In recent years, market volatility—driven by the pandemic, geopolitical tensions, and interest rate fluctuation—has profoundly impacted most industries, including financial institutions. Hedge funds are no exception. Unlike other asset managers, hedge funds are expected to outperform even during a market downturn.

After all, hedge funds exist to generate alpha, even—and perhaps especially—when the market is down. And yet, the last few years have been a mixed bag for hedge fund performance—while some have consistently outperformed the market, others struggled to stay resilient amidst unpredictability.

Increased competition in the hedge fund industry has resulted in the tightening of performance and management fees, while maintaining the need to outperform. This begs the question: what differentiates funds that can deliver in this high-stakes environment from those that come up short?

One answer: digital transformation. Firms are increasingly tasked with adopting and leveraging new technologies that are transforming the investment landscape. Those that can do this successfully gain a competitive edge, navigate change with confidence, and generate the best returns for clients.

Below, we explore the most timely and critical trends impacting the hedge fund landscape in 2024 and beyond. In addition to digital transformation, this includes:

- Prevalence of digital assets

- Evolving fee structures

- Growing role of sustainable investing

- Retaining top talent

- Differentiated strategies for growth

- Resurgence of M&A activity

We’ll explore the ways in which firms can navigate these trends, while maintaining a competitive edge.

Technology at the Forefront

Technology has shifted from a support resource to the foundation of how all businesses function. For hedge fund managers, the speed and scope of tools like market intelligence, financial research, and data analytics platforms directly correlate to keeping pace with the industry and discovering new opportunities.

These tools also uplevel the human innovation potential at firms by powering fast, scalable due diligence processes that optimize analyst productivity so they can allocate their time more strategically.

In recent times, generative AI (genAI) has become a particularly hot topic in investment management. With its promising applications in market research, firms are looking to the power of genAI to increase efficiencies and streamline workflows.

One of the most prized use cases of genAI is the ability to pair in-house research with the power of AI-layered technology to unlock insights and intelligence in real time and capitalize on proprietary knowledge.

Often, investment teams are plagued with inefficiencies created by internal research and external content spread across disparate systems and teams working in silos. Critical components of your firm’s market intelligence—internal research, investment memos, client deliverables, strategy presentations, and meeting notes—are often fragmented and inaccessible, resulting in lost opportunities and doubled work.

As a result, firms lose the ability to swiftly pivot in response to market conditions and struggle to maintain a competitive edge. Tools like AlphaSense’s Enterprise Intelligence solution unlock the value of your firm’s prized internal knowledge using generative AI, delivering holistic insights and intelligence in seconds.

Looking forward, a tech stack complete with artificial intelligence (AI), genAI, machine learning, and advanced analytics will become table-stakes for hedge funds to stay competitive and enhance their trading, risk, and operational functions.

Differentiated Strategies that Outperform

As competition heats up in an already complex market, investors know what they’re looking for when they see it. Having a keen awareness of investor particularities and the trends driving their preferences is essential to remaining competitive.

One recent trend sweeping hedge fund management is the use of multi-manager platforms (multi-PMs). Multi-PM platforms consist of an ensemble of hedge fund managers with unique asset specialties, managing multiple strategies but operating as one entity.

