The expert network industry is constantly evolving—it has grown to $1.5 billion in the last few years and is set to continue expanding. With various providers, expert networks can be used by financial firms, hedge funds, large corporations, or business individuals to gain in-depth perspectives and make more informed business decisions.

Expert networks have become indispensable tools for professionals across industries, offering direct access to expert insights, market intelligence, and real-time data to inform decision-making. These firsthand perspectives are a critical addition to secondary research. Some expert network platforms are equipped with artificial intelligence (AI) capabilities that enable you to accelerate and streamline your research process, while others are more traditional in their offerings.

Tegus, AlphaSense, and Third Bridge are three prominent platforms in this space, each serving unique needs within the market. While all three platforms aim to connect users with expert knowledge, the differences in their approaches mean that they can serve different use cases.

As of July 2024, AlphaSense and Tegus have joined forces, bringing unparalleled access to even more insights and covering more industries and companies than ever before.

This guide compares the popular expert transcript platforms—Tegus (now part of AlphaSense) and Third Bridge—analyzing their use cases, strengths, and weaknesses. We also discuss how AlphaSense’s AI-based market intelligence research solution strengthens Tegus’ platform and how their combined value compares with Third Bridge.

AlphaSense and Tegus: Better Together

Both AlphaSense and Tegus platforms come with extensive libraries of high-quality research, as well as data and AI tools that allow users to extract the most value from the insights they find.

Tegus has an extensive and fast-growing library of high-quality expert research, which includes coverage of 35,000+ public and private companies across TMT, consumer goods, energy, and life sciences sectors. Additionally, Tegus’ financial data offering, which includes financials, KPIs, and fully drivable models on more than 4,000 public companies, as well as its BamSEC self-serve solution to search and access securities filings, adds new and unique offerings to AlphaSense’s extensive product suite and datasets.

Meanwhile, AlphaSense has an extensive universe of content, spanning the four key perspectives of research, as well as industry-leading automation and AI search capabilities. These features will help Tegus customers gain a deeper understanding of market sentiments, investment strategies, and financial forecasts, complementing the expert perspectives they already rely on.

Here’s what each platform brings to the equation to empower clients to make more informed decisions with confidence:

AlphaSense

AlphaSense is a leading all-in-one market intelligence platform and smart search engine. It’s purpose-built for research and business experts—ranging from analysts and financial researchers to corporate professionals—who want to leverage a qualitative research strategy driven by proprietary AI technology and automation.

Financial professionals rely on AlphaSense to tap into over 10,000 premium sources of information, including trade journals, SEC filings, and company filings. Additionally, AlphaSense offers access to broker research and an expert call library, which provide deeper insights into companies and markets. These additional resources are available through two distinct AlphaSense content sets:

- Expert Insights – Tens of thousands of transcripts of one-on-one calls with industry experts, customers, professionals, competitors, and former and current executives, available as an add-on to the AlphaSense package.

- Wall Street Insights® – A collection of broker research from Wall Street’s leading firms, covering global sector themes, industries, and companies from 1,000+ sell-side and independent firms, available within the AlphaSense platform. The best part? Research professionals can preview the contents of a broker report, saving them wasted time and money on potentially fruitless research.

