AlphaSense vs Factiva: Key Differences

AlphaSense

AlphaSense is a secure, all-in-one market intelligence and AI search platform built for robust financial and market research. This tool is ideal for firms looking to accelerate research, enhance productivity, and gain a competitive edge using AI and automation.

Consistently ranked as an industry leader by TrustRadius and G2, AlphaSense was also recognized by Forbes as a top 50 AI company in 2023.

Here’s how AlphaSense helps you extract insights and access both high-value internal and external content with the power of artificial intelligence—all in one single platform.

AlphaSense and Tegus: Better Together

As of July 2024, AlphaSense and Tegus have joined forces, bringing unparalleled access to even more insights, and covering more industries and companies than ever before.

Both platforms come with extensive libraries of high-quality research, as well as data and AI tools that allow users to extract the most value from the insights they find.

Tegus has an extensive and fast-growing library of high-quality expert research, which includes coverage of 35,000+ public and private companies across TMT, consumer goods, energy, and life sciences sectors. Additionally, Tegus’ financial data offering, which includes financials, KPIs, and fully drivable models on more than 4,000 public companies, as well as its BamSEC self-serve solution to search and access securities filings, adds new and unique offerings to AlphaSense’s extensive product suite and datasets.

Extensive Out-of-the-Box Content Library

AlphaSense comes equipped with an extensive collection of external market intelligence and research that comprises over 10,000+ private, public, premium, and proprietary data sources. Our platform is purpose-built to speed up your team’s access to information on all the relevant topics and companies driving your market.

Our external content sources include news, trade journals, and company documents (including SEC and global filings). Beyond that, AlphaSense also gives users access to two proprietary and premium content offerings. These are:

- Expert Insights – tens of thousands of expert transcripts featuring one-on-one calls with competitors, customers, professionals, industry experts, and former and current executives. You can also request bespoke 1:1 expert calls for less.

- Wall Street Insights® – A collection of broker research from Wall Street’s leading firms, covering global sector themes, industries, and companies from 1,000+ sell-side and independent firms, available within the AlphaSense platform. Research professionals can even preview the contents of a broker report, saving them wasted time and money on potentially fruitless research.

Designed for enterprise-level organizations, AlphaSense also enables you to upload, index, and search through your own content using our smart search technology. That includes:

- Internal research, notes, and presentations

- Reports from industry and market intelligence providers

- Newsletters, web pages, and RSS feeds

- Meeting and conference notes

AI Search & Summarization Technology

AlphaSense comes with the following industry-leading AI capabilities:

Smart Synonyms™

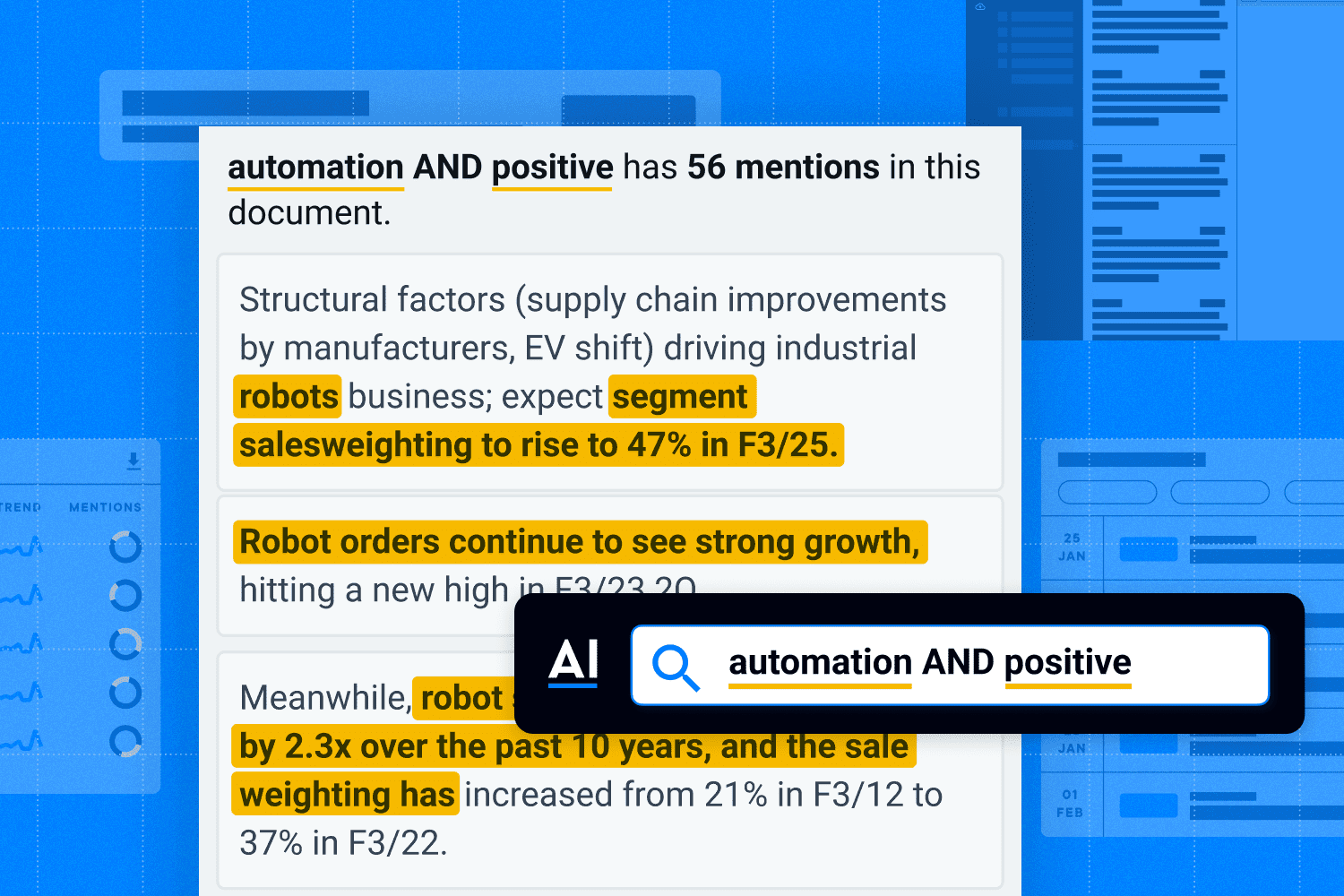

Smart Synonyms™ is a proprietary AlphaSense feature that uses AI technology to recognize both the keyword and search intent behind any query.

AlphaSense uses advanced algorithms to eliminate noise from your search (i.e., content with matching keywords but ultimately irrelevant to your search objective) and leverages variations in language to pinpoint the exact information you need.

