Heading into the second half of 2024, venture capital investors remain cautious as they acknowledge persistent challenging dynamics in the landscape. While dry powder reserves have reached record highs, investors are wary about deploying capital with certain recent macroeconomic factors still fresh in mind.

Over the last couple of years, funding activity has been affected by nearly a dozen interest rate hikes by the Federal Reserve Bank, the highest record inflation in four decades, market volatility, and fading valuations. While dry powder experienced a run in 2021, venture capital investment in the U.S. declined nearly 30% in 2022, and continued to slump 40% in 2023.

Several months into 2024, deals, fundraising, and allocations continue to be down. Signs of optimism are emerging, however, as key economic indicators such as interest rate stabilization take stage to reduce inflation and curb market volatility.

With a current high reserve of $317 billion in dry powder, investors are keen to surface promising opportunities despite lingering stagnation.

Below, we explore the trends and themes shaping the venture capital landscape in 2024, and the ways investors can strategically position themselves for success.

6 Venture Capital Trends to Watch in 2024

- A record high ‘dry powder’ surplus and implications for deal activity

- Generative AI will continue to streamline workflows and drive efficiencies

- The competition for fundraising heats up

- Trending sectors seeing funding: IT, healthcare, and financial services

- Sustainable start-ups are gaining momentum

- Resurgence in IPO activity

‘Dry Powder’ Surplus

At the end of Q1 2024, dry powder reached a record-high surplus of over $300 billion. This figure—also known as uncommitted capital— reflects the remnants of booming fundraising in 2021 and 2022, and the halt in capital spend since that time, as well as a sign of economic conditions.

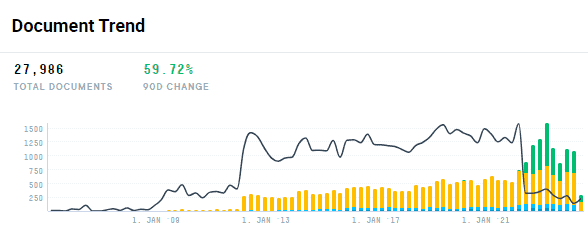

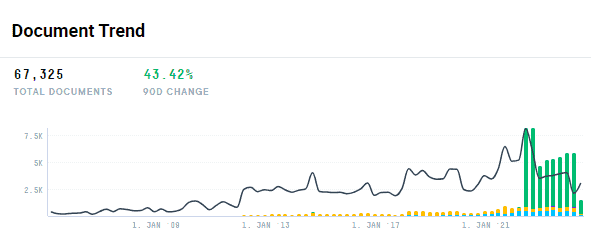

A search for “dry powder capital” on the AlphaSense platform shows a significant increase in document activity over the last 90 days, as this trend remains top of mind for VC investors. According to a recent EY survey, 93% of CEOs said they plan to increase or maintain investment in corporate venture capital funds in 2024, signaling an expanding pool of VC capital and potential offramp to M&A activity.

Ongoing economic stabilization, steady and potentially declining interest rates, and flattening inflation should serve as a catalyst for VC deals. Ideally, deals should pick up in this less volatile environment as investors feel more confident about deploying their surplus of unallocated capital.

The Transformative Effect of Generative AI

By 2025, it is estimated that more than 75% of venture capital (VC) and early-stage investor executive reviews will be informed using artificial intelligence (AI) and data analytics. This staggering statistic is representative of a transformative shift in the asset management space away from archaic research methods.

There is no doubt that generative AI has emerged as a powerful tool in the investment space. Traditional due diligence for start-up investors has historically been riddled with inefficiencies—tying up resources to sort through countless documents and copious amounts of data, and manually crafting market comparisons and performance. It is truly a ‘needle in a haystack’ exercise that is not only time-consuming but also offers limited visibility and lacks the complete picture.

Generative AI in venture capital streamlines workflows, reduces research and due diligence blind spots, and surfaces qualitative and quantitative insights to make data-driven decisions faster. The following are some key use cases:

- Financial Analysis: Automate the process of analyzing a start-up’s crucial financials. Algorithms can generate accurate and comprehensive financial reports, saving time and dramatically reducing the chance of human error.

- Market Analysis: A valuable tool for conducting market research, as it can analyze large volumes of market data, predict market trends, analyze customer preferences, and provide a snapshot of the competitive landscape.

- Forecasting Analysis: Analyze financial data to generate potential forecasts. Using historical financial data and market trends to train on, these algorithms can provide insights into future financial scenarios.

- Competitive Analysis: Conduct a comparative analysis of start-ups in the same space by assessing firms within the same industry and offering side-by-side assessments of their strengths and weaknesses to quickly pivot in the decision-making process.

- Risk Assessment and Management: A model’s training data can teach algorithms to generate risk models and identify potential risks, helping to assess and mitigate risks, improve decision-making, and ensure the stability of operations.

- Market Intelligence at Scale: GenAI has the potential to securely pair a company’s internal content with leading premium market content sources using proprietary large language models (LLMs) and genAI trained on both business and financial content.

The Fundraising Race

According to an outlook published by Wellington Management, distributions from VC funds dropped a staggering 84% from 2021 to 2023, further growing dry powder inventory and extending the allocation drought. Competition for fundraising will continue to be a trending theme among emerging companies in 2024.

