At a Glance

Crunchbase

Best for: Identifying decision-makers and key contacts for outbound sales, sourcing deals, and overall business outreach

Crunchbase is a professional and business platform used by over 75 million people worldwide as a comprehensive database for information about businesses and startups. As part of its intelligence offering, Crunchbase offers details on companies including:

- Company Profiles: Include deep company details, such as the founding date, company location, key management personnel, funding history, and a brief overview of their products or services

- Funding Data: Data collected by Crunchbase about a company’s funding rounds, information about key investors and investment amounts, and their dates.

- Marketplace Insights: Provide insights into a company’s market trends and help users identify popular technologies, areas of innovation and emerging opportunities. Entrepreneurs, investors, and analysts may find this feature particularly useful.

- Search and Discovery: Offers a search engine for specific companies, investors, or industry sectors. Researchers can use Crunchbase for discovery and research, as well as due diligence.

- Investor and Funding Connections: Works as a networking platform, connecting various users with potential investors, and investors with potentially rewarding investment opportunities.

- Crunchbase Pro: Premium subscription service, which provides additional features and advanced search capabilities for users who require more in-depth information.

Crunchbase does have several shortcomings as a marketing automation and intelligence platform. First, it lacks advanced search capabilities and features such as synonym recognition, machine learning, and natural language processing features. Its content sets are also limited and lack expert calls, earnings transcripts, or brokerage reports—all of which are necessary to gain a holistic overview of a company, industry, or market.

Moreover, users have complained about duplicate entry issues, accuracy problems due to user and company self-submitted data, and outdated information in the platform.

Crunchbase is a great tool for entrepreneurs, investors, salespeople and market researchers looking to prospect for new business opportunities, as it can provide in-depth company overviews and organization charts. However, it is less well-suited for enterprise users and organizations looking for in-depth research insights into companies and markets.

Crunchbase Pros:

- Extensive company database of startups, established companies, investors, funding rounds, acquisitions, and industry trends

- Provides valuable data for sales prospecting

- Frequently updated with the latest information on startups and funding

- Allows users to export the data

- User-friendly interface with customizable filters and search tools

- Enables filtering by multiple categories such as stage and location

- Free subscription tier available

- Integrates with business tools like Salesforce and HubSpot

Crunchbase Cons:

- Alert fatigue can be a problem

- Data accuracy and recency issues

- Duplicate entries are a recurring problem

- CRM integration may not be seamless

- Database is not comprehensive, especially for private companies

- Advanced search capabilities like synonym recognition are not available

- Absence of supplementary content sources such as expert calls, earnings transcripts, ESG reports, and brokerage reports

- Limited access to advanced search tools and some data on free tier

Top Crunchbase Alternatives

AlphaSense

Best for: Conducting comprehensive qualitative market research and analysis with advanced AI features for added speed, accuracy, and scope

Established in 2011, AlphaSense serves around thousands of enterprise clients, including 88% of the S&P 100, 95% of the leading consultancies, 80% of the top asset management firms, and 20 of the largest pharmaceutical companies. Consistently rated as an industry leader by G2 and Trust Radius, AlphaSense has also recently been recognized as one of the top 50 AI companies by Forbes.

Here’s how our platform enables you to extract key insights and answers from both high-value internal and external content with the power of artificial intelligence—all on a single platform:

AlphaSense and Tegus: Better Together

As of July 2024, AlphaSense and Tegus have joined forces, bringing unparalleled access to even more insights, and covering more industries and companies than ever before.

Both platforms come with extensive libraries of high-quality research, as well as data and AI tools that allow users to extract the most value from the insights they find.

Tegus has an extensive and fast-growing library of high-quality expert research, which includes coverage of 35,000+ public and private companies across TMT, consumer goods, energy, and life sciences sectors. Additionally, Tegus’ financial data offering, which includes financials, KPIs, and fully drivable models on more than 4,000 public companies, as well as its BamSEC self-serve solution to search and access securities filings, adds new and unique offerings to AlphaSense’s extensive product suite and datasets.

Extensive Out-of-the-Box Content Library

AlphaSense allows you to combine valuable internal content and 10,000+ private, public, premium, and proprietary external data sources into one platform. We have purpose-built our platform to keep teams up to speed on the relevant topics and companies driving their market.

Our external content sources include trade journals, news, and SEC and global filings. AlphaSense users also have access to two premium and proprietary content offerings.

