Investments into global sustainable bonds will continue to skyrocket according to a recent report from the Climate Bonds Initiative, as “the green label continues to dominate global thematic debt issuance, ending the year with 56% of GSS+ volumes and lifting the cumulative total of the segment to USD2.2tn.”

However, Bloomberg forecasts a reduction in the issuance of sustainability-linked bonds due to lingering doubts about target credibility. Meanwhile, green bonds are poised to maintain their dominance in the GSSSB market, following a record-setting level of issuance in the first half of the year.

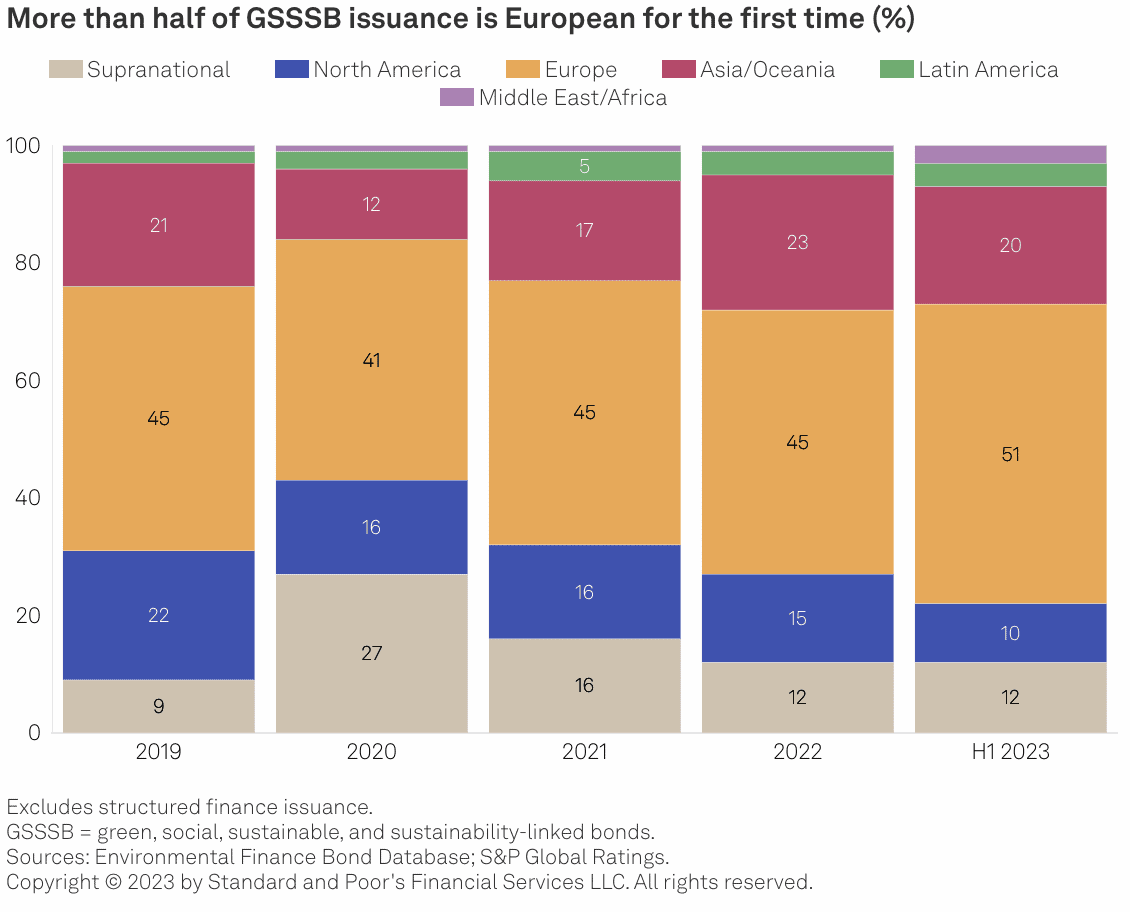

And when it comes to deciphering the competitive landscape, Europe is projected to uphold its position as the primary region for GSSSBs, while North American issuance may face challenges due to diminished supply and demand for the remainder of the year. Emerging markets, on the other hand, might experience a surge in issuance over the upcoming year.