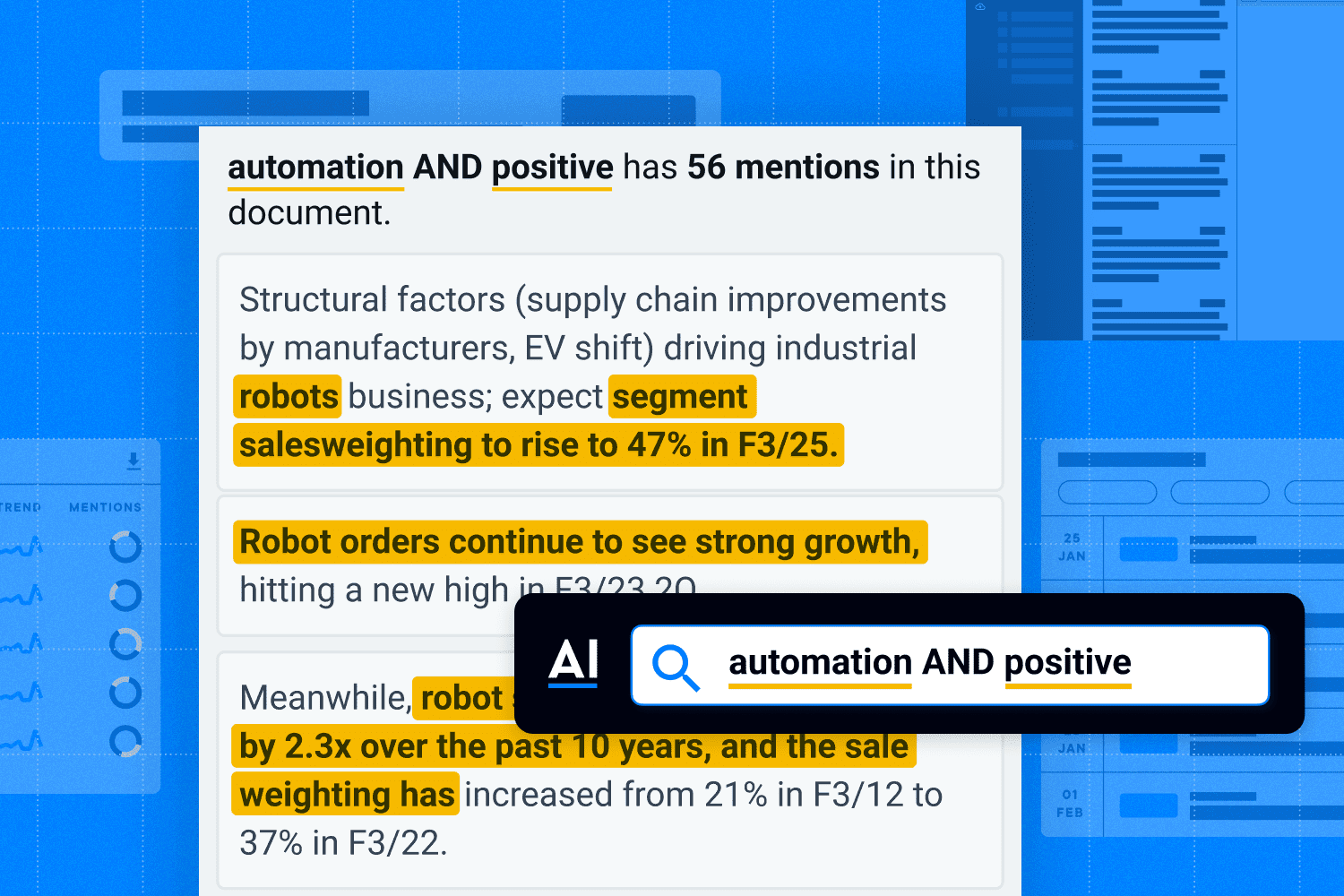

Unlike other research tools, AlphaSense integrates smart search functionality directly into its platform, enabling users to find everything they need for their research without the hassle of switching between multiple tabs. AlphaSense search also includes additional features such as:

Smart Synonyms™

Smart Synonyms™ technology is an AI-supported feature that can recognize both the keywords and search intent behind a query.

AlphaSense utilizes advanced algorithms to filter out irrelevant content from your search—such as results that match keywords but don’t align with your specific objective—and utilizes language variations (e.g., “impact investing” vs. “ESG investing”) to precisely identify the information you need. The AI-powered search functionality makes it easy to locate the exact documents and excerpts most relevant to your query, freeing up time and energy for more strategic tasks like analysis.