These are:

- Wall Street Insights® – A collection of broker research from Wall Street’s leading firms, covering global sector themes, industries, and companies from 1,000+ sell-side and independent firms, available within the AlphaSense platform. Research professionals can even preview the contents of a broker report, saving them wasted time and money on potentially fruitless research.

- Expert Insights – tens of thousands of transcripts of one-on-one calls with industry experts, competitors, customers, professionals, and former and current executives, with the ability to conduct your own 1:1 expert calls for less.

In addition to these sources, you can upload and search through your own content with our Enterprise Intelligence solution. This includes:

- Internal research, notes, and presentations

- Investment memos and CIMs

- Meeting and conference notes

- Reports from industry and market intelligence providers

- Newsletters, web pages, and RSS feeds

- Email content

- Excel documents

AI Search & Summarization Technology

Our industry-leading suite of generative AI tools is purpose-built to deliver business-grade insights. Our proprietary AlphaSense Large Language Model (ASLLM)—trained specifically on business and financial data—matches or beats the leading third-party LLMs over 90% of the time.

Our suite of tools currently includes:

This feature allows you to glean instant earnings insights (reducing time spent on research during earnings season), quickly capture company outlook, and generate an expert-approved SWOT analysis straight from former competitors, partners, and employees. All Summaries provide you with citations to the exact snippets of text from where the summaries are sourced—combining high accuracy with easy verification.

Generative Search is a generative AI chat experience that transforms how users can extract insights from hundreds of millions of premium content sources. Whenever you search for information, Generative Search summarizes key company events, emerging topics, and industry-wide viewpoints. You can dig deeper into topics by asking follow-up questions or choosing a suggested query.

