The traditional expert network model began in the late 1990s, connecting researchers to a pool of industry experts. What initially started as a time-consuming process has since grown tenfold due to rapid innovations in technology, particularly artificial intelligence (AI).

Investment researchers are retiring traditional expert networks and incorporating powerful expert insights into their comprehensive research strategies. As industry applications for expert insights expand beyond its more traditional niches in investment and consulting, companies across a range of industries are leveraging the value of expert insights to refine their services and gain competitive advantages.

AlphaSense, a leading market intelligence platform, has evolved the way researchers access expert insights with an extensive expert transcript library and one-on-one call services. With the power of artificial intelligence and generative technology, users can now access Expert Insights in seconds.

As of July 2024, AlphaSense and Tegus have joined forces, disrupting the expert network landscape by bringing unparalleled access to even more insights and covering more industries and companies than ever before.

Below, we explore what traditional expert networks are and how industry experts have become more accessible through technological innovations.

Understanding Expert Networks

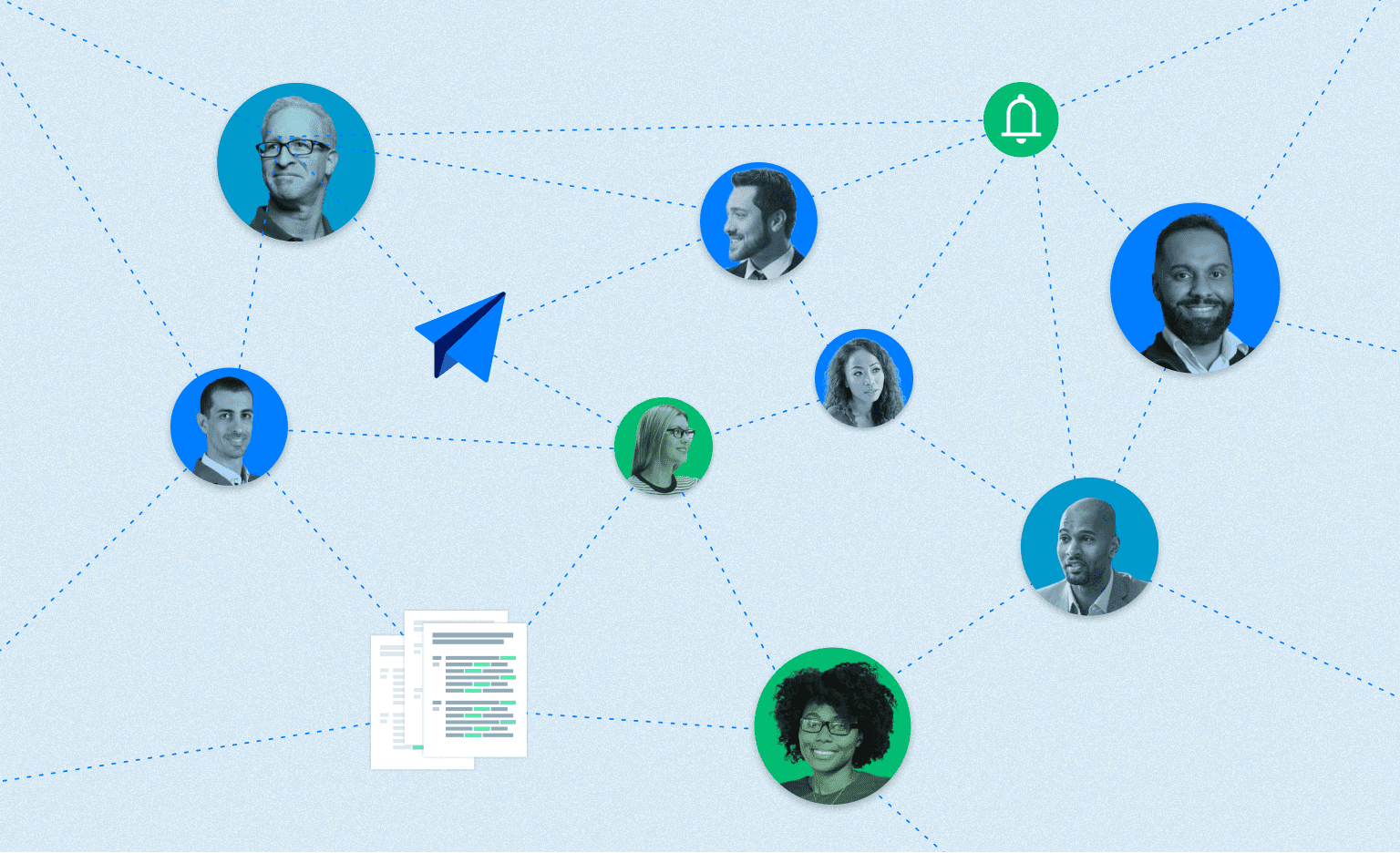

An expert network is a service that connects businesses, investors, and professionals with experts in various fields for consultations. These networks are essentially matchmaking services, pairing clients with experts who possess the specific knowledge they seek. The goal is to provide access to insights that are not readily available through traditional research methods.