Sentiment Analysis

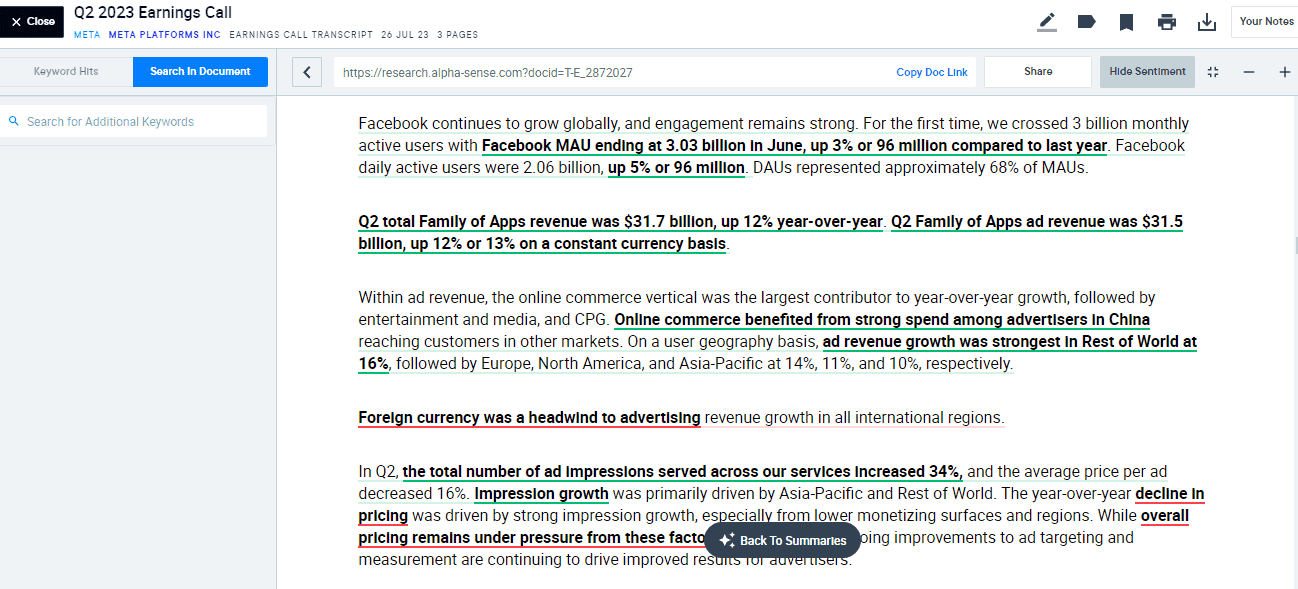

Sentiment analysis, a natural language processing (NLP)-based feature, parses through content and identifies nuances in the tone and subjective meaning of text. It then uses color coding to help readers identify the document’s positive, negative, and neutral sentiments.

This technology assigns each search term a numerical sentiment change score to help users track any slight change in market sentiments across time. Users can take advantage of these historical change scores to make better-informed investment decisions and improve their risk management strategies.

Generative AI

Unlike other consumer-grade generative AI (genAI) tools trained on publicly available data, AlphaSense takes an entirely different approach. Our industry-leading suite of generative AI tools is purpose-built to deliver business-grade insights and leans on 10+ years of AI tech development. Our proprietary AlphaSense Large Language Model (ASLLM)—trained specifically on business and financial data—matches or beats the leading third-party LLMs over 90% of the time.

Our suite of tools currently includes:

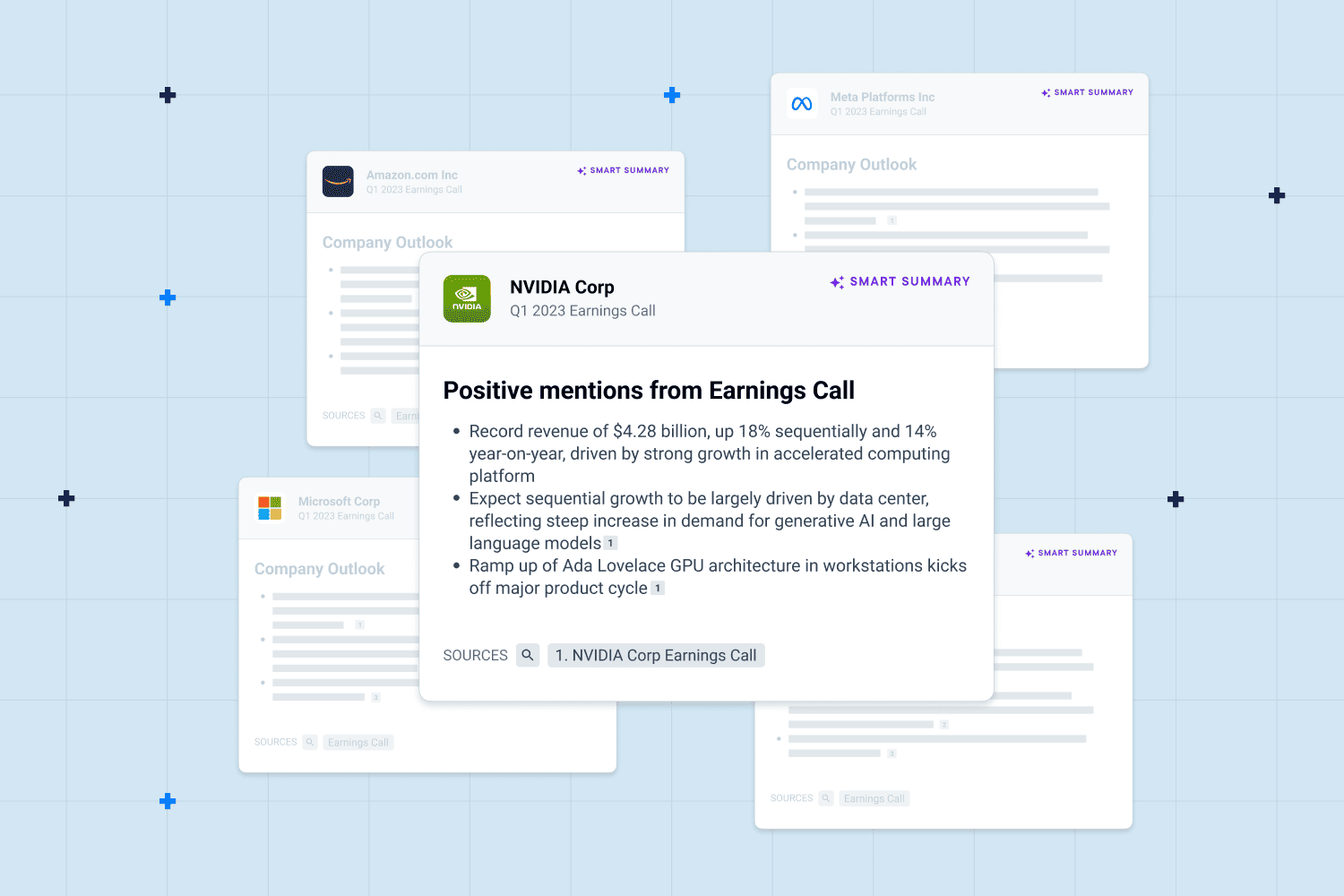

- Smart Summaries – this feature allows you to glean instant earnings insights—reducing time spent on research during earnings season, quickly capture company outlook, and generate an expert-approved SWOT analysis straight from former competitors, partners, and employees

- Enterprise Intelligence – a first-of-its-kind offering that delivers AlphaSense’s AI-powered search and summarization capabilities to customers’ internal organizational knowledge.

- Generative Search (in beta) – a generative AI chat experience that transforms how users can extract insights from hundreds of millions of premium content sources

Integration Capabilities

Even the best companies fall victim to silos. But forward-thinking organizations know to avoid this pitfall by leveraging the advanced collaborative tools found in modern market intelligence platforms.

Seamlessly Integrate with Other Tools

AlphaSense works with the apps and tools you already use to help you be more productive with less effort. Connect with integrations to Box, Sharepoint, OneNote, or leverage our API suite to securely upload your proprietary content.

APIs

API capabilities provided by your market intelligence platform allow you to build your own tools to get maximum ROI from the content sources you can now access. For example, AlphaSense offers the following APIs for users to leverage our proprietary technology and content across other parts of their strategies:

- Alert Feed API: Real-time data feed based on saved searches & alerts.

- Search API: Solution that provides real-time, programmatic access to AlphaSense search infrastructure to query and filter the database of documents from a third party domain.

- Ingestion API: Integration, processing, and enrichment capabilities for internal or custom content sets.

- AI API: Enrichment capabilities that enable company recognition, sentiment, themes and KPI services for internal content.

Monitoring, Analysis, and Collaboration Tools

AlphaSense is designed to help users find insights faster. In order to do that, we offer a number of tools that extend beyond search and summarization to help users accelerate research tasks.

- Customizable Dashboards create a centralized information hub for monitoring key companies and themes, while tailored real-time alerts provide real-time updates.