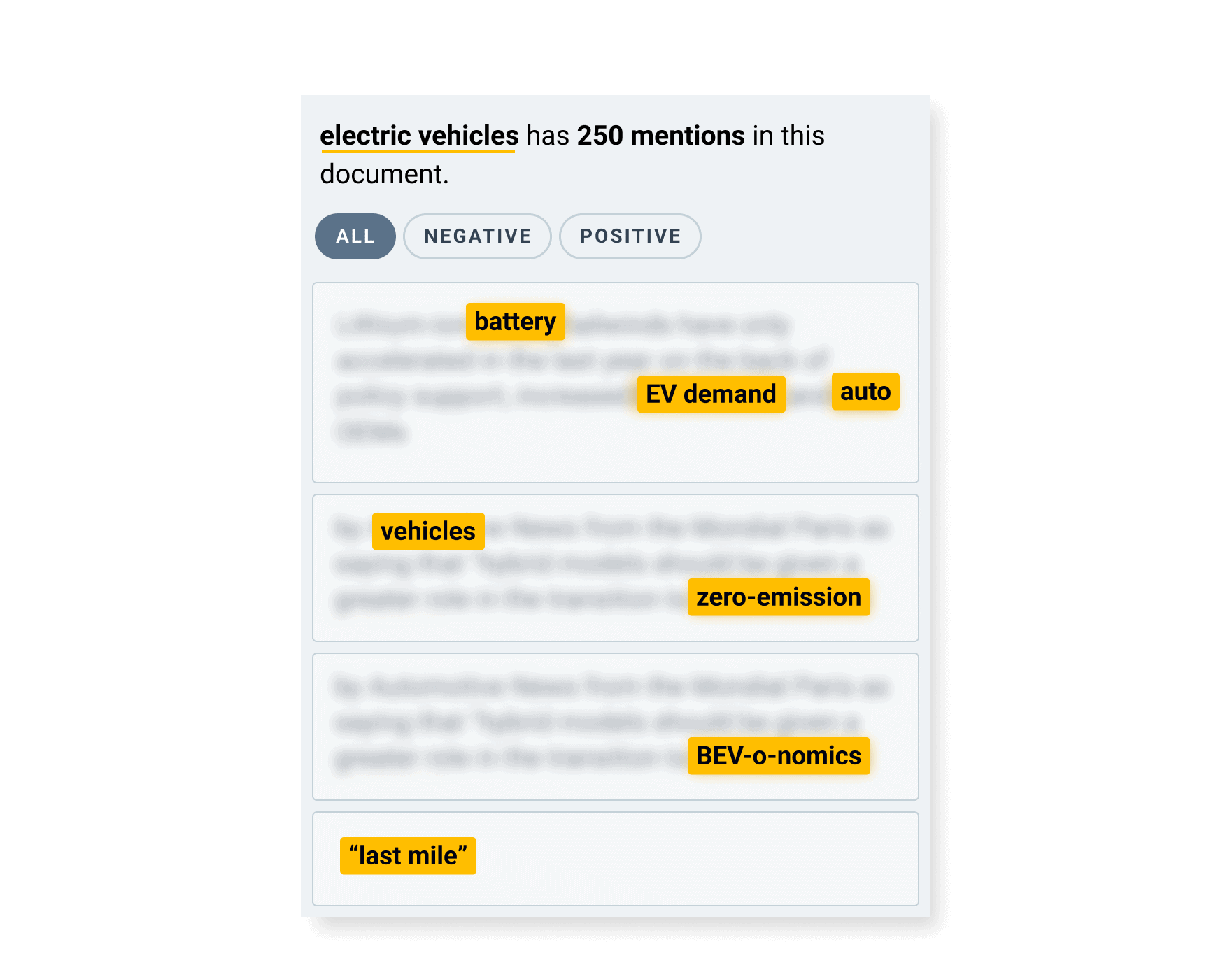

This unique feature is proprietary to AlphaSense and has the capability to understand both the keyword and search intent behind any of your queries, factoring in search results that include variations in business language. For example, a search for TAM will also bring back results on market size.