Sentiment Analysis

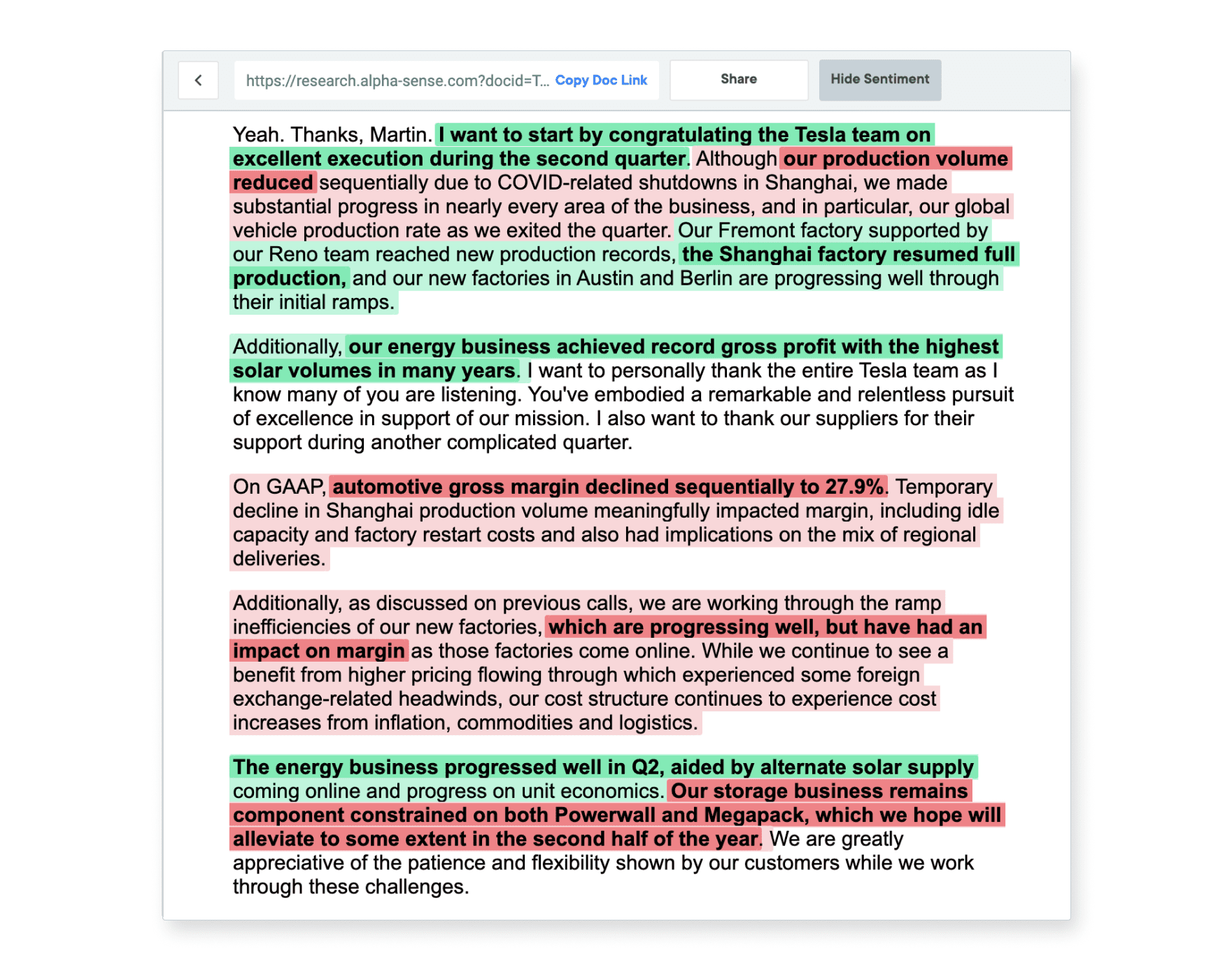

AlphaSense utilizes natural language processing (NLP) in its sentiment analysis technology to detect variations in a text’s tone and underlying meaning. The platform then uses color coding to help readers easily identify positive, neutral, and negative sentiments within documents.

