Across the investment industry, asset managers have felt the effects of lingering economic uncertainty. Over the last couple of years, macroeconomic factors—such as record high inflation, persistent interest rate hikes, market volatility, and geopolitical tensions—have created a difficult environment for both asset managers and investors.

The pressure to generate net positive returns on behalf of clients has become an increasingly challenging task. With lingering downtrends, and ongoing uncertainty, investment teams are at the mercy of these fluctuating conditions for the foreseeable future.

As resourcing and budgeting considerations remain top of mind for firms, it is also more important than ever to accelerate and centralize research findings and prevent the duplicity of work in order to remain competitive and ahead of the curve.

To competitively position portfolios in lingering downtrends, portfolio managers need streamlined intelligence and information in order to strategically pivot. Solutions such as AlphaSense provide the most comprehensive insights, market intelligence, trends, and expert opinions to remove the complexity and guesswork of conducting your research, and deliver efficiencies to your workflow.

Below we will explore the ways that AI and generative AI (genAI) tools are empowering asset managers to position their portfolios with confidence and efficiency, regardless of the state of the market.

Factors Creating a Challenging Market Environment

In the current environment, portfolio management teams are tasked with doing more, at a faster pace, and with less resources. The demand for outperformance and the need to lessen the impact of market volatility on portfolios is greater than ever. Managers are not only competing with each other and striving for client attraction and retention, but are also fending off macroeconomic headwinds.

One challenging headwind for asset managers has been in the form of interest rate hikes. Between March 2022 and July 2023, the Federal Reserve increased interest rates nearly a dozen times to their highest level in over 20 years. The Fed’s efforts to combat soaring inflation has sent waves through the investment community, resulting in market volatility, lackluster confidence, and flattened M&A activity. Lending is more costly than ever, and valuations are down as well.

Weak equity markets in recent years have also resulted in an ‘IPO winter,’ with the lowest number of companies going public in almost a decade. A growing trend among private equity firms has been the buy-back and re-privatization of companies that experienced unsuccessful IPOs and delivered lackluster performance since going public.

More than ever before, asset managers need a holistic market view of their portfolio to pressure test, conduct research, and carry out due diligence that ensures sound fundamentals, protects their investments, and captures potential opportunities during downswings.

The good news is that investment teams can leverage leading market intelligence tools to strategically position themselves and gain a competitive advantage even during times of uncertainty.

Strategic Positioning in Uncertain Times

Even in the most challenging market landscape, asset managers can proactively take control of their portfolio to navigate periods of instability.

With the right tools, they can stay ahead of industry trends and intelligence—including the companies they follow, competitive and market landscape, regulatory developments, news and thought leadership, and expert perspectives. Investment teams can also overcome the challenge of accessing and leveraging large amounts of external information and proprietary intelligence.

Quantitative Tools for Success

With AlphaSense’s cutting-edge AI technology, portfolio managers can monitor a company’s financial condition and assess their fundamentals by:

- Accessing Extensive Financial Information – Search a company’s ticker and run thematic searches across broker research and expert transcripts to quickly validate assumptions.

- Performing Time Series Data Modeling – Filter by SEC filings to access income statements, balance sheets, and more, and then drill down to see and export QoQ data for trend analysis.

- Extracting Key Performance Indicators (KPIs) – Filter by earnings calls and see KPIs highlighted in the panel. Click “Show History” to expand your view to all snippets related to that KPI over time.

- Streamlining financial auditing and workflow with our Table Explorer feature – This feature allows you to generate a historical lookback of a company’s financial performance (broken out quarterly or annually), quickly spot seasonality, and further understand growth trajectory.

Qualitative Resources for a Holistic Snapshot

With a simple keyword search, investment teams can uncover a wealth of documents, transcripts, broker research, and expert perspectives on any theme or topic that may be trending with current holdings in their portfolio, or be driving new position(s).