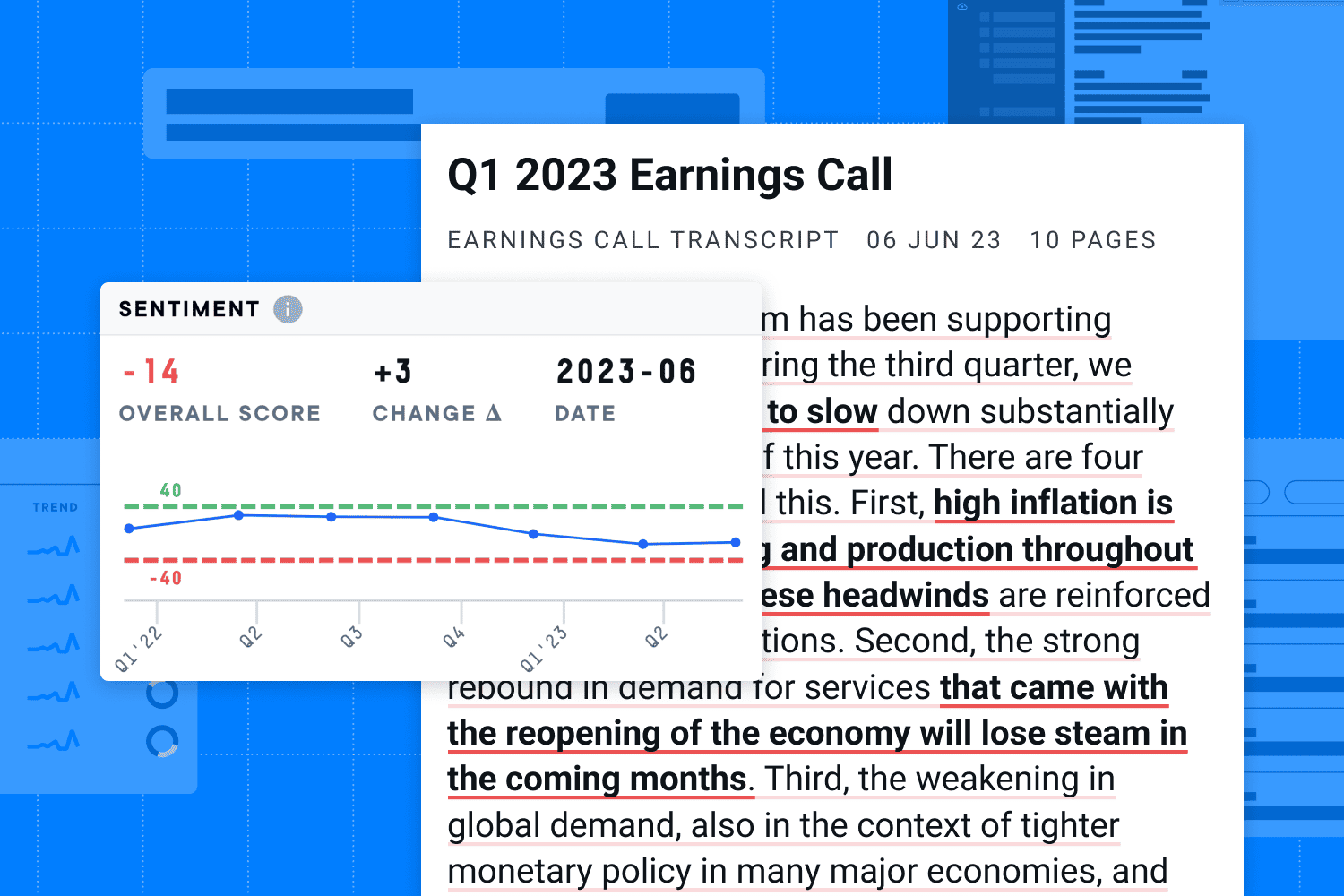

Sentiment Analysis

Sentiment Analysis, a natural language processing (NLP)-based feature, parses through content and identifies nuances in the tone and subjective meaning of text. It then uses color coding to help readers identify the document’s positive, negative, and neutral sentiments.

This technology assigns each search term a numerical sentiment change score to help users track any slight change in market sentiments across time. Users can take advantage of it to make better-informed investment decisions and improve risk management strategies.

This feature can be instrumental in picking up on subtle sentiment shifts in expert interviews that go beyond expert-level commentary. But it can also be applied to company documents—such as earnings transcripts and company presentations—to gain much deeper insight into the perspective of an individual, company, or the market on a key topic.

Relevancy Algorithm

AlphaSense’s advanced algorithm eliminates noise (i.e., content with matching keywords but ultimately irrelevant to your specific search objective) and surfaces only the most relevant results. This algorithm saves you precious time and energy, allowing you to get straight to analysis and other high-level tasks.

Integration Capabilities

Through either an AlphaSense-managed solution in our secure cloud or a customer-managed solution in the cloud of your choice, customers can easily integrate content at enterprise scale through our Ingestion API or enterprise-grade connectors—like Microsoft 365/Sharepoint, Box, S3, and more. Enterprise Intelligence supports the upload and management of tens of millions of documents.

Our integration capabilities allow for even greater knowledge sharing with members across your organization and improve overall team productivity. Our proprietary AI technology allows you to search across all internal IP and external company content to find crucial insights, catching what other platforms miss in a secure and automated way.

Lastly, AlphaSense offers content processing and content management. Content processing allows company recognition within user documents, while content management features support custom tags and folder structures to better index and organize internal content.

Monitoring, Analysis, and Collaboration Tools

AlphaSense is designed to help users find insights faster. In order to do that, we offer a number of tools that extend beyond search and summarization to help accelerate research workflows.