This award-winning technology assigns a numerical sentiment change score to each search term, allowing users to track subtle changes in market sentiment over time.

Expert Insights also enables users to quickly detect sentiment shifts in expert interviews, providing insights that go beyond surface-level commentary. The combination of these features can be leveraged to make more informed investment decisions and enhance risk management strategies.

Smart Summaries

Unlike other generative AI (genAI) tools that are focused on consumer users and trained on publicly available content across the web, AlphaSense takes an entirely different approach. Designed specifically to support major business and financial decisions, our latest Smart Summaries™ feature builds on over a decade of AI technology development and draws from a carefully curated collection of high-quality business content.

With Smart Summaries™, you can instantly access earnings insights—saving valuable time during earnings season—quickly grasp a company’s outlook, and generate an expert-approved SWOT analysis based on input from former competitors, partners, and employees

Integrations and APIs

It’s becoming the industry standard for many market intelligence platforms to integrate internal content that includes both structured and unstructured data, but it’s crucial that this content is indexed and readily accessible. Additionally, a market intelligence platform should enable the upload of new external content sources (such as RSS feeds or web content) so that you can use the platform’s analysis tools to extract relevant insights.

AlphaSense offers integration with popular programs like OneNote, Sharepoint, and Evernote, facilitating seamless collaboration across your organization and boosting team productivity. It also allows you to search across all internal and external company content to uncover key insights, with its proprietary AI technology catching what other platforms may miss, all in a secure and automated manner.

Automated Monitoring

Rather than spending hours manually monitoring, AlphaSense provides real-time alerts to keep users informed about trending topics, companies, and industries of interest. Users can also take frequent snapshots of multiple companies within the AlphaSense platform, ensuring they stay connected with the most crucial insights, news, and market changes they need to be aware of.

Exceptional User Experience

AlphaSense is designed to integrate seamlessly into a user’s processes and workflow. Beyond its intuitive, user-friendly interface for displaying data and information, it enables professionals to export essential data to their mobile devices or PCs. AlphaSense also offers outstanding customer service, with product specialists available 24/7 to assist with searches—support that users find invaluable in streamlining their workflows.

Tegus

For investors who spend too much time manually searching, parsing, and aggregating data from disparate sources, the Tegus platform reinvents the investment research process so you can compete on your unique ability to analyze data correctly and make great investment decisions. The Tegus platform gives investors the fastest way to learn about public and private companies, and delivers the most critical content and data on a unified platform experience, all for a single software license.

Unlike legacy research methods, the Tegus platform gives investors:

The fastest way to learn about public and private companies – Whether getting up to speed or performing deeper diligence, investors need to quickly understand a company’s business model, drivers, and so much more. Tegus helps this process get done in minutes instead of days.

The most critical content and data on a single platform – The only solution with expert research, robust qualitative content sets, and key financial data in one place. Don’t settle for siloed systems and fractured data sets that slow you down.

A single software license to drive value and consolidate research costs – Tegus provides simple platform pricing so you don’t get nickel-and-dimed for those high-value datasets or powerful workflows. It’s all included.

Here are some of the main features Tegus offers, now as part of AlphaSense:

Tegus Expert Transcripts

Tap into a unique, powerful set of expert perspectives through 1:1 expert calls, panel calls, management checks, and the deepest and fastest-growing library of expert call transcripts on the market. With over 100,000 expert transcripts and growing, you can discover unique perspectives faster than ever. The Tegus platform offers the largest curation of public and private company transcripts, coupled with AI-powered functionality, to easily find, sort, and surface powerful insights.

Tegus Expert Call Services

Connect live to the most relevant experts to fit your unique research needs. Unlike other expert networks, Tegus’ call services deliver curated quality experts—fast, without the markup.

