Two years ago, the low-carbon energy transition faced seemingly insurmountable headwinds.

Clean energy costs were on the rise and supply chain issues stemming from the COVID-19 pandemic and Russia-Ukraine war became roadblocks to progress. Further, after many years of easy access to cheap money—and consequently, capital for financing renewable projects—inflation rose to an all-time high of 9.1% within the US by July.

Additionally, the rise of the global energy crisis as well as oil and gas cutbacks from Ukraine and OPEC+ have curtailed nations from taking advantage of low energy prices many thought would last for years. This combination of economic volatility, geopolitical factors, and macroeconomic events have made global government and corporate net-zero targets that much harder to reach by 2050.

Yet even with all of these hurdles, 2022 still saw a remarkable acceleration in the energy transition. But as much as crucial progress has been made in the last four years, gains will be more challenging to come by in the next few QoQs. The future of the global energy transition may be murky but those invested in it are finding ways to prepare for the unexpected in 2024 and beyond.

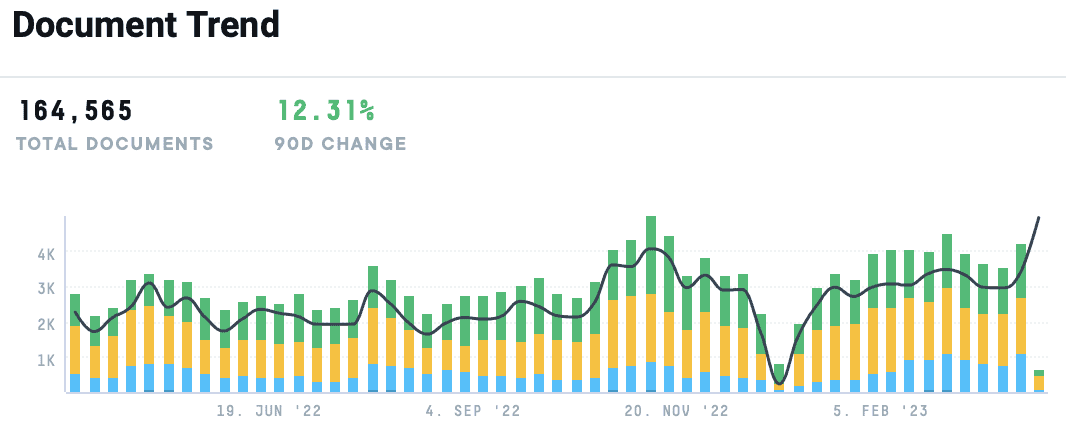

Caption: In the AlphaSense platform, we noticed a more than 12% increase in documents mentioning “energy transition” over the past 12 months

Caption: In the AlphaSense platform, we noticed a more than 12% increase in documents mentioning “energy transition” over the past 12 months

Using the AlphaSense platform, we dug into the trends that are set to define how nations and corporations will navigate the energy transition and its many challenges.

Energy Transition Trends and Outlook in 2024

In the trends we’ve identified, the main areas of focus are on the electrification of cars (a typical passenger vehicle releases about 4.6 metric tons of carbon emissions per year), leveraging AI and Big Data, and the shift to renewable energy sources. All of these have a discernible impact on people’s lives and are part of a larger cultural debate.

Capital is available (although it’s pricier than ever), and policymakers are acting on execution and delivery—setting the stage for a proactive 2024 and beyond with the Inflation Reduction Act (IRA), which is already driving international and domestic investments in renewable resources within the US. Ultimately, energy transition trends for 2024 will continue towards greater electrification and energy efficiency to combat the high prices and environmental impact of fossil fuels.

Likewise, efforts to reduce oil and other supply dependencies mean embracing new forms of electrical technology, such as electric vehicles and battery technology. Some jurisdictions are already drafting legislation to phase out the manufacturing of cars with petrol engines.

But what is the biggest driver of these trends? The rising cost of living and challenging economic conditions are yielding public demand for energy efficiency. Consumers are less tolerant of wasteful practices and sub-optimal infrastructures that drive up household energy bills and the cost of manufactured goods.

AI and Big Data

Big data and artificial intelligence (AI) are being touted for their potential to revolutionize energy efficiency. With AI, algorithms can analyze data to optimize efficiency, improve supply and energy demand predictions, and increase grid flexibility. In the transition to renewable energy sources, the analytical and predictive capacities of AI will be crucial in reducing greenhouse gas emissions.