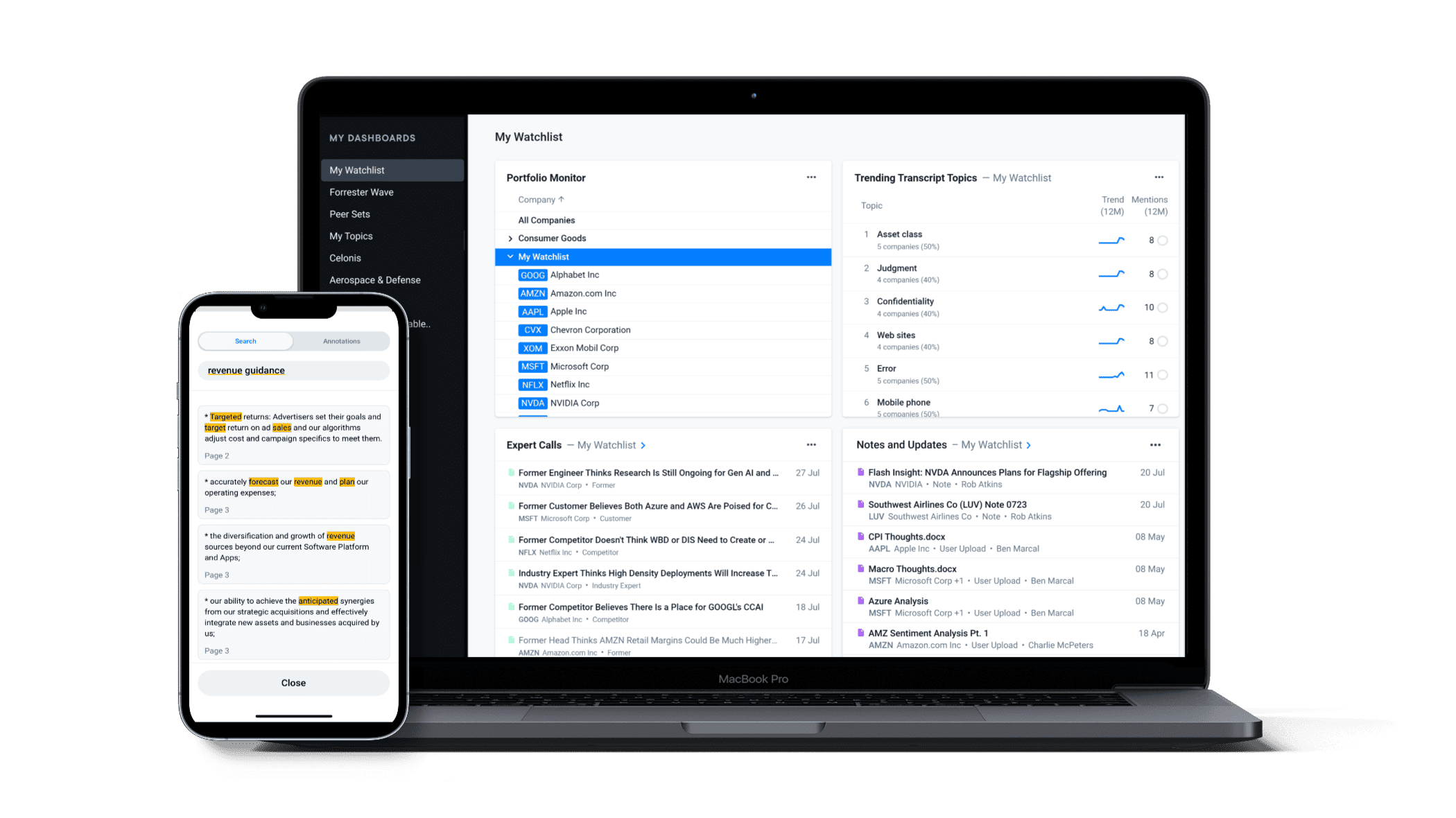

- Customizable Dashboards create a centralized information hub for monitoring key companies and themes, while tailored real-time alerts provide real-time updates.

- Powerful collaboration tools like Notebook+ and commenting features help teams manage and share insights more effectively.

- Table Tools allow you to streamline your quantitative analysis by enabling you to export modeled time-series data on company financials.

- Image Search allows you to discover insights buried in charts to quickly capture data without reading through pages of documents.

- Snippet Explorer allows you to effortlessly look at any topic or theme and all its historical mentions in a single view.

- Our Black-lining feature allows you to automatically identify any QoQ changes in SEC filings

- Automated Monitoring allows you to set up real-time alerts that send instant updates on any relevant market movements, news, emerging trends, and competitor activities. We also generate snapshots of companies and topics regularly that keep you ahead of the curve with actionable insights.

AlphaSense Pros:

- Extensive content database that spans the four key perspectives, including broker research, expert calls, company documents, news & regulatory sites.

- Incorporates AI search technology, machine learning, and sentiment analysis

- Generative AI features, like Smart Summaries, for earnings and image search

- Automated and customizable alerts

- All-in-one research platform

- User-friendly interface

- Internal messaging and collaboration features

- Support for APIs and integrations

- Supports enterprise-level organizations and teams

- Enterprise-grade data production complying with global security standards: SOC2, ISO270001, FIPS 140-2, SAML 2.0

- Excellent customer support team, including 24/7 chat with product specialists, a live Help button on the website, and regular live AlphaSense Education webinars

AlphaSense Cons:

- Visualization tools are limited at this time

- Collaboration tools are limited to users with AlphaSense licenses

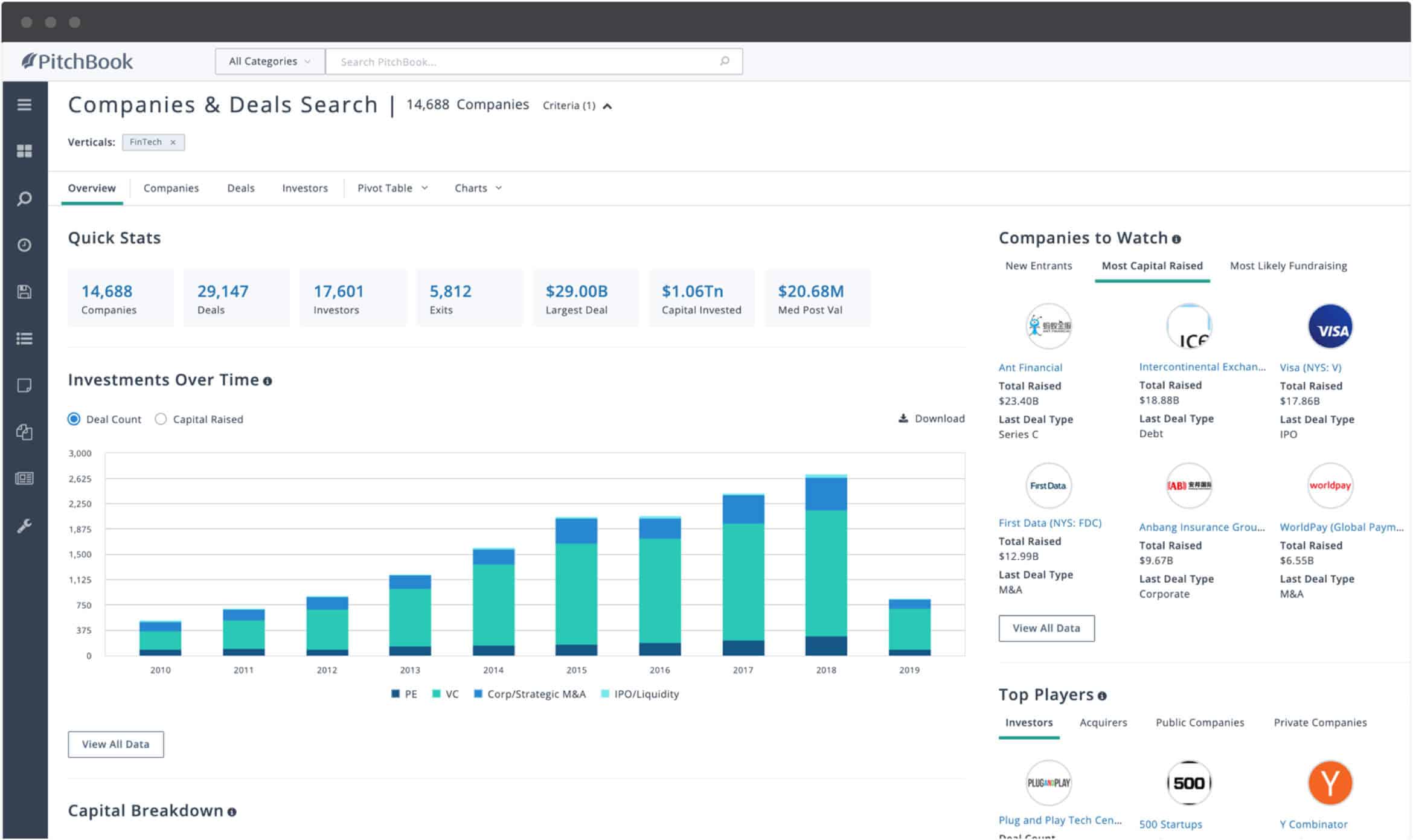

PitchBook

Best for: Private market financial data for deal sourcing, fundraising, and due diligence

PitchBook is a powerful investment research and intelligence platform for venture capitalists, M&A investors, hedge funds, and private equity holders. It has access to valuations, financial histories, investors, and executives on over 3.5 million private and public companies worldwide. It also keeps expanding factsets and meticulous records of over 1.9 million deals with over 450,000 investors and 110,000 funds.

PitchBook provides access to information like:

- Company patents

- Financial analysis

- Non-financial metrics like employee counts and social media following

- Company leadership teams and management

- Deal history, including deal sizes and pre-and post-money valuations

- Former and current company investors

- Financial data charting and infographics

- Networking through executives’ LinkedIn profiles, contact and messaging details

You’ll find PitchBook useful if you’re looking for private market intelligence, venture capital, deal sourcing, or performing due diligence. Moreover, you can use its platform for fundraising, networking, benchmarking companies, and asset allocation across your portfolio.

Some of its features include:

Advanced Search Filters

Using PitchBook’s advanced search tools, users can find deep insights on companies, deals, investors, debts, and lenders. Users can search industries by name, location, age, investors, lenders, and funding stage.

Emerging Spaces

PitchBook uses the Emerging Spaces feature to introduce investors and financial experts to new and emerging spaces. That helps investors learn about trending markets and explore alternative investment opportunities.

High-Quality User Interface

Much like AlphaSense, PitchBook has an intuitive user interface that allows professional and industry experts to integrate the tool into their workflows. It’s easy to navigate, search, and explore different companies and their detailed profiles from the Pitchbook Interface.