Company Perspectives (BamSEC)

Make quantitative investment research easier by transforming how you work with public company data. By streamlining access to SEC filings, earnings and events transcripts, financial documents, and more, BamSEC enables analysts to focus on what matters, save time, and do better work.

BamSEC enables users to search across multiple companies and SEC filings. Customers can use these documents to perform due diligence on companies and explore performance metrics efficiently.

Using the tables on BamSEC, users can explore past filings, create models, and benchmark company performance, all in one place, without needing to pull up individual filings to manually track a company’s metrics.

Financials and Metrics (Canalyst)

Gain instant access to over 4,000 global fundamental models and over 60 industry dashboards, all hand-built and sourced by sector-focused analysts in Vancouver. Unlike building your own models and comp sheets, using Tegus’ off-the-shelf models, dashboards, and data reduces your time spent on undifferentiated work, allowing you to compete on your ability to analyze the data, not aggregate it.

AskTegus

Tegus’ most recent AI innovation, AskTegus, is an AI-powered chat experience that allows investors to quickly cut through the noise and get the insights they need. AskTegus creates a super-charged analyst, giving users the ability to sift through Tegus’ extensive database—the largest investor-led transcript library —and uncover insights within seconds and make better decisions with more confidence.

Compliance

Tegus’ leading compliance framework helps ensure your research is SEC-compliant and implements transparent checks and guardrails so you can make better investment decisions. Tegus’ powerful platform and team of experienced compliance professionals use the latest technology and rigorous policies to prevent and detect potential risks or violations. Every expert call transcript is pushed through a multi-layered compliance review process that deploys proprietary AI and a team of highly trained specialists to identify and remove potential confidential information or MNPI.

Tegus allows customers to search, explore, and detect potential compliance risks or violations. The platform uses over 40 compliance experts to ensure all calls meet SEC, FINRA, and EU regulations without creating conflicts of interest or other potential violations.

Using Tegus’ internal compliance tools, users can manage company-specific protocols and their team’s Tegus activity in expert calls and resulting transcripts.

Pros of AlphaSense and Tegus:

- Extensive content universe with 10,000+ premium sources of information

- Access to SEC and company filings

- Large library of experts and expert call transcripts

- Ability to set up monitoring tools and alerts

- Ability to annotate and comments to call transcripts

- All-in-one access to the four key perspectives of market research

- Smart AI-powered functionality that helps streamline the research process and ensures you never miss a critical insight

- Powered by generative AI features that accelerate and enhance research

- Integration with commonly-used programs like OneNote, Sharepoint, and Evernote that enable better team collaboration and productivity

- User-friendly interface and exceptional customer service

Cons of AlphaSense and Tegus:

- Visualization tools are limited at this time

- Collaboration tools are limited to users with AlphaSense licenses

Research professionals appreciate AlphaSense for its vast content universe and advanced search capabilities that allow users to conduct comprehensive research and uncover valuable insights. With a unified integration of various data sources and a seamless user experience, AlphaSense is a one-stop solution for market intelligence.

Learn more about our scalable pricing options by visiting our pricing page.

Third Bridge

Third Bridge is a private research expert network firm that offers unique insights and analysis to asset managers, corporations, and consultants, enabling them to make smarter decisions faster.

Third Bridge uses primary research techniques in its business model, including interviews with industry experts and professionals, to gather information on various companies, industries, and topics.

It primarily facilitates one-on-one consultations and interviews, offering direct access to industry-specific knowledge. These insights help investors make better decisions, assess market opportunities, and develop business strategies.

Third Bridge is largely utilized among investment professionals, consulting firms, and corporate decision-makers who rely on expert opinions for market insights. It’s best suited for those who need real-time access to specialized knowledge and expert calls.

Offering an extensive library of high-quality content for business, investments, and consulting purposes, Third Bridge’s content collection is regularly curated so that you get the latest data and can make informed business decisions with the help of the most trusted perspectives.