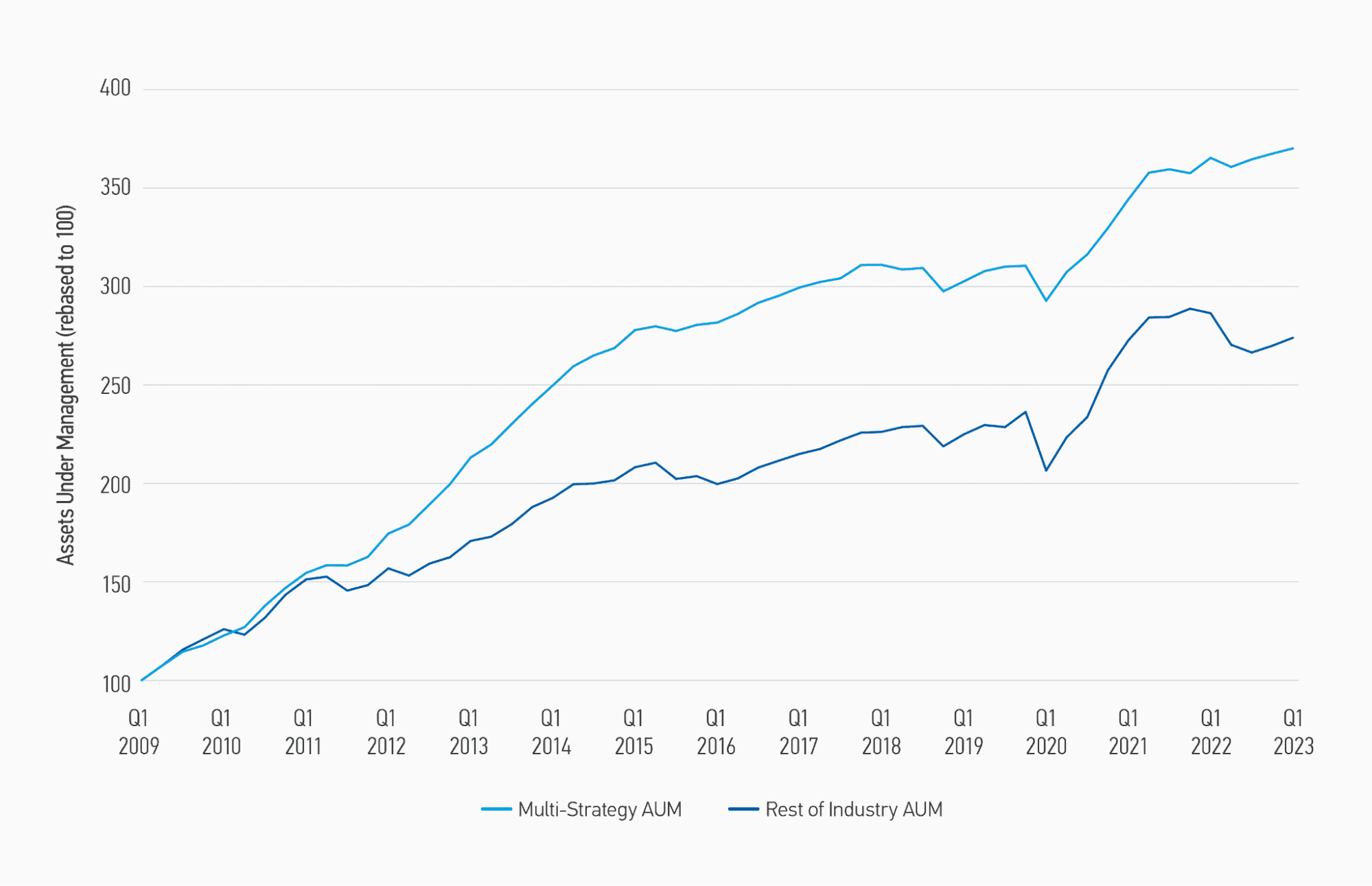

An investment bank document sourced from the AlphaSense platform indicates that over the last six years, multi-manager funds have grown their assets by about 170%, with the remainder of the industry only growing 14%.

According to an article published by Morgan Stanley, multi-PM platforms are differentiated by their ability to offer a range of diversified alpha sources and a centralized risk management function. Each platform manager devotes a comparable level of expertise to managing risk, hedging any unwanted exposures and ensuring they are within risk budget guidelines.

Multi-PM funds are thought to consistently deliver their investment objective and target volatility, and have outperformed traditional hedge management approaches, as indicated in the below chart.

Multi-strategy managers routinely rotate their roster of portfolio managers and strategies and appear to be onto something as they outperform their industry peers. For example, Citadel LLC posted annual returns ranging from 15% to 38% over the last five years. Millennium Management, another multi-strategy shop, had returns ranging from 6% to 26% over the same time range.

As market volatility continues to pressurize the hedge fund landscape, the ability to pivot and re-position strategically will serve as a key differentiator and revenue generator, helping firms to win alpha at a higher rate.

The Growing Role of ESG

Over recent years, ESG has become a key pillar in investors’ strategies, and is clearly not a passing trend. Investors are heavily scrutinizing corporations for their ESG commitments, discerning those that are making meaningful ESG integrations into their portfolio, versus those that are not.

Even with how much of a priority ESG has become for investors, it has taken a while for hedge funds to fully integrate it into their growth strategies. Many hedge fund managers initially saw ESG as just another box to check off while looking for real growth opportunities, but that sentiment has changed.

According to recent UBS analyst research sourced from the AlphaSense platform, hedge funds are ramping up their ESG initiatives, deploying sustainable investment through equity long/short and credit strategies. With the potential for lower interest rates in 2024, it is expected that sustainable assets will gain further momentum within the industry.

Looking ahead, ESG investments should be considered equally high-potential alpha generators among others in hedge fund portfolios. Those that prioritize ESG integration will be better positioned with investors by aligning optimal returns with value-centered priorities. Without a clear hedge fund leader in the ESG space, there is tremendous opportunity to be a first mover in this space as well.

Talent Has Star Power

Since the pandemic, investment firms have had to rethink the way they operate on a day-to-day basis. Even the most traditional industries—investment management included—have felt a major shift toward more flexible remote and hybrid work environments.

To retain top talent, hedge fund firms must also embrace this emphasis on work-life balance. And to stay operationally effective, they need centralized research tools where employees can collaborate and access the same real-time data as their colleagues. Cloud-based platforms (like AlphaSense) enable more productive modern work environments with powerful in-platform collaboration tools and export capabilities for data that needs to be manipulated and/or shared via other communication channels.

Recently, the industry has taken star talent retention and acquisition to a new level. An article from the New York Times delves into the fierce competition for top hedge fund talent, likening portfolio manager compensation to “Tom Brady-like pay packages.” Leading managers such as Citadel, Millennium, and Balyasny are attracting the industry’s best talent with contracts exceeding tens of millions of dollars in guaranteed pay.

