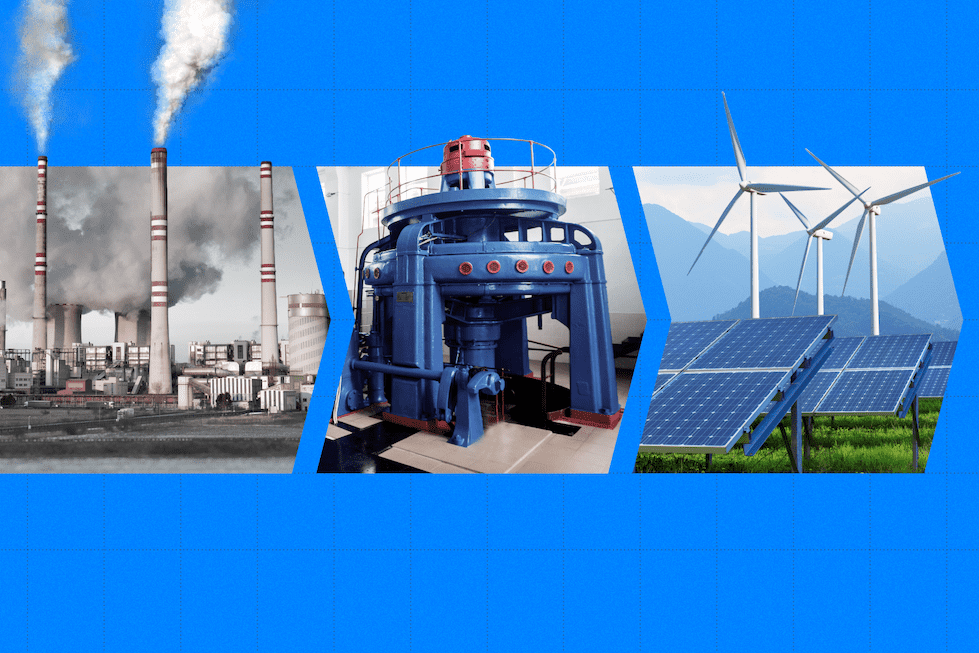

Over the last three months, C-Suite leaders across industries have prioritized conversations around climate change, the global energy crisis, and the consequences of their corporations not enacting a net-zero future.

In the AlphaSense platform, these discussions have taken place throughout a number of earning calls and company conference transcripts—detailing everything from how to decarbonize manufacturing processes to deciphering what solutions will help companies reach their eco-conscious pledges quicker.

The overarching question executives were left to answer: what can we expect to see on the path to net-zero?