According to the World Economic Forum, these improvements for efficiency will create more accurate forecasting of supply and demand. As the shift away from centralized modes of power generation and toward decentralized modes (smaller localized power grids such as solar farms) gains traction globally, coordinating the integration of these networks requires complex AI algorithms. The strategy here is to create an “intelligent coordination layer” that sits between the infrastructure of power consumption by homes and businesses.

Studies suggest that 93% of the environmental UN Sustainable Development Goals (SDGs) can be reached using AI-powered solutions. Moreover, AI-enabled use cases have the potential to help organizations reach as much as 45% of their Economic Emissions Intensity (EEI) reductions by 2030, depending on the industry. Three of the most promising ways in which AI will accelerate the energy transition are smart grids, optimized electricity consumption, and electric mobility.

“The fundamental drivers of superior performance and sustainable competitive advantage are changing. Growth opportunities are moving to new energy markets, including those created by technology disruption, and are expanding in areas related to generative artificial intelligence (AI), the energy transition, and low-emission technology, as well as in gene therapy, the metaverse, and quantum computing.”

– The Boston Group | Press Release

Electric Vehicles

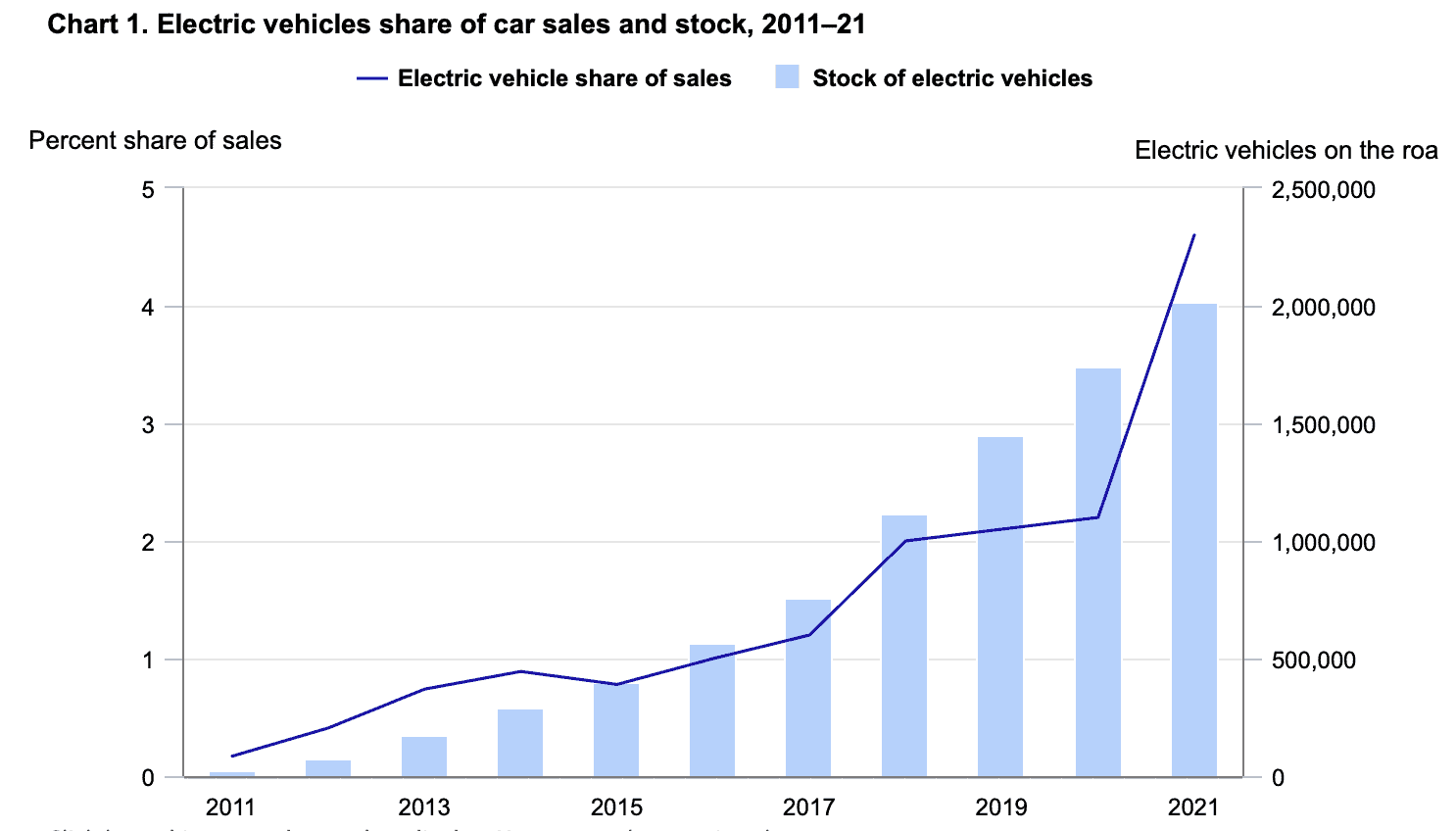

The market for electric vehicles (EVs) has skyrocketed over the past few years and is expected to grow rapidly over the coming decade. From 2011 to 2021, electric car sales in the United States increased from 0.2% to 4.6% of total car sales. While forecasts for the rate of EV adoption over the next decade vary widely among experts, based on government policies and the auto manufacturing industry, many forecasts expect a strong acceleration.

In fact, S&P Global Mobility expects EV sales within the United States to reach 40% of total passenger car sales by 2030, while more optimistic projections foresee sales surpassing 50% by 2030.

These forecasts are backed by the number of EVs already on the road, which jumped from about 22,000 to more than 2 million between 2011 and 2021. These four factors will continue to drive consumer demand for EVs over the next decade: environmental concerns, greater vehicle choice, improved battery capacity, and cost savings.

Green Hydrogen

Challenges in decarbonizing renewable supply chains have made hydrogen a suitable option for helping national leaders and C-Suite executives reach their net-zero pledges. Hydrogen can be produced from diverse domestic, zero-emission resources. Further, it generates renewable power in a fuel cell, emitting only water vapor and warm air— making it a promising option for growth in both the stationary and transportation energy industries.