Moreover, users can also access PitchBook from their PCs or smartphones, allowing them to carry and access insights on the go.

Integrations and APIs

PitchBook supports integrations and APIs that allow you to import and export data to other applications. Also, they offer a Google Chrome extension that enables you to access their services directly from your browser.

Related Reading: PitchBook vs Crunchbase

PitchBook Pros:

- Provides access to a wide array of information, including company patents, financial analysis, information on former and current company investors, and more

- Advanced search filters available, though many users leverage simple search

- Emerging spaces for investors looking to capitalize on new and alternative markets

- You can create custom alerts and monitor your dashboard for news

- Supports integrations from third-party software; has Excel plug-in

PitchBook Cons:

- Much better suited to financial services; lacks key features for corporate users

- Lacks access to an expert call library

- Limited access to earning transcripts and no SEC or global filings

- No advanced AI search functionality or synonym recognition

- Sentiment analysis feature limited to stocks

- Users cannot upload internal content to the platform

- No broker research or aftermarket research. Equity research is available for an additional charge but is mostly for private companies

- Often receives criticism about data accuracy and recency

CB Insights

Best for: Institutional and enterprise-grade users who need to monitor existing and emerging market trends and key players, particularly in the tech sector

Founded in 2008, CB Insights is a market intelligence platform with a massive database for users seeking technology insights and analyses on companies, private capital, and angel investments. This platform is used to support company monitoring, opportunity discovery and forecasting, and vendor research and evaluation—primarily for the technology markets.

It also provides insights into companies’ latest funding rounds, venture capital, proprietary company data, business relationships, patent analytics, earnings transcripts, and more. This data is primarily acquired through machine learning and analyst briefings, a feature unique to CB Insights.

Using machine learning and data analysis, CB Insights provides users with a wealth of information regarding emerging industries, market trends, and investment opportunities. Through its platform, users can perform the following tasks:

- Company Tracking: Gain comprehensive insights into private companies, tracking their activities, growth trajectories, and technological strategies.

- Investor Monitoring: Stay informed about investors’ activities, identifying key players and understanding their investment patterns.

- Industry Analysis: Access in-depth analyses of industries, leveraging data-driven insights to understand market dynamics and emerging trends.

- Technology Utilization: Explore how companies leverage technology, providing a nuanced understanding of technological adoption across various sectors.

CB Insights also provides up-to-date research that helps users understand competitor strategy, keep up with future trends, and make better investment decisions.

Related Reading: CB Insights vs Crunchbase

CB Insights Pros:

- Excellent platform for identifying new opportunities in the technology space

- Access to private company information, including partnerships and valuation

- Access to in-depth data and research analytics

- Custom reports and data visualization tools

- Supports APIs and integrations

- Uses machine learning and analyst briefings to collect data on companies

- Uses AI-powered algorithms to predict future trends, investment opportunities, and potential company success based on market conditions and historical data

CB Insights Cons:

- Leans toward technology market use cases; lack of breadth and depth in other markets

- Focuses primarily on private tech companies, ignoring public companies unless they partner with startups

- No access to global/SEC filings, ESG reports, newspapers, trade journals, expert calls, or broker research

- No smart search functionality

- Not suitable for small-scale firms

UpLead

Best for: Generating pre-qualified leads and building custom contact lists

UpLead is a B2B contact database and lead generation SaaS businesses used to create custom contact lists and pre-qualify leads for account-based marketing. This sales intelligence platform comes with data enrichment features that help your team build a list of prospects and qualify them based on multiple criteria.

Using UpLead’s Prospector feature, users can search through more than 108 million contacts and find accurate details on all their potential clients. This feature covers more than 200 countries with a 95% guarantee.

If you have incomplete information about a prospect, UpLead can help you enrich your data with more emails and contact details, resulting in a higher success rate upon reaching out to them. Data enrichment is ideal for prequalifying leads based on company size, location, revenue, sales, and industry.

You can also use UpLead’s Technographic feature to prequalify leads based on the technologies they use. UpLead tracks both web and mobile technologies, keeping tabs on more than 16,000 different data points.

Users can also verify multiple email addresses using UpLead. This tool can help you determine the validity of an email address in real-time, ensuring its accuracy and reducing bounce rates.

But unlike any of the platforms mentioned above, UpLead only collects and delivers contact information. It offers no competitive intelligence data, company filings, research, or expert calls.

