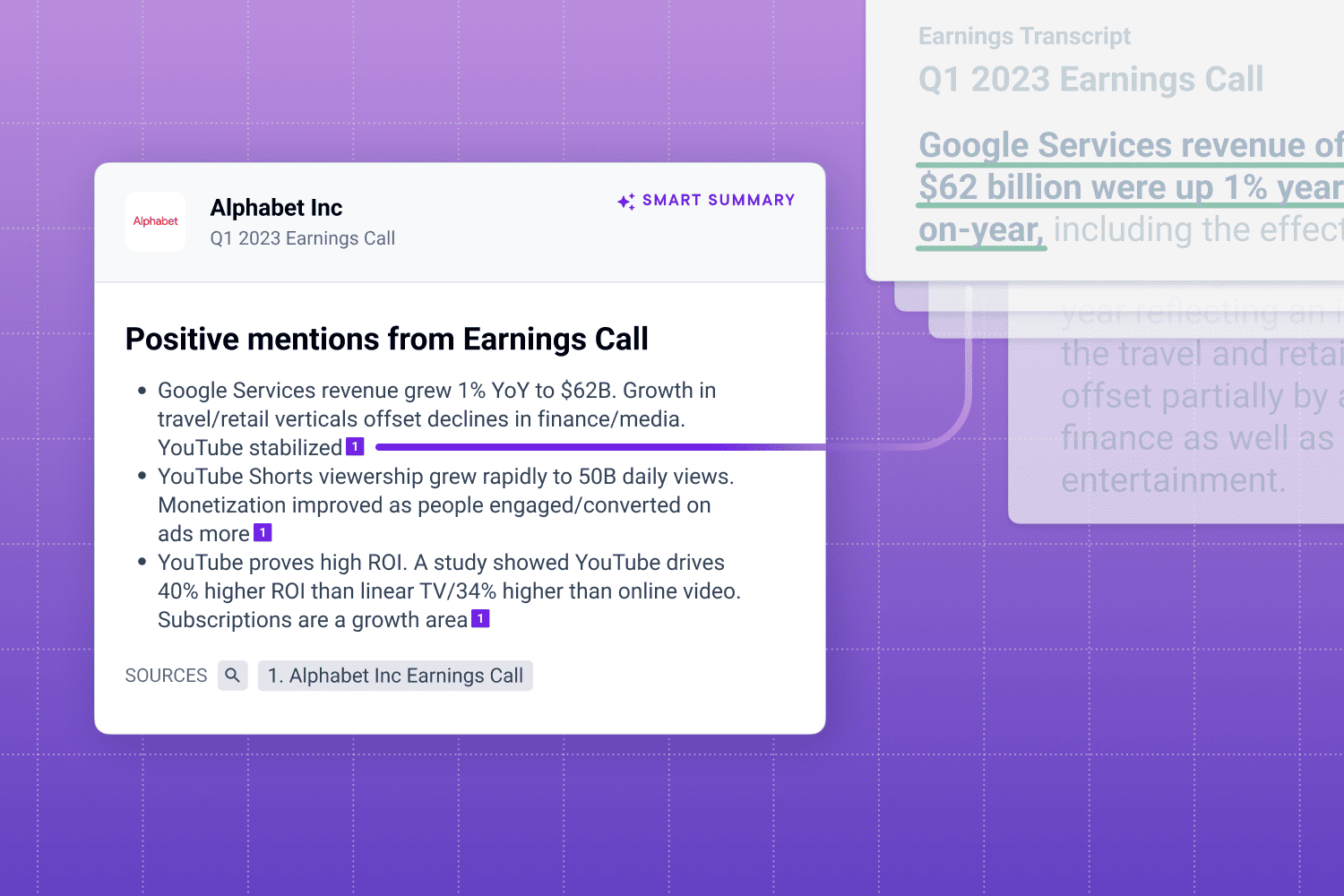

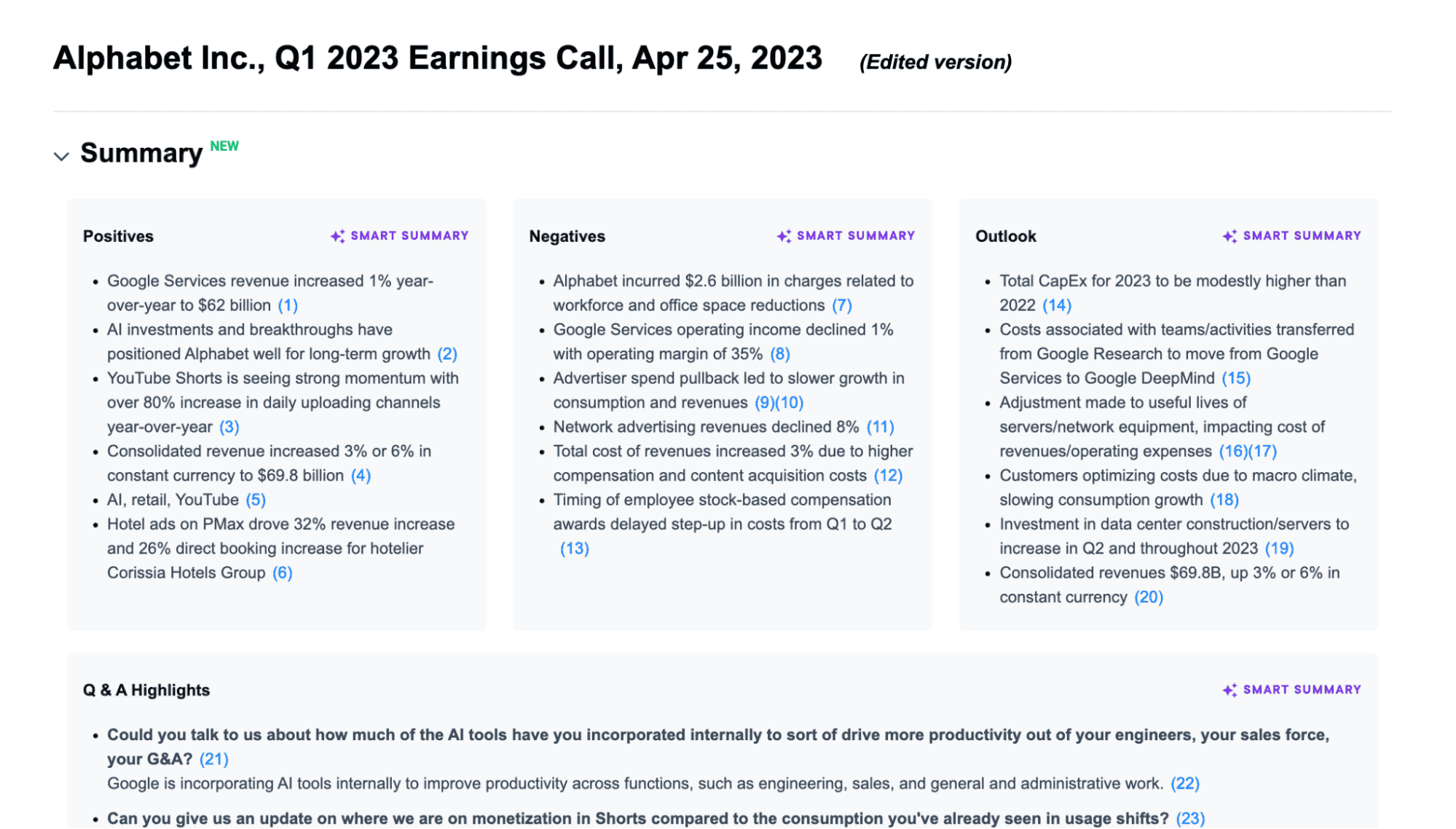

At AlphaSense, we recently launched Smart Summaries for every earnings call transcript. These bulleted summarizations give you the most important topics, guidance, competitive signals, and analyst questions within a call—without any of the fluff—allowing you to quickly get to the heart of what’s happening at a company. Going beyond just highlighting trends, Smart Summaries tell you what a key datapoint means in the larger context of the market.

Our clients have found that they save anywhere from two to 15 hours monthly just from using Smart Summaries to:

- Monitor non-core companies

- Draft post-earnings recaps

- Cross-check key takeaways from a call

- Quickly identify QoQ changes

- Get smart on new companies or markets

…and more.

Of course, time savings mean nothing if you have to re-do all the work because you don’t know where a certain insight came from. In building Smart Summaries, we sought to address two major problems that prevent generative AI from being useful for business analysis: accuracy and auditability.

We’re able to do that with a few key features:

- Snippet Linking: Summarizations are categorized into common themes (positive and negative outcomes, company outlook, and analyst Q&A) and organized in simple, bullet-point lists; each bullet point links to the exact piece of text that the summarization is sourced from, allowing for a one-click verification of any insight.

- Verticalized LLMs: Specialization is crucial for quality, and the large language models (LLMs) we employ are trained on financial datasets and business content to solve for specific workflows (like earnings analysis and competitive intelligence); this focus allows for a faster path to relevance.