Expert networks are used in a wide range of scenarios but most commonly by investment firms seeking deeper knowledge about potential investments, as well as consulting firms looking to provide specialized expertise to clients.

Typically, the flow of communication works like this: expert network firms build their networks to include a wide range of SMEs. When consulting or investment firms are in need of an expert consult, they reach out to the firm, which connects them to the right expert. The investment or consulting firm pays the expert network firm, which then compensates the expert.

When conducting primary investment research, timeliness is imperative to ensuring relevancy. One challenge of expert networks is the lengthy and often costly process of connecting researchers to experts before gaining access to critical information.

Expert network firms generally offer two pricing models for companies to access their resources. Subscription-based models work for firms that use expert networks frequently. They pay for a certain number of requests, often during a specific time period (ex: yearly). Transaction-based models are pay-per-use. This model is becoming less common as firms realize the necessity of integrating expert insights more deeply into their business models.

Accessing Subject Matter Experts

Industry experts typically work directly with companies across a wide range of industries. Therefore, experts typically represent an equally wide range of experience, backgrounds, and areas of expertise. Experts are generally executive-level professionals in their fields who have extensive experience with the research topic, company, or industry at hand.

Experts can come from various backgrounds, including academia, industry, and consulting. They offer expertise in everything from market trends and competitive landscapes to technical details and strategic advice. This access to specialized knowledge helps clients make informed decisions, mitigate risks, and identify opportunities.

In decades past, the recruitment of experts relied heavily on building and maintaining industry connections. The internet and the resulting worldwide digital connectivity of the 21st century have radically transformed this process. Today, firms rely heavily on junior employees to do the bulk of their research, scouring online databases and networks like LinkedIn for experts who fit client requests.

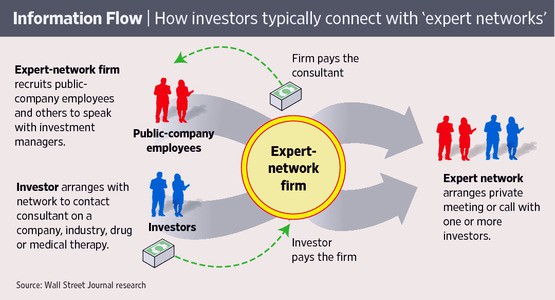

The speed and scope at which experts can now be found have shifted recruitment from a long game of outreach and cultivation to a more on-demand approach, leading to more specialized expertise and services for end clients.

In the image below, you can see how the model has changed over time since the infancy years of the expert network in the 1950s:

Leveraging Expert Calls

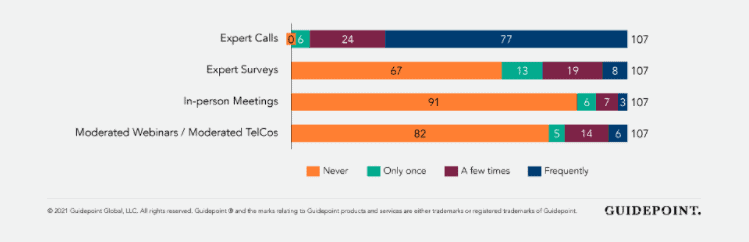

Expert calls are the most common way firms access expert insights. In a survey conducted by Guidepoint, an expert network firm, respondents overwhelmingly indicated that expert calls are their preferred method of research — with more than 75% stating they use calls frequently.

Expert calls are typically about 30-60 minutes long and are conducted by a research analyst with the right background and knowledge to ask the right questions and work with the expert to get the information the client needs. They are typically recorded and transcribed so the end client can access the insights directly whenever they want.

Expert transcript libraries, like AlphaSense, have become a reliable source of expert insights for firms and companies needing access to industry expertise, especially during times of extreme market volatility. AlphaSense offers a centralized, searchable database with thousands of transcripts and recordings of expert calls. Users can use customized search terms like expert name, company name, industry, topic, and more to find multiple expert insight calls, all relevant to their current needs. Ultimately, researchers can access call recordings and transcripts on-demand.