Findings show that VC investors are no longer buying into the idea that good valuations alone drive good investments, and gone are the days of young founders that raced to raise $100 million of capital with scarcely-formed business models, no products or customers at launch, and short-term exit strategies.

Instead, investors will likely turn to innovative start-up companies with promising growth plans and strong leadership teams. Startups that survive the funding drought and succeed in securing allocations will be those with experienced, executive-level leadership and compelling customer-centric solutions.

These prospects are more likely to secure financing ahead of their more risky, underdeveloped counterparts. Investors are more discerning than ever with their capital, as a result of economic circumstances, but also the intrinsic high failure rate that is common with start-ups.

Sectors Leading Funding Activity

In Q1 2024, VC-backed deals totaled 3,205 in the US. While VC deals on the whole are down and hovering near historic lows, there is still notable activity—even some megadeals. The top three trending sectors—information technology, healthcare/biotech, and business and financial services—ushered in funding rounds over $100 million into 2024, providing optimism for a resurgence in deal activity.

The renewable energy sub-sector is also seeing promising activity. Generate Capital secured a $1.5 billion capital raise earlier this year to fund sustainable infrastructure projects. Other sectors seeing notable funding rounds since the start of 2024 include consumer services, industrials, and consumer goods.

Signs of optimism may not be premature after all, with venture funding in American and Canadian companies up 14% in Q1 2024.

Sustainable Start-Ups Gaining Momentum

Venture capital investors are increasingly setting their sights on sustainable and climate tech start-ups. One VC sustainability investor in particular set forth a plan to reduce 10% of global carbon emissions by 2035 by investing in 100×100 companies. These are sustainability start-ups designed to mitigate 100 megatons of emissions in ten years while generating $100 million in revenue.

As the world evolves to adopt sustainability more holistically, it is no surprise that many lucrative, purpose-driven enterprises have sprouted as a result. Sustainability has proven itself an evergreen investment theme rather than a passing trend. Just as ESG investing has long taken precedence with institutions and public companies, sustainability-focused investments are gaining momentum among VC investors as well.

From organizations that revolutionize soil health globally to promote agricultural sustainability, to companies that produce biodegradable plastic made from algae, sustainability-focused startups are garnering attention from VC investors both for their unique and innovative purposes, and for their potentially lucrative return on investment.

Resurgence in IPO Activity

The start of 2024 saw IPO activity at its lowest level since 2016 as a result of swelling interest rates, geopolitical tensions, and ongoing market volatility. With fundraising heating up, the market stands to break free from the ‘IPO winter’ and see a resurgence in activity.

In addition to investors chipping in late-stage funding, there is a backlog of venture-backed startups waiting for a liquidity event such as an IPO, according to EY. This may trigger a waterfall effect in terms of exit activity among both newly funded late-stage and primed startups.

Notable recent IPOs that fared long-awaited debuts to public markets include Reddit, Astera Labs, and Kyverna Therapeutics. In its first day of trading, Reddit’s shares soared 48%, nearly two and a half years after filing its original IPO. Astera Labs also debuted last month as the first VC-backed IPO of 2024, closing their first day of trading up 72%.

Outlook for Venture Capital in 2024

VC investors still have their work cut out for them in 2024, and will have to tread cautiously around macroeconomic factors and ongoing geopolitical situations that will pose challenges for the foreseeable future. Investors are keen on surfacing lucrative opportunities and deploying funding that has sat untouched for years.

Generative AI will continue to transform the way venture capital investors accelerate the due diligence process and surface opportunities quicker. By leveraging AI-driven automation and algorithms, investors can harness comprehensive insights and relevant data to make sound decisions with greater speed and confidence.

Competition for fundraising will continue heating up among startup companies in 2024. Investors are more selective than ever in committing capital to startups that have experienced leadership and compelling, customer-centric solutions to scale for long-term growth and viability.

Top sectors, including information technology, healthcare/biotech, business & financial services, and renewable energy have ushered in funding rounds over $100 million into 2024, providing optimism for a resurgence in deal activity. Sustainable startups are also gaining traction with VC investors for their innovative and potentially lucrative solutions.

There is also a potential for an IPO resurgence in 2024, driven by exit activity among both newly funded late-stage and primed startups. VC-backed companies recently experienced successful IPOs on the public market, bringing a wave of optimism for the landscape’s outlook.

AlphaSense Helps Venture Capital Investors Stay Ahead of the Curve

To stay ahead of the topics and trends making the greatest impact on the venture capital landscape in 2024 and beyond, you need a trusted resource that delivers intelligence and insights with the speed of the changing market.

AlphaSense is a leading market intelligence platform designed to help investment firms make faster, more confident decisions and revolutionize the way venture investors conduct market research. Venture capital investors can optimize their primary investment research by leveraging AlphaSense to gain quality expert insights, an integrated workflow, faster time to insight, and more comprehensive due diligence.

Want to learn about how AlphaSense is empowering venture capital firms to accelerate their research efforts? Read our case study with Innovation Endeavors, an early-stage venture capital firm, to see how our platform streamlines its research process by serving as a single portal for insights, both internal and external.

Don’t miss out on the next big opportunity. Start your free trial today and accelerate your investment research.