However, hydrogen energy produced today is “gray,” meaning it’s derived from fossil fuels. High carbon dioxide levels are released into the atmosphere during production, making its impact on net-zero efforts technically negative. As such, gray hydrogen is seen mostly as a transitional renewable energy option.

The true end goal is green hydrogen. Produced through electrolysis (adding electricity to water to separate hydrogen and oxygen molecules), green hydrogen is an end-to-end “clean” renewable energy source. But right now, it’s an expensive resource—making cost the primary deterrent to its production and adoption at scale.

HSBC research predicts it will still take the better part of a decade for gray and green hydrogen costs to reach parity so that green can be the viable option of choice. However, business leaders are discussing its potential to expand markets and increase profits.

“Green hydrogen, I would say, energy companies that facilitate decarbonization, carbon. Capture and storage, we think, is one, economic, and two, rapidly growing in many of our core markets, particularly in Canada and the United States. So it’s absolutely an asset class that while we made our first step into it this past quarter, we do expect to grow and grow very rapidly and be a significant player in that market going forward.”

– Brookfield Renewable Partners LP | Q1 2022 Earnings Call

Bioenergy

Biomass or biofuel, and the energy that can be derived from it, could generate far more of the power than what is expended by society. Bioenergy is renewable energy derived from biological sources like wood, crops like sugarcane, or even waste materials—to be used for heat, electricity, or vehicle fuel. Thermal, chemical, and biological processes are used to create more efficient forms of fuel from these biological materials.

Already, bioenergy is a major pillar in reaching carbon neutrality commitments. For the Intergovernmental Panel on Climate Change (IPCC), bioenergy is fundamental in plans to restrict global warming from reaching 1.5°C this century while the International Energy Agency predicts that bioenergy will account for 30% of renewable energy production by 2023.

Today, bioenergy accounts for two-thirds of all renewable energy consumption worldwide, including renewable electricity and renewables for heating, cooling, and transport. Half of this consumption is in the form of traditional cooking and heating, mostly in developing countries. But modern applications of bioenergy could provide electricity generation, heating in buildings, transport fuels, or industrial uses—especially in sectors with limited renewable alternatives.