Many firms access expert networks for insights about specific projects and scenarios their company is handling, and in those cases, they would want to connect with an expert directly. However, expert call transcript libraries are becoming a hugely valuable resource in cases where firms seek more general insights and want to become more familiar with a particular company or industry over time.

For example, a private equity firm looking for target companies in the clothing retail industry may spend time in an expert call transcript library, reading as many calls as possible to familiarize themselves with trends, important players, and potential opportunities to pursue.

We know that firms seek out expert networks to access knowledge they don’t have internally, but what are the specific ways they leverage those insights? It mainly depends on the industry, but here are some common ways:

- Due diligence – Incorporating expert insight sources into due diligence processes to gain a better understanding of potential investments, deals, or other opportunities.

- Client services – Obtaining specialized knowledge and expertise that is not present in-house to provide optimal services to clients.

- Private market research – Working to understand a particular company or industry better.

- Compliance – Navigating the rules and regulations of a highly technical or regulated industry to ensure compliance standards are met.

The Evolution of the Expert Network Industry

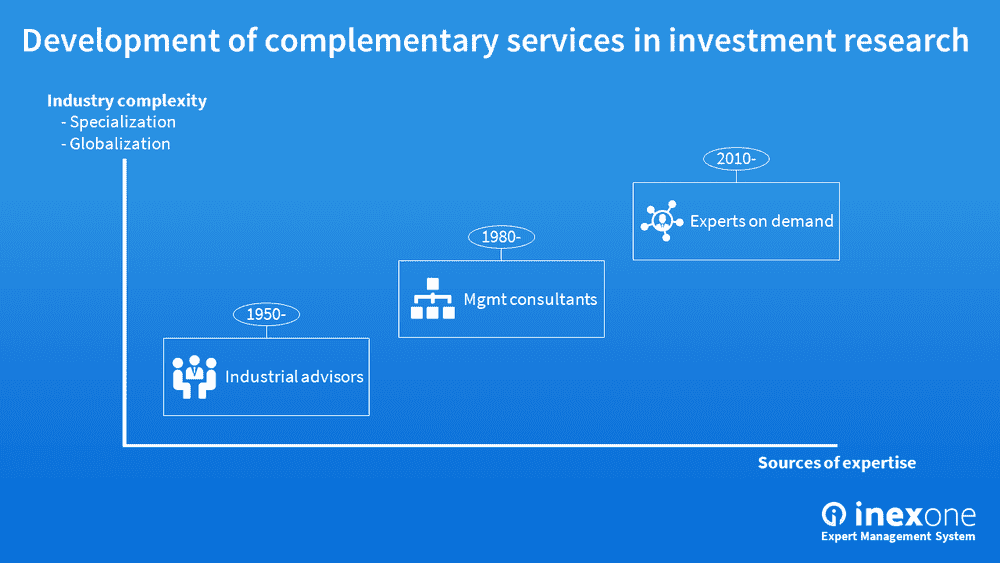

The expert network industry has grown significantly since its inception in the early 2000s. Initially, these networks were small and focused primarily on providing insights to hedge funds and private equity firms. As the demand for expert knowledge increased, so did the scope and scale of the networks.

Below, we explore the evolution of the expert network over the past few decades in greater detail:

Early 2000s: Formation and Growth

The early 2000s saw the formation of the first expert networks. Firms like Gerson Lehrman Group (GLG) pioneered the industry, primarily serving clients in financial services. These early networks focused on connecting investors with industry experts to provide insights that could influence investment decisions.

Mid-2000s to Early 2010s: Expansion and Diversification

During this period, the industry expanded beyond the financial sector. Companies across various industries recognized the value of expert networks for strategic decision-making. This diversification led to the inclusion of experts from a broader range of fields, including healthcare, technology, and consumer goods.

2010s to Present: Technological Advancements and Regulation

The past decade has seen significant advancements in technology, which have transformed the expert network industry. Platforms have become more sophisticated, utilizing AI and machine learning to match clients with experts more effectively. Additionally, the rise of virtual consultations has made it easier for clients to access expert insights from anywhere in the world.

Regulation has also shaped the industry. As expert networks became more prominent, confidentiality and insider trading concerns led to stricter compliance standards. Today, reputable expert networks adhere to rigorous guidelines to ensure the integrity of their services.