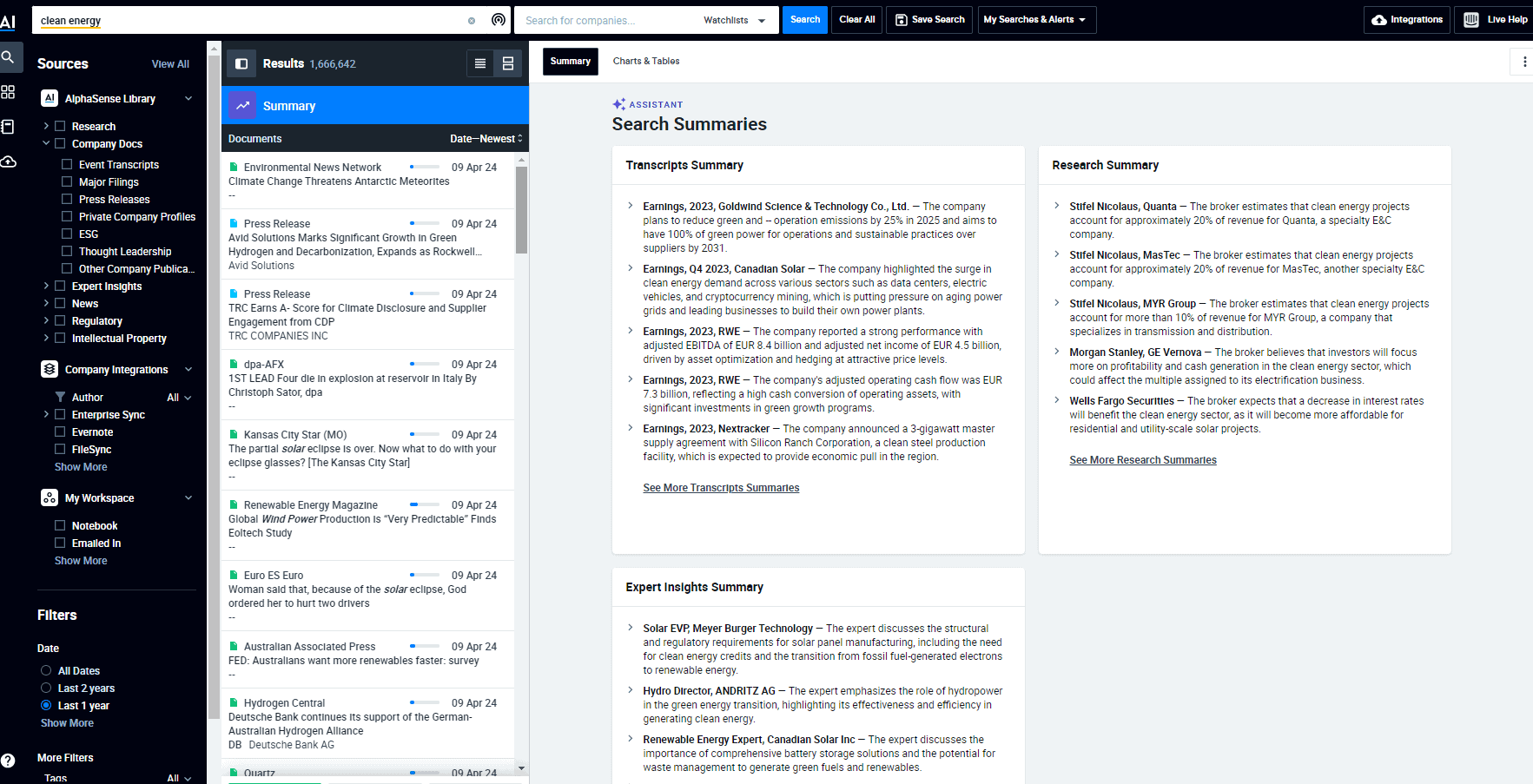

For example, a search for “clean energy” on the AlphaSense platform yields over 1.6 million documents, outlining the most current earnings transcripts, broker research findings, and expert insights relevant to that specific topic. Traditionally, aggregating this amount of research would be a tremendous undertaking likened to finding a needle in a haystack, and would be intensely time-consuming.

With AlphaSense’s Smart Summaries, paired with our newer Assistant feature, you can glean instant insights about trends at a particular company. Drawing from a premium content universe specifically curated for investment professionals, Smart Summaries generate insights across all four key perspectives: company documents, news, expert interview transcripts, and equity research.

Smart Summaries helps provide a holistic snapshot of:

- Analyst upgrades and downgrades, outlooks, and broader market sentiment

- What former employees, competitors, and channel partners are saying about the firm’s strengths, weaknesses, opportunities, and threats (SWOT analysis)

- Future guidance on critical KPIs for the company

A comprehensive qualitative snapshot of a prospect company is another powerful way to competitively position portfolios. AlphaSense Expert Insights provide meaningful perspectives from industry experts who have actually spent time at an organization. Their first-hand insights are unparalleled when it comes to culture, leadership styles, internal motivations and challenges, and other intangible factors that can potentially impact an investment placement.

Our Expert Insights offering includes:

- Expert Transcript Library – Over 40,000 expert transcripts in our library to access proprietary insights from former executives, customers, competitors, and channel participants across a range of industries. Leverage our premium insights on thousands of public and private companies to strategically position your portfolio.

- Expert Call Services – Access to more than one million pre-qualified expert profiles spanning all industries across the globe. Our Expert Call Services allow you to quickly and inexpensively connect with experts for customized interviews to fill in any gaps in your research.

Capitalizing on Proprietary Knowledge

In an age of dwindling resources, it is critical that investment teams can accelerate and centralize research findings and prevent the duplicity of work. The ability to capitalize on proprietary knowledge by pairing in-house research with the power of AI-layered technology to unlock insights and intelligence in real time is another way investment teams can competitively position their portfolios.

Often, investment teams are plagued with inefficiencies created by internal research and external content spread across disparate systems and teams working in silos. Critical components of your firm’s market intelligence—internal research, investment memos, client deliverables, strategy presentations, and meeting notes—are often fragmented and inaccessible, resulting in lost opportunities and inefficiencies. As a result, firms lose the ability to swiftly pivot in response to market conditions and struggle to maintain a competitive edge.

AlphaSense’s Enterprise Intelligence unlocks the value of your firm’s prized internal knowledge using generative AI. Our purpose-built AI searches, summarizes, and interrogates your proprietary internal data alongside a vast repository of 300M+ premium external documents to surface the most valuable insights. It allows you to automatically integrate and tag your PDFs, SharePoint documents, CIMs, Excel sheets, and more. You can also interrogate long documents with natural-language chat that goes straight to the source to surface the most relevant insights.

Gain the Competitive Edge with AlphaSense

AlphaSense’s leading AI-driven market intelligence platform equips you with the insights, premium sources, trends, and expert opinions to navigate the complexities and uncertainties of lingering downtrends. Paired with our Enterprise Intelligence solution, investment teams can unlock the value of their internal knowledge and seamlessly integrate it with the premium external sources and AI capabilities of our platform.

Learn how our industry-leading platform can help you sift through the noise, accelerate your research, and bring efficiencies to your workflow.

Take control during economic fluctuations and competitively position your portfolio—start your free trial of AlphaSense today.