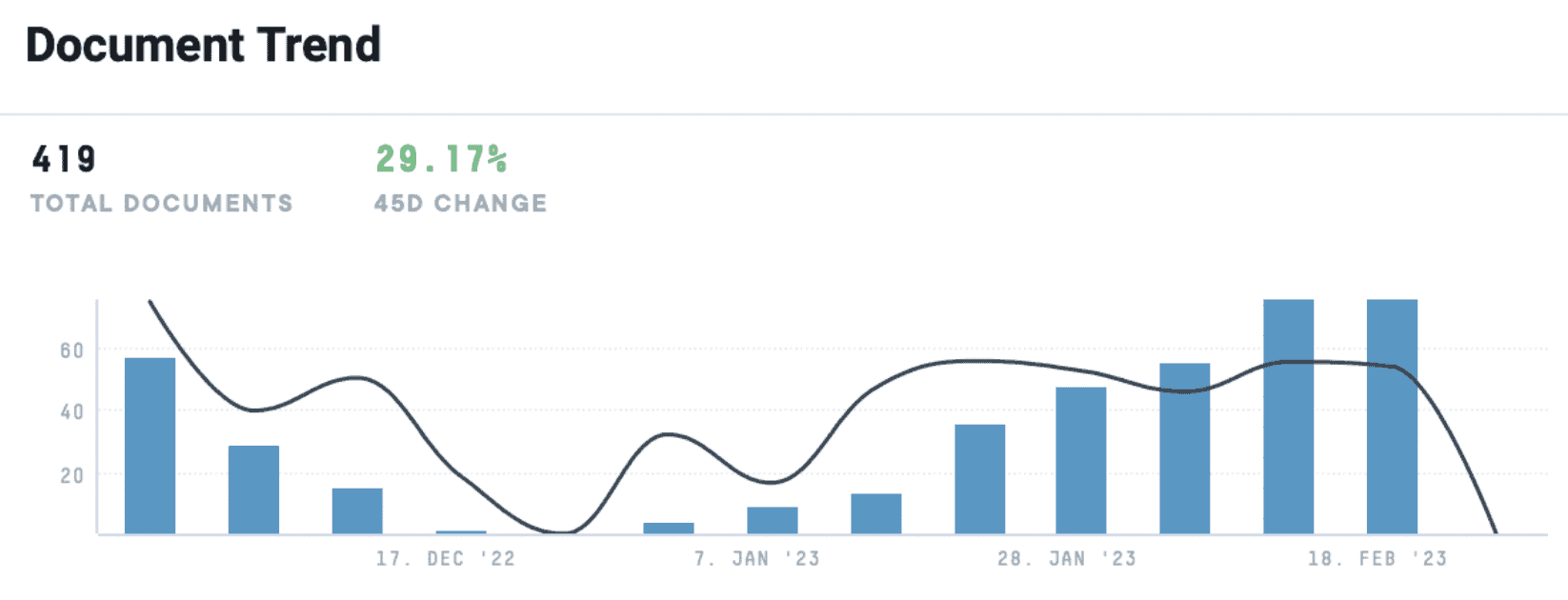

Caption: In the AlphaSense platform, there was a 29.17% increase in Event Transcripts mentioning “net-zero” over the last 90 days.

While each company, sector, and industry will inevitably have their own individual approach, we noticed a myriad of trends that will likely shape how businesses navigate the transition of their energy resources to rely on cleaner, eco-conscious fuel. From tactical M&A deals to more transparent ESG-reporting initiatives, discover what you can expect to unfold in the market.

M&As Help Reach Net-Zero Futures Faster

Even long-standing industry titans are quickly realizing that converting their supply chains and beyond to rely on eco-friendly forms of fuel is a time-consuming and costly process—directly hindering their ability to cleanse their energy demands of carbon. Cue M&As: E&I companies and carbon-producing organizations are partnering with or outright buying sustainable companies to facilitate operational changes faster.

To date, there’s been substantial deal-making that’s pushed this approach into boardrooms globally. In November, French utility giant Engie and lender Credit Agricole acquired Spanish solar and wind developer Eolia Renovables for $2.3 billion.

For Engie and Credit Agricoles, their purchase gives them control over 899 MW of operating solar and onshore wind farms and a 1.2-GW pipeline of projects, helping Engie reach its target of 50 GW of renewable capacity by 2025. Crédit Agricole Assurances, on the other hand, aims to double its investments in renewable energy to enable an installed capacity of 10 GW.

“Of course, we are not necessarily forbidding ourselves to look at this type of bolt-on transactions that can help us accelerate and can help also bring synergies to existing assets. I think we’ve done that really nicely with Eolia in Spain, which is doing very well. But the key point is that we’re trying to change the Engie culture on M&A, which means that we are focused on demonstrating that we can make these assets that we would buy better by applying our operational and industrial levels, and we’re trying to force ourselves to show the value that we are adding by doing that.”

– Engie SA | Earnings Call Feb 2023

Shell’s subsidiary, Shell New Energies US, acquired Inspire Energy Capital, a renewable energy residential retailer, this past July. While a deal value has yet to be disclosed, the British oil and gas company’s purchase greatly furthers its goal to build and scale renewable energy, reduce emissions, and reach a net-zero state by 2050.

Private equity firms, especially those in Europe, are also investing in renewable energy due to the high returns on offer. For example, in 2021, Swedish PR firm EQT acquired Solarpack, a Spain-based firm developing solar photovoltaic plants, for $1.5 billion, while Swiss PE firm Partners Group acquired Lithuania-based green energy firm Gren Group for $951.8 million.

Competition Over Government Tax Incentives

To combat the astronomical energy prices Americans faced this past summer and develop domestic resources, President Biden’s administration has taken proactive legislative measures with the Inflation Reduction Act.

Through the Act, the federal government will provide tax incentives of up to $369 billion for new solar, wind, thermal, and energy storage devices over the next decade (i.e., the White House aims to triple domestic solar manufacturing by 2024).

Experts are forecasting national but also international businesses to take advantage of Biden’s energy incentives, setting the stage for a lucrative yet competitive landscape for energy investors:

“Certainly, now I think with the passing of the Inflation Reduction Act, my anticipation would be that the strong incentives that are in that bill for building solar power plants will really supercharge the industry and that we’re going to see a very dramatic continuation and growth of the deployment of solar technology in the United States.”