But what laid the foundation for these conclusions? What do they mean long-term for the market? What can investors take away from these forecasts? Below, we answer these pressing questions and more.

A Recovering Market: GSSSB Issuance Will Nearly Match 2021 Levels

ESG Today stated GSSB issuance will resemble that of 2021, or roughly $900 billion to $1 trillion evaluation. What accounted for this significant change? Financial markets rebounded between April and June this year, helping various sectors make up for first-quarter issuance shortfalls in the global bond market.

In fact, GSSSBs are estimated to account for 14%-16% of total bond issuance in 2023, supported by non financial corporates, financial services, US and international public finance sectors, and sovereign issuance. During the first half of 2023, GSSSBs captured nearly 13% of the total global bond issuance and will continue to outpace traditional bond issuance for the rest of 2023, achieving its highest-ever percentage of global bond issuance.

By June 2023, cumulative GSSSB issuance since inception reached $4 trillion, indicating significant growth within a year of surpassing the $3 trillion mark. The second half of the year is expected to witness increased GSSSB demand, driven by key regions, focus on the energy transition, and supportive climate policies.

However, there’s a handful of potential factors that could hinder GSSSB activity, ranging from rising interest rates to recession risks in Europe and North America. Additionally, political factors (i.e., conflict in the Middle East, Ukraine-Russia war, China-US Semiconductor conflict, etc.) may limit GSSSB issuance, with some US states discouraging or disallowing certain public finance issuers from using GSSSB labels, which could affect issuers in other sectors.

Sovereign green bond issuance is also anticipated to increase notably, with $80 billion issued in the first six months, surpassing the total for the entire previous year. The Middle East has seen significant growth in green bond issuance, reaching $13 billion, exceeding its GSSSB issuance for the entire previous year.

On the other hand, sustainability-linked bond issuance continues to lag, and, consequently, is unlikely to reach 2022 levels. The projected issuance for the year is $33 billion, making up 6% of GSSSB issuance, down from 9% in 2021. Over 99% of sustainability-linked bond issuance in 2023 is from non-financial corporates, compared to 88% in 2022.

The bottom line: questions persist about the effectiveness of sustainability-linked bonds in motivating issuers to set ambitious sustainability targets, particularly related to ESG goals (i.e., Scope 3 greenhouse gas emissions). Further, Stakeholders have expressed concerns about whether the structural and financial features provide adequate incentives for issuers to meet these goals, given their indirect nature and association with value chains.

Regulations Promoting or Hindering Green Issuance?

Several global and national policies regarding GSSSBs took effect at the beginning of 2023—and their influence is likely to extend beyond next year. But while some regulations (i.e., the EU’s new voluntary Green Bond Standard) are not expected to significantly impact issuance, others clearly had an impact.

Issuers have encountered challenges in meeting the strict criteria and face limited data availability required to adhere to Green Bond Standard (GBS), potentially discouraging adoption. If issuers find it challenging to adhere to the GBS, they may opt to continue using other standards, such as the International Capital Market Association (ICMA) principles.

In contrast, experts forecast that China will witness an increased number of internationally aligned green bonds due to adjustments made to the country’s green bond standard in 2022, aligning it with international standards like ICMA’s Green Bond Principles.

In the first half of 2023, mainland China saw green bond issuances totaling $8 billion, with only Hong Kong surpassing that figure at $13 billion in the Asia-Pacific region. China and the EU are collaborating on a shared taxonomy to harmonize definitions of qualifying green activities, with the aim of facilitating cross-border issuances.

In the US, the Inflation Reduction Act has spurred investments in decarbonization. Companies are striving to capitalize on various tax credits for investments in green projects. Issuances from auto manufacturers, energy companies, and financial institutions have increased, driving investments in clean transportation, renewable energy, and energy-efficient projects.

Additionally, there may be an uptick in foreign companies relocating manufacturing and production facilities to meet minimum US production requirements. The finalization of the Securities and Exchange Commission’s climate disclosure rule may impact US issuance, although its implementation could be delayed beyond the end of 2023.