Third Bridge Product Features

Third Bridge is an expert network, so while it can provide specialized insights, it does not offer comprehensive market intelligence for data-driven, holistic market research. Third Bridges recognizes this shortcoming with its features—if you’re facing a unique business problem and there is no relevant existing content in the platform, you can take advantage of Third Bridge Connections.

Forum

Forum is an archive of analyst-led investigative interviews, which provide global industry knowledge and full sector insights. The library has over 50,000 transcripts and conducts over 10,000 interviews annually.

Maps

Third Bridge’s Maps product is the result of in-depth specialist profiling sessions conducted by Third Bridge’s analyst team. A Map visualizes the specialist’s individual insights about a company, the ecosystem in which it operates, and its wider value chain.

Connections

Investors can gain direct access to prequalified industry experts in one-on-one consultations for better insights into the market.

Community

Community connects Third Bridge clients to relevant experts by leveraging its extensive global expert network, thorough pre-qualification processes, and a compliance framework.

These interviews are then anonymized and made available via Forum, so clients can get preferential fixed-rate pricing on one-on-one consultations versus traditional more expensive one-on-one expert consultations.

Community’s investor-led content, generated from fixed-rate one-on-one consultations, offers clients unique insights into companies, markets and investor sentiment.

Primers

Primers content is generated from 1-hour expert interviews focused on gathering fundamental information on PE and VC-backed companies. Each Primer interview is moderated by a Third Bridge analyst and covers standardized questions with a former company executive who has had P&L responsibilities.

Tearsheets

A Tearsheet is a condensed summary of the Primer transcript, which extracts the specialist’s crucial quotes and data estimates. Third Bridge also overlays company information, such as deal history and senior management, and presents it all in an easy-to-read, downloadable format.

Surveys

Surveys empower clients to source large volumes of high-quality insights and to validate their hypotheses with ease. Third Bridge provides responses from hard-to-find experts across all major sectors, pre-screened to meet clients’ project-

specific needs.

Advisory Solutions

Third Bridge Advisory Solutions facilitates high-quality deal collaborations between top-tier industry advisors and leading PE firms. Third Bridge helps private equity teams gain an edge by carefully identifying and sourcing bespoke senior advisors with high-impact potential to lend their expertise across the entire deal cycle.

Pros of Third Bridge:

- Over 50,000 call transcripts in the Third Bridge content library

- Allows clients to conduct one-on-one interviews with experts

- Extensive network of experts across various industries.

- Uses a proprietary company ranking model

Cons of Third Bridge:

- Cannot upload internal content

- Lacks broker research, company documents, and news for holistic market research

- Can be cost-prohibitive for small businesses or startups

- Scheduling expert calls can be time-consuming

Third Bridge excels in providing high-quality, qualitative and quantitative insights through its extensive network of industry experts and suite of products.

For even more information on Third Bridge and how it compares to other solutions in the market, check out Third Bridge Alternatives & Competitors.

According to Inex One, the Third Bridge pricing model requires a $50k prepayment with an average cost per interview of $1,350 per hour.

Choosing the Right Tool For Your Business Needs

When selecting a platform for effective market intelligence, buyers should consider platforms that offer both qualitative and quantitative data analysis, AI-driven insights, and real-time access to an extensive content universe. These valuable offerings enable organizations to analyze diverse data sets and make informed decisions quickly and efficiently.

Third Bridge excels in providing high-quality, qualitative insights through its extensive network of industry experts. However, its focus on qualitative data can be limiting for organizations that need a more comprehensive and holistic view of market dynamics. Without quantitative data and automated insights, Third Bridge may not fully meet the needs of teams needing a broader, data-driven approach.

In contrast, the combination of AlphaSense and Tegus offers a robust and comprehensive research solution that streamlines both qualitative and quantitative research in a single platform. With access to financial data, broker research, company documents, and real-time news, AlphaSense provides a holistic view of the market. And with advanced AI search technology and automation, researchers can accelerate their research and increase confidence in their findings.