UpLead Pros:

- Access to high-quality contact details

- Generates massive lists of viable leads for different types of marketing campaigns

- Access to accurate company information

- Advanced filtering options for highly targeted lead generation

- Supports multiple integrations, APIs, and a Chrome extension

- Can enrich your existing contacts with more information

UpLead Cons:

- Has multiple search filters but no AI smart synonyms search

- No access to research data or insights beyond contact details and basic company information

- Lacks competitive intelligence data

- No expert calls, broker research, news, or advanced company information

- Focuses solely on generating leads, with limited coverage on other topics

- Some data may be outdated

Demandbase

Best for: Lead qualification and account-based marketing

Demandbase is an account-based marketing tool that enables users to create, target, and manage new audiences. Sellers, marketers, and customer success professionals use Demandbase for advertising, sales intelligence, and market analytics.

In recent years, Demandbase has also integrated the use of AI in its platform to help users streamline the qualification process and engage prospects better to improve sales.

Demandbase has two key products:

- The Go-To-Market platform helps users identify opportunities faster and make informed sales decisions for ABM, B2B advertising sales intelligence, and data

- Account Intelligence combines data from multiple sources and AI to make smarter business decisions. This includes account identification, technographics, intent, and first-party contact information from companies and businesses.

Demandbase Pros:

- Offers access to high-quality contact and prospecting details

- Has useful tools for qualifying leads

- Uses AI to improve its search capabilities and streamline workflows

- Supports multiple integrations

- Offers access to intent information

- Has an intuitive interface

Demandbase Cons:

- Offers limited coverage on other topics outside account-based marketing

- Some contact-level data points may be incomplete or insufficient

- Data export and API connections can be costly

- AI is not as robust as other tools

- Alerts may not be instant

Owler

Best for: Prospecting new clients, nurturing client relationships, and account-based marketing

Owler is a sales intelligence and business information platform ideal for businesses and organizations prospecting new clients, relationships, and research. It has access to industry insights and data for users benchmarking competitors, looking for new leads, and up-to-date news and market trends.

Owler features a sales companion that helps users discover and qualify new business leads. Besides that, users can generate customized insights about companies and businesses, sending them directly to email or integrated tools like CRMs.

Owler also features a community of more than 5 million business professionals, which enables users to obtain a general market overview and gain insights into competitors and prospects. From here, users can also find detailed company information and set notifications on relevant news and updates, pertaining to specific companies or markets.

There are 15 million+ company profiles accessible on Owler, with over 500,000 monthly contributors and over 150 million verified contacts. This makes Owler an exceptional account-based marketing tool, especially for both private and public companies.

Owler Pros:

- Excellent tool for prospecting and account-based marketing

- Utilizes crowd-sourced information, which can provide unique insights and perspectives from industry professionals and competitors

- Plenty of resources available with the free trial

- Real-time alerts and updates

- User-friendly, intuitive interface

Owler Cons:

- Some information may be incomplete

- Does not offer complete coverage, and only focuses on sales intelligence

- Crowd-sourced data can sometimes be inconsistent or inaccurate

- No extensive historical data or trends for companies

- No expert calls or broker research

- Lacks robust search functionality

- Lacks robust AI

Choosing an Alternative to Crunchbase

Crunchbase is an excellent option for users looking for prospecting and business intelligence solutions. But if you are an enterprise user or someone looking for deeper, more comprehensive market intelligence, it may not suit your needs. When choosing the right tool for you, consider the following criteria:

- Data coverage: Crunchbase offers a wide coverage of business intelligence and research. Platforms like AlphaSense offer even more data coverage than Crunchbase, while others like Uplead are severely limited. Ensure your chosen provider has access to markets you’re interested in and has comprehensive data coverage for those areas.

- Data quality: Find a platform with accurate, up-to-date, and reliable data. Duplicate or outdated data, like that found on Crunchbase, may affect your ability to compete in an ever-changing market.

- Pricing: Choose a platform that offers plans within your budget limits or flexible subscriptions. Also, consider which platform will give you the biggest ROI—check out our ROI calculator for additional context.

- User interface and user experience: Ensure you opt for a navigable platform with a user-friendly interface that can filter and customize data.

- Additional features: Make sure to opt for a platform that goes the extra mile to make a difference by offering analytics, AI, generative AI, automation, alerts, internal data integrations, broker research reports, and smart search functionality. Value-added services like these can help you make more informed investment decisions, speed up your research process, and make you much more competitive.