Understanding GSSSB Categories

Green, social, sustainability, and sustainability-linked bonds can be classified into two primary categories:

- Sustainability-linked bonds (SLBs): These are financial instruments whose characteristics can vary based on whether the issuer achieves predefined sustainability objectives.

- Use-of-proceeds bonds: These instruments allocate the net proceeds (or an equivalent sum) exclusively to finance or refinance new and/or existing eligible green and/or social projects. The three primary subcategories of use-of-proceeds instruments include:

- Green Bonds: Raising funds for environmentally beneficial projects, such as renewable energy, green buildings, and sustainable agriculture.

- Social Bonds: Raising funds for projects addressing specific social issues and striving to achieve positive social outcomes, like improving food security and access to education, healthcare, and financing, particularly for target populations.

- Sustainability Bonds: Raising funds for projects with both environmental and social benefits.

Global Outlook For the GSSSB Market

In the realm of global Green, Social, and Sustainable Bond (GSSSB) issuance, competition is brewing between nations.

For example, Europe, historically a frontrunner in the GSSSB field, is positioned to maintain its lead with anticipated growth in the second half of the year. The Middle East is on track to achieve its highest-ever annual issuance levels, while North America is facing a downward trajectory, with issuance volumes expected to be at their lowest since 2020.

What has laid the foundation for the current competitive landscape? Europe’s enduring dominance can be attributed, in large part, to its consistent issuance of green bonds. Surpassing the previous first-half record set in 2021, Europe achieved an impressive $269 billion in GSSSB issuance, marking the first time it accounted for over 50% of global issuance.

This remarkable growth was propelled by green bond issuance, including sovereign bonds, with countries like Germany ($15 billion), Italy ($13 billion), the UK ($10 billion), France, and Austria ($6 billion each) significantly increasing their volumes.

Additionally, the recent revisions to the EU Taxonomy underline Europe’s commitment to refining the definition of sustainable activities, focusing on those that yield the most substantial impact. Sovereign GSSSB issuance nearly doubled year-on-year in the first half of 2023. Financial sector issuance closely mirrored last year’s record level, standing at $73 billion. On the other hand, nonfinancial corporate issuance experienced a 10% decline year-on-year, although it remained the dominant issuer type in Europe, accounting for 30% of total volumes.

This decline can be partially attributed to the corporate GSSSB segment’s increased reliance on sustainability-linked instruments. The second half of the year may reveal whether Sustainability-Linked Bonds (SLBs) can make a resurgence through combined frameworks, where issuers commit to both use-of-proceeds and sustainability-linked debt within a single document. Expectations are high for continued growth in European issuance during the second half of 2023, with the possibility of setting new records.

Conversely, North America is suffering from a complexity of factors that are suppressing GSSSB issuance. Total issuance has significantly contracted since 2022, reaching a mere $55 billion thus far in 2023, which is slightly over one-third of the previous year and less than one-third of the 2021 values. During the first half of 2023, North America contributed a record low of just over 10% of global GSSSB issuance.

The current trajectory suggests that North American GSSSB issuance will continue at this subdued pace throughout the remainder of 2023, resulting in volumes considerably lower than those witnessed in 2022. Notably, in the first half of 2023, European issuance volumes exceeded North America’s by over five times.

The overarching decline in North America can be ascribed to the cautious stance adopted by US investors in the bond market, influenced by events such as the fall of regional banks like Silicon Valley Bank in March, the prolonged US debt ceiling debate, and certain states implementing policies that disrupt the supply and demand dynamics for GSSSB. It’s worth noting that 33% of US GSSSB issuance is within the US municipal bond market, aligning with social and environmental objectives.

Staying Ahead with AlphaSense

An increasing number of C-Suite executives, competitive strategists, and financial services professionals are implementing market intelligence and search platforms into their operations to find the answers they need and act swiftly. But not every market intelligence platform provides measurable ROI on its insights, which is why it’s important to select one that fits your needs.

AlphaSense’s AI search technology and extensive content library, which aggregates business documents from over 10,0000 content sources, allow our clients to remain at the forefront of their respective industries.

Start your free trial with AlphaSense today to see how our platform can keep you at the forefront of the power sector.