New products are launching every day across every industry throughout the globe carrying their business risks. The CPG industry alone is responsible for an average of 30,000 launches annually, with most of those launches failing. The failure rate is so substantial that HBR notes that about 95% of new products fail and “less than 3% of new consumer packaged goods exceed first-year sales of $50 million—considered the benchmark of a highly successful launch.”

There are plenty of places for a company to trip up as they set out to launch a new product. Some of the obstacles that can contribute to a failure include:

- The product doesn’t do what it’s supposed to

- The growth outpaces the company’s ability to support the product

- The product is a category-maker and requires substantial customer education

- There is no market for the product

- The creation isn’t distinct enough from competitors

So what differentiates a failure from a success? From pricing and messaging to market sizing and competitive deep-dives, gaining a thorough understanding of the total addressable market and your end buyers. In addition, a robust and data-driven planning process centered around detailed market research can often be the differentiating factor that leads to a successful product launch.

Related Reading: An Innovator’s Guide to Competitive Intelligence

The challenges of data-driven research

The quality of research and the ability to find granular information are key factors that can make or break the success of a product launch. Total addressable market, market share, growth potential, peer strategy and suppliers, macro trend impact, and M&A activity are all fine pieces of information that you might be on a journey to discover. Unfortunately, much of the challenge comes from the fact that these insights lie within sources on disparate, expensive, difficult-to-search platforms.

With both speed and accuracy paramount in the fight to gain market share, delays and incomplete or poor quality of information could mean a missed business opportunity in today’s competitive markets.

AI-powered market intelligence

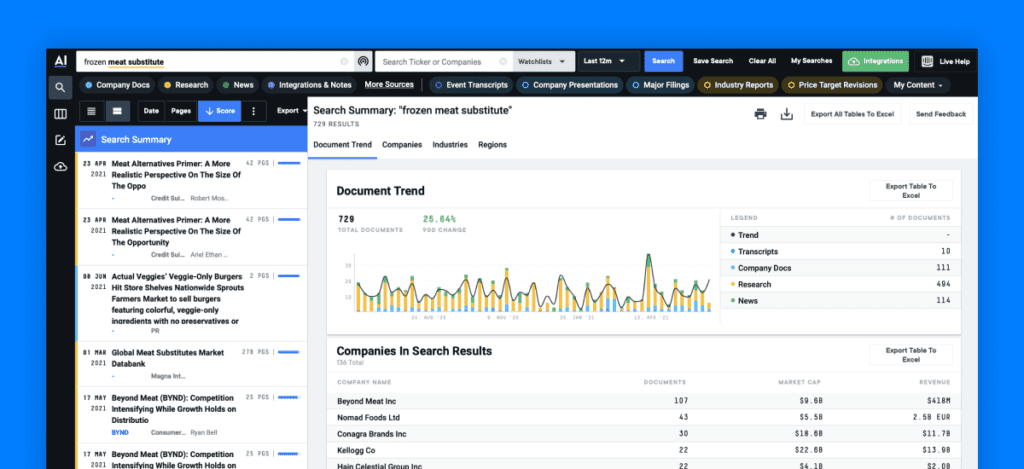

Tedious research processes to validate market information have been displaced by modern technology. With powerful NLP technology layered on top of millions of curated content sources, you can gain speed and accuracy as you assess market risks and opportunities.

Confidence in the big picture

Millions of trusted sources are available within the AlphaSense platform, providing confidence in the depth and quality of research outputs. Many turn to the Wall Street Insights collection to uncover expert information on market share, growth potential, and total addressable market. These research reports do much of the heavy-lifting, with expert analysts often outlining this specific information within their analyses. For example, a leader from one of the world’s largest pharma companies used these expert reports to identify the US market share for oncology treatments. He placed a detailed table outlining the precise information he was after in seconds.

Efficiency gains for higher-value activities

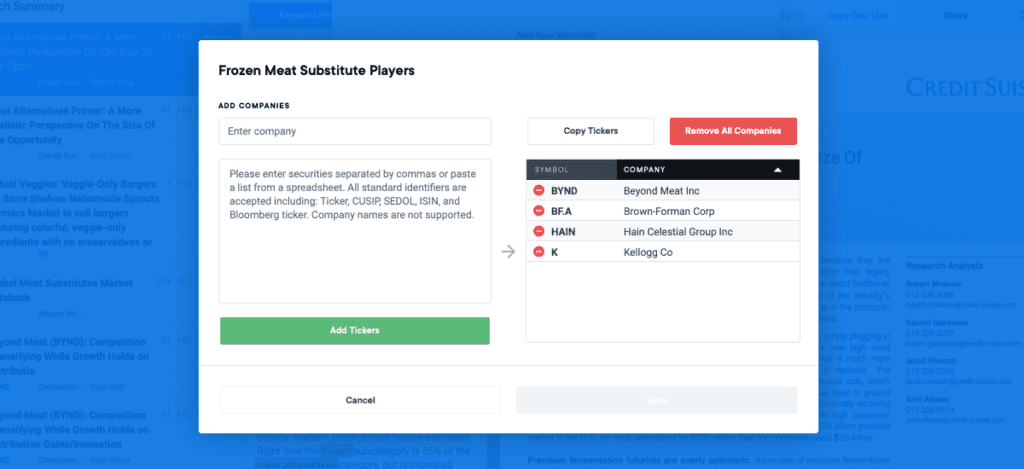

With a deep library of valuable content, you also gain central efficiency in your workflow by conducting thematic searches across the vast array of sources available within AlphaSense and, for example, analyzing what the press, analysts, and other companies are saying about a recent trend or new product in the market provides a more holistic view of supporting a product launch.

As speed and accuracy of information continue to play a huge role in businesses’ ability to launch new products effectively, the need for technology to aid in the research process only grows. AlphaSense’s unique AI search is powering the research process and enabling businesses to make more timely, data-driven decisions.

Check out this video of best practices in leveraging AI to identify opportunities and risks for new product launches or unlock a free trial of AlphaSense here.

Here are a few scenarios and how AlphaSense’s intelligent AI can tackle the new product development workflow:

| What info you’re seeking | Scenario | How to do it in AlphaSense |

| Forecasted revenue | Uncover the forecasted revenue for Keytruda (prescription medicine for skin cancer) | After running a thematic search, identify key exhibits within broker research reports detailing forecasted revenue and export tables to Excel.

Search link for AlphaSense users. |

| Competitive landscape | Discover significant players and new entrants talking about 5G | After running a thematic search, look at Search Summary to discover the companies speaking about 5G most frequently

Search link for AlphaSense users. |

| Trend impact | Understand the COVID-19 vaccine hesitancy rate | Run a thematic search on the trend (vaccine hesitancy #) across documents (news and broker research)

Search link for AlphaSense users. |