While bioenergy certainly has its pros, its cons include negative environmental, social, and economic impacts such as biodiversity loss, food insecurity, and deforestation. To effectively use bioenergy, minimizing these potential adverse impacts requires a strong policy framework tailored to local contexts.

Energy Transition Funds

In the wake of the SVB banking crisis, the process of sourcing for capital to finance energy investment in renewables and other transition assets is going through an evolution. Yet, demand for investing in this sector remains resilient—last year, the growth of “energy transition” funds saw proponents launching or closing under the watch of mammoth investment management firms.

For example, Brookfield closed its first Global Transition Fund with $15 billion of committed capital, making it the largest private fund in its history. Similarly, Blackstone’s fourth energy fund has a clear focus on renewable generation assets (with ‘Transition’ being added to the fund’s name after its initial launch).

2024 will see more of this activity, with further dedicated ‘green’ or ‘transition’ funds dedicated to investing in transforming carbon-intensive industries and climate-action projects in both OECD (Organisation for Economic Co-operation and Development) and non-OECD jurisdictions.

For investors, these funds have powerful incentives: strong ESG credentials, the opportunity to capitalize on the anticipated growth in renewable energy projects, and the emergence of new low-carbon technology on a global scale.

Critical Minerals

With demand for energy-efficient technology like EVs and battery energy storage systems rising, a global need for lithium-ion batteries will likewise soar over the next decade. Beyond rare earth minerals like lithium and cobalt, metals like aluminum and copper will be important for the energy transition. They’ll be critical in manufacturing solar panels and wind turbines to develop electricity networks and battery storage.

Currently, the European Commission is working on a Critical Raw Minerals Act, which intends to curb the EU’s reliance on China and Russia for the metals and minerals that are essential to the energy transitions. The proposal will identify strategic projects along the supply chain, from extraction and refining to processing and recycling, and will feed into the EU’s trade arrangements.

For the US, Biden’s IRA intends to spur further investment in the renewables sector and drive the building of critical infrastructure, but it also aims to assist national mining companies with producing the critical minerals necessary for the energy transition.

“Amid a historic decline in ore grades and in the face of rapidly rising demand, the search for new sources of metals for the clean energy transition risks exacerbating the planetary and social impacts of mining on land. According to the International Energy Agency, the production of energy transition metals will need to increase six-fold by 2040 to meet the world’s ambitious climate targets.”

– TMC The Metals Company Inc. LP | Press Release

Resurging Wind Investments

In 2023, wind energy investment declined by 35% primarily due to increased costs and permitting difficulties, according to a Deloitte survey. These challenges have resulted in record curtailments of wind projects in most independent system operators (ISOs). Among the 55 GW of delayed clean power projects, wind projects are experiencing the longest delays, averaging 16 months.

Moreover, wind energy project developments have been particularly affected by local and state restrictions—as the number of local restrictions for wind and solar projects increased by 35% from March 2022 to May 2023, according to a report by the Sabin Center for Climate Change Law at Columbia University.

But these aren’t the only headwinds the sector is facing: high capital requirements, lengthy project development and permitting timelines, and fixed power sales contracts are continuing to create difficulties. Developers who signed agreements during periods of low inflation are now grappling with higher financing costs and a 40% increase in equipment and construction costs over the past year.

Additionally, state policymakers may be hesitant to provide additional support that could raise consumer costs, leading to contract renegotiations and cancellations that have jeopardized half of the offshore wind pipeline. To keep projects on track, federal and state actions to expedite permitting, ease financing, and adjust incentives may be necessary.

Despite these challenges, 2024 is expected to mark a turning point for the wind energy industry as it adapts to new conditions. Key developments to watch include the launch of operations at Vineyard Wind in Massachusetts, the construction of the country’s largest offshore wind project in Virginia, and lease sales in Oregon, the Central Atlantic, and the Gulf of Mexico, with coordinated procurement efforts in three northeastern states also expected.

Stay On Top of the Energy Transition with AlphaSense

Global decarbonization is a critical goal for modern corporations, and staying ahead in the race to embrace a net-zero future requires constant market monitoring. To uncover new opportunities and the latest developments related to energy transitions, it’s essential to have a market intelligence platform that informs you of emerging trends and keeps you up to date on the most pertinent events happening around the world.

Discover how AlphaSense can help you stay on the leading edge by starting your free trial today.