How AlphaSense Revolutionized the Expert Network Industry

While traditional expert networks may help connect business and investment researchers with industry experts, they are often time-consuming and costly before finally reaching critical insights. Technological innovations may make information more accessible than ever, but they cannot replace the value of high-level insights from human industry experts.

AlphaSense has an extensive universe of content, spanning the four key perspectives of research, as well as industry-leading automation and AI search capabilities. These features will enable investment researchers to better understand market sentiments, investment strategies, and financial forecasts, complementing the expert perspectives they already rely on.

Both the AlphaSense and Tegus platforms come with extensive libraries of high-quality research, as well as data and AI tools that allow users to extract the most value from the insights they find. The combined power of both AlphaSense and Tegus has revolutionized the expert network industry to provide industry-leading expert insights.

Leading AI Technology

Traditional expert networks are often time-consuming and can slow down your research process. When conducting primary investment research, fast time-to-insight is critical to making efficient and informed investment decisions.

With over ten years of investment in AI technology, AlphaSense’s award-winning AI aggregates an entire content universe to provide instant insights at your fingertips and improve your time to decision.

AlphaSense cuts the time spent on research from hours to seconds by streamlining the process of finding and accessing relevant transcripts. This efficiency boost accelerates the research process and allows analysts to focus on more strategic decision-making, thereby enhancing overall productivity.

By leveraging the following AI-driven research tools in the AlphaSense platform, users can quickly traverse our extensive expert transcript library and gain instant insights:

- Smart Summaries – Enables users to glean expert insights instantly with generative AI (genAI) summaries that capture the gist of any expert call transcript found within the extensive AlphaSense library in seconds.

- Smart Synonyms™ – Empowers users to expand keyword and thematic searches to deliver the most relevant expert insights by including all synonyms, excluding irrelevant results, and filtering out the noise.

- Sentiment Analysis – Allows users to identify and quantify levels of emotion around specific topics within expert transcripts by using a boolean operator to search for mentions of a specific topic in a positive, negative, or neutral light.

- AI Assistant – Alllows users to ask live questions and gain real-time answers with our AI-powered chatbot designed to summarize billions of data points to get you from question to answer faster.

- Enterprise Intelligence – Enables businesses to secure searches, summaries, and follow-up questions across their proprietary internal data and a vast repository of 300M+ premium external documents.

Combining AlphaSense’s powerful AI search technology and user-friendly navigation lets you easily capture insights from thousands of on-demand transcripts and find the information you need faster, so you never waste time or money on irrelevant sources.

Expert Insights

Dive into our extensive library of expert transcripts with audio to access proprietary insights from former executives, customers, competitors, and channel participants across a range of industries. Leverage on-demand access to our premium insights on thousands of public and private companies to create strategies that lead to fresh insights on new products, market sizes, and sector occurrences.

Additionally, our Expert Call Services offering allows you to quickly connect with experts for customized interviews to fill in any research gaps in your investment strategies. Gain access to more than one million pre-qualified expert profiles spanning all industries across the globe with seasoned subject matter experts—such as thought leaders, former executives, customers, partners, and competitors.

Tegus

Tegus has an extensive and fast-growing library of high-quality expert research, which includes coverage of 35,000+ public and private companies across TMT, consumer goods, energy, and life sciences sectors. Additionally, Tegus’ financial data offering, which includes financials, KPIs, and fully drivable models on more than 4,000 public companies, as well as its BamSEC self-serve solution to search and access securities filings, adds new and unique offerings to AlphaSense’s extensive product suite and datasets.

Gain instant access to over 4,000 global fundamental models and over 60 industry dashboards, all hand-built and sourced by sector-focused analysts. Unlike building your own models and comp sheets, using Tegus’s off-the-shelf models like Canalyst, dashboards, and data reduces your time spent on undifferentiated work, allowing you to compete on your ability to analyze the data, not aggregate it.

Transform how you work with public company data to simplify your quantitative investment research process. By streamlining access to SEC filings, earnings and event transcripts, financial documents, and more, BamSEC enables analysts to focus on what matters, save time, and do better work.

Uplevel Your Primary Investment Research with AlphaSense

As the investment research landscape evolves, the ability to quickly gather personalized insights from human experts remains at the heart of informed decision-making. As industries become more complex and data-driven, the demand for specialized knowledge will only increase.

Discover how AlphaSense combines the power of AI with granular insights from industry experts in our white paper, The Future of Primary Investment Research.

Ready to evolve your primary research with AlphaSense? Start your free trial today.