- Smart Alerts monitor the most important themes, companies and market updates with weekly, daily, or real-time alerts.

- Notebook+ and commenting features increase collaboration and help teams manage and share insights more effectively. Notebook+ also includes templates that streamline the process of creating deliverables, as well as folders for better content organization and retrieval.

- Table Tools allow you to streamline your quantitative analysis by enabling you to export modeled time-series data on company financials.

- Image Search allows you to discover insights buried in charts to quickly capture data without reading through pages of documents.

- Snippet Explorer allows you to effortlessly look at any topic or theme and all its historical mentions in a single view.

- Our Black-lining feature allows you to automatically identify any QoQ changes in SEC filings

- Automated Monitoring allows you to set up real-time alerts that send instant updates on any relevant market movements, news, emerging trends, and competitor activities. We also generate snapshots of companies and topics regularly that keep you ahead of the curve with actionable insights.

AlphaSense Pros

- Extensive content universe that spans the key perspectives of market research, including broker research, expert calls, company documents, news & regulatory sites.

- Incorporates AI search technology, machine learning, and sentiment analysis

- Generative AI features, like Smart Summaries, for earnings and image search

- Automated and customizable alerts

- All-in-one research platform

- User-friendly interface

- Internal messaging and collaboration features

- Support for APIs and integrations

- Supports enterprise-level organizations and teams

- Enterprise-grade data production complying with global security standards

- Excellent customer support team, including 24/7 chat with product specialists, a live Help button on the website, and regular live AlphaSense Education webinars

AlphaSense Cons

- Visualization tools are limited at this time

- Collaboration tools are limited to users with AlphaSense licenses

Factiva

Access to Factiva gives users a massive archive of over 33,000 premium trusted sources, including global newspapers, magazines, reports, publications (such as The New York Times, The Financial Times, Reuters, and the Wall Street Journal).

Factiva is a rich source of business news, trade reports, press releases, historical equity stock quotes, market indexes, and journals. It also provides users with government data, information on potential global trends, politics, and events.

Factiva users can take advantage of the database to perform business functions such as:

- Conducting competitive intelligence

- Data mining and advanced analytics

- Corporate communications and media monitoring

- Sales intelligence and business development

- Application development

- Customer engagement and marketing

- Conducting research and strategy

Factiva provides access to public and private company profiles, financial data, and documents—while making it easy for users to share this information internally. The platform also allows users to perform advanced searches and filter information using smart indexing tools.

Factiva’s direct relationship with Reuters and Dow Jones & Company makes it a valuable tool for companies looking for a media intelligence tool. It helps users track the latest news updates in specific industries or companies and provides access to a wide breadth of quality media content.

However, Factiva has significant limitations in its content sources and may not be suitable for users looking for a full-scale research solution. Without access to premium and proprietary content sets like broker reports or expert transcripts, it can be challenging to gain a complete view of a market, industry, or trend. Additionally, Factiva does not utilize AI in its platform, technology that is often instrumental in saving time and money and accelerating research practices.

Factiva’s key use cases include:

- Media monitoring and corporate communications

- Sales funnels and business development

- Competitive intelligence

- Application development

- Advanced analytics and data mining

- Business development and sales intelligence

- Customer engagement and marketing

Factiva Pros

- Has access to over 33,000 news archives and sources worldwide with robust international news coverage

- Great for media monitoring and intelligence

- Supports third-party integrations and APIs

- Provides detailed company information, including financial data

- Supports collaborations and newsletters

- Customizable dashboard and alerts

- Robust search and filtering tools

- Trend tracking and news sentiment analysis

Factiva Cons

- Sometimes displays duplicate news and report entries

- Does not support simultaneous logins

- Links created inside the Factiva platform cannot be accessed outside of it

- Lacks AI search capability to optimize searches

- No generative AI functionality

- No broker research, expert calls, or ESG reports available

- Data is not always accurate

- Functions more as a media intelligence tool, not a robust market intelligence tool