– Former Data Scientist Expects Acceleration in US Installation | Expert Call

In fact, President Biden’s Act has already piqued the interest of the South Korean group Hanwha Group. The Group announced plans to build a $2.5 billion solar-manufacturing supply chain in Georgia—the largest solar investment to take advantage of the US’s massive tax incentives.

Under Qcells, the conglomerate would build new facilities in the Atlanta region that would manufacture 3.3 gigawatts of solar panels a year—enough to supply around 18% of the estimated US demand in 2022. Qcells would also manufacture almost every component required for solar panels, including solar cells, ingots, and wafers, on-site—otherwise, items not currently manufactured in the US.

Developing Transparent ESG-Reporting Initiatives

ESG investing soared during the COVID-19 pandemic and continues to flourish, as Bloomberg forecasts that ESG assets will generate $53 trillion in valuation by 2025, representing a third of AUM. For 2023 and beyond, ESG is part of the normal course of business discourse.

While interest in ESG is high, investor faith in companies claiming to be ESG compliant is fading fast. Recent investigations into Goldman Sachs Assets Management (GSAM) and Deutsche Bank have led to speculations of fund managers relabeling their products to cash in on the trend without doing any of the heavy-lifting. It’s led to what many are calling the ESG backlash.

Without institutional means of measuring and reporting their commitments, there’s no system or process to validate the thousands of companies that have committed to ESG-related efforts. Consequently, investors and industry leaders are finding new tactics and establishing systems to check the authenticity of stocks labeled “ESG.”

At the 2021 United Nations Climate Change Conference (COP26), the International Sustainability Standards Board (ISSB) was created to develop a global framework for ESG reporting. The ISSB put forth its proposals this past March, and initial responses—compiled into a statement—showed support from over 80 CFOs.

Feedback centered on clear definitions and guidelines that would coexist with existing frameworks (i.e., SASB standards). New ISSB standards are expected to be released later this year.

While the framework is not legally binding yet, it will at least create a global standard to make ESG reporting much more transparent and easier for consumers and investors to understand. And with those standards, leaders see business opportunity:

“If you look at the COP26 themes coming out, having to produce 60% to 75% more electricity in the next 30 years to reach that 1 degree of containment on temperature, tremendous opportunity. And I think that is going to transform that utility industry in a way they haven’t seen before, similar to probably what happened to the energy industry 30, 40 years ago.”

– Aspen Technology, Inc. Presents at Berenberg Thematic Software Conference 2022

Prioritizing Green Hydrogen

Green hydrogen is critical in decarbonizing energy systems. Produced through electrolysis (adding electricity to water to separate hydrogen and oxygen molecules), green hydrogen is an end-to-end “clean” renewable energy source. Not only can green hydrogen store energy, but provide resilience and transport high volumes of energy over long distances via pipelines and ships.

Distance plays to hydrogen’s selling points, as it allows energy companies to tap extremely competitive but otherwise “stranded” renewable energy in remote locations—pushing forward energy transitions globally.

Additionally, because hydrogen can be produced from electricity and used as, or converted into, fuels, chemicals, and power, the production of hydrogen from electricity will connect and fundamentally reshape current power, gas, chemicals, and fuel markets.

According to McKinsey’s Hydrogen for Net-Zero: A Critical Cos-Competitive Energy Vecor Report, “in terms of end uses, hydrogen is critical for decarbonizing industry (e.g., as feedstock for steel and fertilizers), long-range ground mobility (e.g., as fuel in heavy-duty trucks, coaches, long-range passenger vehicles, and trains), international travel (e.g., to produce synthetic fuels for maritime vessels and aviation), heating applications (e.g., as high-grade industrial heat), and power generation (e.g., as dispatchable power generation and backup power).”

Ultimately, supplying clean hydrogen at a cost-optimal price will not happen without the right regulatory framework, meaning both governments and businesses will need to act. Suitable policies such as mandates and robust carbon pricing, the development of large-scale infrastructure, and targeted support and de-risking of large initial investments will most likely be required.

Looking Ahead

Global decarbonization is a hefty yet achievable goal, and for corporations, staying ahead in the race to embrace a net-zero future requires constant market monitoring. To uncover new opportunities and the latest developments related to energy transitions, it’s essential to have a market intelligence platform that informs you of emerging trends and the most important happenings across the investment world.

Discover how AlphaSense can help you stay on the leading edge by starting your free trial today.

Our four-part HSBC series covers market-moving trends like urbanization, demographics, and inflation, so you can keep your finger on the pulse. Access the full webinar here: The Formula to Net Zero: Decarbonization, Hydrogen, and the Energy Transition.