- Curated Content: We’ve spent the last decade building a market-leading universe of business content, from publicly available earnings calls to premium Wall Street analyst reports, to proprietary expert interviews; meaning that as we expand to multi-doc and search-based summarizations, you always know that summaries are sourced from the highest quality sources of content available.

Plus, Company Smart Summaries, now available in beta, allow you to incorporate more key market perspectives into your analysis.

With the addition of these summary modules, Company Tearsheets will feature summarizations of earnings performance from the most recent quarter (including Wall Street’s reactions post-call), recent analyst reports (including explanations around upgrades and downgrades, and SWOT analysis), and curated expert insights pulled from our library of 30,000+ interviews with former executives, partners, and customers from the world’s top public and private companies.

Speed Up Analysis Without Sacrificing Quality

It’s critical that all market intelligence professionals stay ahead of the curve and lean in to new innovations that can offer the potential to do more with less. At the same time, when using new technology to drive key business strategy, there must be a measured approach taken to how much and what type of work we’re comfortable offloading to machines.

Here at AlphaSense, because we’re building generative AI that is purpose-built for business professionals, we continue to prioritize usability over everything—which means building workflow-specific tools, maintaining the highest bar for accuracy, and always allowing for our customers to audit anything generated by AI in just one click.

Don’t miss our State of Generative AI & Market Intelligence Report 2023.

Ready to take Smart Summaries for a spin? Start your free trial of AlphaSense today.