A centralized source for research and data is more imperative than ever in this high stakes talent environment to ensure swift, informed, and accurate decision-making. Firms adopting best practices to retain, empower, and engage employees will have the most success in the very competitive hedge fund talent landscape.

Fee Structure Evolution

In the last decade, the hedge fund industry has experienced a movement away from its traditional fee structure of charging investors a 2% management fee and a 20% performance fee. In light of market volatility leading to underperformance and ultimately lower net gains, many managers are offering an amended version of this fee structure as a 1.5% management fee, with 15% performance of net profits.

Furthermore, hedge fund managers are tailoring fee structures to remain competitive, utilizing tactics such as commitment clauses, additional share classes, allocation-based tier structures, and performance crystallization time frames to differentiate their offerings.

While many firms have evolved their fee structure, leading funds are bucking the trend. In contrast, funds led by top industry talent are recuperating top portfolio manager salaries by passing the cost onto investors.

A Resurgence in M&A Activity

After record highs in 2021 amidst low post-pandemic interest rates and the Federal Reserve’s quantitative easing program, M&A deal volume fell significantly throughout 2022, then hit its 10-year low for single-quarter volume in 2023.

There’s good news for M&A arbitrage on the horizon. With interest rates steadying into 2024, M&A activity is expected to experience a resurgence as the year goes on, marked by a healthier level of mid-market deals rather than blazing mega-deals that capture tons of attention.

The key takeaway here is that event-driven hedge funds like merger arbs cannot only depend on traditional due diligence methods to identify alpha-generating M&A opportunities. In an unpredictable market, it’s more critical than ever to have the capability to pinpoint the best deals in any conditions.

Related Reading: 5 Crucial Due Diligence Questions to Consider

Market intelligence platforms like AlphaSense deliver the capabilities firms need to make this a reality. Customized watchlists, automated alerts, and AI-powered analytics features pull the most important insights from structured and unstructured data, enabling firms to be first to see and pursue potential new opportunities, while never missing a critical update.

Digital Assets Gaining Momentum

Hedge fund activity in digital assets such as blockchain and cryptocurrency has been mixed coming out of 2023. While hedge fund investment in cryptocurrency decreased from 37% in 2022 to 29% in 2023, it is expected that momentum around digital assets will resume in 2024.

According to a report published by PwC, hedge fund managers remain confident in the value proposition and long-term sustainability of crypto assets. Traditional hedge fund managers that are currently invested in crypto-assets plan to either increase or maintain exposure, regardless of underlying market volatility and regulatory barriers that have challenged confidence in the asset class.

As cryptocurrency evolves and continues to garner attention, hedge funds will continue to focus on regulatory guidance, as well as explore and develop risk management protocols within their own firms.

From an overarching perspective, it is likely that hedge funds will continue to play a large role in the crypto space, as operational and regulatory obstacles continue, correlations between cryptocurrency and other asset classes decouple, and future markets expand to other blockchain opportunities.

Outlook for 2024 and Beyond

Will hedge funds maintain their place as leaders in finding needle-in-the-haystack, high-alpha opportunities? With a continual eye toward the future and tools and technologies in place to inform action, all signs point to yes—the macro outlook for hedge funds forecasts continuous growth and outperformance.

Unpredictability in the markets, geopolitical events around the world, economic volatility, and faster-changing trends mean that hedge fund managers must be more adaptable and agile than ever before to protect capital and generate alpha.

The differentiating factor between those that succeed and those that fall behind will be tech- and data-driven capabilities enabled by digital transformation.

For hedge funds that want to stay on the pulse of the trends we covered, as well as be first to know of any emerging trends, the time is now to implement market intelligence and automation tools that will uplevel your strategies and give you the competitive edge.

Gain the Competitive Edge with AlphaSense

AlphaSense is the leading financial research platform servicing 80% of the world’s top asset management firms. Recently, AlphaSense was named the #1 Leader in G2’s Winter 2024 Grid Report for Financial Research.

The AlphaSense platform offers a massive content library of over 10,000 public and private data sources. They include:

- Regulatory filings and disclosures from 68,000 companies

- 30,000+ proprietary expert interview transcripts

- Reports from 1,500 top research providers

- Top-tier newspapers, journals, and other media sources

- Insights from 1.4 million private companies

For hedge fund firms looking to gain the competitive edge, AlphaSense is the most comprehensive tool on the market for accessing key market insights and trends, and for enhancing due diligence. Remove the guesswork and blind spots from your research to make the most informed and timely decisions.

Read more about how AlphaSense is helping hedge funds generate more alpha, uncover crucial insights, and dive into new investment territories:

- Recurve Capital Saves Time Uncovering Insights to Drive Investment Decisions

- How Papyrus Capital Uses Stream Expert Call Transcripts to Deep Dive into New Investment Territory

See all that AlphaSense has to offer and explore firsthand how it can help your firm transform.